Cerebras files for IPO, shows rapid revenue growth and declining losses

Cerebras's valuation is currently unclear

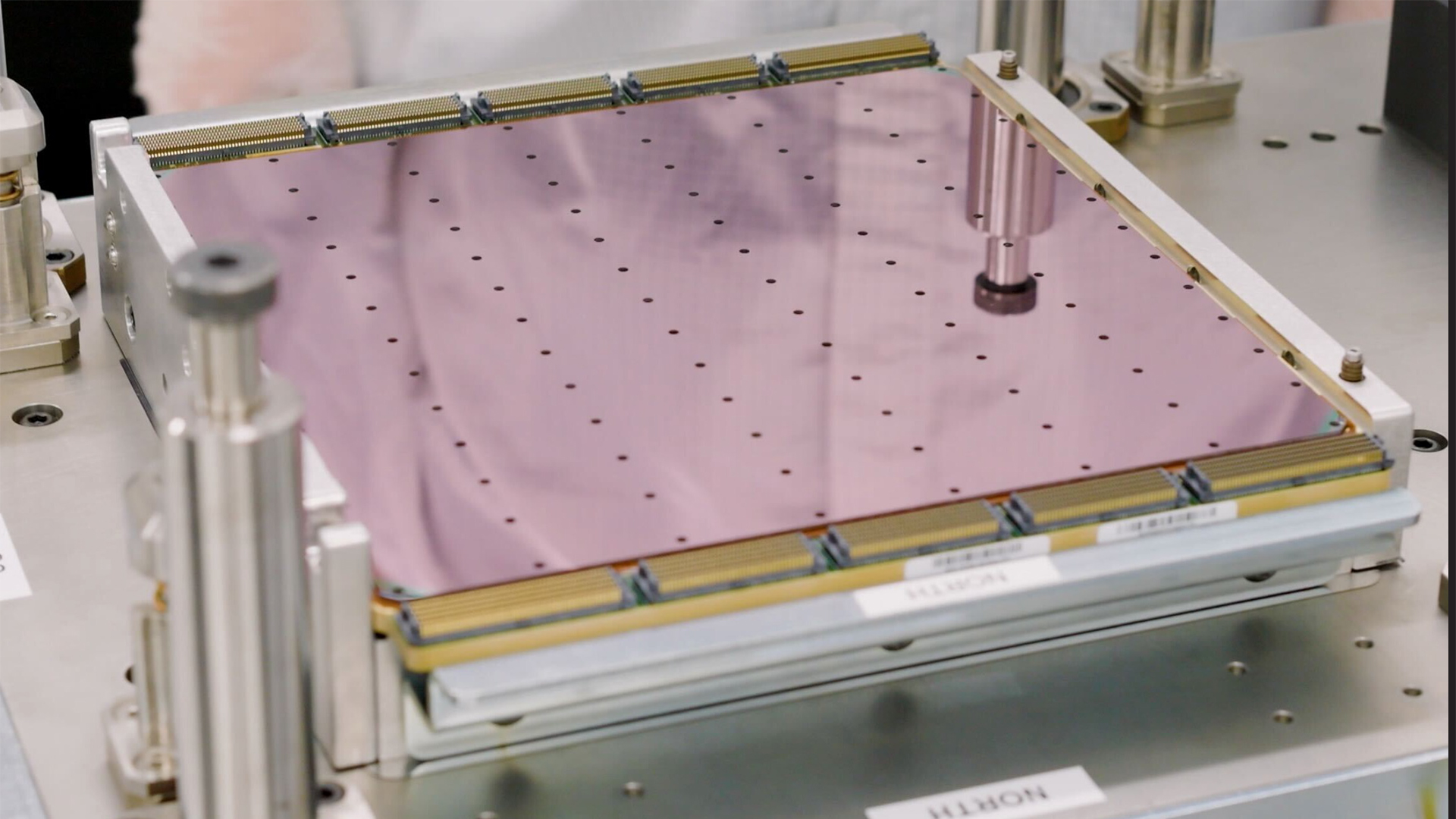

On Tuesday, Cerebras Systems, the company primarily known for wafer-scale processors for AI, filed for an IPO on the Nasdaq under the symbol CBRS. Cerebras, which offers both servers based on its Wafer Scale Engine 3 processors as well as cloud services (sometimes in partnership with giants like Group 42) revealed financial results for its recent years and it appears that company revenues are increasing, while its losses are decreasing. A great time for an IPO.

Cerebras's valuation is currently unclear.

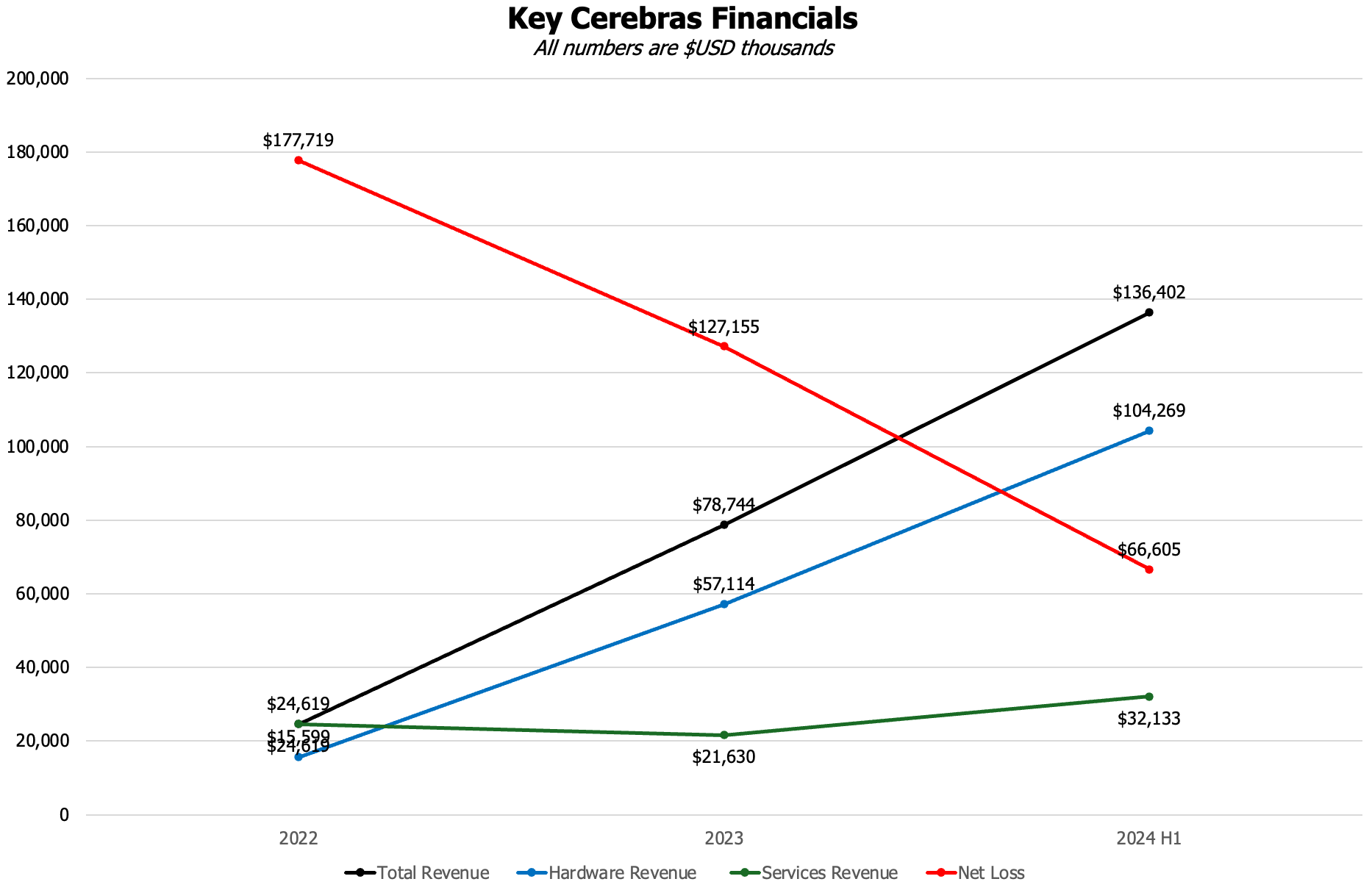

Back in 2022, the Cerebras's total revenue comprising of hardware sales and services, was $24.62 million, whereas its loses topped $177.7 million. The company increased its revenue to $78.74 million in 2023 and shrank its losses to $127.15 million in 2023. This year, Cerebras's revenue skyrocketed to $136.4 million in the first half alone, whereas its losses dropped further to $66.60 million.

Revenue growth has primarily been driven by the UAE Group 42 (aka G42), a UAE-based AI firm that accounted for 83% of Cerebras's revenue in 2023 and 87% of the company's revenue in the first half of 2024. In a deal signed in May 2024, Group 42 committed to purchasing $1.43 billion worth of Cerebras products by March 2025. Group 42 currently holds less than 5% of Cerebras's Class A shares but may acquire more based on the volume of future purchases.

Relying on essentially one big customer, based in the UAE, a country which is under U.S. export restrictions, is a risk and Cerebras makes no secrets of that.

"While we have obtained an export license from BIS to export, reexport, or transfer (in-country) our CS-2 systems to G42 in the United Arab Emirates, all of the systems we have sold to G42, or for which purchase orders have been placed by G42, to date have been or are expected to be deployed in the United States, which does not require an export license from BIS," a statement by Cerebras reads. "To the extent that we cannot export to a specific customer without a license from BIS, we may seek a license for the customer. However, the licensing process is time-consuming. There is no assurance that BIS will grant such a license or that BIS will act on the license application in a timely manner. Even if BIS issues a license, it may impose burdensome conditions that we or our customer cannot accept or decide not to accept."

The company competes both against AI giant Nvidia as well as other supporters of AI processors, such as AMD and Intel. The main advantage of Cerebras's Wafer Scaling Engine (WSE) processors is high-bandwidth low-latency on-wafer interconnect that optimizes both performance and power consumption. While it is hard to produce wafer-scale processors, their performance, power efficiency, and bandwidth promise to ensure that Cerebras will have a special place on the market due to unique advantages.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

bit_user Reply

Forget the fact that it's a foreign customer - relying on a single customer is bad for other big reasons. Having multiple customers helps spread mindshare, creates a developer community, fosters collaboration on integrating support into open source projects and OS distros, and ultimately helps drive demand at other customers. So, I think it was short-sighted of them, if they failed to set aside a chunk of their production volume to use for courting other customers.The article said:Relying on essentially one big customer, based in the UAE, a country which is under U.S. export restrictions, is a risk and Cerebras makes no secrets of that.

Speaking of their architecture more generally, a challenge I foresee them facing is the issue of SRAM-scaling. For good performance, they're very dependent on storing weights in the wafer, not in separate DRAM. While their compute logic will benefit from smaller manufacturing nodes, they won't get much more SRAM density. Perhaps they can address this by die-stacking like AMD did, but I'll bet it's a lot harder to do on a wafer-sized slab of silicon than on individual chiplets. Also, it could result in some of the tiles becoming defective, which I'm sure isn't an insurmountable problem, but not one you'd like to have.

Anyway, I think it'd be a lot of fun to program, though I doubt I'll ever have the chance. Good luck to them! -

gg83 Reply

A 3d vcache over a wafer scale processor would be amazing! My using slightly mature/perfected nodes would make sense I think. I definitely wouldn't buy into the ipo though.bit_user said:Forget the fact that it's a foreign customer - relying on a single customer is bad for other big reasons. Having multiple customers helps spread mindshare, creates a developer community, fosters collaboration on integrating support into open source projects and OS distros, and ultimately helps drive demand at other customers. So, I think it was short-sighted of them, if they failed to set aside a chunk of their production volume to use for courting other customers.

Speaking of their architecture more generally, a challenge I foresee them facing is the issue of SRAM-scaling. For good performance, they're very dependent on storing weights in the wafer, not in separate DRAM. While their compute logic will benefit from smaller manufacturing nodes, they won't get much more SRAM density. Perhaps they can address this by die-stacking like AMD did, but I'll bet it's a lot harder to do on a wafer-sized slab of silicon than on individual chiplets. Also, it could result in some of the tiles becoming defective, which I'm sure isn't an insurmountable problem, but not one you'd like to have.

Anyway, I think it'd be a lot of fun to program, though I doubt I'll ever have the chance. Good luck to them!