Nvidia's first desktop PC chip lands this month — Asus leads with Ascend GX10 Grace Blackwell desktop platform

Precise availability date and pricing remains unclear.

Actual systems based on Nvidia's GB10 Grace Blackwell platform will be launched starting July 22, according to an Asus invitation, spotted by VideoCardz, promoting the event. The company plans to re-introduce its Ascend GX10 mini-PC on the day. However, the presentation itself barely indicates availability timeframe, or actual price, though both were touched upon by Nvidia itself previously.

"Asus Ascent GX10 Product Launch: Discover the power of the compact Asus Ascent GX10," a statement in the flyer published by VideoCardz reads. "Learn about its key advantages and how it empowers Al development. Nvidia Keynote Speaker: Hear from an Nvidia expert on the cutting-edge features of DGX Spark Software Stack – and how they are redefining Al performance."

The description clearly puts the Asus Ascend GX10 system beyond 'just mini PCs' and skyrockets the unit right into the workstation and edge AI space.

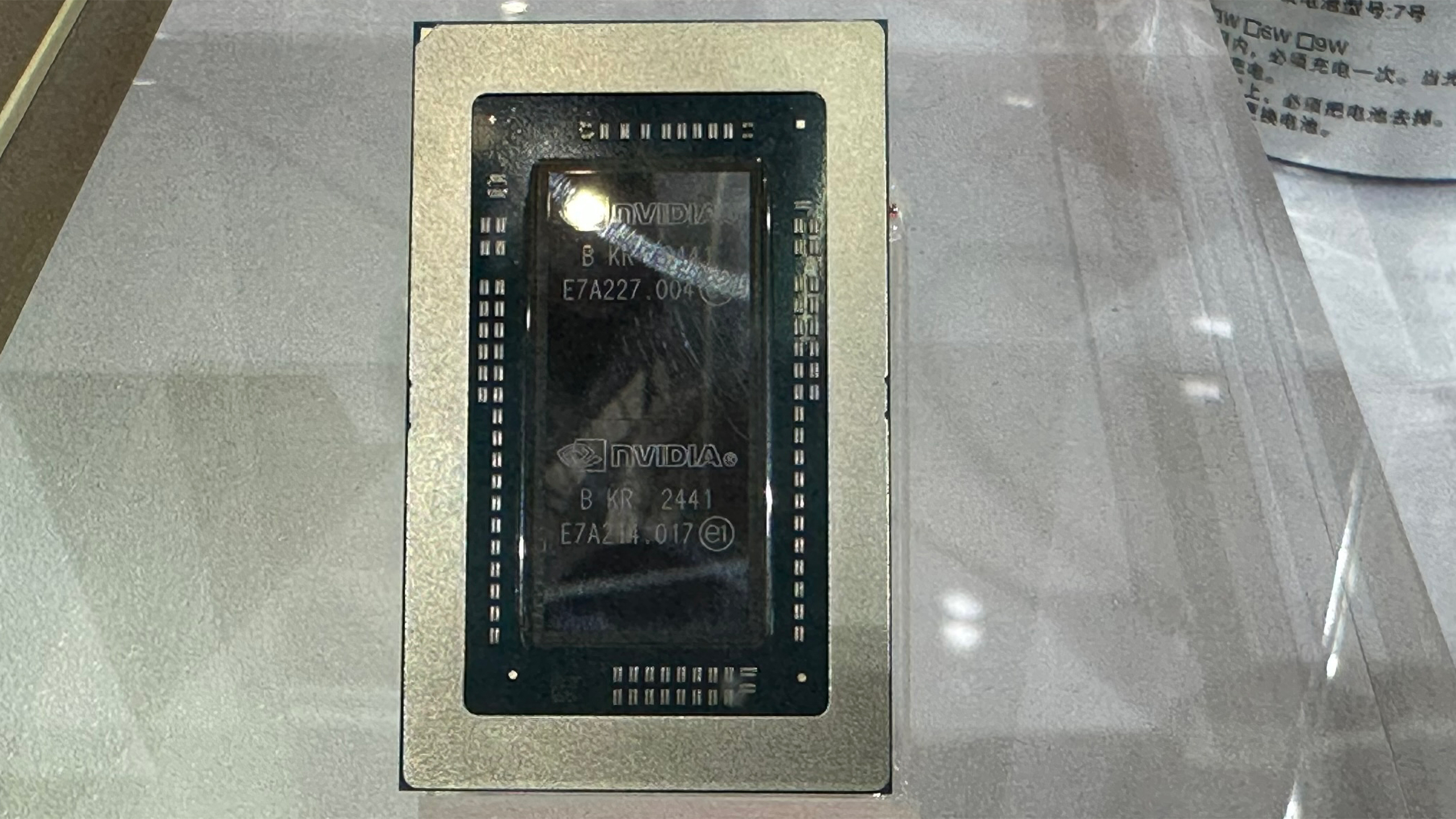

Nvidia's GB10 Superchip system-in-package (SiP) integrates a Grace CPU that packs 10 high-performance Arm Cortex-X925 cores running up to 3.90 GHz with 10 power-efficient Cortex-A725 cores, alongside a Blackwell GPU capable of delivering 1 PetaFLOPS of FP4 compute throughput for AI workloads. The SiP features a 256-bit memory interface supporting 128GB of unified LPDDR5X memory, reaching bandwidths up to 273 GB/s, which is comparable to the memory subsystem of Apple's M4 Pro.

Nvidia positions the GB10 platform as an AI solution that delivers data center–level performance in a compact form-factor suitable for workstations and edge deployments. The unit is expected to come at a steep price, though, something that Asus does not clear up at this point.

Nvidia emphasizes the SiP's unified memory architecture, massive FP4 throughput, and strong single-thread performance as key advantages over traditional CPU-GPU setups. In this way, Nvidia presents GB10 as an ideal solution for building and running LLMs, generative AI applications, and other demanding workloads on desktop-class systems.

However, leaked performance Geekbench figures of the GB10 may disappoint. When it comes to general-purpose compute in Geekbench, the GB10 is close to Qualcomm's Snapdragon X Elite and near Apple's M3 processor, based on the leaked scores. Given that this processor targets AI workstation use cases, high single-thread performance remains an important factor.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Asus' Ascend GX10 mini-PC should closely resemble those of Nvidia's own DGX Spark small form-factor system that is priced at $3,000. In addition to Asus, Dell, HP, and Lenovo are prepping their own versions of the DGX Spark, though prices of such machines as well as their positioning remains unclear.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

bit_user I've already said most of what I had to say about this, back when Nvidia was still calling it Project DIGITS. All I have to add is that Nvidia/Mediatek better be planning on much more aggressive pricing for their mainstream laptop SoC, if they hope to make any significant degree of market penetration, next year.Reply

Relative to their price, the GPU portion of these chips is quite weak, by comparison with their dGPU products. Anyone not specifically looking to use them for AI is going to be disappointed by that. -

bit_user Reply

I know, but I expect them to be closely related to what N1 or N1X that they were originally planning to launch into the the Windows/Arm laptop and mini-PC market, this year.baboma said:These are specifically for AI dev work. I doubt anyone will buy these as general-purpose PCs.

High-end, thin-and-light laptops, comparable to Macs with Apple's Pro-tier of M-series SoCs. Older quotes from AMD execs make that pretty abundantly clear. The applicability for AI is a more recent development and not what Strix Halo was originally targeted at.baboma said:I've wondered about the target market for Strix Halo, viz Ryzen AI Max+ 395. -

ezst036 Its a shame that its Nvidia cause it could otherwise make a decent ARM Linux box once the price came down. But Nvidia isn't exactly the best at Linux support anymore on the GPU front.Reply -

bit_user Reply

You mean because their proprietary drivers were recently put in EOL status through Pascal? Well, they have a new opensource driver, so maybe the future support situation won't be so bad.ezst036 said:Its a shame that its Nvidia cause it could otherwise make a decent ARM Linux box once the price came down. But Nvidia isn't exactly the best at Linux support anymore on the GPU front.

I think a better sense of how their support for these systems will go is to look at how well they've supported the Jetson lineup. Early on, I read about them quickly abandoning them. However, I sort of doubt that's true of more recent models. Granted, it's not a perfect predictor, since those are targeted at embedded application and therefore require longer-term software support, but they're more similar to this, in that they're an entire SoC.

FWIW, I'm not trying to carry water for Nvidia, here. I just bought an AMD dGPU, in fact. My point is just that I wouldn't write off Nvidia so easily. -

bit_user Reply

In one of their early announcements, around the partnership, MediaTek confirmed plans to extend the platform to gaming desktop/mini-PCs. At that time (circa 2022, IIRC), AI PCs weren't even a "thing".baboma said:>the GPU portion of these chips is quite weak, by comparison with their dGPU products.

As with QC Snapdragon X, I expect AI will be the emphasis for Nvidia, not gaming, not when most PC games will only run via software translation. Ergo, GPU perf is not important. Gaming may become more important later, but not for the initial launch.

It's possible they could pivot to AI, but then it doesn't really seem like the "AI PC" has done particularly well, when consumers are given a choice between similar specs where one is an AI PC and the other is not. Given that, I think trying to launch a truly mass market product, where the only real selling point is AI, is rather dubious.baboma said:AI PCs will be where growth will come from, not gaming PCs.

It flopped because Qualcomm initially priced it too high and believed they had an unassailable lead on efficiency that didn't really pan out. I'm glad Qualcomm is back in the CPU game, but their fatal flaw is that they believe too much of their own hype.baboma said:Snapdragon X flopped because it mistimed the market,

I think Mediatek is more accustomed to being a "value" alternative, but their partnership with Nvidia seems partly motivated to break out of this niche. If they can price it aggressively, I think they can probably make some inroads, but they should really try to "wow" people on the value for money of at least the lower product tiers.

Then it will flop like Qualcomm. Outside of the niches already being served by GB10, I think there won't be enough interest in a premium priced solution that's still slower than their dGPUs.baboma said:Nvidia will use the same strategy as QC. It'll launch first in premium tiers. The Nvidia brand (like Qualcomm) is associated with leading-edge performance, not "value." It won't compete on price, cf its dGPU pricing. -

bit_user Reply

...said the same people who over-predicted demand for "AI PCs".baboma said:Edge AI market is set to substantially increase.

I think it's more a matter of "build it and they will come", where "they" is the software developers. Once most PCs have some AI capability, more apps will start to take advantage of it. Not the reverse, which MS seems to be hoping for.

The tradeoff is the size of the models and not everybody has the connectivity or data plans needed to download them, at least not like "whenever".baboma said:Offloading some compute load onto AI PCs would save it money.

Do not want.baboma said:AI needs to come to the OS level before people are motivated to go buy new PCs.

But it doesn't run locally. Make it run locally, without big tradeoffs, and with significant benefits to the user vs. using the cloud service, and then we'll talk.baboma said:AI is already a mass market product. Case in point: ChatGPT.

These are already things people can do in the cloud and not enough people spend enough time doing to justify a new PC.baboma said:Windows will have to offer more than a chatbot. Off the cuff, image generation is an easy pick. There may be others. AI tutor for , tax-prep guide, etc.

I suspect Qualcomm believes the main value proposition is their brand name. Second to that: battery life and 5G connectivity. In the US, few people rely on 5G for data and the battery life wasn't that much greater than their peers.baboma said:It's overpriced because the value proposition isn't there.

I think something in Qualcomm's culture won't allow them ever to try capturing a market simply by making a cheaper alternative. They seem to have the mindset of a premium brand, like Hermès or Ferrari, because their actions tend to look like preventing brand erosion at all costs.

That was in regards to the the economics, performance, and efficiency of different lithography and silicon engineering approaches. These are quantifiable and analyzed by many experts and architects.baboma said:Remember what you yourself said, when you think you are smarter than the industry, think again.

What we're talking about, here, is more along the lines of some marketing dweeb's "gut feel", as evidenced by how badly and frequently they've gotten it wrong. If it were such a clear-cut numerical case as the lithography and silicon engineering questions, then they might've had the odd misstep or execution error, but their strategy would not be so easily called into question.

I'll thank you not to take further statements of mine out of context.

I know they don't like to compete on price, but there are many successful examples where it's worked. Not least of all, the x86 PC, itself - the very thing they're trying to replace! It displaced far better computing solutions, some of which were already entrenched in businesses, by commodifying and undercutting everything else, on price. Then, successfully moved up the value chain, until a point about a decade ago where x86 held complete dominance over the server and cloud markets.baboma said:For a business, competing on price is the absolute last resort,

So, it's definitely possible to start with cheaper solution and work upwards. The nice thing about this strategy is that you build your installed base quickly, and that attracts software developers. That can address not only the questionable value proposition of AI, but also whether there are enough games & other apps that run natively. -

uplink-svk We already have great chips from Qualcomm, what we need is proliferation. I've had all great ARM Windows notebooks at launch and they were all a disaster. x86 still rules iT lands. Nvidia, Microsoft or Google need to invest a lot more to developers and 3rd parties to make ARM widely used.Reply