China's new semiconductor rule spares Taiwan fabs, punishes Intel, GlobalFoundries & Texas Instruments

Killing two birds with one stone.

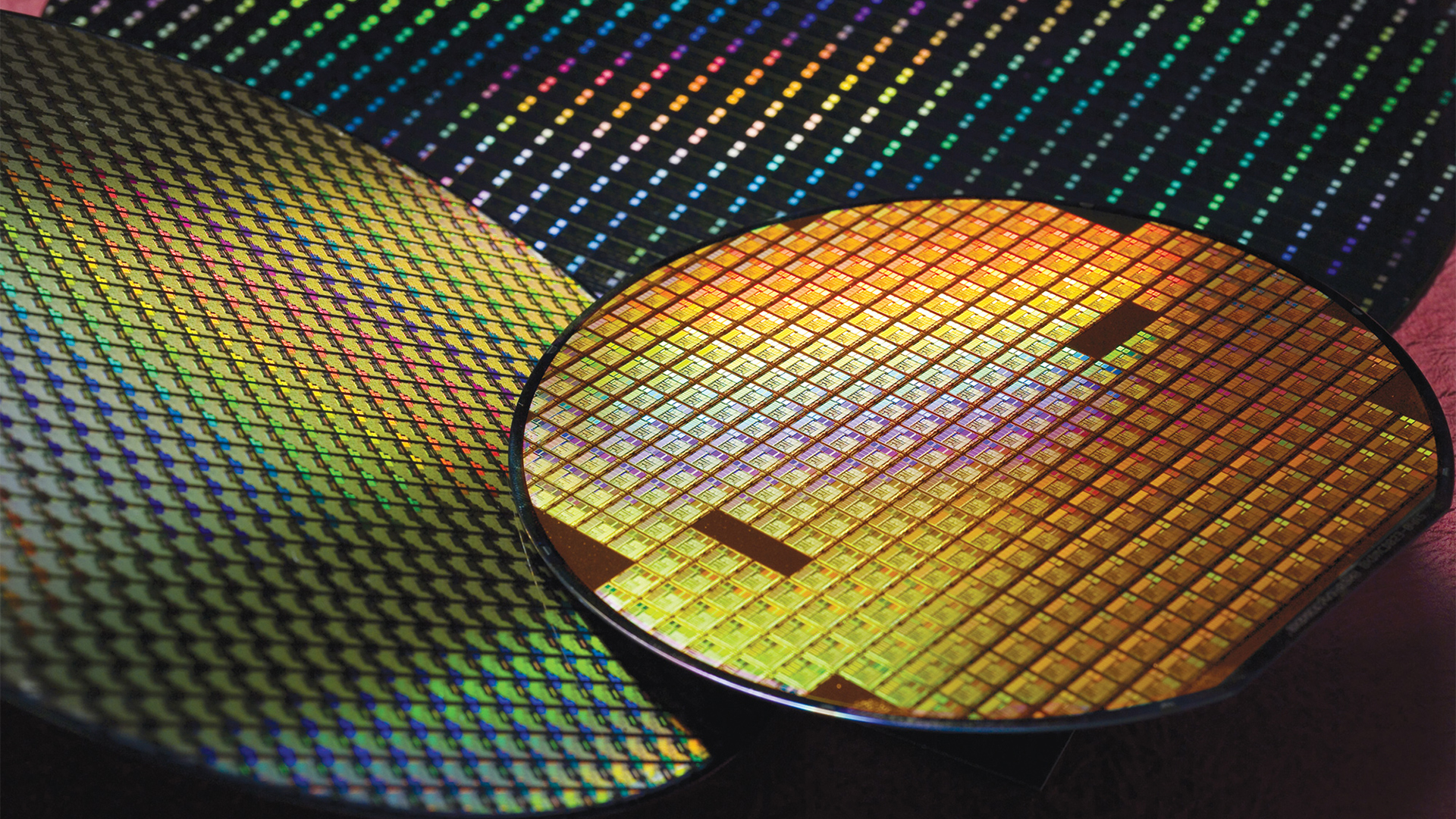

Amid a fierce trade war with the US, China's General Administration of Customs has changed its rules of how the origin of imported chips must be classified, now deeming that the wafer fabrication location should be counted as the origin of chips shipped to the country. This rule exempts products from AMD, Nvidia, Qualcomm, Intel, and other chipmakers who outsource wafer fabrication to Taiwanese companies from the punitive 125% tariff China now imposes on products from the U.S. However, this badly hurts Intel, Global Foundries, Texas Instruments, and chip designers who produce chips in America.

Today, the China Semiconductor Industry Association published an urgent notice regarding the rules for determining the 'country of origin' of semiconductor products shipped to China. As it turns out, the location where the wafer was processed is deemed the 'country of origin,' no matter where the chip was developed or packaged, according to a CSIA document published in WeChat and republished by various analysts. The rule applies to both packaged and unpackaged semiconductors.

Because China deems Taiwan its own territory, chips fabricated by TSMC, Micron, UMC, Vanguard, and other chipmakers in Taiwan will be exempt from punitive 125% import duties imposed on products from then U.S. even though virtually all contemporary chips from companies like AMD, Broadcom, Intel, Nvidia, Micron, and Qualcomm are developed in America and are sold by U.S.-based company.

By applying this rule, the Chinese government kills two birds with one stone.

On the one hand, it allows chipmakers to ship their products to China without any restrictions or punitive tariffs, which enables China-based fabs to continue making actual products based on those chips, thus keeping Chinese facilities busy. As an added bonus, China shows American companies that it considers Taiwan its own territory and actually means it by not imposing any punitive import duties.

On the other hand, it punishes American chipmakers and chip designers that produce their ICs in the U.S., which includes companies that outsource to GlobalFoundries' Fab 8 in New York as well as Texas Instruments, which builds its chips in Texas.

As an added bonus, the Chinese government helps TSMC, UMC, Vanguard, and China-based foundries to potentially land new customers. This has implications, too. Many products made in China use chips from American companies produced in America by companies like Analog Devices, GlobalFoundries, NXP, or ON Semiconductor, or fabbed by contract chipmakers in the U.S., such as Intel or GlobalFoundries. Consequently, companies that use chips from the U.S. will now have to find alternatives, which takes time and costs money. For some, this may be the end of the line.

One thing to note is the stark contrast between how Chinese customs treat semiconductor products and how American customs treat chips in terms of 'country of origin.' The U.S. determines the 'country of origin' by the location of the last substantial transformation, where the product undergoes a major change. For example, a memory IC developed in the U.S., fabbed in Japan, but packaged in China is considered a Chinese product subject to punitive tariffs, according to the current laws. The same applies to logic chips designed in the USA but fabbed in Taiwan and packaged in China by subsidiaries of Taiwanese OSAT giants. By contrast, China's customs determine the 'country of origin' by the location of the actual wafer fabrication facility.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

bit_user So, most companies are going to dual-source. US-based fabs for chips sold in the US and a handful of other countries, while the chips produced for most countries will probably still be fabbed in Taiwan, South Korea, Japan, etc. I expect this is how it'll go for most industries.Reply -

el_rizzo Am I the only one to.think that the Chinese classification makes more sense than the American one? An OEM could do 99% of the production in China, ship the components to Japan just to apply the stickers and it would be deemed a Japanese product. A chip is a chip, wafer making should be the discriminator. But I guess we would have people discussing whether BEOL or FEOL is the real chipmaking step then 🤣Reply -

TCA_ChinChin Reply

Both wafer fabricating and chip packaging are so complex and nuanced nowadays that depending on the context, either one (or both) is legit.el_rizzo said:Am I the only one to.think that the Chinese classification makes more sense than the American one? An OEM could do 99% of the production in China, ship the components to Japan just to apply the stickers and it would be deemed a Japanese product. A chip is a chip, wafer making should be the discriminator. But I guess we would have people discussing whether BEOL or FEOL is the real chipmaking step then 🤣 -

bit_user Reply

This seems related to how the US tariffs are based on trade deficit, and why the administration has taken the position that they will not do "zero for zero" (i.e. nullifying the tariff on a country, if it nullifies its tariffs on US products).el_rizzo said:Am I the only one to.think that the Chinese classification makes more sense than the American one? An OEM could do 99% of the production in China, ship the components to Japan just to apply the stickers and it would be deemed a Japanese product.

Let's consider the example of a country on which the US has placed a low or zero tariff rate. Naturally, producers making lots of imports to the US will want to relocate final assembly to that country. If that happens, then suddenly the US will see a huge trade deficit with that country develop, at which point the US would presumably increase its tariffs on products from that country, thereby defeating the point of producers moving final assembly there.

Okay, so then what if they move final assembly to the US? Well, if the components of the product are where most of the value lies, then the import costs of those components will still incur most of the tariff burden. So, by basing the tariff rates on the trade deficit with a country, the US is trying to draw most of the value addition inside its borders.

However, this only works for those products where final sale occurs inside the US. When we're talking about companies making products for export, the tariffs hurt their competitiveness. For selling into any countries which have enacted retaliatory tariffs (such as China, in this case), there's an incentive for US companies not to do the main value-addition inside the US. That's why I made the above comment about dual-sourcing. -

baboma >Am I the only one to.think that the Chinese classification makes more sense than the American one?Reply

Anything would make more sense than the idiotic premise that if I buy more from you, thereby creating a "trade deficit," then you are ripping me off.

The irony of the situation is that, just as the US is going to war against China, it is paradoxically giving China all the cards (in POTUS' parlance). The US is whacking on its trade allies with ludicrous tariffs, while China is making the rounds to ASEAN and EU countries to foster new trade arrangements.

China is in talks with EU to drop tariffs against Chinese EVs.

https://autonews.com/manufacturing/automakers/ane-europe-could-drop-china-ev-tariffs-0410

China visits Vietnam (46% US tariff), Cambodia (49%), Malaysia (24%) to consolidate ties.

https://reuters.com/world/asia-pacific/chinas-xi-visit-vietnam-malaysia-cambodia-april-14-18-xinhua-reports-2025-04-11

One fallout from the looming US/China face-off is that all those other countries just got a lot more leverage in negotiations, and they will only need to give the US cosmetic concessions so US can save face and back off its ridiculous tariffs. They're now the kingmaker. -

nogaard777 Reply

No, part of the agreements to get US tariffs back down is to agree not to "clean" foreign products. They get busted helping other countries dodge tariffs and their own tariffs go right back up.el_rizzo said:An OEM could do 99% of the production in China, ship the components to Japan just to apply the stickers and it would be deemed a Japanese

That's precisely why Biden's ban on AI hardware was laughably useless because his brainless team did squat when they thought it out. Chinese firms simply set up shadow companies in Singapore, then magically Nvidia's shipments to "Singapore" soared by 7000%. Of course Nvidia DGAF and look the other way when the shipping containers never reach Singapore. -

nogaard777 Reply

The EU is psychotically protective of their auto market. Not gonna happen. Vietnam needs the US more than they need China because THAT'S where many companies are moving to get away from China and it's saber rattling threatening Taiwan. When China loses the other countries gain.baboma said:>Am I the only one to.think that the Chinese classification makes more sense than the American one?

Anything would make more sense than the idiotic premise that if I buy more from you, thereby creating a "trade deficit," then you are ripping me off.

The irony of the situation is that, just as the US is going to war against China, it is paradoxically giving China all the cards (in POTUS' parlance). The US is whacking on its trade allies with ludicrous tariffs, while China is making the rounds to ASEAN and EU countries to foster new trade arrangements.

China is in talks with EU to drop tariffs against Chinese EVs.

https://autonews.com/manufacturing/automakers/ane-europe-could-drop-china-ev-tariffs-0410

China visits Vietnam (46% US tariff), Cambodia (49%), Malaysia (24%) to consolidate ties.

https://reuters.com/world/asia-pacific/chinas-xi-visit-vietnam-malaysia-cambodia-april-14-18-xinhua-reports-2025-04-11

One fallout from the looming US/China face-off is that all those other countries just got a lot more leverage in negotiations, and they will only need to give the US cosmetic concessions so US can save face and back off its ridiculous tariffs. They're now the kingmaker.

What's really going on here is China realized they effed up and shot themselves in the foot cranking tariffs on semiconductors they badly NEED, so they came up with a convoluted reason why just that stuff can be allowed, even though the profits still go to US companies.

Not to mention the US tariffs omitted semiconductors to begin with. So there's no "makes more sense than the American one" when they simply changed it to be exactly the same as the US one was all along. -

bit_user @nogaard777 , their solution to avoid AI products finding their way into China was called the AI Diffusion Rule. It's fairly drastic, which is why they gave it a long runway. It hasn't yet come into effect:Reply

https://www.tomshardware.com/tech-industry/artificial-intelligence/nvidia-and-sia-fire-back-at-u-s-govs-new-export-restrictions-on-ai-gpus-to-china