TSMC's average wafer price jumped 22% in one year — nearly all semiconductor industry growth now comes from more expensive products, not higher production volumes

Shipments of 3nm wafers account for 15% of the company's revenues.

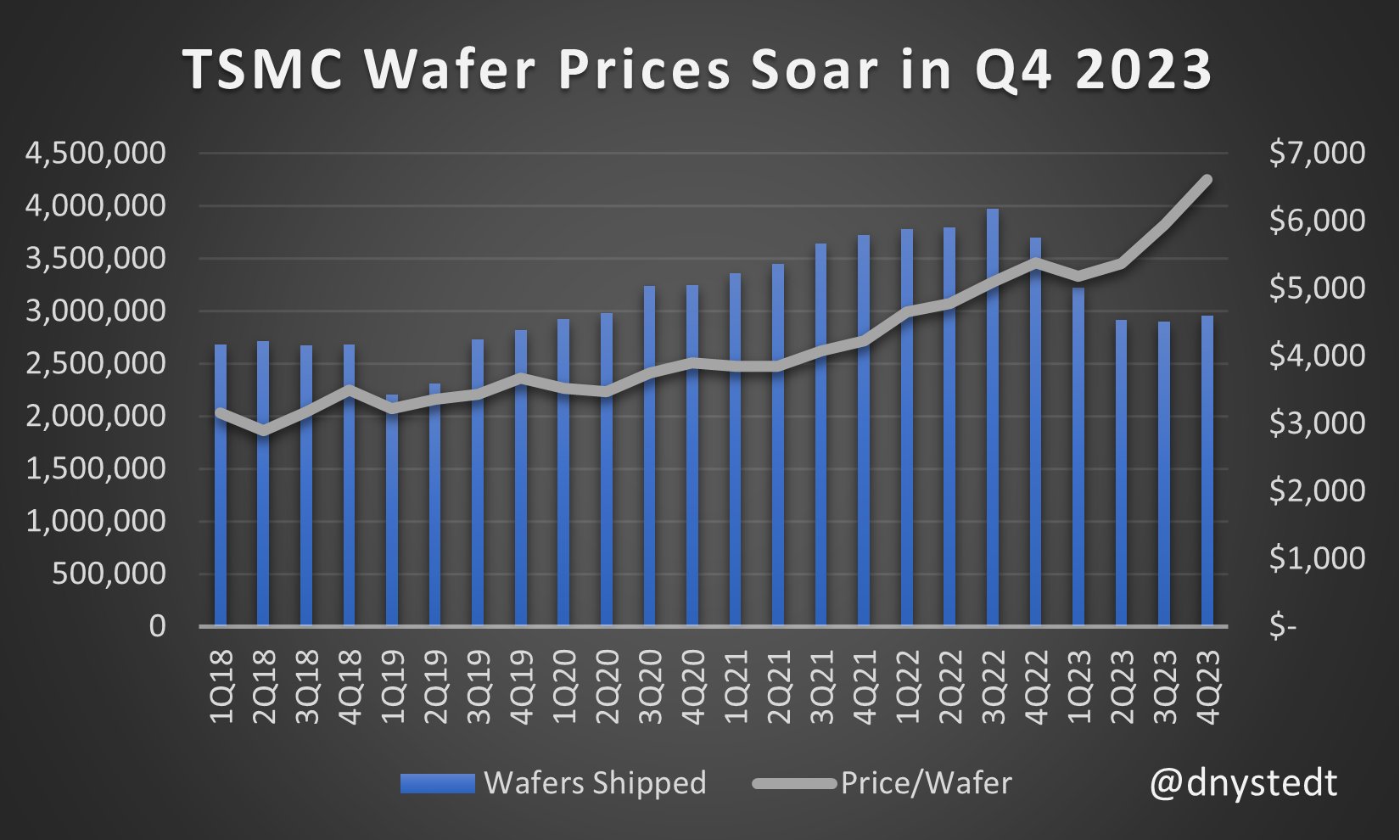

Demand for chips is not exactly at record highs these days, but despite the industry slump, the average selling price (ASP) of a TSMC 300-mm wafer increased to $6,611 in the fourth quarter, an increase of 22% in a single year, as noticed by analyst Dan Nystedt, who attributes this increase to the ramp of TSMC's N3 (3nm-class) process technology. Bernstein Research's Stacy Rasgon also points out that most semiconductor industry growth now comes from increased pricing, and not an increase in the number of processors shipped.

In many respects, TSMC's wafer shipments prove just that: the world's No.1 foundry shipped 2,957 million 300-mm equivalent wafters in Q4 2023, down from 3,702 million in Q4 2022 and below three million for the first time since 2020. However, it only saw a slight drop in revenue.

TSMC's net revenue for Q4 2023 hit $19.62 billion, down 1.5% from $19.93 billion in Q4 2022, despite a massive 20.1% drop in wafer shipments. Meanwhile, as Nystedt observed, the average price of a processed 300-mm TSMC wafer reached $6,611 in Q4 2023, up from $5,384 in Q4 2022. This is because of the rise of TSMC's N3-based wafer shipments to its alpha customers, including Apple.

Some analysts estimate that TSMC may charge as much as $20,000 per wafer processed using its N3 technology, and while this number may not be entirely accurate (as TSMC's quotes depend on many factors), the point is that TSMC charges more for N3 than it does for N4/N5 or N6/N7 process technologies.

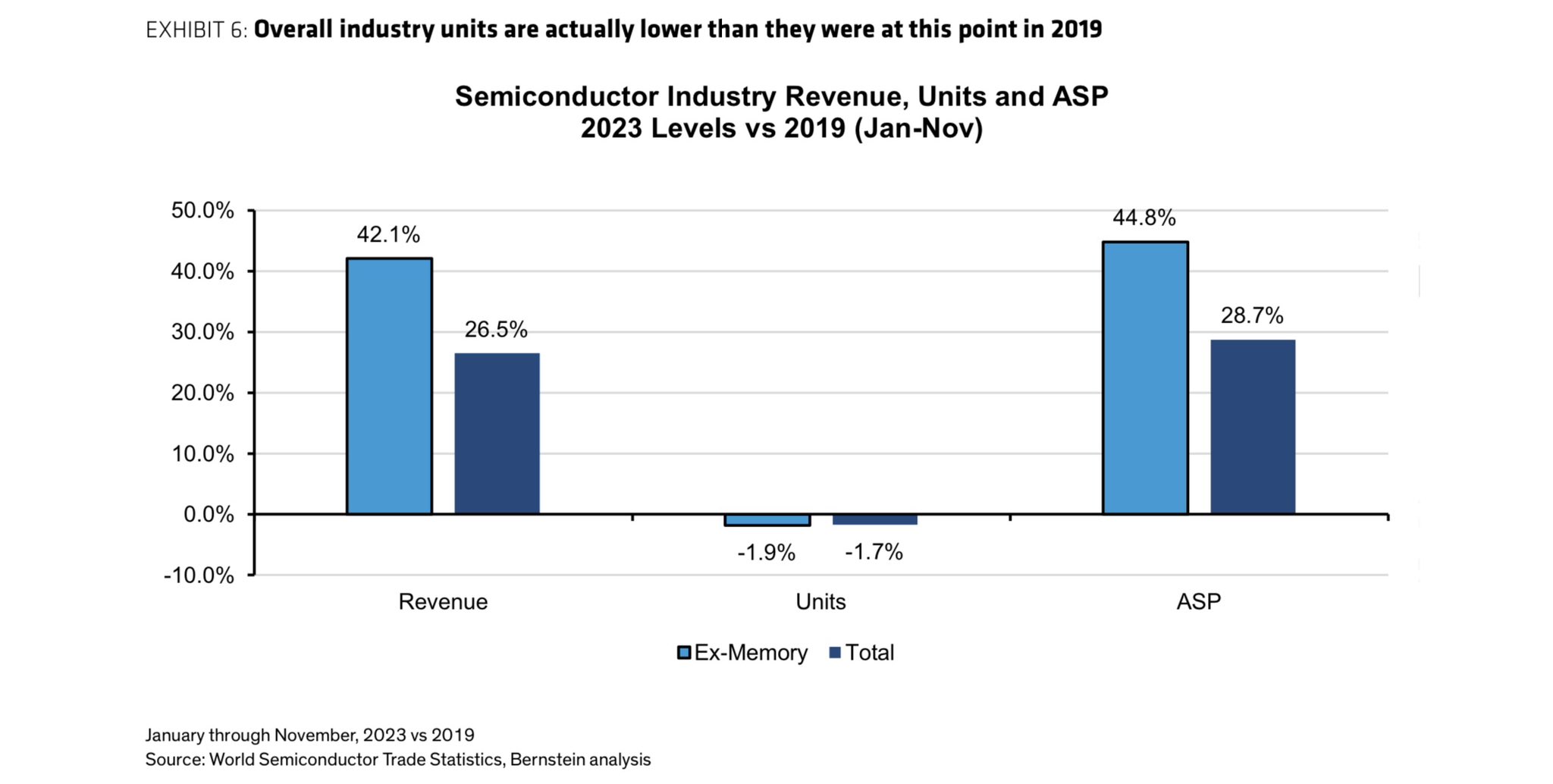

Indeed, the increased prices on wafers processed on the latest nodes largely contributed to almost all of the semiconductor industry growth in recent years, according to Stacy Rasgon, a senior analyst of U.S. Semiconductors and Semiconductor Capital Equipment at Bernstein Research.

"How much has pricing contributed to semiconductor industry growth in recent years," Rasgon rhetorically asked in an X post. "Would you be surprised to learn the answer is 'More than all of it?"

In short, newer process node technologies are becoming much more expensive over time. Rasgon's report shows that while the total number of chips (units) shipped has actually declined from 2019 to 2023, the average selling price (ASP) has risen tremendously, thus leading to more revenue growth for chipmakers.

Speaking of the more expensive process nodes, it should be noted that 15% of TSMC's Q4 2023 wafer revenue came from wafers processed with N3 technology, while N5 and N7 technologies contributed 39% and 17%, respectively. In monetary terms, N3 technology generated $2.943 billion for TSMC, N5 technology brought in $6.867 billion, and N7 technology yielded $3.3354 billion.

Overall, TSMC's advanced technology nodes (N7, N5, N3) represented 67% of its total wafer revenue. Moreover, a broader category, which includes all FinFET-based process technologies, constituted 75% of the company's wafer sales.

It is interesting to note that revenue shares of system-on-chips (SoCs) used in smartphones and high-performance computing applications (an umbrella term TSMC applies to a range of products from gaming consoles to PCs, and from networking chips to datacenter-grade processors) were the same, each accounting for 43%, which is different from TSMC's shipments in the recent years where smartphone SoCs dominated. Revenue from automotive chips made up 5%, and Internet-of-Things chips also contributed 5%.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

To add even more details about TSMC's N3 shipments, we should note that Apple — which is probably the main customer for N3 — uses 3nm processors both for its iPhone 15 Pro smartphones and for MacBook Pro laptops, which is a bit different from its usual tactics to adopt a leading-edge node for handsets first and then use it for its PCs quarters later. For obvious reasons, this is good news for TSMC as it can sell more wafers processed using its leading-edge process technology.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

dlheliski You misused comma for decimal inReply

shipped 2,957 million 300-mm equivalent wafters

It was 2.957 million wafers. -

tbq Replydlheliski said:You misused comma for decimal in

shipped 2,957 million 300-mm equivalent wafters

It was 2.957 million wafers.

That's how they do it in Europe. They also use a comma for the decimal so 99¢ would be written 0,99 instead of 0.99 -

TJ Hooker Reply

That isn't relevant here though, as neither this article nor the TSMC slides referenced are using the convention of a period as thousands separator. The slides list the number of wafers as "2,957 kpcs", with kpcs presumably meaning kilo (thousand) pieces. Which would be just shy of 3 million.tbq said:That's how they do it in Europe. They also use a comma for the decimal so 99¢ would be written 0,99 instead of 0.99 -

dlheliski Reply

I considered that but elsewhere they clearly use period as the decimal point, as in "N3 technology generated $2.943 billion"tbq said:That's how they do it in Europe. They also use a comma for the decimal so 99¢ would be written 0,99 instead of 0.99 -

Co BIY Does this represent an actual slow down in total chip containing goods sold or chip consolidation inside the products or low prices on legacy nodes because of competition ?Reply -

magbarn I understand it's crazy expensive to make 3nm chips, but isn't this partly from TSMC's monopoly?Reply -

dlheliski Reply

I don't think it has much to do with TSMC's market share. Everyone is buying the same tools for $400M per unit, and they have a fixed throughput. TSMC's margins are not changing dramatically.magbarn said:I understand it's crazy expensive to make 3nm chips, but isn't this partly from TSMC's monopoly?