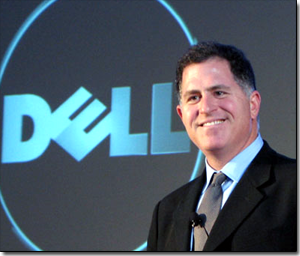

Dell Announces $24 Billion Deal to Go Private

The last couple of weeks have been fraught with rumors regarding a Dell buyout. Word that Dell was looking to go private once more started doing the rounds in mid-January. More recent rumors pointed to sizable investments from Silver Lake and Microsoft as well as Michael Dell himself. Bloomberg this morning reported that the Dell board met last night to vote on the deal, and it seems all went according to plan, as Dell has just announced a $24 billion deal to go private.

Dell said in a statement today that shareholders would receive $13.65 in cash for each share of Dell common stock as part of the transaction, which is valued at $24.4 billion and financed by CEO and founder Michael Dell and Silver Lake. The deal represents a 25 percent increase on the Dell's closing share price of $10.88 on January 11 (January 11 being the day rumors of the buyout first hit the web). Though the company is barely mentioned in the release, Microsoft did contribute to the financing for this deal and Dell confirmed that Redmond put forth a $2 billion loan.

"I believe this transaction will open an exciting new chapter for Dell, our customers and team members. We can deliver immediate value to stockholders, while we continue the execution of our long-term strategy and focus on delivering best-in-class solutions to our customers as a private enterprise," Dell CEO Michael Dell said in a statement today.

"Dell has made solid progress executing this strategy over the past four years, but we recognize that it will still take more time, investment and patience, and I believe our efforts will be better supported by partnering with Silver Lake in our shared vision. I am committed to this journey and I have put a substantial amount of my own capital at risk together with Silver Lake, a world-class investor with an outstanding reputation. We are committed to delivering an unmatched customer experience and excited to pursue the path ahead."

Dell's board approved the merger agreement unanimously when it came time to vote on the deal. Dell says Michael Dell recused himself from all board discussions and from the vote regarding the transaction. The buyout is still subject to the usual regulatory approvals but is expected to close before the end of the second quarter of Dell’s FY2014.

Contact Us for News Tips, Corrections and Feedback

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Jane McEntegart is a writer, editor, and marketing communications professional with 17 years of experience in the technology industry. She has written about a wide range of technology topics, including smartphones, tablets, and game consoles. Her articles have been published in Tom's Guide, Tom's Hardware, MobileSyrup, and Edge Up.

-

p05esto Dell servers are among the best and their Precison workstation laptops are not too shabby either. I've never had a problem with Dell service (just the opposite). So overall, as far as PC vendors go who else is better, who else provides good enterprise hardware? Maybe HP, but they have their own problems which seem worse in my opinion.Reply -

RealBeast Seems like a much better investment for Microsoft than most of their misadventures. :)Reply -

ojas There was just so much "Dell" in that article...Reply

p05estoDell servers are among the best and their Precison workstation laptops are not too shabby either. I've never had a problem with Dell service (just the opposite). So overall, as far as PC vendors go who else is better, who else provides good enterprise hardware? Maybe HP, but they have their own problems which seem worse in my opinion.Dell's consumer PCs/Laptops are horribly over-priced. -

internetlad ojasThere was just so much "Dell" in that article...Dell's consumer PCs/Laptops are horribly over-priced.Reply

Don't get me started on their enthusiast products. 3000 bucks for a tower I could build for 1200.

The only good thing about dell's consumer laptops is you can get an el cheapo for ~300 bucks, so when your brat kid sits on it and breaks the screen, you throw it out and buy a new one. -

kingssman nieurI think it will allow company to make brave decisionsReply

This is the part I look forward to. They have a solid enterprise model that produces profit and keeps the company operating in the black. By going private, they can be unshackled by the hindrance of shareholders, and instead able to invest billions into new tech and other business routes that would on paper cause them to be less profitable for one quarter.

Without the obsession of wall street demands or subject to knee-jerk reaction in the trading market, they can concentrate on tangible profits and investments of the company and not be at the mercy of sensationalist stock market shares. -

mbreslin1954 _^_ Exactly! They can be relieved of short-term thinking, worrying about what Wall Street thinks the next quarter results should be.Reply