Ethereum's Latest Hard Fork Drastically Cuts Mining Profitability

Ethereum mining is falling down, falling down...

Ethereum's latest hard fork, London, went live today with several changes meant to prepare the cryptocurrency for long-term success. But one change in particular could drastically reduce the profitability of Ethereum mining in the process.

Ethereum Improvement Proposal (EIP) 1559 makes several changes to ETH transactions that favor cryptocurrency users over miners. The first is the introduction of an algorithmically determined base fee that is burned—which means it's permanently removed from circulation—when the transaction is completed.

The base fee introduced by EIP 1559 can be supplemented by a priority fee that a transaction can offer as incentive to miners for inclusion in their blocks. Transactions can also set a maximum fee, however, which means they only pay the priority fee if it doesn't exceed the amount they're willing to spend. (The base fee is always paid.) Here's how the authors of EIP 1559 explained the purpose of the proposal:

"This ensures that only ETH can ever be used to pay for transactions on Ethereum, cementing the economic value of ETH within the Ethereum platform and reducing risks associated with miner extractable value (MEV). Additionally, this burn counterbalances Ethereum inflation while still giving the block reward and priority fee to miners. Finally, ensuring the miner of a block does not receive the base fee is important because it removes miner incentive to manipulate the fee in order to extract more fees from users."

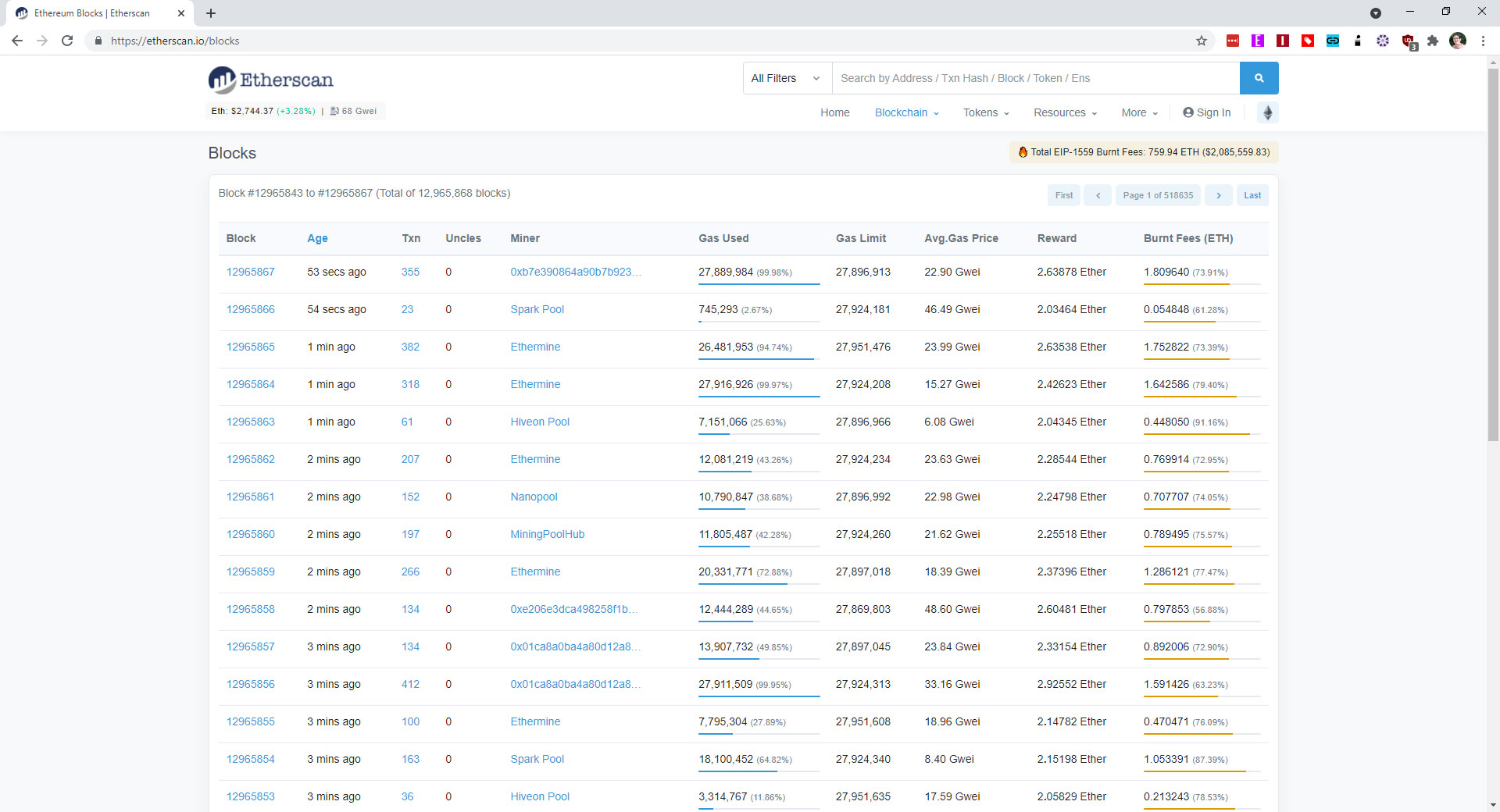

You can see the burning of ETH start at block 12,965,000, but as that was the first block after the switch, only 0.03 ETH was burned. More interesting is the running total, which you can see at the top of the Etherscan.io blocks list. At the time of writing, just under 900 blocks after the London fork went live, about 760 ETH has already been burned—aka, destroyed. That's over $2,000,000 worth of cryptocurrency, if you're wondering.

We did some quick calculations as well, to see how the London fork was affecting mining rewards. Prior to the fork, looking at 100 blocks (12,964,992 through 12,964,893), the average block reward was 2.581 ETH. After the fork, looking at another set of 100 blocks (12,965,779 through 12,965,680), the average reward dropped to 2.234 ETH. That's 'only' a 0.347 ETH difference, but it's still about 15% less profits for miners in the long run. It's also about $280,000 per hour in potential shared profits that will no longer be available.

The not-so-calm before the proof-of-stake storm

The change effectively reduces the short-term profitability associated with mining, then, in exchange for improving the Ethereum platform writ large. But this isn't the only threat to miners' profits—the network's plan to shift from a proof-of-work to a proof-of-stake model with Ethereum 2.0 was already set to obviate mining.

With the proof-of-work model, Ethereum miners are responsible for "the mechanism that allows the decentralized Ethereum network to come to consensus, or agree on things like account balances and the order of transactions," Ethereum.org said. The proof-of-stake model shifts that responsibility from miners to ETH owners.

CNBC reported that "a few years from now, once the protocol has fully migrated to a proof-of-stake model, the entire industry around ethereum mining as it exists today will no longer be relevant." Ethereum miners had a clear incentive to make as much profit as possible before that happened; EIP-1559 directly hinders those efforts.

The report also noted that another change introduced with the London hard fork, EIP-3554, served as a reminder of the looming shift to a proof-of-stake model. EIP-3554 is a self-described "difficulty bomb" that will see mining clients "calculate the difficulty based on a fake block number suggesting to the client that the difficulty bomb is adjusting 9,700,000 blocks later than the actual block number."

EIP-3554 author James Hancock said the difficulty bomb is "targeting for the Shanghai upgrade and/or the Merge to occur before December 2021" and that it "can be readjusted at that time, or removed all together," once that happens. (Shanghai is the code name assigned to Ethereum's next hard fork.)

All of which means Ethereum miners are watching as the base fee wrecks their profits, the difficulty bomb threatens to dramatically reduce the effectiveness of their mining efforts, and the shift to a proof-of-stake model makes them irrelevant. Maybe that means enthusiasts will finally be able to buy graphics cards at retail.

We suspect those who do manage to snag a GPU will be pleased with miners' woes. They won't find much comfort elsewhere, either, because so far the market is reacting favorably to the London hard fork. CoinDesk data puts ETH's price at about $2,800 at time of writing, which is an increase of approximately 6% from yesterday.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Nathaniel Mott is a freelance news and features writer for Tom's Hardware US, covering breaking news, security, and the silliest aspects of the tech industry.

-

RealBeast Ah, so sad to see those who scooped up all the new high end graphic cards not getting their payback.Reply

And what about those crazy folks that bought loads of HDDs for Chia after Backblaze calculated that they could not produce a positive return even considering they already owned the drives so would not even consider it on test pods? -

kal326 It’s almost like those selling pickaxes are going to be the profit winners on this gold rush.Reply -

dcbohn2016 Unless one bought from scalpers, well the ROI should have paid for the cards in 5 to 8 months (card dependent). My single 3060 was paid off 2 or 3 months ago. Thus even at a lower rate my massive investment ($400) will continue to be profitable.Reply