Ethereum Drop Makes GDDR SGRAM Cheaper: Will Graphics Cards Drop too?

Will graphics cards get cheaper?

Ethereum mining has not been as profitable for the past couple of months, though volatility could still change things. The drop in ETH prices not only affected miners' profitability, but also spot prices of graphics memory, such as GDDR5 and GDDR6. Cheaper SGRAM on the spot market could potentially affect contract prices of graphics memory, though we don't expect retail prices of graphics cards (especially the best graphics cards that are used for demanding games) to decrease in the coming months because of GDDR spot price drop.

ETH prices fell by more than 50% within a two-month period as regulators in countries like China and Turkey implemented measures to circumvent speculation on cryptocurrencies and illegal/semi-legal mining. In Q1 2021, about 700,000 graphics cards were sold to miners, according to estimates from Jon Peddie Research, and many of these graphics cards were made using GDDR6 memory sold on the spot market. With demand for boards from miners on the decline, that leads to lower spot prices on memory, but there's a catch: The vast majority of graphics cards use memory that is supplied under contracts with appropriate pricing.

"Even though spot prices are still higher than contract prices for GDDR6 chips, the difference is rapidly shrinking," TrendForce's findings reveal. "This, in turn, will have an adverse effect on the general price trend of GDDR6 chips in the future. The trading is even more subdued for GDDR5 chips that are used in the earlier generations of graphics cards."

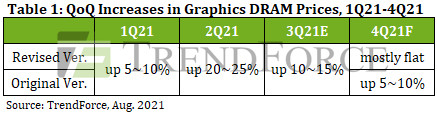

Makers of graphics cards and developers of GPUs — which sell many of their high-end chips liike the Nvidia GA102 with memory — have supply contracts with makers of memory and reconsider prices on a quarterly basis. Because makers of DRAM prioritize production of high-margin server memory, with long-term supply contracts with PC OEMs and relatively low volumes of GDDR memory needed by the graphics industry, GDDR5 and GDDR6 chips remain rather expensive in general. Meanwhile, prices of GDDR SGRAM have been gradually increasing in the recent quarters, according to TrendForce. In fact, analysts from the company expect contract graphics DRAM prices to increase by up to 15% in Q3 and then by up to another 10% ~ 15% in Q4. Even in the best-case scenario, prices would stay flat through Q3.

Another factor that affects demand for graphic cards and therefore prices of GDDR6 memory (which is used on the majority of them) is the secondhand market. Since the profitability of ETH is not as high these days, loads of miners are selling off their hardware, which influences retail prices of graphics cards and indirectly affects prices set by distributors and manufacturers.

Speaking of secondhand graphics cards, we should mention that TrendForce is not the only one to mention these boards and their influence on the market. Palit Microsystems recently gave an interview to Benchmark.pl (via PCGamer) and said that graphics cards used for mining can lose some 10% of performance per year due to working under constant load and thermal stress. While we doubt that a graphics card's wear can be quantified with such a precision, the general idea is that a gamer should avoid secondhand used graphics cards that potentially spent a lot of time in the mines.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

bigdragon Graphics cards won't actually drop until they're regularly in stock. The latest cards are all still sold out at retailers in the USA. Scalper prices might drop, but MSRP and elevated AIB prices will remain until stock catches up with demand. Same goes for memory chips and other components. We won't see any drop in retail channels until supply catches up with demand or exceeds it -- something not likely until next year at the earliest. We'd all like to dream of falling prices, but Nvidia, AMD, and AIBs will bundle games before they dream of lowering prices.Reply

Lets also keep in mind that miners are still making money. They're not making as much money, but they're still doing it. The mining world isn't controlled by Wall Street or Hollywood thinking where making money can be seen as a failure if not enough money is made. This drop in ETH is inconsequential given that so many people are dreaming of the next boom. -

hannibal The prices dont drop untill AIB drops their prices… many retailers have a lot of gpus that dont sell because they are too expensive. And retailers dont want to sell them at loss, so those gpus remains to be on the shelves and retailers just dont buy new gpus so that means that nvidia and amd have to reduce production because demand is going down…Reply