Ethereum Gold Rush Wanes As Price Plummets, Mining Difficulty Skyrockets

It appears the recent gold rush surrounding Ethereum is coming to an end. The price of Ether dipped below $200, and the mining difficulty level jumped by nearly 20%. If you’re getting into Ethereum mining now, it’s probably too late.

Cryptocurrency (also known as crypto coins or altcoins) found its way back into the public eye in recent months when Ethereum's value spiked dramatically: At the end of 2016, Ethereum was worth $8.22 per coin, but by February 28, 2017, the value of Ether doubled to $16.05. On March 6, Ether peaked at $19.45, and 10 days later the value more than doubled again, to $43.87. By the end of April, the value of Ether coins began rising again, and by May 6, Ether was trading for $94.81.

This is around the time that people outside of the crypto-mining scene started to pay attention, and many jumped into the mining craze--so much so that the worldwide inventory of GPUs was all but wiped out. Good luck finding an AMD RX 570 or 580 on the shelf, and if you happen to find a GTX 1060 or 1070, the price will likely be jacked up through the roof.

Mining isn’t the only craze around Ether. People are buying the coin on exchange markets such as Coinbase.com to get in on the investment opportunity. As a result, the price of Ether continued to skyrocket through May and well into June. On May 25, the value reached $195.27. The price dipped slightly the following day, but it rallied again and reached the all-time high value of $380.28 on June 13.

Following that peak, the price of Ether began to drop, and it hasn’t yet begun to recover. At press time, the price is sitting at $198.75—its lowest point since March 29.

Increased Difficulty

Ethereum is in no way dead, but the opportunity to make a handsome living from a mining rig in your basement is coming to an end. But how can that be? If people were able to make money when Ether was trading at around $10, how could $200 per coin be unprofitable? The answer is that the mining difficulty has increased at a staggering rate in the first half of 2017.

As Ethereum gains popularity and more mining rigs come online, the total number of processing power on the Ethereum network increases. As the network’s capabilities increase, the Ethereum blockchain adjusts the difficulty to keep the rate of processed blocks somewhat constant. If it takes less than 10 seconds for the network to find a block, the difficulty increases. Should the network's hash rate drop such that it takes longer than 20 seconds to find the next block, the difficulty gets lowered. And blocks uncovered within 10 to 19 seconds have no effect on the mining difficulty.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

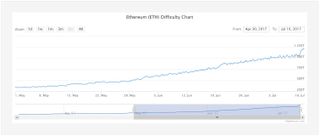

The sudden influx of Ethereum miners, which was spurred by the media response to the value increases, caused a massive increase in mining power and, in turn, huge increases in difficulty. Throughout the lifespan of Ethereum, the difficulty rating has doubled every six months, but that all changed this year. In mid-March, when the price of Ether started to see significant gains, the Ethereum network required less than 200 THash/s (Terrahash per second) to uncover a block. The increased value of Ether coins encouraged seasoned miners to double down on Ethereum, which in turn caused rapid difficulty increases. By May 1, the Ethereum mining difficulty increased to 350 THash/s, and it surpassed 400 THash/s on May 13.

Since then, the Ethereum mining difficulty rating has steadily increased. For a time, the price of Ether kept well ahead of the difficulty increase, but the profit margins are getting slimmer by the day. On May 29, the Ethereum difficulty level surpassed 500 THash/s for the first time, but on July 2, the network requirements rose past 1,000 THash/s (1 Petahash/s).

This week, the Ethereum network was hit with the largest difficulty increase in its history. The difficulty rating jumped from 1.066 PHashps to 1.228 PHashps in less than 48 hours. Couple that with the plummeting value of Ether, and it's easy to see the bottom dropping out of Ethereum mining profitability. If you’ve recently invested in hardware with the expectation of paying it off quickly and letting the cash roll in, you might be in for a surprise. And if you fell for a scalper’s trap and paid above market value for your mining system, you should probably start looking at other coins to help pay off your investment.

CoinWarz.com offers a difficulty chart that you can use to track the changes in the network's hashrate requirements.

Inevitable End To Ethereum Mining

If you already have an Ethereum mining system running, it’s probably worth continuing to mine for now, but your time is coming to an end. Even if the difficulty drops (which would happen if a significant number of miners switch to a new coin), there’s still a finite window in which you can mine Ether coins. The Ethereum network will eventually switch from a Proof-of-Work (PoW) model (mining) to a Proof-of-Work/Proof-of-Stake (PoS) model. The PoS model would still pay participants a share of Ether, but it would be a percentage of the transaction rather than fresh currency. It's somewhat like a dividend payment on a stock investment.

No one knows for sure when Ethereum will switch to the PoS model, but expect the change to begin in the next couple months. In May, one of the developers involved in Ethereum’s creation, Filippo Merli, published an implementation guide that explains how the change would occur. The transition will happen in two stages--a hybrid Pow/PoS model followed by a complete change over to PoS. It’s only a matter of time before Ethereum mining is no longer viable, and if the price continues to drop, that time may come sooner than later.

Kevin Carbotte is a contributing writer for Tom's Hardware who primarily covers VR and AR hardware. He has been writing for us for more than four years.

-

JamesSneed Now hopefully when AMD releases Vega the miners wont buy them all and cause the prices to skyrocket.Reply -

AgentLozen This sucks if you've heavily invested in a mining rig but this is good news for gamers. I couldn't imagine paying $500+ for a GeForce Gtx 1070. Like Jamessneed was saying, this should make Vega launch (and stay) at a reasonable price.Reply -

cats_Paw When the craze is shouted everywhere for people to jump in is a few days before the thing crashes.Reply

What an interesting coincidence...

And by the way, if that is being manipulated, stolen, hacked, etc; good luck trying to get your money back. -

Slumy__57 Fiiiiiiinally. Maybe now we'll see GPU prices back to normal, they were really starting to get into the sweet spot, I saw 1070s going for $330ish, and 1080s going for $380ish, and I was really hoping to pick up a 1080 sometime soon.Reply

I can't help but wonder if the craze is going to have more of a lasting impact though. I hope we don't see prices settle back into that just-above-msrp zone again. -

InvalidError Reply

When Vega launches, it'll be too expensive to consider for mining anyway. What made the 470/480/570/580 so popular for Ethereum is 8GB VRAM for $200-250. 8GB Vega will likely be closer to $500 as it is aimed at the GTX1080.19929399 said:Now hopefully when AMD releases Vega the miners wont buy them all and cause the prices to skyrocket. -

DSzymborski Thank goodness, I was at the point where I wouldn't even answer questions about a mining rig. No way did I want to take part in people lured by free, easy money that was causing problems for people that just wanted to build a nice, normal, gaming PC.Reply -

Pompompaihn As someone who just cleared $425 on a 6 month old RX480, all I can say is man I had good timing!Reply -

dstarr3 Didn't take long for that bubble to burst. It's like the stock market, once you hear about something big, it's too late.Reply

Most Popular