The Week In Storage: SSDs Sales Surging, But Shortage May Be Upon Us

The week in storage found us taking a rare look inside the IBM FlashSystem 900 All-Flash Array to compare how the custom-designed SSD modules differ from typical enterprise-class commodity SSDs. IBM announced that it has perfected the art of storing 3 bits per cell in Phase-Change Memory, which will pose a potent density threat to the forthcoming Intel/Micron 3D XPoint if IBM can find the correct manufacturing partner.

It appears that Toshiba is absorbing part of OCZ, which it purchased for a scant $35 million in 2013, into the larger company. OCZ silently retired a large portion of its client products as its site and branding underwent a makeover. We expect more updates to emerge at Computex.

QNAP unveiled its new TS-x82T systems at an event at the Tech Museum in San Jose, and Chris Ramseyer was on hand to examine the new systems, which offer both Thunderbolt and 10 GbE connectivity options.

SSDs have already replaced millions of HDDs in notebook and desktop PCs, and if SanDisk has its way, the speedy storage will also displace external HDDs. Flash is almost impervious to shock and vibration, which makes it a uniquely well-suited medium for mobile applications, as Chris detailed in the SanDisk Extreme 500 Portable SSD Review.

SSD Sales Surging

The HDD market is bleeding from multiple wounds, as evidenced by the blood-soaked quarterly revenue reports from Seagate and WD, but it should go without saying that the SSD market is thriving. Unfortunately, many of the NAND fabs are also taking a revenue drubbing as the industry transitions to 3D NAND, so the picture is not as clear.

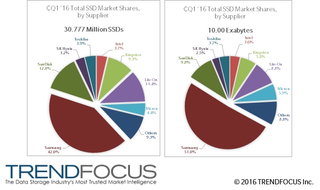

The most recent Trendfocus report indicated that SSD penetration into the desktop PC market continues unabated in spite of the 15 percent Quarter-over-Quarter (QoQ) PC decline. The total number of client SSDs shipped in Q1 increased 4 percent to 27 million units. The total number of SSDs shipped was listed at 30.777 million units, which revealed that enterprise SSDs accounted for only 6.777 million of the SSDs shipped; client SSDs continue to be (by far) the largest SSD cash generator.

Typical 2.5" SSDs grew 5 percent QoQ, but module-based SSDs (such as M.2) exhibited slower growth, which Trendfocus analyst Don Jeanette attributed to the receding PC market.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

The enterprise segment also continued to make great strides forward in all segments. SATA SSDs, which account for 80 percent of all the enterprise SSDs sold, grew 5 percent. SAS grew 6.7 percent, but the burgeoning PCIe SSD segment jumped 16.3 percent QoQ (up to 164,000 units). The average capacity of enterprise SAS SSDs also jumped significantly, and we expect that to continue as Samsung's 15 TB SSDs make their way to market--EMC indicated that it will begin using them in many of its appliances by the end of the year.

Samsung continued to lead the market share category in both total units (42 percent) and capacity shipped (51 percent). However, Samsung's unit-shipped market share declined 4.8 percent in comparison to the previous quarter. This is likely due to the lackluster notebook market. Samsung did well in every facet of the enterprise SSD market (SAS, SATA, PCIe) and continues to ship more bits every quarter.

Flash also plays a pivotal role in mobile use-cases, such as tablets and phones, and this slice of the NAND pie accounted for over 60 percent of the total capacity shipped last quarter (a decrease of 4 percent QoQ). Trendfocus predicted this mix will continue to change as more 3D NAND makes its way into SSDs.

...But Is Winter Coming?

There is increasing speculation that a shortage of MLC NAND might hit the industry in the coming months. The disjointed state of the NAND market makes that a strong possibility. The increasingly rocky transition to 3D NAND may spark the shortage due to a lack of 2D NAND manufacturing capacity during the transition.

We spoke with Don Jeanette of Trendfocus for more details on the current state of the NAND market:

“NAND supply is tightening up as demand from smartphones (new models transitioning to higher capacity) and strong pull from SSDs, i.e.… The increased adoption of SSDs in notebooks being a big part of this. Additionally, the conversion from 2D to 3D will have some negative impact on total output until 3D processes and yields mature. We are hearing that the potential shortage is already upon us. The solid inroads that SSDs have been able to make within the last couple of years have been largely due to sharply falling prices and NAND availability. If the supply tightens, will SSD prices stabilize or go up? We are also hearing some reports that this may be happening, as well. ”

Jeanette indicated that during a shortage, NAND suppliers might route less NAND to the merchant market, which will affect third-party vendors the most. Trendfocus also anticipates that the NAND supply situation should improve next year as new 3D capacity comes online and predicted that overall output will grow 25 percent this year and nearly 35 percent in 2017.

This Week's Storage Factoid

The HDD industry underwent a period of intense consolidation that whittled the number of manufacturers down from 200 to three. The presence of a few players led to rational output increases and decreases based upon market consumption. This restraint balances supply and demand, thus ensuring a steady price structure.

The NAND fabbing industry may have only six major flash manufacturers (with two pairs of partners) with significant output, but it is still in a state of flux. Changing partnerships, and new players, may unsettle the market even more in the future.

China-based XMC is building a new NAND fab, which brings a new (and perhaps irrational) actor onto the NAND stage. Intel is producing NAND for the first time in decades, which is a significant change from its normal joint manufacturing with Micron in the IMFT venture. Toshiba and SanDisk also jointly produce NAND for the Flash Forward venture, but the dynamics of the relationship may change with WD's recent SanDisk purchase.

Increasing demand is another factor that can upset the NAND cart. Weak NAND demand in the mobile and desktop space fueled the low pricing that increased the rate of SSD adoption, particularly in notebooks and enterprise applications. Many vendors are increasingly reliant on flash. However, the increased demand could lead to higher prices during the transition to 3D NAND, indicating that the NAND sword cuts both ways.

Paul Alcorn is a Contributing Editor for Tom's Hardware, covering Storage. Follow him on Twitter and Google+.

Follow us @tomshardware, on Facebook and on Google+.

Paul Alcorn is the Managing Editor: News and Emerging Tech for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

Most Popular