Top 25 Cryptocurrencies By Market Cap

Bitcoin

Created by an anonymous developer, Bitcoin came out in 2008. Whoever it was, the developer’s goal was to create a “peer to peer cash system that would allow online payments to be sent directly from one party to another without going through a financial institution.”

What Bitcoin did differently compared to other attempts at digital cash was implement a “blockchain” system that prevented double spending. Instead of using a trusted central party to verify all transactions, Bitcoin verifies transactions through its peer to peer network.

Bitcoin is not just the original cryptocurrency that allowed almost a thousand cryptocurrencies to bloom, but also the king of all cryptocurrencies; Bitcoin currently has a market capitalization (number of coins multiplied by value of each coin) of over $57 billion, or roughly 45% of the value of the whole cryptocurrency market.

(unchanged)

Ripple

Ripple is a payment network that enables "secure, instant and nearly free global financial transactions of any size with no chargebacks."

Ripple is unlike most cryptocurrencies in that it doesn’t use a blockchain to establish consensus for transactions. Instead, it uses an iterative consensus process that makes it faster than the Bitcoin network, but may also leave it more exposed to attacks.

The developers of a rival network called “Stellar Lumens” that used the same consensus ledger as Ripple discovered that the system is unlikely to be safe when there is more than one node validating a transaction. However, Ripple strongly disagreed with the conclusion and claimed Stellar had incorrectly implemented the consensus mechanism and lacked some of the built-in protections that Ripple had supposedly built.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Ripple has seen some success in convincing large financial institutions, including Japan's largest banks, to test its blockchain and perhaps even implement it in the future.

(Previously #3 ↑ )

Ethereum

The main promise of Ethereum is that it’s a Turing-complete “programmable blockchain” that allows developers to build all sorts of distributed apps and technologies that wouldn’t easily work on top of Bitcoin (as it stands today).

The Ethereum platform has enabled many companies to raise tens (or even hundreds) of millions of dollars in funding for their own Ethereum-based projects. This has further increased Ethereum’s value, reaching around half of Bitcoin’s market cap this year.

Ethereum has recently faced some scaling issues as the number of companies launching an “Initial Coin Offering” (ICO) has boomed. The network has been bogged down for many hours or even days at a time due to a handful of popular projects launching their own ICO to raise funds.

The developers behind the platform has promised both medium-term and long-term changes to solve this, including switching to a “Proof of Stake” (PoS) transaction verification system that’s supposed to be much more efficient than the Proof of Work (PoW) system that most cryptocurrencies, including Bitcoin, use.

(Previously #2 ↓ )

Stellar Lumens

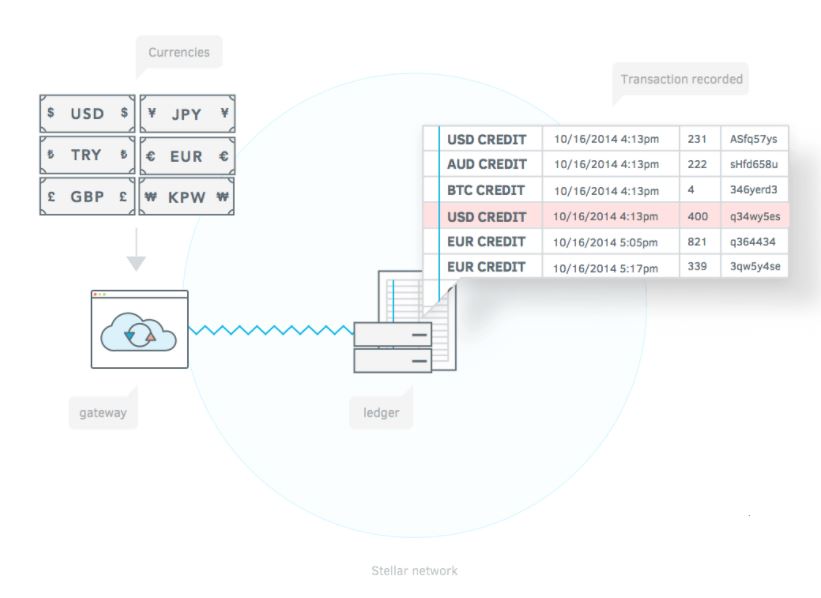

Stellar Lumens is a cryptocurrency similar to Ripple and aims to become the de facto cryptocurrency system used by banks and other financial institutions. The “lumens” are the currency units that exist on the Stellar network.

The developers behind the Stellar network believe that lumens could eventually be used as a “bridge” between different cryptocurrencies. However, to exchange between cryptocurrencies, you’d have to trust a third-party “anchor,” similar to how you trust a cryptocurrency exchange to convert your money from one currency to another. The main difference seems to be that these anchors will live on the Stellar network.

Recently, IBM announced a partnership with Stellar to enable banks to complete instant cross-border transactions with each other, which seems to have propelled Stellar Lumens back into the top 25 cryptocurrencies. IBM will use its own custom blockchain solution for much of the transaction clearing, but the transaction settlement will be done on the Stellar network.

(Previously #6 ↑ )

Bitcoin Cash

Although it has only existed for a few weeks, Bitcoin Cash has already surged to top five in terms of market cap. That's because Bitcoin Cash is actually a fork of Bitcoin, supported by the biggest Bitcoin mining company as well as the manufacturer of Bitcoin mining chips (ASICs) -- Bitmain.

A fork happens when a group of developers decide they don’t like the direction of the current software roadmap and then take the existing code and add their own improvements to it. This creates a separate version of the previous software with its own roadmap.

Bitcoin Cash was created mainly because Bitmain didn’t like a feature called SegWit that Bitcoin recently implemented. SegWit allows for cheaper transactions (bad for miners such as Bitmain) and prefers bigger mining blocks (8MB vs 1MB for Bitcoin) as a solution to Bitcoin’s increasing scalability problem.

(Previously #4 ↓ )

EOS

EOS is yet another Ethereum competitor that uses a “Delegated Proof of Stake” (DPOS) system, which supposedly improves on the regular PoS system because users can delegate their voting rights to others in the network in order to decrease transaction verification times and make the network run more efficiently.

EOS also separates read and write actions to increase speed and enables public and private blockchains to communicate asynchronously. Instead of long addresses, users of the platform can also create account names, and those accounts can have different permission levels.

With EOS, you can also roll back changes to fix serious bugs if a supermajority of users agree to the changes. Presumably, this is done to avoid the same situation that created Ethereum Classic and the new Ethereum fork.

(Previously #5 ↓ )

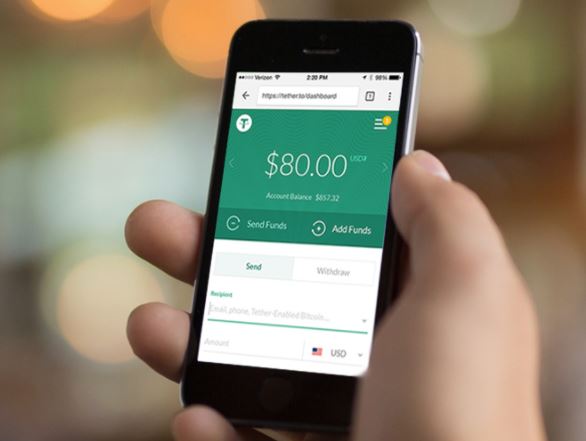

Tether

Tether is a special kind of cryptocurrency in that its value is anchored to the U.S. dollar. That means it allows people to store their USD in a cryptocurrency that doesn’t see the same kind of volatility other cryptocurrencies see on a daily basis.

Traders, especially, can store their money in Tether whenever the market is going down, taking the value of all cryptocurrencies with it. When the market is showing signs of recovery, they can start trading other cryptocurrencies again.

The company behind Tether claims the coins are backed 1-to-1 by USD reserves and that its holdings are published daily and frequently audited. However, the company also says it won’t convert your Tether coins to USD itself. You will have to exchange your tether to other currencies via online exchanges.

Tether was recently hacked, and almost $31 million was stolen. Some speculation points to the hacker being the same person or group of people that previously hacked the European Bitstamp cryptocurrency exchange service.

(Previously #9 ↑ )

Litecoin

Litecoin was one of the very first “altcoins” to be created with the goal of being the “digital silver” to Bitcoin’s digital gold. Litecoin was also a fork of Bitcoin (as many cryptocurrencies were in the early days), but it could generate blocks four times faster and have four times the maximum number of coins (84 million).

It also uses a different mining algorithm, called “scrypt,” compared to Bitcoin, which uses SHA256. This gives Litecoin a mining decentralization advantage because people only need GPUs to mine Litecoin, as opposed to Bitcoin, where ASICs are required these days for any sort of mining reward.

More recently, the original developer of Litecoin committed to working full time on the cryptocurrency. He also set a mission for Litecoin to become a mature cryptocurrency where new innovations could be tested out before Bitcoin adopts them, too. This would make it safer for Bitcoin to adopt new technologies while also raising the importance of Litecoin on the market.

(Previously #7 ↓ )

Bitcoin SV

(Previously unranked )

TRON

TRON is the first cryptocurrency built on top of the Ethereum blockchain as a standard ERC20 token to have 10 million wallet users. TRON’s purpose is to be an open source platform for the global digital entertainment industry by providing functions of payment, development, storage, and credit sharing.

Texts, pictures, videos, and live broadcasts could all be distributed on the Tron blockchain. People who play games that support the TRON platform will also be able to freely exchange their in-game credits with each other.

(Previously #11 ↑ )

Cardano

Cardano is a new cryptocurrency that comes with some interesting new innovations. It was built by a team of technology-focused developers and academics from multiple universities. One of these innovations is that the code was written in Haskell, a more memory-safe programming language, which should minimize the existence of bugs on the Cardano network.

On top of that, Cardano’s developers have formally verified some core components of the network, including its Proof of Stake (PoS) system, which should also drastically increase its security. The "Ouroboros” algorithm for PoS systems was also peer-reviewed by multiple cryptographers.

Cardano’s developers have said that the protocol’s multi-layer architecture should allow for Bitcoin levels of privacy for users while also allowing regulator oversight on a per-app basis. Cardano also comes with its own “treasury” system, which the developers have said will ensure the sustainability of the protocol.

(Previously #8 ↓ )

Lucian Armasu is a Contributing Writer for Tom's Hardware US. He covers software news and the issues surrounding privacy and security.

-

abryant Archived comments are found here: http://www.tomshardware.com/forum/id-3741880/top-cryptocurrencies-market-cap.htmlReply -

beayn And worth an honorable mention should be the coin with the highest gains for the last couple of weeks - Ravencoin. I think it made top 50 now.Reply -

ricechristopher241 Hi, I also would recommend this articale -Reply

https://www.telegraph.co.uk/technology/digital-money/top-10-popular-cryptocurrencies-2018