Top 25 Cryptocurrencies By Market Cap

Monero

Monero is one of the private transactions-capable cryptocurrencies with the most active communities because of its open and privacy-focused ideals. Many consider it the most private cryptocurrency, especially after a recent Europol bust where the only cryptocurrency transactions that couldn’t be traced were Monero transactions.

Monero’s privacy is guaranteed by a ring signature algorithm, which means that the coins are “mixed” at the protocol level, which according to Monero developers, makes transactions “untraceable.”

Monero’s coins are also fungible, which means there won’t be any way for an exchange or for vendors to block certain Monero coins. All Monero coins will be interchangeable with others.

(Previously #10 ↓ )

Binance Coin

Binance Coin (BNB) is the cryptocurrency belonging to Binance, one of the largest cryptocurrency exchanges. The Binance Coin was one of the fastest growing cryptocurrencies ever, with its value increasing from about 10 cents to $22 in only six months in 2017.

The value of the Binance Coin grew so rapidly mainly because Binance was giving everyone who used it on its platform a 50% discount in trading fees. This led to more and more people buying the Binance Coin so they could benefit from lower trading fees, which in turn increased the coin’s value. The discount will drop to 25% later this year, and 12.5% a year after.

Binance also promised to buy back up to 100 million Binance Coins in the future (of out of a maximum of 200 million coins), and then burn those coins, thus further increasing the value of the remaining coins.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

(Previously #14 ↑ )

IOTA

IOTA is a cryptocurrency technology that targets the Internet of Things (IoT) and doesn’t use a blockchain in order to reduce the computational needs of the network and eliminate transaction fees.

IOTA’s breakthrough ledger technology is called “Tangle,” wherein the Sender in a transaction is required to do a proof of work that approves two transactions. This removes dedicated miners who are needed to verify transactions on most other cryptocurrencies. It also makes the system more decentralized because every user essentially becomes a “node” in the network.

Another remarkable thing about IOTA is that it becomes faster the more users perform transactions, because all of those users are also required to verify other transactions. This is the opposite of most other cryptocurrencies that tend to become slower as more people use them and require new solutions to increase scalability.

(Previously #12 ↓ )

NEM

One of the things that sets the New Economy Movement (NEM) apart is its “Proof of Importance” (PoI) algorithm. Unlike PoW, which requires miners to use significant processing power to get new coins, or PoS, which requires users to already own a certain amount of coins in order to get new ones, PoI actually encourages users to spend their coins. The PoI algorithm tracks a user’s transactions to determine how important that user is to the overall NEM economy.

Bitcoin has been considered “digital gold,” and one of the main reasons for that description is its limited number of coins (a maximum of 21 million can ever be created). This means that Bitcoin’s value should keep rising over time as long as more people start buying Bitcoin. This should encourage a large portion of those who buy Bitcoin to hold it long term as opposed to spending it to purchase products.

NEM, on the other hand, encourages owners of its coins to spend them fast and furiously in order to gain even more NEM coins.

(Previously #17 ↑ )

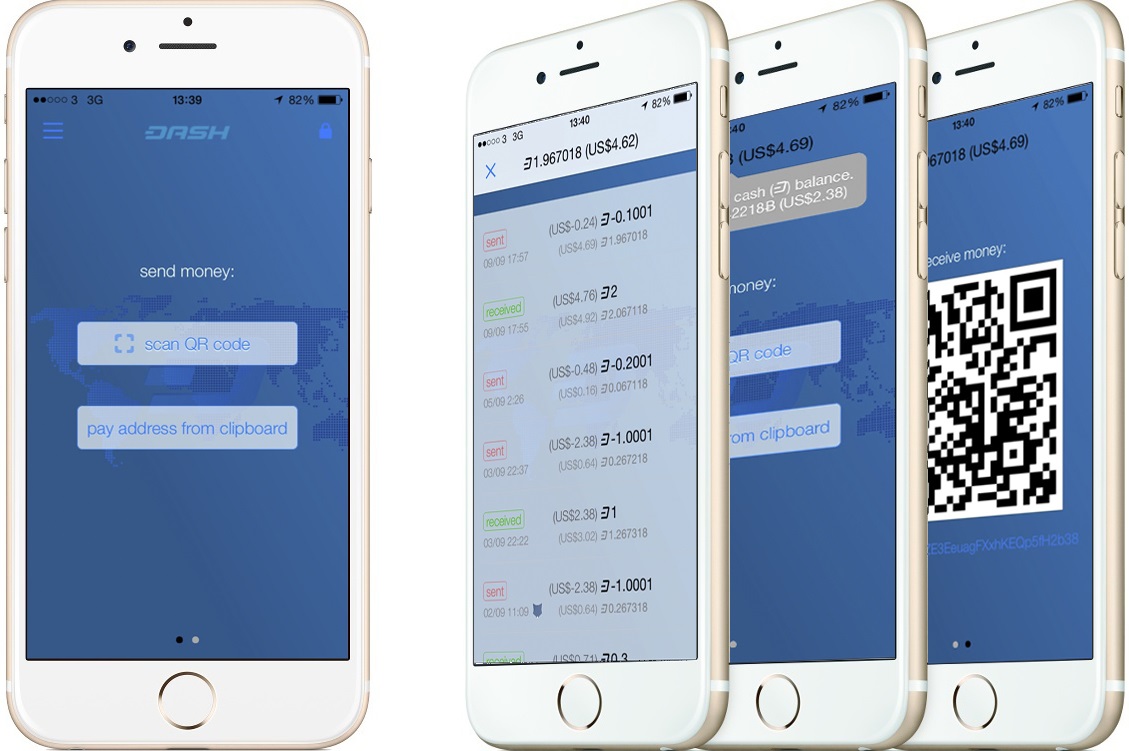

Dash

Dash is a more private version of Bitcoin that offers faster transactions (InstantSend technology), as well as anonymous transactions (PrivateSend technology). It also has decentralized governance, which makes it the first decentralized autonomous organization.

Dash uses a two-tier architecture for its network. The first tier consists of miners who secure the network and write transactions to the blockchain, and the second tier is made of “masternodes.” Masternodes relay Dash transactions and enable the InstantSend and PrivateSend types of transactions.

Anyone can set up a masternode as long as you lock at least 1,000 DASH coins on their server. Masternodes earn money for those who operate them, which encourages people to run these masternodes and enable DASH’s advanced features.

(Previously #13 ↓ )

NEO

NEO, previously called “Antshares,” is often called the “Chinese Ethereum” because it has many of the same goals as Ethereum and is developed in China, unlike the majority of other cryptocurrencies that are developed in the U.S. or Europe. Being in China may also give it some advantages due to potentially improved relationships with both regulators and local Chinese businesses that may prefer adopting it over a Western cryptocurrency.

NEO is a smart contract platform that enables all sorts of financial contracts and even third-party distributed applications to be developed on top of it, much like Ethereum. Unlike Ethereum, where developers can only use its own JavaScript-like “Solidity” programming language, NEO allows developers to use any coding language they like.

(Previously #15 ↓ )

Ethereum Classic

Ethereum Classic is the original version of Ethereum; the new “Ethereum” is a fork of this original version. The split happened when a decentralized autonomous organization built on top of the original Ethereum was hacked. “The DAO,” as this organization was called, acted as a venture capital fund for future distributed applications that would be built on top of Ethereum.

One hacker took advantage of a loophole in the Ethereum code that allowed him to siphon a third of this organization’s money (around $50 million at the time). As a solution, the Ethereum developers proposed doing a “hard fork” that would be incompatible with the previous version and would be able to deny the hacker the funds that he stole.

However, not everyone switched over to the “new” Ethereum fork because they still believed in Ethereum’s original promise of standing against financial corruption and changes to the network based on a human's whim. To them, this is what the new Ethereum became when the developers decided to essentially “bail out” the DAO and saved it from the hacker by forking the entire platform.

Therefore, those who preferred the more immutable nature of the original Ethereum decided to stick to Ethereum Classic. As such, it has remained one of the top 10 cryptocurrencies.

(Previously #16 ↓ )

Zcash

Zcash is the next-generation of the Zerocoin protocol, which aimed to create the first truly anonymous cryptocurrency. It uses a recently invented breakthrough technology called Zero-Knowledge Succinct Non-Interactive Argument of Knowledge (zk-SNARK), and it’s a novel form of zero-knowledge cryptography.

“Zero-knowledge” proofs allow one party (the prover) to prove to another (the verifier) that a statement is true, without revealing any information beyond the validity of the statement itself.

Although Zcash has the potential to be the most private cryptocurrency around,comments made by the developers, as well as the initial “trusted setup” for the secret key, have given many privacy-focused people pause when deciding whether or not they can trust it.

This is why although it may not be as technically impressive, Monero remains the most privacy-focused cryptocurrency right now, and it has real-world data to prove it.

(unchanged)

Maker

Maker is a relatively new smart contract platform built on top of Ethereum with two official coins: MKR, the token used to govern the platform, and DAI, a coin used for payments and savings.

MKR’s value is volatile just like most other cryptocurrencies, whereas the DAI is a “stablecoin,” whose value remains relatively fixed and is pegged to the USD. Therefore, one DAI should always equal roughly one dollar.

DAI isn’t the first stablecoin to be pegged to the dollar, but it’s the first one to live completely on the blockchain. Other stablecoins, such as Tether, are supposedly “backed by USD” in the sense that the companies creating the stablecoins have as much USD in their bank accounts as their number of stablecoins.

The owners of these coins have to trust that these companies actually have all of that money. If the stablecoin owners want to sell their coins at any time, they should be able to get real USD for those coins. However, in the real world, that may not actually happen if these stablecoin companies try to defraud their users.

DAI, on the other hand, relies on a system of collateral and debt to maintain the relatively fixed value. When users deposit a certain amount of collateral on the Maker platform they receive DAI coins. In order for the user to retrieve the collateral they must pay the debt along with interest. The interest is what stabilizes the stablecoin.

(Previously #22 ↑ )

Bitcoin Gold

Bitcoin Gold is a recent fork of the Bitcoin blockchain primarily aimed at decentralizing Bitcoin mining once again. Bitcoin was initially mined through CPUs, then the miners moved on to GPUs, and finally to application-specific integrated circuit (ASIC) chips.

As ASIC chips are not the type of chips you’d find in everyone’s computers, the mining power has become concentrated in the hands of a few large mining operators who can afford to buy ASIC chips costing thousands of dollars each. This could potentially become an issue for Bitcoin in the future, because miners have the voting power when it comes to implementing new features.

Bitcoin Gold also implements new safety features such a unique address format and replay protection. Replay protection is used to prevent users from accidentally sending their money to both the Bitcoin and the Bitcoin Gold networks, after the fork. Due to this protection, Bitcoin transactions on the Bitcoin Gold network will be invalid, and vice-versa.

Bitcoin Gold’s developers recently announced that they found some malicious files in the wallet software they were distributing to users, which implies that their servers were hacked. Bitcoin Gold users should delete the old wallets and install the new version.

(Previously #23 ↑ )

Lucian Armasu is a Contributing Writer for Tom's Hardware US. He covers software news and the issues surrounding privacy and security.

-

abryant Archived comments are found here: http://www.tomshardware.com/forum/id-3741880/top-cryptocurrencies-market-cap.htmlReply -

beayn And worth an honorable mention should be the coin with the highest gains for the last couple of weeks - Ravencoin. I think it made top 50 now.Reply -

ricechristopher241 Hi, I also would recommend this articale -Reply

https://www.telegraph.co.uk/technology/digital-money/top-10-popular-cryptocurrencies-2018