Buffet Spends $5 Billion For a Slice of TSMC

Investor moves into the chipmaking sector

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Noted wealthy individual Warren Buffet has bought 60 million shares in chip fabricator TSMC, with the investment carried out via his investment company Berkshire Hathaway, valued at $5 billion. The news comes via an SEC filing.

As the sixth richest person in the world, with a net worth of over $100 billion, Buffet should know a thing or two about investing. However, his purchase is oddly timed, with companies such as Intel and GlobalFoundries announcing market share losses and job cuts as the semiconductor industry experiences a slowdown following its recent peak.

Still, we assume he knows what he’s doing, and TSMC’s own figures show a rise in revenue for the first ten months of 2022 of 44% over the same period in 2021 and a profit of $8.81 billion for July to September this year. However, in a conference call announcing the results back in October, the company’s CFO Wendell Huang said he expected “our business to be flattish as the end market demand weakens, and customers' ongoing inventory adjustment is balanced by continued ramp-up for our industry-leading 5nm technologies."

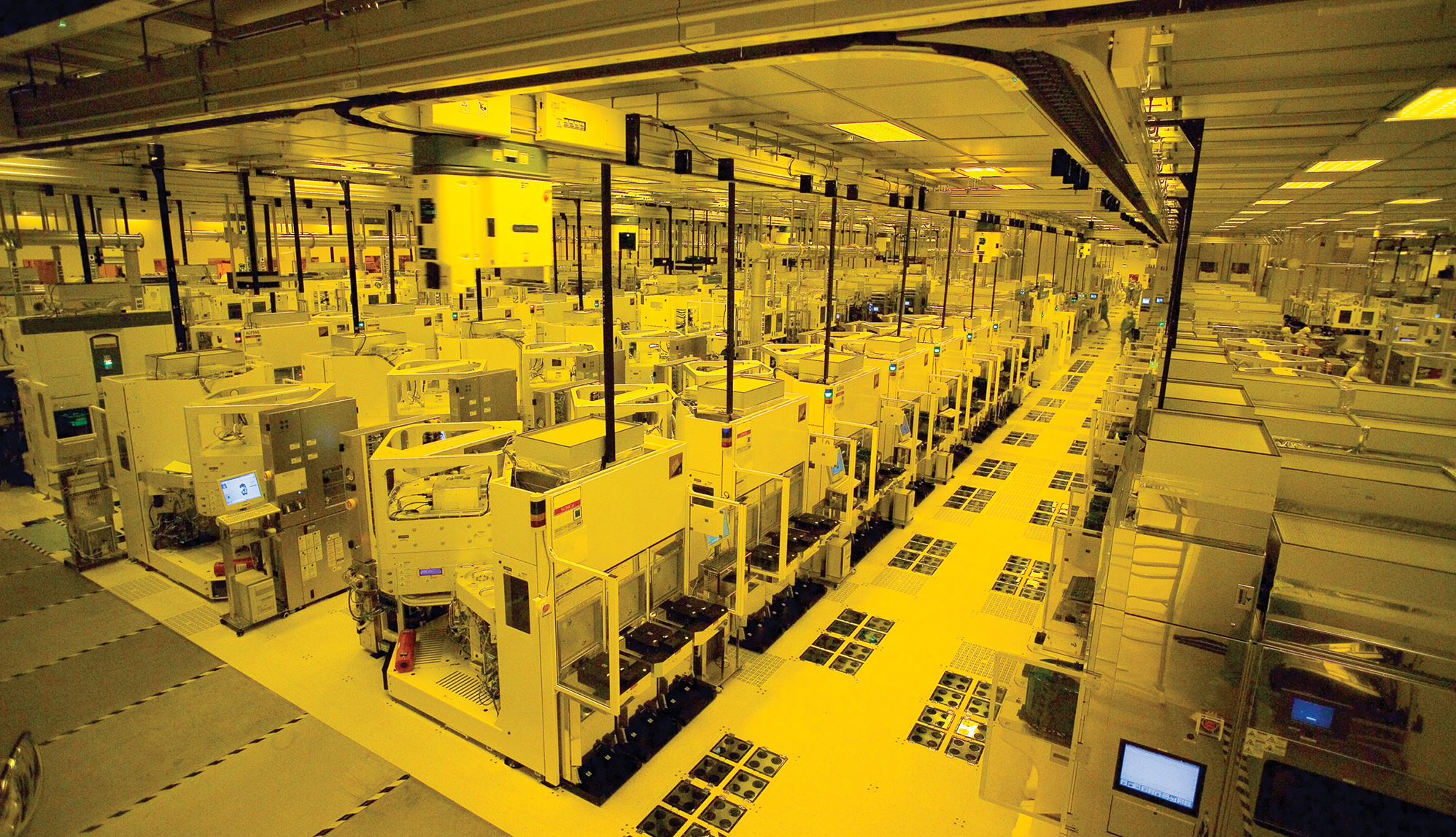

In happier news, the Taiwan-based company, which is the largest dedicated independent semiconductor foundry in the world and is mostly owned by foreign investors since listing on the NYSE in 1996, has negotiated a one-year exemption from US export control rules and can continue ordering American equipment to use in its Nanjing manufacturing facility, something that might have attracted Buffet to the firm. Samsung and SK Hynix received similar deals.

Chinese businesses contributed 10% of TSMC’s revenue in 2021, having been 17% the year before. However, according to the business news site Nikkei Asia, the announcement of the export rules caused TSMCs share price to drop markedly, contributing to a fall of 35% this year and wiping a trillion new Taiwan dollars off the firm’s market capitalization. For context, there are 31 NT$ to a single US dollar.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Ian Evenden is a UK-based news writer for Tom’s Hardware US. He’ll write about anything, but stories about Raspberry Pi and DIY robots seem to find their way to him.

-

Math Geek oh yah, he hits way more than he misses, so i'd say he knows something we don't for sure.Reply -

helper800 As a standard disclaimer; Investment in stocks is akin to gambling, invest at your own risk.Reply -

bit_user Reply

Yes and no, but more yes than no.helper800 said:As a standard disclaimer; Investment in stocks is akin to gambling, invest at your own risk.

For sure, if you invest in individual stocks or targeted funds without knowing what you're doing, it's basically gambling. I stopped buying individual stocks, a long time ago. I wish I had the passion for investing that I have for tech, but I just don't.

By comparison, buying a lotto ticket is virtually flushing your money down the toilet. Even if a stock you buy goes down, they generally don't lose all of their value. -

helper800 Reply

I and many studies actually argue the opposite such that random investments are more effective than targeted or managed investments. As you have said though lottery tickets basically are never give ROI.bit_user said:Yes and no, but more yes than no.

For sure, if you invest in individual stocks or targeted funds without knowing what you're doing, it's basically gambling. I stopped buying individual stocks, a long time ago. I wish I had the passion for investing that I have for tech, but I just don't.

By comparison, buying a lotto ticket is virtually flushing your money down the toilet. Even if a stock you buy goes down, they generally don't lose all of their value.

Sources:

https://www.forbes.com/sites/alexknapp/2013/03/22/computer-simulation-suggests-that-the-best-investment-strategy-is-a-random-one/?sh=1915436f5136https://www.fool.com/investing/2016/08/01/a-cat-outperformed-pro-stock-pickers-heres-what-th.aspx -

bit_user Reply

What I think I've heard about actively-managed funds is that they rarely outperform index funds by enough to overcome the additional fees.helper800 said:I and many studies actually argue the opposite such that random investments are more effective than targeted or managed investments.

For me, the problem with index funds is that you still have to keep your portfolio balanced. That's where I tend to slip up. -

helper800 Reply

You skipped the part that shows randomly investing removes bias and improves profits.bit_user said:What I think I've heard about actively-managed funds is that they rarely outperform index funds by enough to overcome the additional fees.

For me, the problem with index funds is that you still have to keep your portfolio balanced. That's where I tend to slip up. -

TJ Hooker Reply

You can buy ETFs that cover the global equity markets, which automatically rebalance based on relative market cap. And you can buy ETFs that have a mix of stocks and bonds, and auto rebalance to keep the funds desired allocationbit_user said:For me, the problem with index funds is that you still have to keep your portfolio balanced. That's where I tend to slip up.

Where's the need to manually rebalance? -

TJ Hooker Reply

Saying that active investing/stock pocking is no better (or outright worse) than investing at random is completely different than your original statement (i.e. that any equity investing is no different than gambling).helper800 said:I and many studies actually argue the opposite such that random investments are more effective than targeted or managed investments. As you have said though lottery tickets basically are never give ROI.

Sources:

https://www.forbes.com/sites/alexknapp/2013/03/22/computer-simulation-suggests-that-the-best-investment-strategy-is-a-random-one/?sh=1915436f5136https://www.fool.com/investing/2016/08/01/a-cat-outperformed-pro-stock-pickers-heres-what-th.aspx -

helper800 Reply

You are correct the first thing I said is not the second thing I said. If you were to read the conversation you would realize that I brought up these articles because bit_user said the following as a reply to my first post.TJ Hooker said:Saying that active investing/stock pocking is no better (or outright worse) than investing at random is completely different than your original statement (i.e. that any equity investing is no different than gambling).

The connection between gambling and random vs intentional investing in not one I ever made other than investing being a gamble. I brought those articles up because it is my belief that if any "investors" actually knew what they were doing they would be able to match or beet random investment picks by cats, apes, and otherwise. My first point is that no matter the investment type or strategy it is a gamble. My second point was that intentional investing is no better or worse than random investment.bit_user said:Yes and no, but more yes than no.

For sure, if you invest in individual stocks or targeted funds without knowing what you're doing, it's basically gambling. I stopped buying individual stocks, a long time ago. I wish I had the passion for investing that I have for tech, but I just don't.

By comparison, buying a lotto ticket is virtually flushing your money down the toilet. Even if a stock you buy goes down, they generally don't lose all of their value.