China Now Produces One Billion Chips a Day

It's an all-time record.

Chinese semiconductor manufacturers produced over one billion chips every day in June, which was an all-time record. Yet, while local chipmakers set records, it is not enough to meet the demand of Chinese manufacturers that import the vast majority of semiconductors they use.

171.2 Billion ICs Made This Year So Far

Chinese semiconductor makers (including makers of memory and logic components) produced 30.8 billion chips in June, which was a 43.9% increase from the same period in 2020, according to the National Bureau of Statistics, reports the Southern China Morning Post. In May, Chinese manufacturers produced 29.9 billion ICs. In the first six months of the year, Chinese makers produced 171.2 billion chips, up 48.1% year-over-year.

Without any doubt, 30.8 billion chips made in a month is a lot. Yet China imported 51.9 billion semiconductors in June, which means that the country could fab around 37% of its semiconductor needs. That means that while China has formidable installed capacity, it isn't quite self-sufficient as far as chip supplies are concerned.

Catching Up with Japan

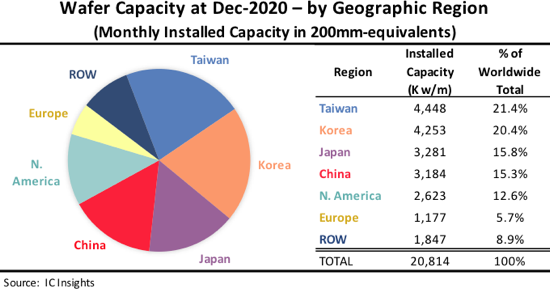

Earlier this week, IC Insights released its Global Wafer Capacity 2021-2025 report which revealed that Taiwan, South Korea, and Japan are the world's top three nations in terms of semiconductor production capacity, controlling well over a half of the global semiconductor output.

Taiwan is host to Taiwan Semiconductor Manufacturing Co., the world's largest contract maker of logic chips, United Microelectronics Co., a number of smaller foundries, and numerous makers of DRAM, so it controls 21.4% of the global semiconductor output. Taiwanese companies could process as many as 4.448 million 200mm-equivalent wafers per month, according to IC Insights.

South Korea has Samsung Electronics, SK Hynix, the world's largest makers of 3D NAND and DRAM memory, and a number of smaller semiconductor companies. The country's semi firms could process up to 4.253 million 200mm-equivalent wafers per month as of late 2020 and commanded around 20.4% market share, based on data from IC Insights.

Japanese companies no longer produce leading-edge logic chips, but the country is home to the world's largest 2D/3D NAND production facility operated by Kioxia and Western Digital. Furthermore, companies like Renesas still produce chips for various industries (including automotive), and there are numerous fabs in the country. Japanese companies could process around 3.281 million 200mm-equivalent wafers per month and control approximately 15.8% of global semiconductor production.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

China is actually the world's number four producer of chips, and it is largely on par with Japan with its 3.184 million thousand 200mm-equivalent wafers per month capacity and 15.3% share. It should be noted that the vast majority of logic chips made in China are processed using 28nm or older nodes, so they cannot really be used in devices that require truly high performance, such as mainstream and high-end PCs. Furthermore, Samsung and SK Hynix, which have fabs in China, are not really eager to transfer their leading-edge technologies to the country.

The US closes the top five of the world's largest makers of chips with 12.6% of the global market share and capacity of around 2.633 million 200mm-equivalent wafers per month. While it is obvious that the US is behind China, Japan, and South Korea, it is important to bear in mind that American companies with fabs in the country mostly produce expensive, high-margin logic chips.

Summary

The Chinese semiconductor industry has made extraordinary progress in the last 20 years and it is not running out of steam – it is set to grow further and will probably replace Japan from the top three spot in IC Insights' report this year or next.

Yet, because Chinese logic producers are at least five years behind industry leaders like Intel, TSMC, or Samsung Foundry, it is unlikely that the country will be able to produce advanced CPUs or GPUs any time soon. Nonetheless, even now the local logic industry can satisfy the demand of many Chinese chip designers.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

JDLifeMasters With China producing billions of chips even back in 2020 how did the industry run out of chips, caused a GPU shortage and price scalping. Regardless of a shortage of GPUs how did the scalpers maintained a steady flow of GOUs into the market at exorbitant prices?Reply

The availability of GPUs are super positive except that they are only available at criminal scalpers’ prises.

Consumers are literally victimized by the industry and being taken advantage of. The industry exploited the irrationality of the child/adolescent with computer games, created a habit, and exploited that vulnerability to victimize the world. -

avg9956 Afaik China's chip technology is like 10 years behind. Sure they can produce a lot of chips because they have the raw mats for it, however the utility for these chips won't end up in something like consumer GPUs. They need the required technical designs and know-how in order to execute it. The chips that they produce probably are then used in their own home-grown electronics like Chinese motherboards, Chinese CPUs, etc made by Chinese brands.Reply

But once they do attain that same level of quality, then it can change the whole tech industry. Politics in the silicon industry will surely be a heated battlefield. -

JDLifeMasters I hope that China’s NVIDIA and RADEON manufacturers have stringent quality control, as China is notorious for sloppy work ethics and lax quality control.Reply

Most recent, there were complains about sloppy work when companies in the cable sleeving industry moved their manufacturing to China.