Ethereum Founder Unveils Roadmap For Next-Gen Blockchain

At the “Beyond Block” conference in Taipei, Ethereum’s founder, Vitalik Buterin, unveiled the plans for “Ethereum 2.0,” the next-generation version of Ethereum.

Ethereum 1.0 Problems

The Ethereum network was born as an idea for next-generation cryptocurrency network, which could do far more interesting things than just financial transactions. The Ethereum network has also been called the “programmable blockchain,” because you could develop “distributed applications” (dapps) on top of it.

However, the network’s rapid growth in recent years has also revealed a few major issues within the network. According to Buterin, there are currently three major problems that need to be solved to push the Ethereum network to the next level: privacy, consensus safety, smart contract safety, and perhaps the biggest of them all: scalability.

Privacy

When Bitcoin first came out, everyone started calling its transactions “anonymous,” because you didn’t have your name directly tied to a transaction like you do with a credit card, especially if you were using a PC wallet to transact the money, rather than a centralized exchange.

However, Bitcoin and many other cryptocurrencies’ core technology is something called the “blockchain,” a distributed ledger in which all transactions and wallet addresses are inscribed. What that means is that every single transaction and its corresponding address is recorded.

The blockchain is also public for most cryptocurrencies, including Ethereum, which means anyone can look up all the transactions done from a given wallet address. That wallet address could then be tied to a real person’s identity if that person does any transaction that may reveal it.

For instance, if the person in question transfers the money from that address to a centralized exchange’s address where his or her name is used, then all the previous transactions can be traced back to them. This is somewhat similar to using Tor for anonymity but then logging in to your real Facebook account or to an email address into which you’ve logged before with your real IP address.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The Ethereum developers have already taken steps to address this by implementing the same zero-knowledge proof privacy technology used by Zcash in a recent upgrade. The technology should enable distributed apps (such as voting apps, for instance) to have mathematically provable anonymity.

Buterin said that the privacy issue should be 75% solved already at the network-level, with the remaining 25% to be solved by apps that work on top of Ethereum which would need to actually implement those privacy features.

Consensus Safety

Consensus is currently achieved through a “proof of work” system, where the miners have to “mine” blocks on the network by using computational resources. The system is necessary to ensure that the network isn’t taken over by an attacker who could then control how the money is spent on the network.

However, the big downside to this system is that it keeps using increasingly more power. A recent report said that Bitcoin mining consumes as much power in a year as 159 countries. Buterin admitted at the recent conference in Taipei that Ethereum isn’t much better.

However, the plan is to eventually start switching Ethereum (slowly) to a “proof of stake” system, which wouldn’t require anywhere near as many computational resources.

Smart Contract Safety

Ethereum has gone through its own share of cryptocurrency drama over the past couple of years. One of the most appealing things about Ethereum is that it’s also a smart contract platform. A smart contract is a self-executing contract where the terms between a buyer and a seller, as well as the enforcement of the clauses, are all written into code.

It turns out that smart contracts can be about as buggy as any other piece of software. The only difference is one buggy smart contract can cost people hundreds of millions of dollars if something goes wrong - and it has.

On one occasion, a hacker was able to temporarily steal $55 million from a distributed app running on top of Ethereum. The Ethereum developers were able to stop the attack by forking the Ethereum blockchain, thus creating what is now called Ethereum and the "old" Ethereum Classic.

Buterin said that Ethereum will eventually introduce formal verification for smart contracts as well as a new Python-like “Viper” smart contract programming languages that’s supposed to enable the development of safer Ethereum applications.

Scalability

The biggest problem with Ethereum, as with the majority of cryptocurrencies, is scalability. If Ethereum is to be used universally by big banks and everyone in the world, it needs to be able to do many orders of magnitude more transactions per second than it can right now.

Buterin said there are multiple scalability solutions being explored by different cryptocurrencies, including Bitcoin, but these involve some compromises. For instance, most cryptocurrencies, including Ethereum, currently sacrifice scalability to get safety. To increase scalability, some cryptocurrencies plan to sacrifice some safety by off-loading some transactions to other cryptocurrency networks where the transaction fees are cheaper.

Enter “Sharding”

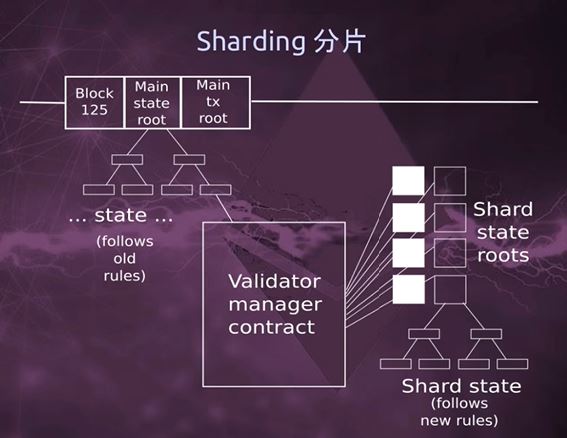

Buterin explained that the next generation of Ethereum will use a new architecture called “sharding,” which will enable the network to process thousands of transactions per second -- all on the same chain, which means safety will not be sacrificed.

Sharding will enable multiple “parallel universes” or domains to exist on the same network, but the transactions that occur in one of those universes won’t affect the speed of the network in other universes. There will also be protocols to link the different universes, but they will be more limited. Transferring data from one universe to another could, for instance, take two weeks, according to Buterin.

These universes will share consensus, so if an attacker wants to take over one of the universe, would have to take over all of them, so the entire Ethereum network.

For now, this new architecture still looks very much in the planning mode as not all of the details seem to have been figured out. The Ethereum team does plan to release a more limited version of this idea in the near future.

Buterin also noted that sharding will create new types of addresses on the network, which will give Ethereum the opportunity to evolve by adopting new backwards incompatible protocols without disrupting the main blockchain.

Lucian Armasu is a Contributing Writer for Tom's Hardware US. He covers software news and the issues surrounding privacy and security.

-

beavermml can someone give me on application that utilizes blockchain tech that DOES NOT involve financial as in ICO, mining, coin etc..Reply -

TJ Hooker Reply

https://www.nytimes.com/2017/03/13/business/energy-environment/brooklyn-solar-grid-energy-trading.html20423410 said:can someone give me on application that utilizes blockchain tech that DOES NOT involve financial as in ICO, mining, coin etc.. -

koga73 Ethereum is pretty cool, code can be executed on the block-chain. Potentially you could use it as a distributed web serverReply -

drinking12many The one concern I have with all these cryptocurrencies is that there is nothing which prevents millions of them from existing, we see quite a few already. So over time there could be so many that they all become equally worthless. What really prevents that from happening. It is its own sort of hyperinflation of sorts. Sure there may be limited coins in any one specific currency, but over time the shear number of them reduces the value of all.Reply -

TJ Hooker @drinking12many if many people think a bunch of different cryptocurrencies have value, then they'll all have value. If most people think only a few currencies have value, then only those will have (significant) value.Reply

You could say the same thing about stocks. There's no limit on how many publicly traded companies there can be. You just have to convince people that your enterprise has value, much like someone launching a new cryptocoin would. -

drinking12many I suppose that is true, and in that respect no different than the currency of many small nations or even large ones for that matter. It just seems like a way many people could lose their shirt investing in shit cryptocoins... i guess its the same risk as stocks. I am mining ethereum myself because might as well make money off of it while its possible and I bought an RX480 when they came out for games... this is just a bonus its what any good investor should do.Reply