Intel Misses Revenue Targets and Issues Weak Outlook Amid Record Revenue

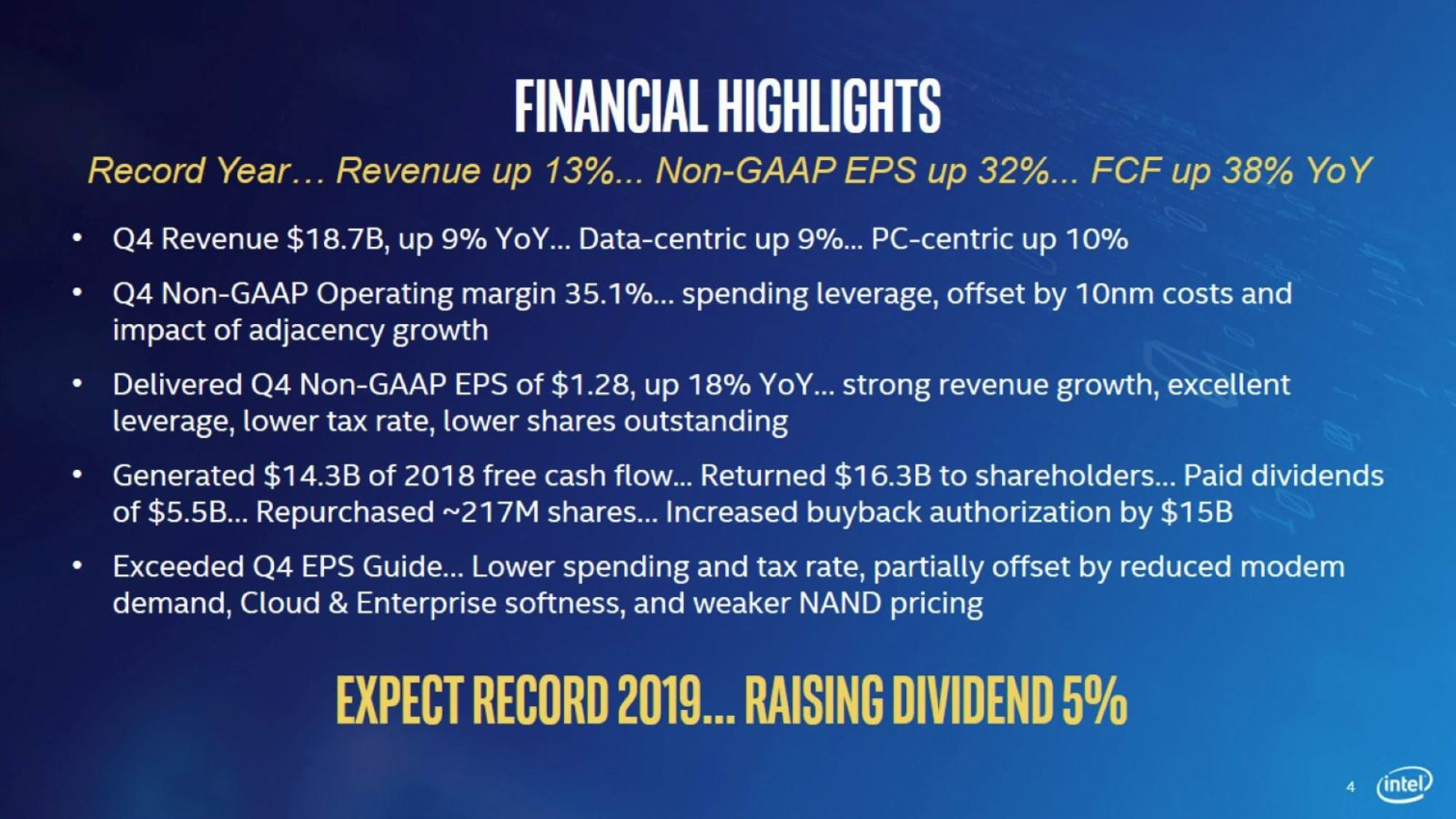

Intel released its full-year and fourth quarter 2018 financial results today. Overall, the company posted yet another full-year revenue record of $70.8 billion, but its fourth-quarter performance fell short of analyst projections. The company also presented lower-than-expected guidance for 2019.

Intel's CEO search was top-of-mind as rampant speculation led many to believe that company would appoint its next leader during the earnings call. Unfortunately, Intel's interim-CEO Bob Swan dashed those hopes by saying the company is still searching for the right candidate, saying "I am convinced the board will close on a new CEO in the near future. In the meantime, we will not be distracted by the void."

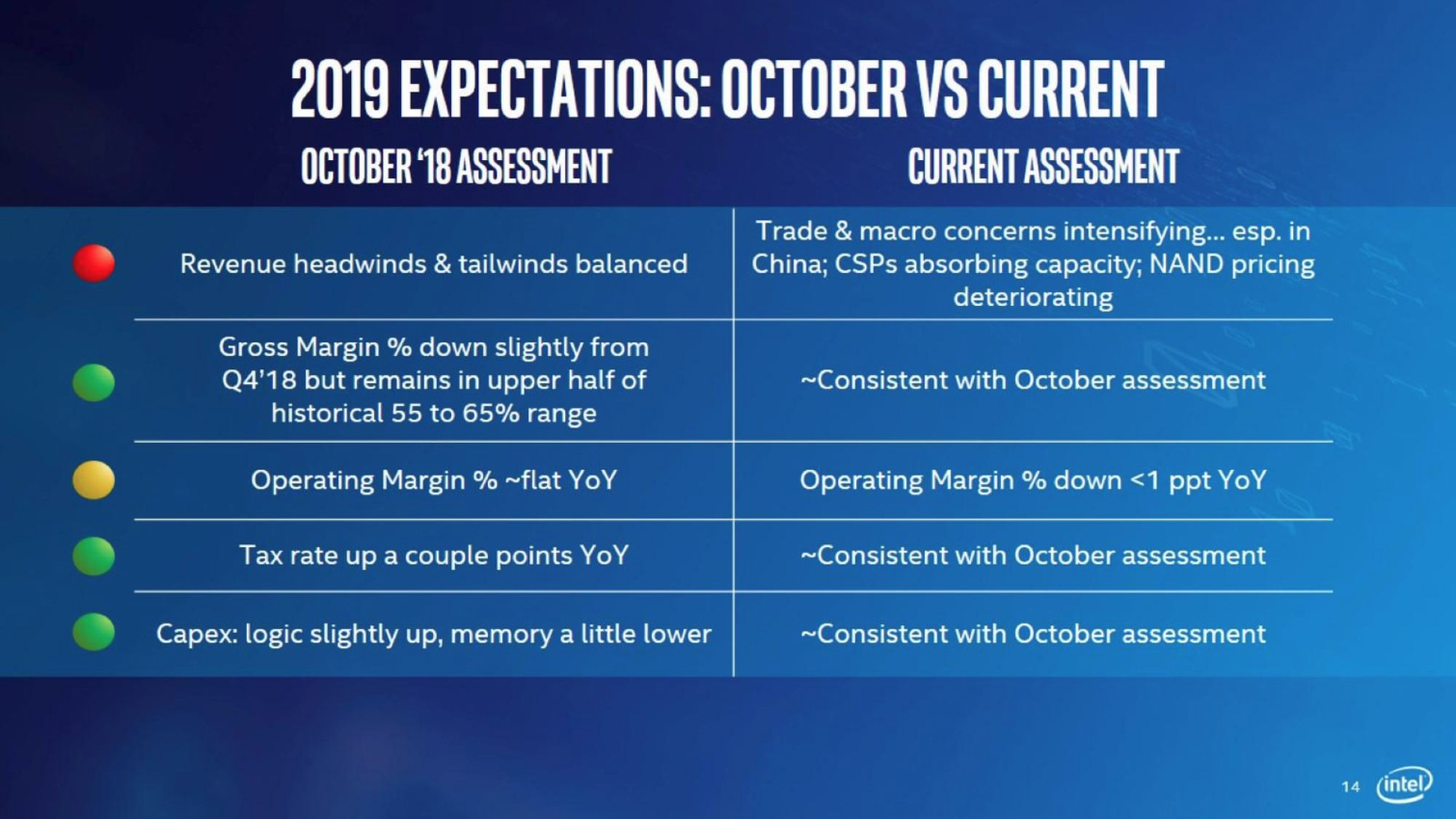

Many of Intel's revenue challenges are due to its own recent success: Building atop a string of record-setting quarters is difficult, and the company's commanding market share in several key segments, like desktop PCs and data centers, means there isn't much low-hanging fruit in terms of share growth. Whip in the challenges borne of the US-China trade war, a slowing China economy, nagging production constraints with 14nm processors and slumping NAND prices, and Intel has a tough hill to climb.

Intel says its 10nm processors are on-track for a volume retail launch in 2019, and also that it expects the shortage to last through the end of the second quarter. In the meantime, the company will continue to focus its production efforts on high margin products, meaning the shortages of low-end desktop processors will continue.

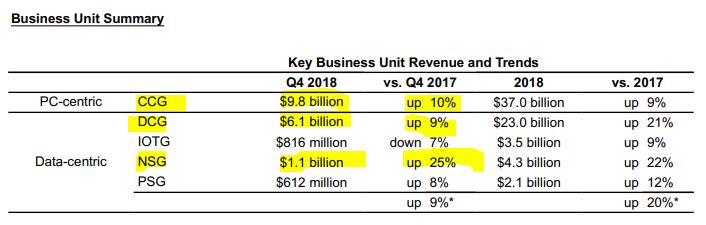

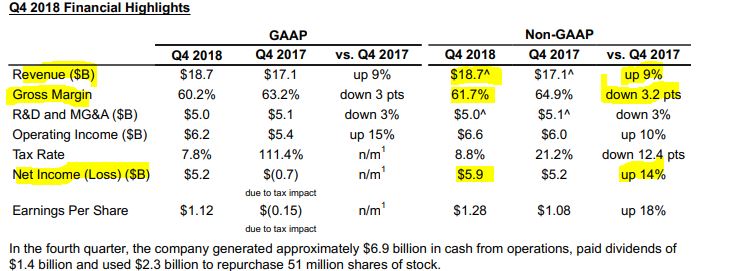

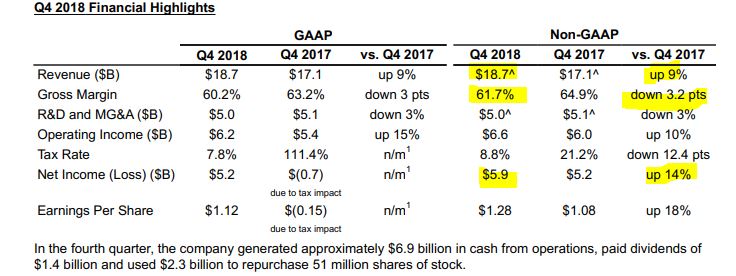

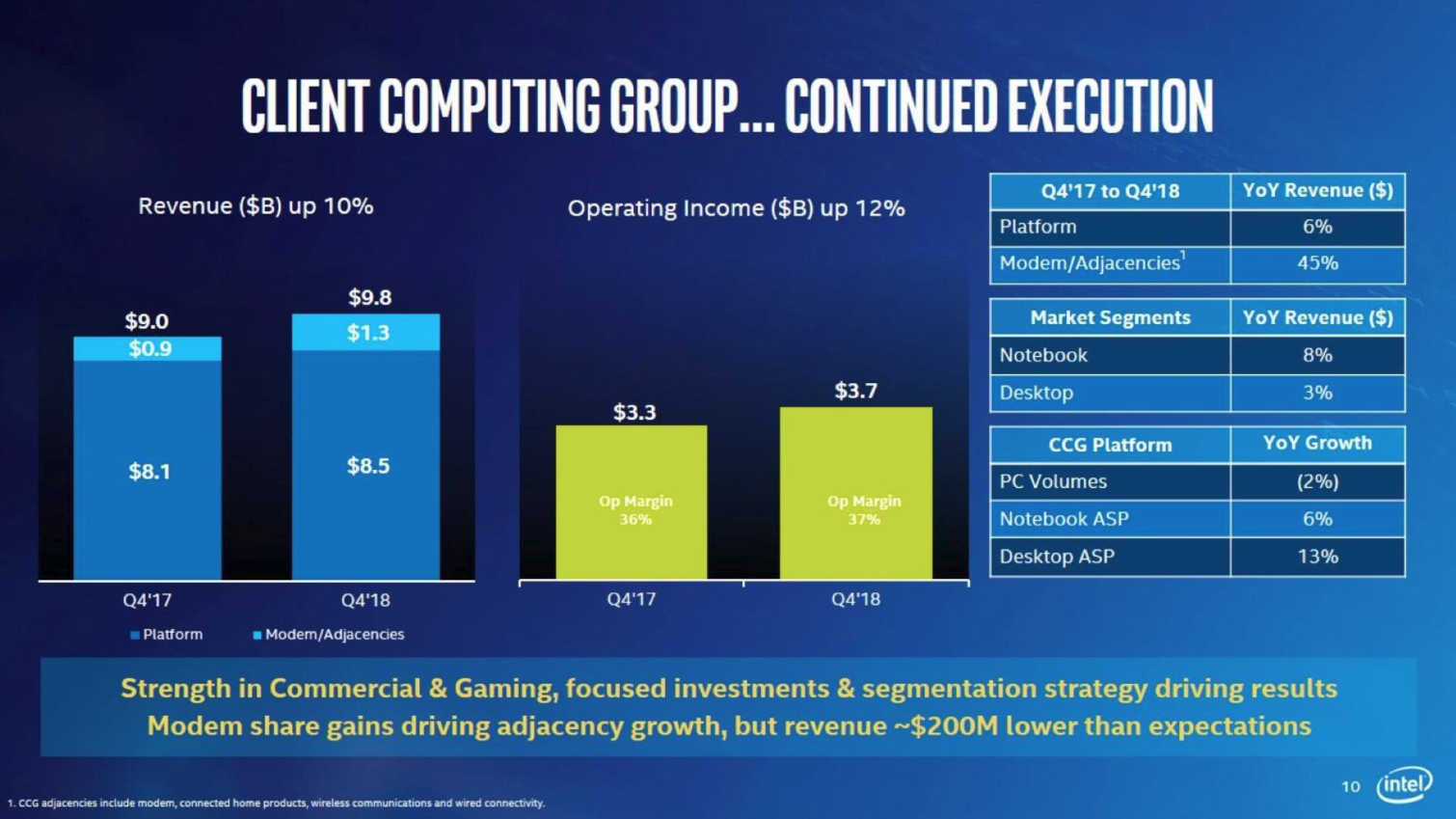

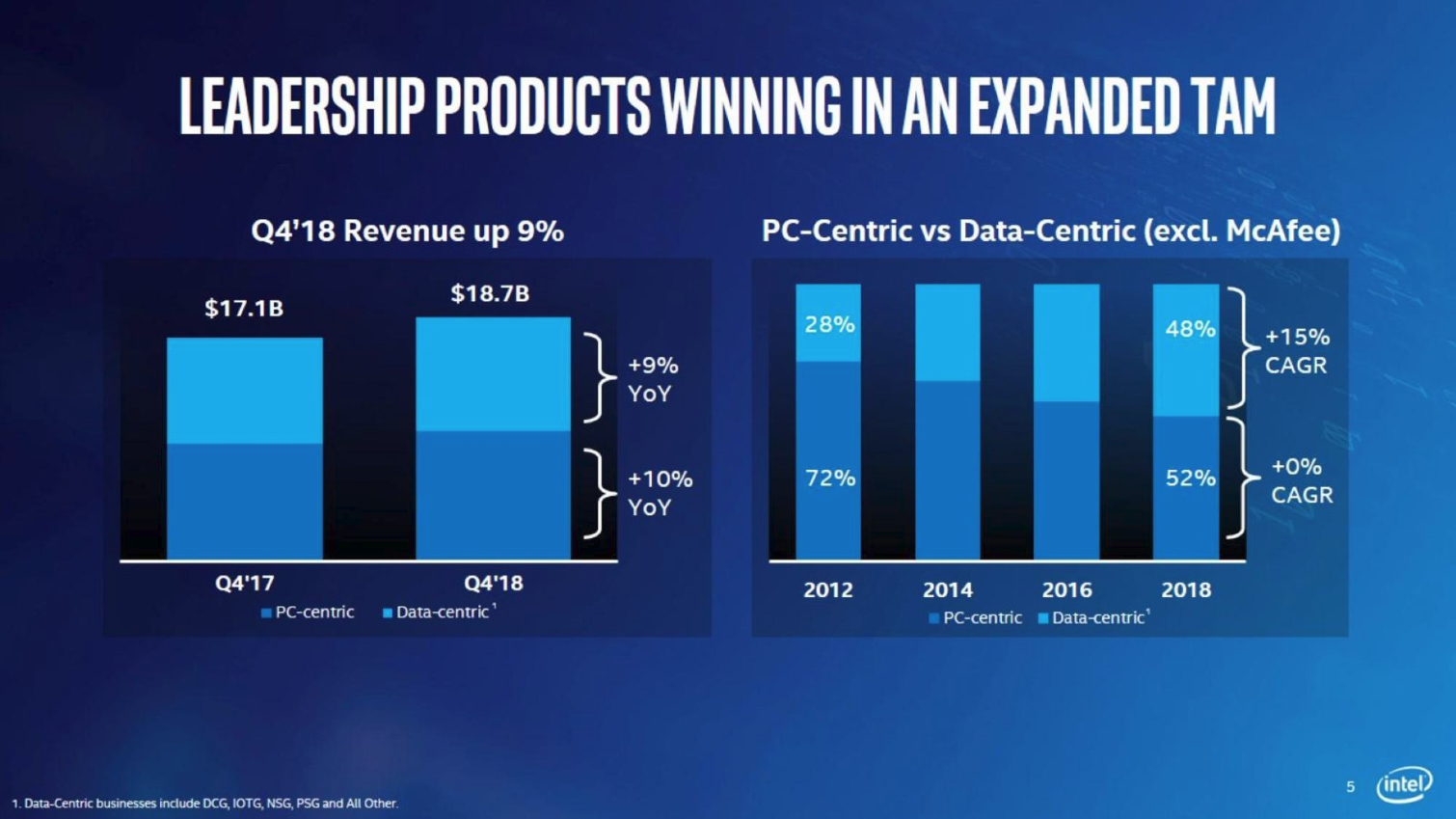

In spite of missing its revenue targets, Intel still delivered impressive numbers given the environment. Estimates had pegged Intel's overall revenue at ~$19 billion, leading to a slump in after-hours trading, but the firm's Q4 revenue of $18.7 billion represents a 9% year-over-year (YoY) increase, much of that coming on the back of its data-centric businesses (data center, etc.) that notched a solid 9% YoY gain. The company also reported a 10% YoY revenue increase in the PC-centric business, but much of those gains came from modem sales. Overall, PC volumes declined 2% on the year, which isn't surprising given the ongoing processor shortages.

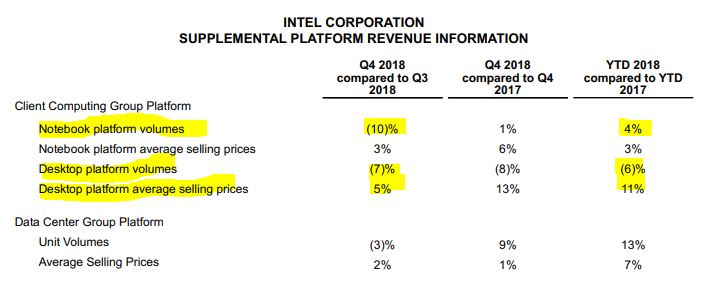

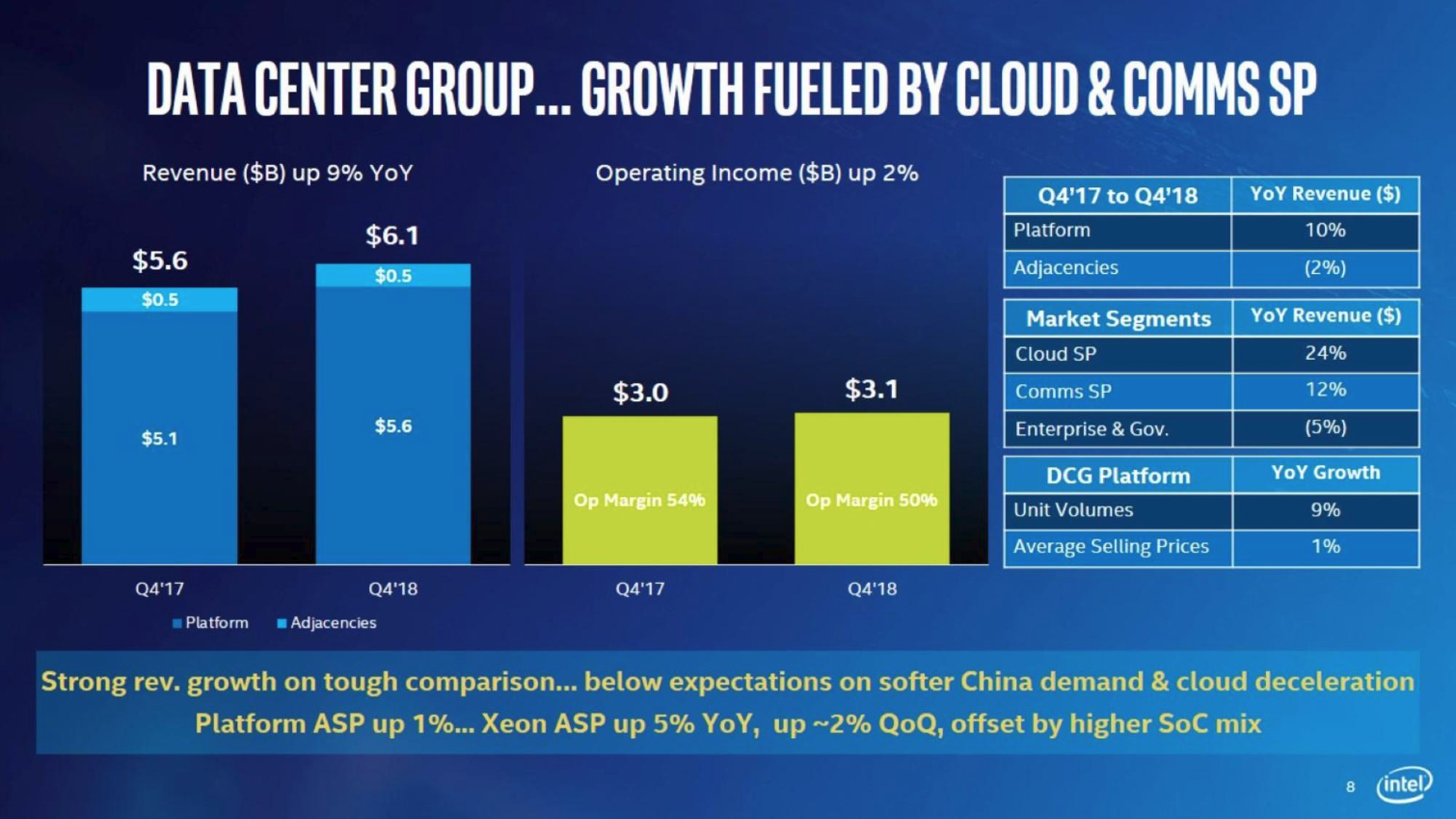

Compared to the previous quarter, Intel's notebook volumes dropped 10% and desktop volume also fell 7%, though the company has increased notebook volume by 4% overall compared to 2017. Desktops didn't fare as well, with a 6% decline in volume YoY, largely offset by an 11% increase in the average selling price (ASP). The Data Center Group (DCG) also did well with a 13% increase in unit volumes paired with a 7% increase in ASP, but the unit missed revenue targets.

Notably, Intel's margins fell from 63% to 60%, largely due to increased investments in ramping production.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Intel's growth in the data center segments cooled off, which the company attributed to large orders that were processed earlier in the year finally being deployed. Industry analysts reported large orders earlier in the year as Chinese data centers built up stockpiles amid the looming threat of a trade war, so it's logical to assume that much of the new deployments come from that existing stock.

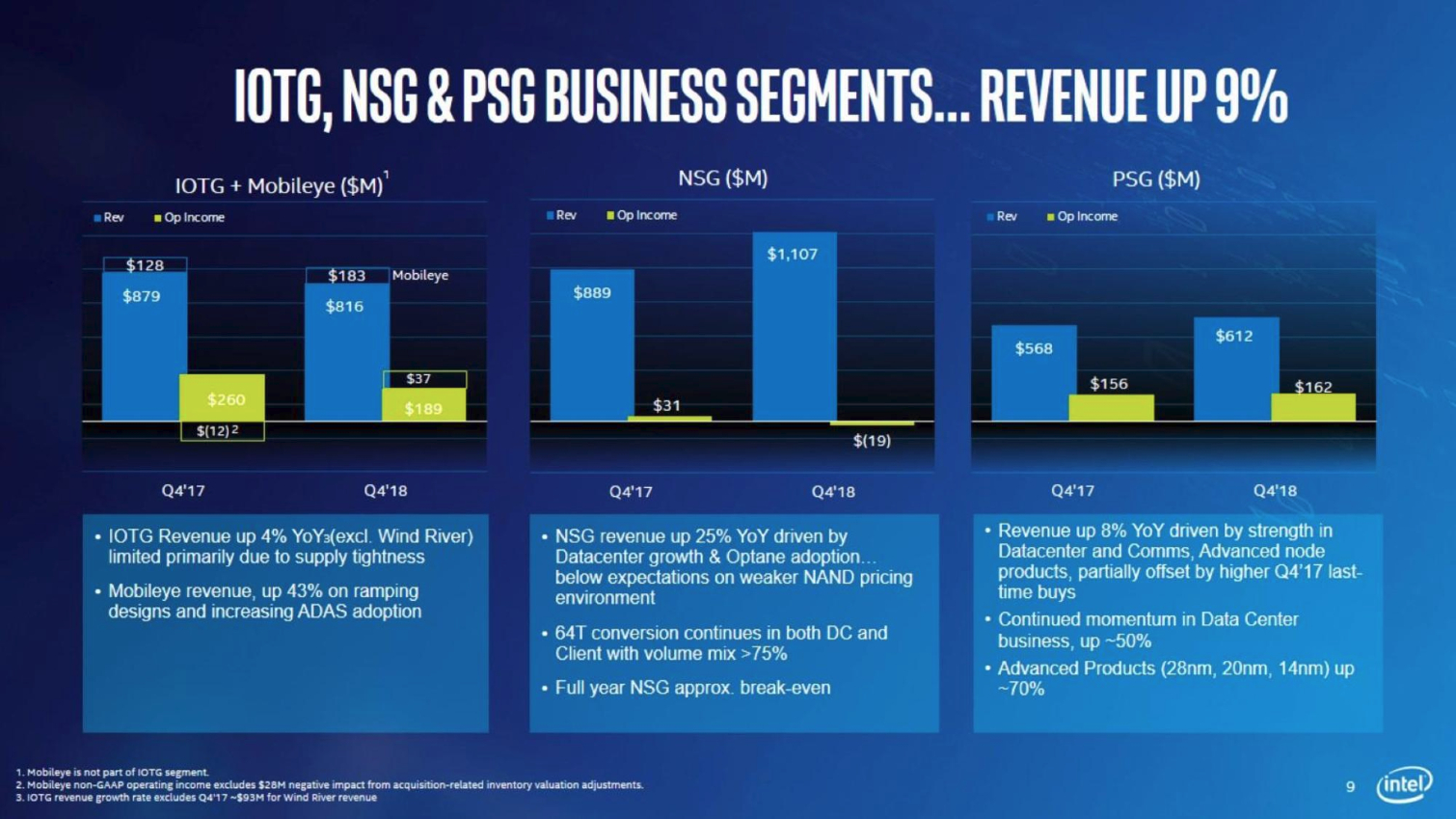

Slumping NAND prices hurt the Nonvolatile Storage Group's (NSG) profitability, so its 25% revenue growth on the year merely brought the unit to the break-even point. Intel CEO Bob Swan acknowledged that Micron had formally moved to purchase Intel's share in the IM Flash Technologies joint venture. Intel and Micron jointly produce NAND and 3D XPoint (Optane) memory through this venture, but Swan noted Intel has its own production facilities and long-term supply agreements with Micron that extend beyond the termination of the partnership.

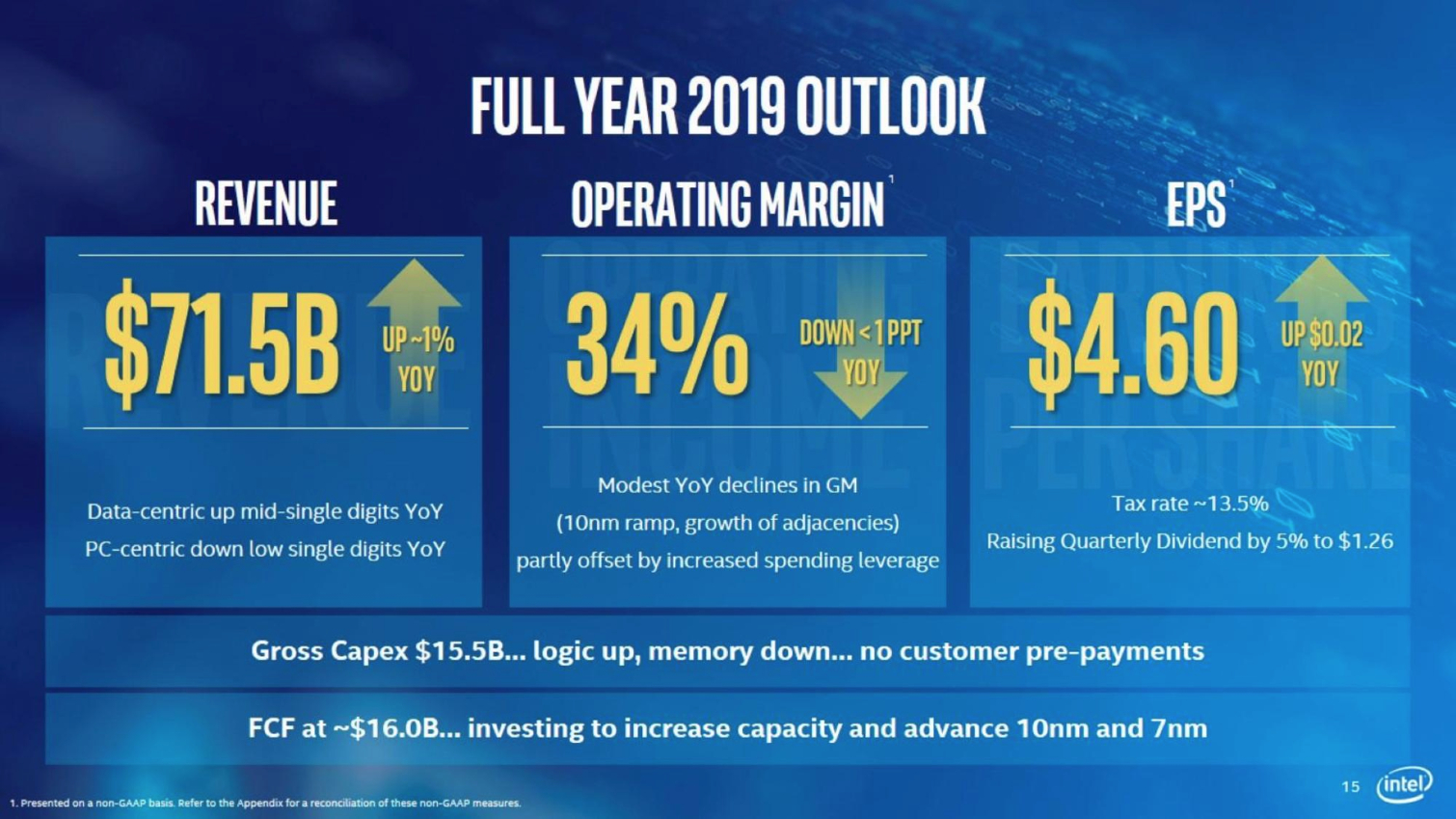

Intel's projections for $16 billion in revenue for Q1 2019 is essentially flat year over year, and it projects a 1% gain in revenue to $71.58 billion in 2019.

Overall the company's record results and 2019 outlook are viewed as somewhat tepid in the investor community. Intel cited increased competition in several of its segments, along with the other factors listed above, as headwinds going into 2019. Intel didn't specifically mention AMD as the source of increased competition, but with its 7nm EPYC Rome and 7nm third-gen Ryzen processors coming to market soon, it's logical to expect the company factors into the equation.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

mischon123 Too many obfuscating names for overpriced half to 2/3 defective chips that have to be binned low because of production and thus yield issues. Those are the consumer chips. If 1/3 of the chiproduction cannot be sold at the quality-pricepoint - this is catastrophic. We ve seen that Intel has a huge problem going one process iteration down and most 2/3..or more of the production is faulty - this will cap market saturation massively.Reply

Because of that - nobody wants the job because Intel cannot reform production. Because of the horrendous dev prices..16bn $ revenue can almost be called minuscule. The offset is awfully small. Pringle knows how to bake chips. AMD knows how to bake chips. Why not Intel?

Also Intel is beeing perceived as the bully. This never goes down well in the midrun. -

bit_user Reply

I assume the yields on their 10 nm node?21710866 said:@mischon123 what on earth are you talking about?

A source would be appreciated.

-

chickenballs "Overall, the company posted yet another full-year revenue record of $70.8 billion"Reply

wow this means people are still buying their cpus even though they keep refreshing their Skylake architecture and increase prices

and they have to thank the "experts" who keep recommending gamers to buy i7s and i9s to play CS and Battlefield -

bit_user Reply

In case you didn't notice, they've been increasing clock speeds and core counts, along the way.21711040 said:wow this means people are still buying their cpus even though they keep refreshing their Skylake architecture and increase prices

-

chickenballs Reply21711052 said:

In case you didn't notice, they've been increasing clock speeds and core counts, along the way.21711040 said:wow this means people are still buying their cpus even though they keep refreshing their Skylake architecture and increase prices

while their competitor has increased core counts even more

the i7 8700K is 499 usd on Newegg

and i7 9700K is 549 usd

do you still remember how much the previous mainstream i7 cost? -

bit_user Reply

Well, you're getting more performance for the additional cost. Your previous post didn't acknowledge that anything was gained for the higher prices.21711059 said:21711052 said:

In case you didn't notice, they've been increasing clock speeds and core counts, along the way.21711040 said:wow this means people are still buying their cpus even though they keep refreshing their Skylake architecture and increase prices

while their competitor has increased core counts even more

the i7 8700K is 499 usd on Newegg

and i7 9700K is 549 usd

do you still remember how much the previous mainstream i7 cost?

And no, I'm not happy about those prices. But then, I'm not buying Intel CPUs right now, either. -

chickenballs Reply21711064 said:

Well, you're getting more performance for the additional cost. Your previous post didn't acknowledge that anything was gained for the higher prices.21711059 said:21711052 said:

In case you didn't notice, they've been increasing clock speeds and core counts, along the way.21711040 said:wow this means people are still buying their cpus even though they keep refreshing their Skylake architecture and increase prices

while their competitor has increased core counts even more

the i7 8700K is 499 usd on Newegg

and i7 9700K is 549 usd

do you still remember how much the previous mainstream i7 cost?

And no, I'm not happy about those prices. But then, I'm not buying Intel CPUs right now, either.

yes thats called progress

by your logic intel should charge tens of thousands for a 4 core cpu because its so much faster than the Pentium Pro from 1996 which had a msrp of several thousands of dollars

and yet you are defending them

how uh nonsensical ;-) -

spentshells Article title is quite deceptive.Reply

"Intel is increasingly profitable, AMD has been able to make more money than usual."

That feels more accurate. -

shmoochie Reply21711513 said:Article title is quite deceptive.

"Intel is increasingly profitable, AMD has been able to make more money than usual."

That feels more accurate.

What is deceptive about it? It seems like a succinct outline of the article to me.