NAND Flash Prices Hikes Expected to Hit in Coming Quarter

But consumer SSD and eMMC won't be as badly affected as Enterprise products.

In early February we reported on contamination issues affecting NAND flash production lines owned by Kioxia and WD. At least seven exabytes of NAND flash had to be scrapped or recovered, and factory capacity was underutilized for the best part of a month.

Thankfully, the above accident is in the rear view mirror. However, pricing and supply impacts are due very shortly, as inventory buffers from Kioxia and WD's NAND flash customers have been used up.

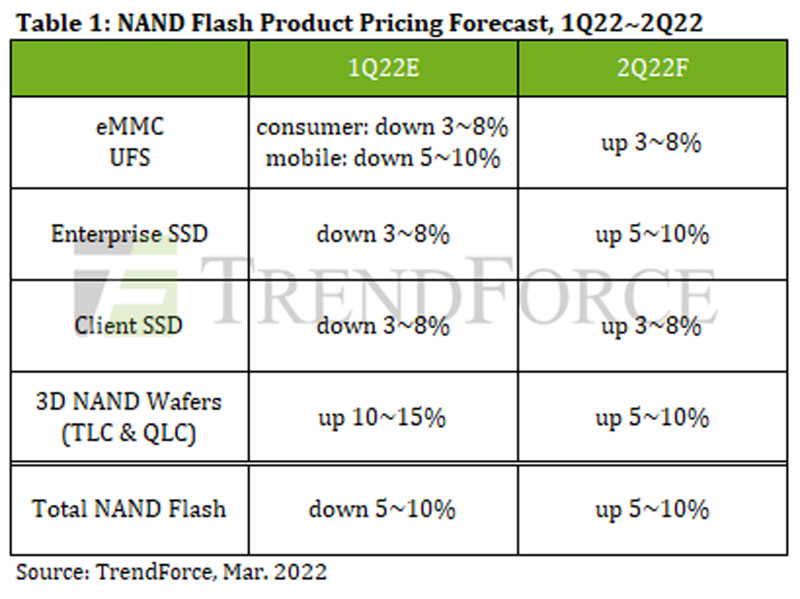

Now market researchers at TrendForce have had time to weigh up the situation, and have reiterated their earlier view that NAND flash prices will spike 5 to 10% in Q2. TrendForce have also had time to gauge the movements in supplies and markets affecting the consumer, eMMC and enterprise segments and have some predictions for each of these. In short, price inflation won't be as bad for the consumer and eMMC segments as for enterprise, according to TrendForce's new report.

Consumer SSDs may get off lightly with just a moderate to 3~8% price increase. Behind these mitigated figures are the observation that "the Russian-Ukrainian war has compelled PC OEMs to adopt a conservative stocking strategy for orders in 2Q22," highlights the report by TrendForce. Moreover, the demand for PCs, laptops and mobiles has been hit by overall inflation, reducing demand for what are non-essentials to some people.

eMMC and UFS storage gets off as lightly as the consumer SSD segment with expected 3~8% pricing uplifts. Similar reasons apply, and this increase isn't too bad due to weakened demand for tech like TVs, Chromebooks, and tablets.

Lastly, TrendForce considered the enterprise SSD market and says "procurement capacity and orders for servers and hyperscale data centers grow and lead times on Enterprise SSD products balloon due to material contamination at Kioxia and WDC." THus this market could see prices rise up 5~10% in the coming quarter.

Of course the above figures are not set in stone, even though Q2 is just one full day away, the predictions apply over the three months. There could be movements either way. On one side ,industries can be hit by more man-made or natural calamities. On the other, demand for certain products could weaken considerably as markets saturate, trends change, and we move towards a different post-peak-pandemic world.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.