Nvidia to become the world's largest semiconductor firm in 2023, according to TSMC chairman

As long as the AI boom isn't a bubble.

TSMC chairman Mark Liu believes Nvidia will become the largest semiconductor firm by the end of the year (via Trendforce). Speaking at a lecture held by the Chinese National Association of Industry and Commerce, Liu discussed the future of TSMC in an AI-focused world and stated that Nvidia would develop into the world's largest semiconductor company thanks to AI.

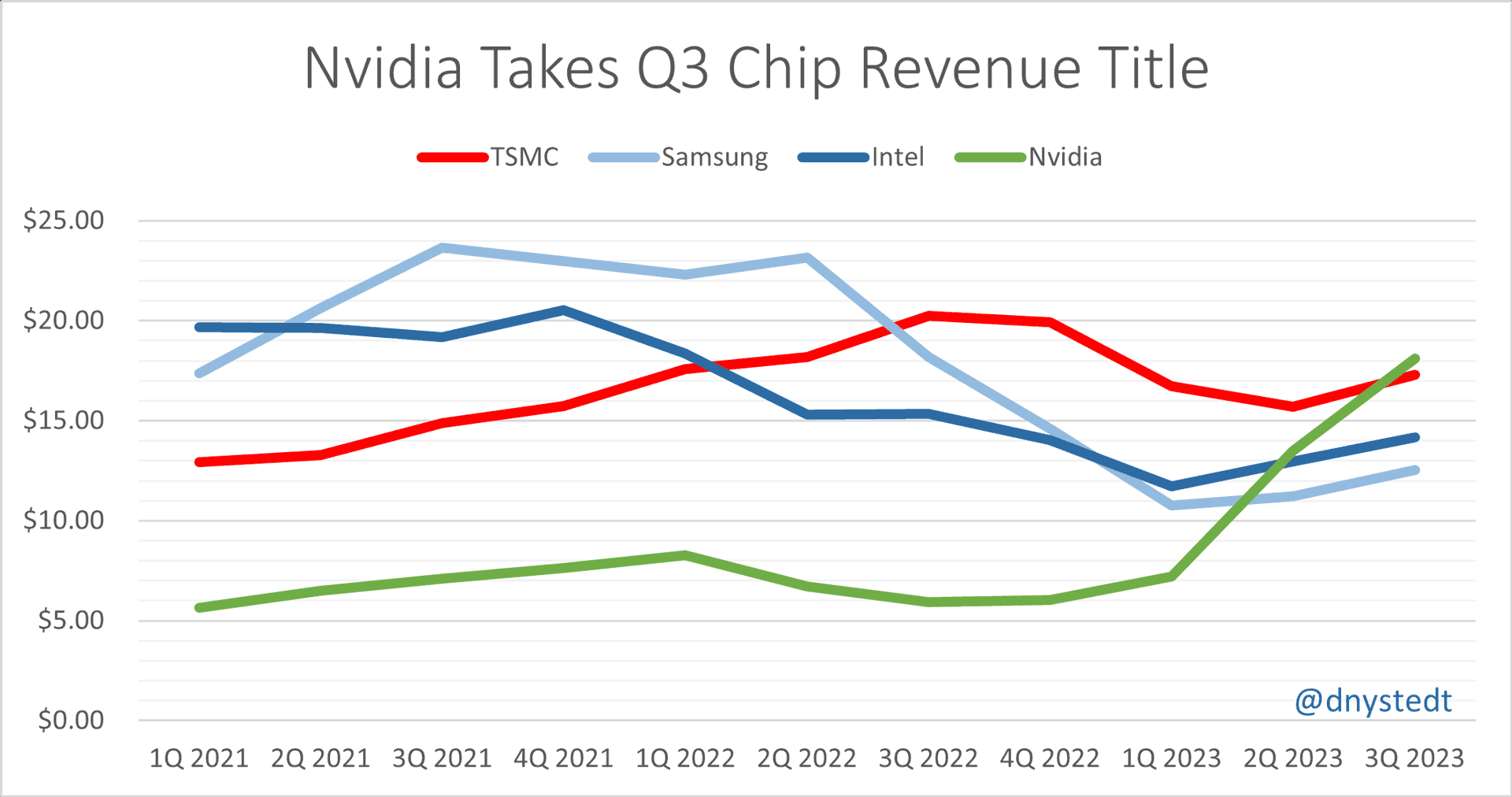

2023 has been nothing short of extraordinary for Nvidia. Its record $13.5 billion in revenue for Q2 was impressive on its own, and the company followed that up with $18.12 billion in Q3. That kind of quick growth is practically unheard of in semiconductors; even AMD didn't see its revenue more than triple in the space of a single year when it started gobbling up market share from Intel.

• RTX 4060 Ti: now $449

• RTX 4090 Prices: from $2399

• RTX 4070: now $569

As for Nvidia's rivals, the company made more revenue than Intel, Samsung, and even TSMC, the company that produces the vast majority of Nvidia's chips. Nvidia also beat them all in profit, especially Intel, which lost $8 million, and Samsung, which saw $2.86 billion wiped out due to factors like the NAND flash crisis. That's presumably why Liu believes Nvidia will be the largest of its peers by the end of the year.

However, there are some caveats to Liu's claims. Although Nvidia did beat out its immediate rivals and made the most money in Q3, that might only have been possible since Intel, Samsung, and TSMC are in a slump. All three companies were doing significantly better in revenue before the start of the year, and they all have posted at least one quarter with more than $20 billion in revenue since 2021. If this turns out to be a temporary dip rather than a permanent development, Nvidia would need to make even more money to keep up.

It's also not clear what Liu counts as a semiconductor company. Apple, Google, Amazon, and now Microsoft all make their own custom processors, and all four are far larger than Nvidia in terms of revenue and employee count. Nvidia's next closest rival would be Microsoft, which made $52.9 billion in Q3, which is quite the mountain to climb.

However, it's also true that these companies have many other businesses outside of chip design and sales, so perhaps Liu is focusing purely on semiconductor-derived earnings. That would be challenging to measure, but given Nvidia's Q3 earnings, it's probably safe to say Nvidia has the lead.

Liu also noted that fabless chip designers like Nvidia, AMD, and Google are expected to grow by 10% in the next five years, while projections for Intel and Samsung (the only chip designers to own their fabs) are at just 4% in the same time frame. Both companies have declined for a year or so, with Intel taking great measures to reform its business. TSMC, of course, stands as a major beneficiary if these projections prove accurate, as most fabless companies who want to make cutting-edge processors go to TSMC.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Matthew Connatser is a freelancing writer for Tom's Hardware US. He writes articles about CPUs, GPUs, SSDs, and computers in general.

-

elforeign Interesting article, no doubt AI/ML has rocketed NVIDIA into a new sphere with all the demand for their chips. Certainly, they are mainly being hampered in sales and revenue by the amount of chips they can produce in any given quarter and looking ahead, the ramifications of import/export restrictions not only for their end product, but also up and down the supply chain with raw material procurement.Reply

Can't say what it will mean for their stock price, but it will be interesting to see how they continue to develop their professional lines and the R&D to make/improve their product lines.