Pricing pressure drives DRAM revenues lower

El Segundo (CA) - DRAM makers faced steep declines in memory revenues in the second quarter of this year: DDR production is slowly shifting in favor of DDR2, but only two out of the ten largest manufacturers were able to post gains during the period, iSuppli said in a report released on Wednesday.

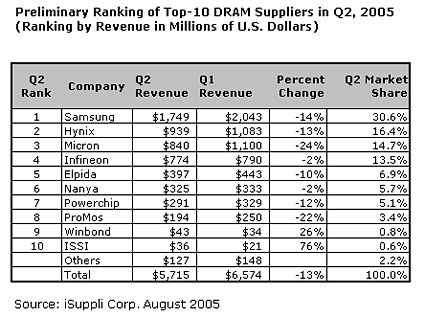

The market research firm's results follow on the heels of Q2 report of the Semiconductor Industry Association (SIA), which indicated a weak quarter for DRAM manufacturers. Virtually all large companies saw their revenues retreating on a sequential basis. Exceptions were Winbond in ninth and ISSI in tenth place. The firms posted increases of 26 and 76 percent, respectively. However Winbond and ISSI account for only 1.4 percent of the total DRAM market.

All other firms saw a significant decrease in revenues, including Samsung, which continues to dominate the market with a share of 30.6 percent. Sales of the firm were down 14 percent 2.04 billion to $1.75 billion. Hynix traded ranks with Micron and came in second with a share 16.4 percent and 13 percent revenue decline to $939 million. Micron was hit with the sharpest revenue decline of 24 percent. Winners of Q2 were Infineon (rank 4) and Nanya (rank 6) with sales contracting by only 2 percent.

Overall DRAM revenue in the second quarter fell to $5.7 billion, down 13 percent from $6.6 billion in the first quarter. Although global shipments of DRAM megaBytes increased by 15 percent in the second quarter, compared to the first, the increase was reversed by a 25 percent decline in Average Selling Prices (ASPs). DDR2 accounts for an increasing amount of DDR volume, but has little effect on revenues at this time. iSuppli estimates that DDR2 production accounted for about 25 percent of total DDR output.

According to the market research firm, Hynix managed to limit the ASP decrease to a relatively mild 19 percent, while its megaByte shipments increased by 10 percent. In contrast, Micron's DRAM ASP fell by 28 percent, while its megaByte shipments rose only 6 percent.

Infineon's megabit shipments rose by 44 percent during the quarter, due to increased production at its manufacturing partners, Inotera Memories, Winbond Electronics and Semiconductor Manufacturing International (SMIC). Inotera accounted for 15 percent of Infineon's DRAM shipments in the second quarter, while SMIC and Winbond together accounted for 20 percent, iSuppli said.

The current ranking in detail:

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Related stories:

Global semiconductor industry on track for solid growth in 2005

Wolfgang Gruener is an experienced professional in digital strategy and content, specializing in web strategy, content architecture, user experience, and applying AI in content operations within the insurtech industry. His previous roles include Director, Digital Strategy and Content Experience at American Eagle, Managing Editor at TG Daily, and contributing to publications like Tom's Guide and Tom's Hardware.