Report: Semiconductor Foundry Revenue Reaches New Historical High

Constant growth that lasts for years

Semiconductor manufacturing can be a challenging business sometimes. With the difficulty of manufacturing silicon increasing, it is often very hard to stay at the top. However, if you play your cards right, it can be very valuable. According to TrendForce, the semiconductor foundry business has hit another record revenue number with a 6.2% growth Quarter-over-Quarter (QoQ).

The current COVID pandemic is causing semiconductor suppliers to max out their production lines, as the demand for new chips s surging rapidly. It is reported that the whole telecom industry shift to 5G, geopolitical tensions, and supply chain shortages have caused the revenue of the main semiconductor foundries to hit another record-setting amount.

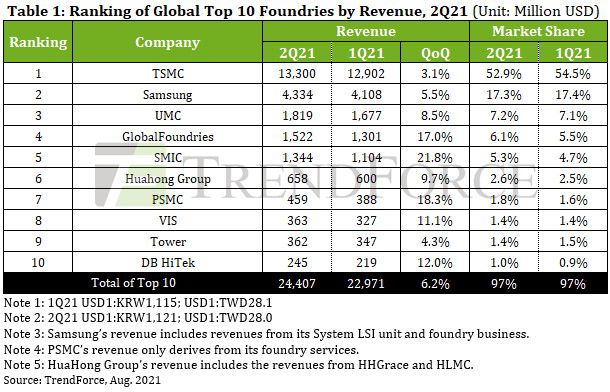

TrendForce has calculated that the global semiconductor foundry revenue has reached 24.407 billion US Dollars in Q2 of this year, setting another record quarter after quarter. This represents a 6.2% growth QoQ, showing that semiconductor foundries are still not winding down from the growth started back in Q3 of 2019.

At the top of the list, there is TSMC, which paves the way for all semiconductor manufacturing and is currently supplying millions of consumers. Right after TSMC, there is the Korean giant Samsung with its foundry also producing an astonishing amount of silicon. You can check out the table provided by TrendForce below, to get a sense of the market share each company currently covers.

It is important to note that TSMC and Samsung were affected by power shortages in their respective facilities, and that impacted their growth. If there were no these obstacles, it is estimated that the two companies would project even higher numbers for Q2. Additionally, we are now seeing entries from Chinese Fabs that show us how much Chinese domestic manufacturing has grown.

As far as shortages are concerned, TrendForce left comments stating that "As of 3Q21, the shortage of foundry capacities that began in 2H19 has persisted and intensified for nearly two years. Although newly installed capacities from certain foundries have become gradually available for production, the increase in production capacity has been relatively limited, and these additional capacities have been fully booked by clients, as indicated by TrendForce’s investigation into orders placed by foundry clients." This means that we are still a bit away from the supply issues being resolved, so all we can do is wait for more facilities to power on.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.