Semiconductor Industry CapEx Set for Steepest Decline Since 2008: Forecast

Major chipmakers are expected to cut Capital Expenditures significantly in 2023.

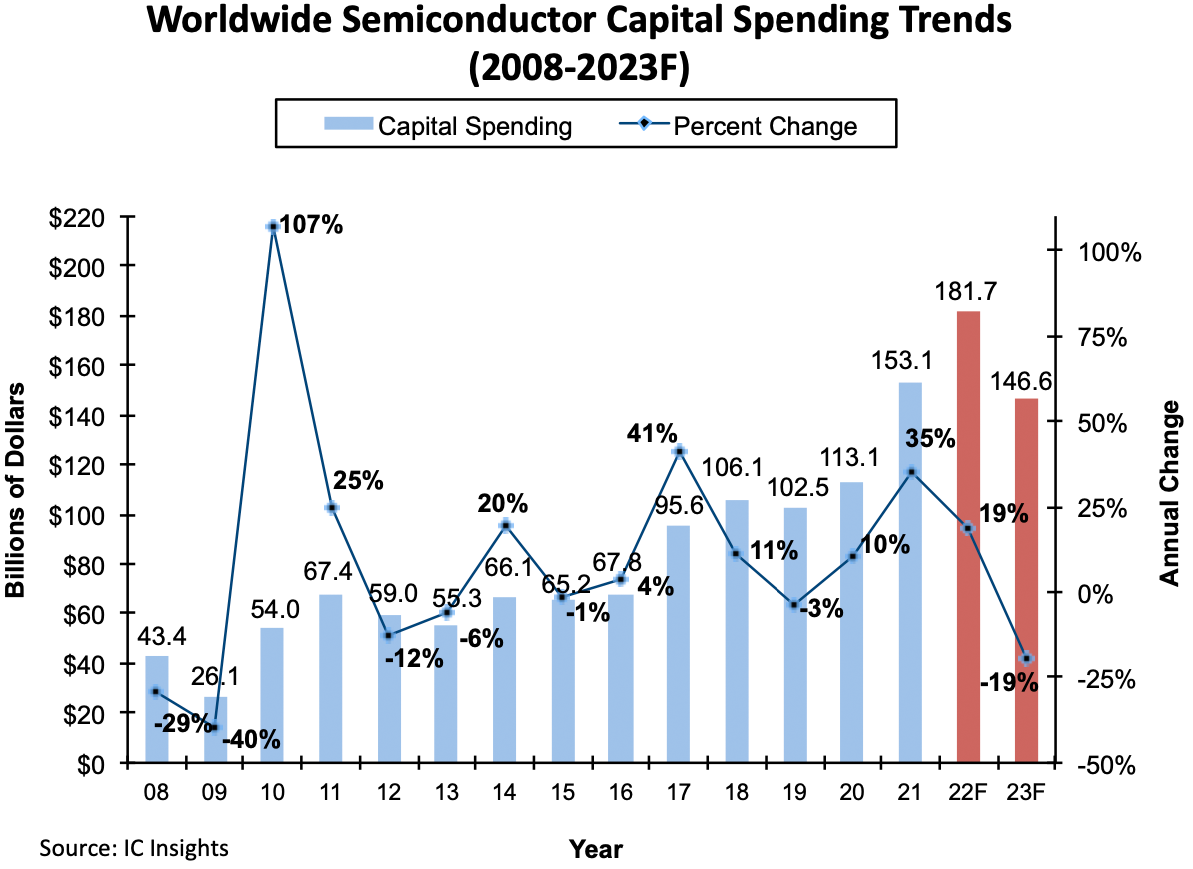

Rising inflation and a weakening global economy had forced many, if not most, chipmakers to lower aggressive expansion plans set when demand for chips exceeded supply. Nonetheless, even with the semiconductor industry's decreased capital expenditures (CapEx), the 2022 forecast stands at $181.7 billion, a new record high, according to IC Insights.

Capital expenditures of semiconductor manufacturers have been increasing since 2020 due to strong demand for everything digital, from smartphones and PCs to giant televisions and self-driving cars. The report claims that CapEx budgets increased by 35% in 2021 to $153.1 billion and are poised to grow 19% in 2022 to $181.7 billion.

But now that companies like Intel and Micron are reviewing their CapEx plans for 2023, IC Insights revises its forecasts and believes that the industry's spending will drop by 19% in 2023 to $146.6 billion. This is just 4.25% lower than the $153.1 billion in 2021 and is significantly above capital spending in 2020.

Meanwhile, IC Insights believes that the memory industry will suffer more than the logic industry as major producers will reduce their capital expenditures by 25%. Also, Chinese semiconductor companies will have to cut their budgets by around 30% as the U.S. sanctions against the People's Republic's chip sector will inevitably affect their ability to procure new production tools.

Anyhow, a 19% decline in capital spending year over year is the steepest decline since the global financial crisis in 2008 – 2009, notes IC Insights.

Indeed, semiconductor industry CapEx spending dropped 40% year-over-year in 2009 but only grew to 107% in 2010 when the global economy showed signs of a rebound. Given how quickly semiconductor CapEx budgets have increased in recent years, we would not expect them to grow by around two times from $146.6 billion in 2023. Meanwhile, virtually all makers of chips (including logic and memory chips) expect demand for their products to rebound in 2024 ~ 2025. As a result, they think they need expanded production capacities to meet that demand in the middle of the decade. As a result, spending on new fabs will grow significantly in 2024 ~ 2025.

Fabs already being constructed or equipped, including those in the U.S. by companies like Intel, Micron, Samsung Foundry, TSMC, and Texas Instruments, will come online on time, as delaying such projects is expensive.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Interestingly, IC Insights does not believe that funding U.S. semiconductor suppliers as part of the U.S. CHIPS and Science Act will give a significant boost to their spending in 2023 as they will use the money they are going to receive in grants in a bid to replace their own money they would have spent on their new fabs.

"In other words, the CHIPS and Science Act money is not expected to be 'additive' funding to planned semiconductor industry spending, but instead is likely to replace the money a semiconductor producer was going to budget if CHIPS and Science Act funding was unavailable," wrote Bill McClean, the president of IC Insights.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

bit_user According to the graph, every 3-4 years there's a couple down years. Very cyclical.Reply

they will use the money they are going to receive in grants in a bid to replace their own money they would have spent on their new fabs.

On the bright side, at least they'll be spending something. In other words, that sets a floor on the decline. It should be easier to recover, in the following couple of years.