China's chip imports boom as the country stockpiles before anticipated new sanctions, struggles to become self-sufficient

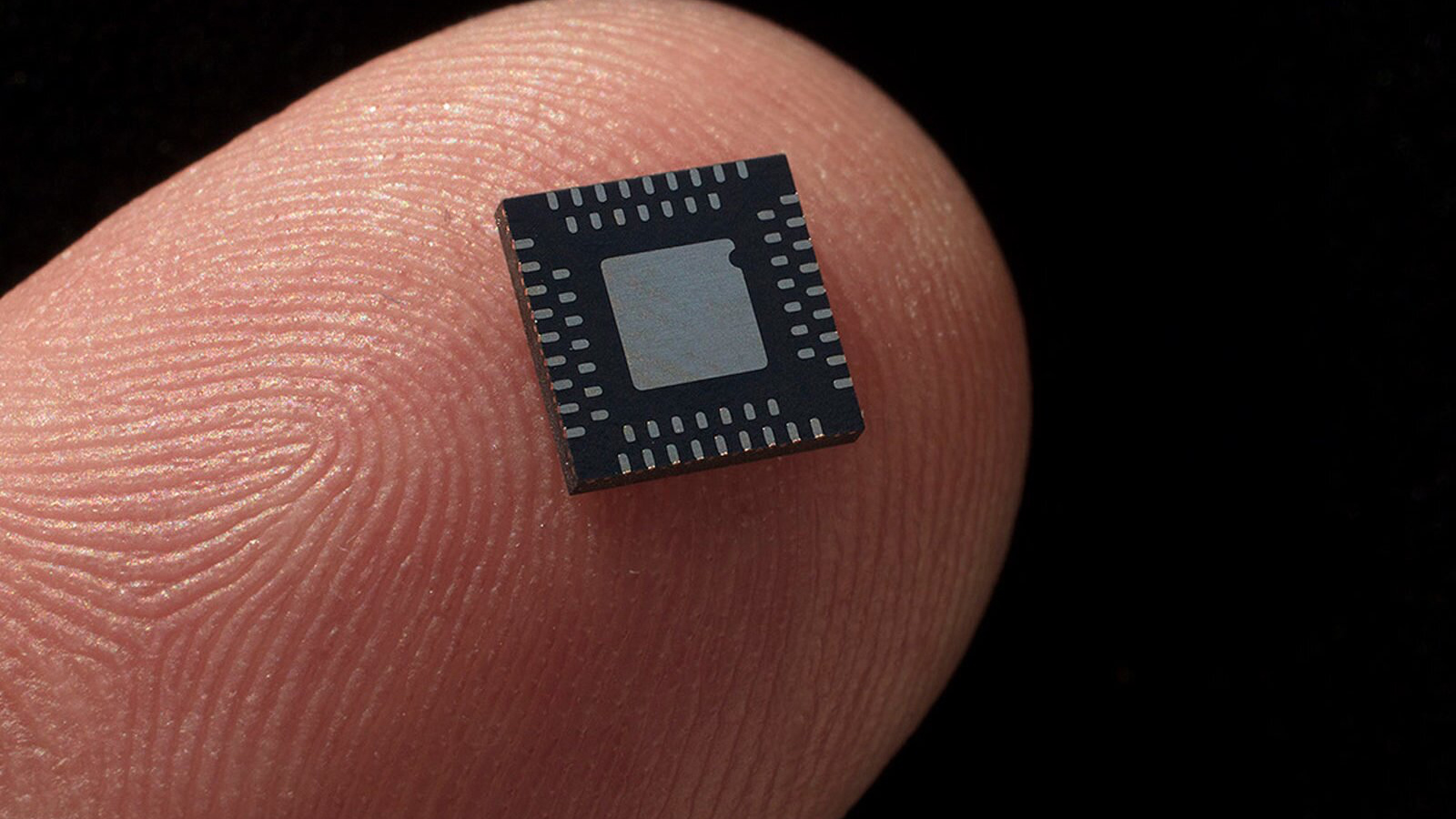

Chips imports to China are back.

Despite China's intentions to become self-sufficient in chip production, this year, Chinese companies increased their chip imports year-over-year as consumer electronics, PC, and server markets began to rebound last year.

In the first seven months of 2024, China imported 308.1 billion semiconductor units, valued at about $212 billion, which indicates a 14.5% increase in volume and an 11.5% rise in value compared to the same period last year, reports South China Morning Post citing General Administration of Customs of China. In 2023, China's total semiconductor imports were valued at $349 billion, a 15.4% decline from the previous year and was in line with 2020, according to DigiTimes citing China customs.

Perhaps 2023 is not a good year to compare as companies performed inventory corrections last year after record 2022 ($413.15 billion) and 2021 ($423.38 billion). However, Chinese companies intensified the purchase of foreign chips in the first seven months of the year. Among these semiconductors are HBM2E stacks from Samsung that companies like Baidu and Huawei use with their custom AI processors. Chinese companies are reportedly stockpiling HBM2E modules ahead of possible sanctions by the U.S. government, which will curb the purchase of high-bandwidth memory by Chinese entities.

China semiconductor imports

| Year | Quantity ( billion units) | Value (USD million) | YoY (%) | ASP |

|---|---|---|---|---|

| 2019 | 4,451.30 | $305,530.60 | -2.1 | $14.57 |

| 2020 | 5,435.00 | $349,963.60 | 14.54 | $15.53 |

| 2021 | 6,356.00 | $432,385.60 | 23.55 | $14.70 |

| 2022 | 5,377.20 | $413,152.20 | -4.45 | $13.02 |

| 2023 | 4,795.60 | $349,376.50 | -15.44 | $13.73 |

This increase in semiconductor exports coincides with a recovery in the PC, smartphone, and server markets. For example, the PC market grew 3% year-over-year in the second quarter, according to IDC, whereas global smartphone shipments rose by 6.5% in the second quarter of 2024. This rebound has also positively influenced China's semiconductor export figures. Yet, some believe that the recent import surge suggests a strategic move by Chinese companies to mitigate the impact of upcoming U.S. trade restrictions.

The rise of chip exports to China indicates that despite the country's efforts to become self-sufficient, it is still not even close to achieving that goal. Of course, China is not going to be able to make higher-end processors and FPGAs like those from AMD, Altera, Broadcom, Intel, MediaTek, Nvidia, Qualcomm in high volumes any time soon, so makers of PCs, smartphones, telecommunications equipment, and other gear will have to import them to build their products in China.

However, import volumes and average selling prices (ASPs) of chips imported to China indicate that Chinese companies are purchasing leading-edge processors and commodity things. In particular, loads of automotive parts are developed by companies like NXP and Renesas and are made in Japan and Taiwan. The rise of the Chinese automotive industry in recent years certainly requires these components, as modern cars employ over a thousand chips. Many of them are made locally, such as display drivers and power management ICs. Others must be imported.

However, China's semiconductor industry is not standing still, either. China's semiconductor exports have also seen significant growth. From January to July 2024, exports reached 166.6 billion units, a 10.3% increase from last year. The total value of these exports rose by 22.5% year-on-year to $90 billion, driven by strong international demand for legacy chips used in consumer electronics.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.