Chinese companies spend $26 billion on advanced chipmaking machinery investment

More tools, more chips.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

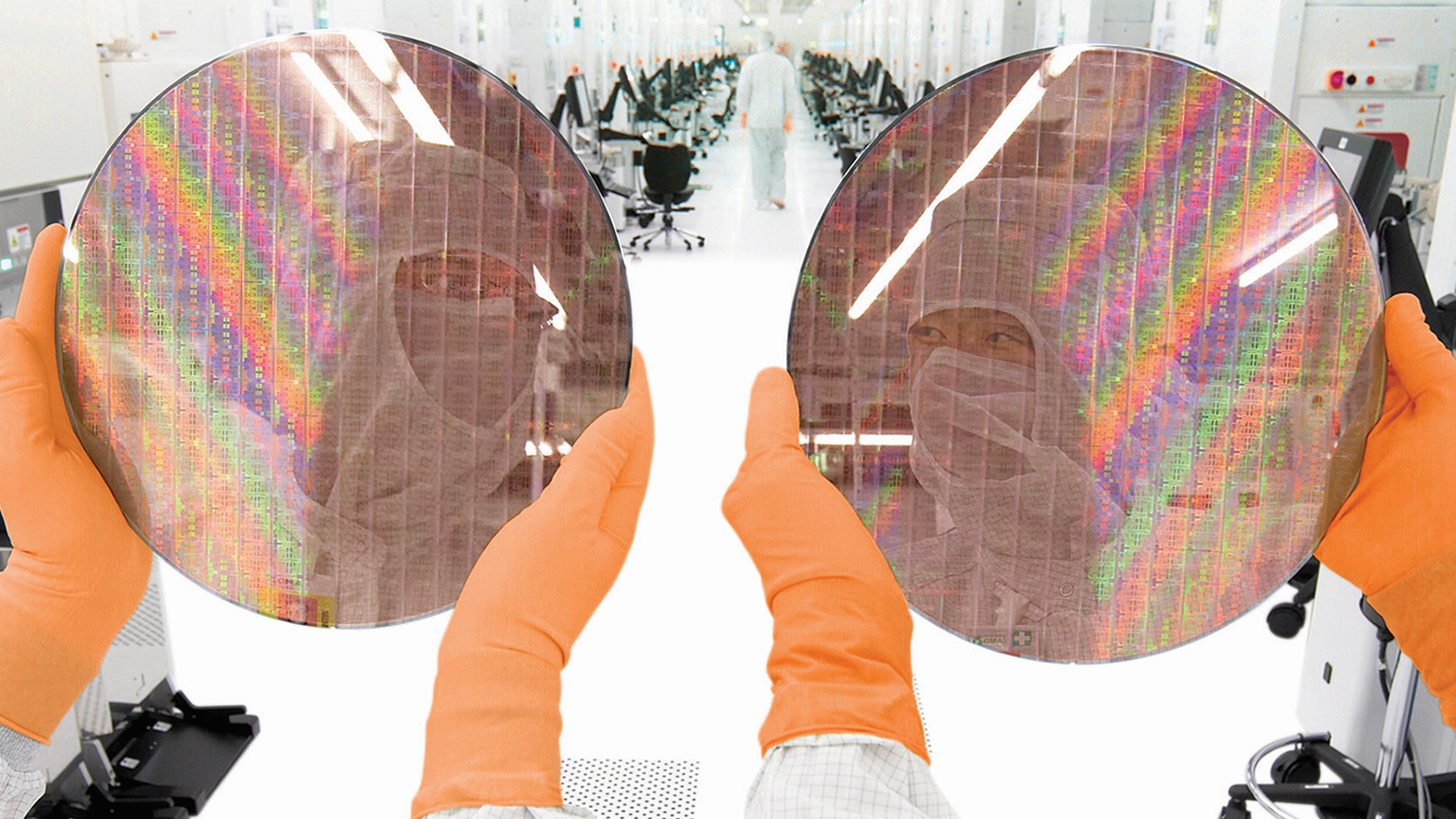

Chinese companies have drastically increased their imports of chip production equipment, spending nearly $26 billion in the first seven months of the year, according to a Bloomberg report citing data from China’s General Administration of Customs. This surge marks a new record, surpassing the previous peak set in 2021, as these companies prepare for potential further restrictions from the U.S. and its allies on advanced chipmaking tools.

Chinese companies have particularly focused on acquiring lower-end semiconductor equipment used to make chips on mature process technologies from suppliers like ASML Holdings, Applied Materials, and Tokyo Electron. This shift to mature nodes allows Chinese fabs to develop and supply chips to other sectors of the Chinese economy, namely the automotive industry.

Dutch exports to China, largely driven by purchases from ASML, reached over $2 billion in July, the second-highest monthly total on record, according to Bloomberg. Most of these tools are lithography systems used to make chips on trailing nodes. Supply of these tools has been particularly important for companies like Semiconductor Manufacturing International Corp. (SMIC) which recently became the world's second-largest pure-play foundry due to its ability to supply chips made on advanced nodes to companies like Huawei and vast manufacturing capacities focused on mature nodes as well as smaller and emerging players that specialize solely on mature and specialty nodes.

There are several reasons why Chinese companies are accelerating their purchase of semiconductor production tools. On the one hand, 18 new fabs are expected to start operations in China in 2024 and these production facilities must be equipped. Over a dozen more fabs are coming online in China in the coming years.

Another reason for the increase in equipment purchases is driven by concerns over tightening export controls from the U.S. and its allies. These controls, aimed at limiting China's access to advanced semiconductor production technology, have led Chinese firms to stock up on machinery while they still can.

In terms of wafer starts, China is already the world's largest maker of chips. Industry group SEMI believes that China's semiconductor production capacity increased by 12% year-on-year, reaching 7.6 million wafers per month in 2023. With new fabs coming online in 2024, this growth is projected to continue with a 13% year-on-year rise, bringing capacity to 8.6 million wafers per month this year. Then, Chinese semiconductor production is expected to increase by 14% in 2025, potentially accounting for nearly a third of global output.

With the export restrictions led by the U.S., Netherlands, Japan, and Taiwan, Chinese chip companies have to focus on mature nodes and because so many of new fabs specializing in trailing nodes are coming online, they start to fight for clients. Essentially, the plan is to flood the market with chips made on older nodes and push out rivals.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Late last year SMIC, Hua Hong Semiconductor, and Nexchip reportedly lowered their tape-out service prices to attract Taiwanese chip design companies and fill new production capacity. As a result, some customers shifted orders from their usual partners like GlobalFoundries, PSMC, Samsung Foundry, and UMC to Chinese contract makers of chips. In response, Taiwan's UMC and PSMC as well as South Korea's Samsung Foundry reduced their prices by 5% to 15% to stay competitive.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Pierce2623 So what happens when they COMPLETELY flood the world with legacy node chips and the bottom drops out of prices?Reply -

The Historical Fidelity Reply

Historically, the world has brought dumping charges on the source country to the International Trade Commission and penalty duties on those goods will be implemented to make them uncompetitive. A historical example would be the once thriving Japanese memory chip producing sector.Pierce2623 said:So what happens when they COMPLETELY flood the world with legacy node chips and the bottom drops out of prices?

https://www.nytimes.com/1985/08/03/business/japan-chip-dumping-is-found.html#:~:text=In%20a%20major%20trade%20victory%20for%20United%20States,may%20impose%20penalty%20duties%20against%20the%20Japanese%20manufacturers.