China to lead semiconductor industry expansion with 18 new fabs in 2024 —global chipmaking capacity to reach record heights

China builds more new fabs than other countries.

The SEMI World Fab Forecast report anticipates a 6.4% increase in capacity in 2024, reaching over 30 million wafer starts per month (wpm). Driven by serious government funding, China is predicted to lead the world in expanding semiconductor production, with a total of 18 new fabs expected to begin production in 2024.

The rather substantial 6.4% increase in wafer processing capacity follows a 5.5% rise to 29.6 million WSPM in 2023. The expansion is primarily driven by developments in leading-edge logic by Intel, TSMC, and Samsung Foundry, as demand for processors aimed at artificial intelligence (AI) and high-performance computing (HPC) applications continues to grow rapidly.

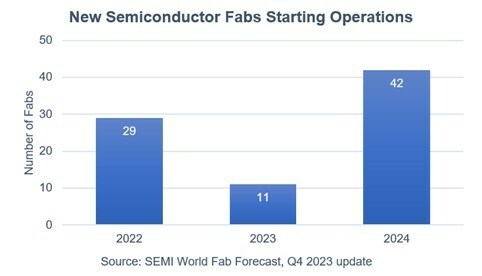

SEMI expects as many as 82 new fabs to go online from 2022 through 2024, which includes 11 projects slated for 2023 and an ambitious 42 projects in 2024. These new facilities will use a range of wafer sizes from 100mm to 300mm and dozens of mature and leading-edge process technologies, indicating a diverse expansion across the semiconductor industry.

China is poised to lead this expansion, bolstered by government funding and various incentives for chipmakers. In 2023, Chinese chip manufacturers are forecasted to grow capacity by 12% year-over-year (YoY), reaching 7.6 million WSPM. This growth is projected to accelerate to 13% in 2024, reaching a capacity of 8.6 million WSPM. A total of 18 new fabs are expected to start operations in China in 2024.

Other regions are also contributing to the increase in global chip production capacity. Taiwan is set to remain the second-largest region in semiconductor capacity, with a projected increase to 5.4 million WSPM in 2023 and 5.7 million WSPM in 2024. South Korea and Japan follow, with South Korea expected to reach 5.1 million WSPM in 2024. The Americas, Europe, Mideast, and Southeast Asia are also gearing up for growth, with each region launching several new fabs in 2024.

In terms of specific segments within the semiconductor industry, the foundry suppliers are forecasted to lead in equipment purchases, increasing their capacity to a record 10.2 million WSPM in 2024. Despite a slowdown in 2023, the memory segment, including DRAM and 3D NAND, is expected to increase capacity gradually. The discrete and analog segments, driven by vehicle electrification, are also projected to grow significantly, highlighting the diverse and dynamic nature of the global semiconductor industry's expansion.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Avro Arrow Without being able to buy equipment from ASML, what will China equip these fabs with?Reply -

George³ Reply

There must be at least a few shiploads of machinery delivered from before the sanctions that have not been installed.Avro Arrow said:Without being able to buy equipment from ASML, what will China equip these fabs with? -

Avro Arrow Reply

Yeah, that makes sense. Then they'll reverse-engineer the hell out of it and all of the sanctions won't make one iota of difference. They already have full access to x86 architecture through their previous ventures with VIA so I think that the US sanctions will be nothing more than a paper tiger.George³ said:There must be at least a few shiploads of machinery delivered from before the sanctions that have not been installed. -

DavidMV I think the world is way overshooting in semiconductor production capacity. This overproduction will be good for consumers for a little while with dirt cheap prices... but ultimately it will cause a lost decade or two in progress... You need large margins and profits to fund the next generation. Many industries get stuck in this cycle from time to time.Reply -

toffty What's missing is the transitor size for these new fabs.Reply

I they're mostly in the 40nm+ regime then iot and auto chips will be dirt cheap but new CPU/GPUs will still be as expensive.

Even 10nm+ won't have much effect in most of our prices. If they're all 100nm+, that's laughable -

phead128 Reply

ASML has been selling to China since 1984, so they have 1,400 pieces of lithography and measurement instruments installed by end of 2023.Avro Arrow said:Without being able to buy equipment from ASML, what will China equip these fabs with?

Plus the metric ton of orders before the Jan 1 2024 deadline.

China has enough NTX:2100i/NTX:2050i for 7nm chip wafer expansion as much as they possibly need until their domestic EUV version is scaled.

Most are probably 14nm/28nm and lower, . That's were all the demand is at, 90% of demand is <14nm nodes.toffty said:What's missing is the transitor size for these new fabs.

I they're mostly in the 40nm+ regime then iot and auto chips will be dirt cheap but new CPU/GPUs will still be as expensive.

Even 10nm+ won't have much effect in most of our prices. If they're all 100nm+, that's laughable

Yes, sanctions has only accelerated their development. This is what happens when policy wonks don't understand technology they are regulating.Murissokah said:The only possible outcome for those sanctions is happening, how surprising. -

Avro Arrow Reply

I have a hard time believing that the industry is suffering when nVidia just passed into the TRILLIONS of dollars. Your words are what I call "Corporate Kool-Aid" because it assumes that the semiconductor industry is poor, but it is anything but. Even with losses from prices being too low, the industry is in no danger of collapse and competition will continue because it has to.DavidMV said:I think the world is way overshooting in semiconductor production capacity. This overproduction will be good for consumers for a little while with dirt cheap prices... but ultimately it will cause a lost decade or two in progress... You need large margins and profits to fund the next generation. Many industries get stuck in this cycle from time to time.

We're not losing anything when it comes to progress, no matter how cheap things are. All you're doing is crying poor on behalf of the rich which is an absolute joke. -

DavidMV ReplyAvro Arrow said:I have a hard time believing that the industry is suffering when nVidia just passed into the TRILLIONS of dollars. Your words are what I call "Corporate Kool-Aid" because it assumes that the semiconductor industry is poor, but it is anything but. Even with losses from prices being too low, the industry is in no danger of collapse and competition will continue because it has to.

We're not losing anything when it comes to progress, no matter how cheap things are. All you're doing is crying poor on behalf of the rich which is an absolute joke.

1. Nvidia and AMD build nothing... they just design things. I'm talking about TSMC, Global Foundries, Intel, Samsung, Micron, ASML and others that actually build stuff. They are the ones that make new nodes. Things are healthy now but won't be if we overbuild capacity. Politics is causing an overbuild, not market forces.

2. That trillion is market cap. Revenue and especially profit matter a lot more. The stock market is often detached from reality

Look at flash memory... that become unhealthy and the companies are cutting back production to get the prices near levels that can support R&D and fab replacements. A Fab costs $30 billion! If I make $10 off an SSD... that means I need to sell 3 billion SSDs just to build the next fab and break even. That is insane. -

ThomasKinsley With this many fabs coming online, it's hard to believe China is solely interested in the domestic market. The West is even thinking of banning these chips, which suggests they believe the chips will succeed in some markets. Were China to succeed in selling low-tier chips, their growth in the chip sector would help fund the more complex sanctioned processes.Reply

Overall, it is a sound strategy.