ASML warns that more U.S. sanctions against China could have a major impact on its business

China pouring billions into self-sufficiency could also hurt ASML's bottom line.

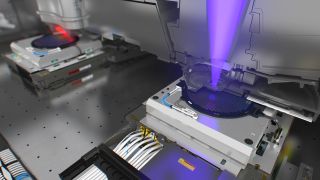

Chinese customers accounted for over 25% of ASML's revenue in 2023 and China represents a major market for the world's top maker of lithography tools. Export rules imposed by the governments of the Netherlands and the U.S. already restrict sales of advanced deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography machines to customers in China, but this hasn't really impacted the company's balance sheet.

However, further restrictions could seriously harm ASML, the company said.

"Geopolitical tensions may result in export control restrictions, trade sanctions, tariffs and more generally international trade regulations which may impact our ability to deliver our systems, technology, and services," ASML stated in its recently released 2023 Annual Report.

"Our ability to deliver technology in certain countries such as China has been and continues to be impacted by our ability to obtain required licenses and approvals. […] The list of Chinese entities impacted by export control restrictions has increased since 2022. […] These and further developments in multilateral and bilateral treaties, national regulation, and trade, national security and investment policies and practices have affected and may further affect our business, and the businesses of our suppliers and customers."

Chinese fabs accounted for 26.3% of ASML's revenue in 2023, and China was the second largest buyer of ASML's tools on country/region basis, just after Taiwan (which accounted for 29.3%). Indeed, Chinese customers accelerated procuring fab tools in the second half of 2023 in the face of strengthening sanctions against China's semiconductor industry. The latest U.S., Dutch, and Japanese export rules restricted the sales of tools and technologies that can produce logic chips with non-planar transistors on 14nm/16nm nodes and below, 3D NAND with 128 or more layers, and DRAM memory ICs of 18nm half-pitch or less.

The majority of China's logic chipmakers (excluding SMIC and Hua Hong) specialize on mature process technologies and barely care about equipment that can be used to produce on FinFET-based 14nm/16nm production nodes. What they are interested in is getting enough tools to make chips on 28nm-class process technologies and thicker, and ASML is more than willing to supply previous-generation fab tools to these clients. As of Oct. 2022, ASML's backlog in China exceeded $38 billion.

If the U.S. and other governments decide to further curb China's semiconductor sector in general, they could either prohibit sales of 28nm-capable tools or restrict exports of China-made chips to their countries. In both cases, ASML would be severely impacted as sales of wafer fab tools for mature processes to China-based chipmakers bring a lot of money.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

For now, ASML enjoys its leading position on the market of lithography equipment, and its business in China thrives. But China pouring billions of dollars not only into new fabs, but also into development of wafer fab equipment, could also be another potential threat to the company's business.

"We also face competition from new competitors with substantial financial resources, as well as from competitors driven by the ambition of self-sufficiency in the geopolitical context," ASML noted. "Furthermore, we face competition from alternative technological solutions or semiconductor manufacturing processes."

Anton Shilov is a Freelance News Writer at Tom’s Hardware US. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

endocine China is only buying what it needs to copy the tech and make their own machines, it was a lost market in the long term regardlessReply -

HaninTH Reply

This! It still baffles me that these companies operate under the notion that China will be a positive client. Their end goal is always to produce in-house to minimize US interference.endocine said:China is only buying what it needs to copy the tech and make their own machines, it was a lost market in the long term regardless

They may buy your products now, but if they think they will ever be limited, they will ensure they can produce it and not have to depend on imports.

The Global Market will only work if everyone plays along, and China refuses. I really don't blame them, at times. -

tomscomments Replyendocine said:China is only buying what it needs to copy the tech and make their own machines, it was a lost market in the long term regardless

china already has thousands of them but you can't read an article; it's not about copying, china has more patent than anyone

it's about industrial bottlenecks

""Furthermore, we face competition from alternative technological solutions or semiconductor manufacturing processes.""

witch means : ASML fears Chinese innovation. Chinese are silent. They may bring new processes (more advanced chipset patents or even photonic chips) sooner than we think. Canon is also trying to find a new life by actively working with some chinese tool makers

last but not least, i guess they are tool makers we don't know -

tooltalk Reply

A lot of wishful thinking there. It is however true that China definitely has stepped up their theft/espionage efforts in recent years. The Chinese founders of XTAL who stole ASML's IP as former employee and fled to China after losing a US court case is now doing well under China's protection. ASML also reported other thefts by Chinese employees past couple of years. And let's get real, China's most cutting edge litho maker SMEE just announced 28nm to be delivered in 2024, after making lab-quality equipments all these years.tomscomments said:china already has thousands of them but you can't read an article; ...

""Furthermore, we face competition from alternative technological solutions or semiconductor manufacturing processes.""

witch means : ASML fears Chinese innovation. Chinese are silent. They may bring new processes (more advanced chipset patents or even photonic chips) sooner than we think. Canon is also trying to find a new life by actively working with some chinese tool makers

last but not least, i guess they are tool makers we don't know

If you haven't yet noticed, there is de-risking under way. Japan has already changed their policy on equipment collaboration/export with China last year, which disallows all, but legacy nodes. -

ThomasKinsley Set politics aside. Sanctions will inevitably split China from the rest of the world. Without China as a customer, the West's technology is set to get even more expensive.Reply -

tooltalk Reply

I don't get this logic. Why would they get more expensive? I think many in the West still love to overstate the impact of anything China. China produces less than 10% of all semi-chips produced globally and accounts just about 20% of chip consumption. The average cost of transistors rapidly declinedwith or without China since the first invention of transistors in the 1940's, until it more or less stalled after 28nm, released in 2011. It's technical progerssion and commodification of technology that allow cheaper chips, not China.ThomasKinsley said:Set politics aside. Sanctions will inevitably split China from the rest of the world. Without China as a customer, the West's technology is set to get even more expensive. -

ThomasKinsley Reply

China is reportedly 22% of AMD's external sales and 27% of Intel's in 2022. If these companies lose that market, then they lose that profit. Less profit means less research and development, a smaller supply chain, fewer advanced machines, and higher prices. To put it another way, today's global companies will become tomorrow's regional companies. Before the separation was called the Iron and Bamboo curtain. Now we're already seeing an economic curtain of sanctions being unfurled. It's bound to have an effect on the global economy, and Western leaders have already told their civilians to prepare for higher prices as a result.tooltalk said:I don't get this logic. Why would they get more expensive? I think many in the West still love to overstate the impact of anything China. China produces less than 10% of all semi-chips produced globally and accounts just about 20% of chip consumption. The average cost of transistors rapidly declinedwith or without China since the first invention of transistors in the 1940's, until it more or less stalled after 28nm, released in 2011. It's technical progerssion and commodification of technology that allow cheaper chips, not China. -

drajitsh Reply

That that is going to happen in any case. Read the article about longsoon CPUThomasKinsley said:China is reportedly 22% of AMD's external sales and 27% of Intel's in 2022. If these companies lose that market, then they lose that profit. Less profit means less research and development, a smaller supply chain, fewer advanced machines, and higher prices. To put it another way, today's global companies will become tomorrow's regional companies. Before the separation was called the Iron and Bamboo curtain. Now we're already seeing an economic curtain of sanctions being unfurled. It's bound to have an effect on the global economy, and Western leaders have already told their civilians to prepare for higher prices as a result. -

NinoPino Reply

in fact it's really strange for a company to consider a good customer someone who makes 1/4 of his business.HaninTH said:This! It still baffles me that these companies operate under the notion that China will be a positive client. Their end goal is always to

As every other company in the world (funds permitting).HaninTH said:produce in-house to minimize US interference.

They may buy your products now, but if they think they will ever be limited, they will ensure they can produce it and not have to depend on imports.

The "Global Market" works only if every country have the same amount of resources. And this was not and will never be true.HaninTH said:

The Global Market will only work if everyone plays along, and China refuses. I really don't blame them, at times.

Most Popular