ASML: Demand for Chip Tools Hits Record, Backlog Exceeds $38 Billion

U.S. chip sanctions against China have "limited" direct impact on ASML

ASML on Wednesday posted record revenue and profits as demand for chip production equipment hit records despite slowdown of PC and smartphones sales. The company's backlog for its products — including deep ultraviolet (DUV) lithography scanners and extreme ultraviolet (EUV) litho tools — now exceeds $38 billion as chipmakers continue to invest in wafer fab equipment (WFE). ASML continues to sell its DUV tools to Chinese customers. Furthermore, all current EUV customers have committed to High-NA EUV tools.

Record Demand

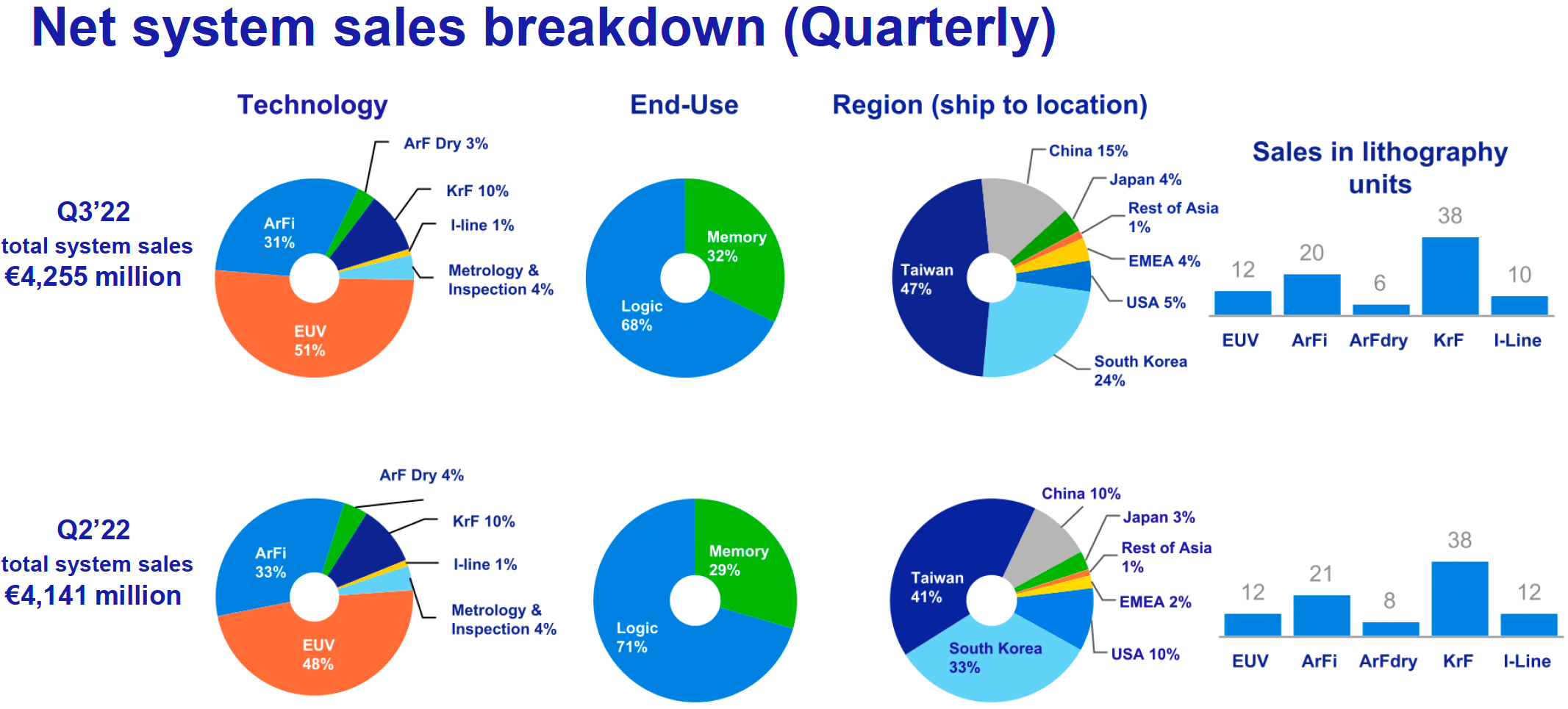

ASML's third quarter sales came in at €5.8 billion as it sold 80 new lithography systems as well as six used scanners, including 12 EUV tools (in line with Q2) as well as 74 DUV machines (down from 79 in Q2).

The company's profits reached €2.994 billion in the quarter, while its gross margins hit 51.8%. Some of TSMC clients prefer so-called fast shipments — a shipment process that omits some of the testing at ASML's facilities and brings final testing and formal acceptance to the customer site — so some of the company's Q3 2022 sales will be recognized in the following quarter(s).

While demand for PC, smartphone, and consumer electronics chips is getting weaker, chipmakers expect sales of their products to start increasing in 2024 ~ 2025, which is when they are going to need new production capacity with installed tools. At present there are multiple fabs being built by such leading companies such as Intel, Micron, Samsung, and SK Hynix that will need equipment in the coming years. For ASML this meant record bookings of around €8.9 billion in the third quarter, of which €3.8 billion were EUV litho tools, including those with 0.33 numerical aperture as well as High NA systems with 0.55 numerical aperture.

As of today, ASML's backlog exceeds $38 billion (up from $33 billion in Q2), which includes well over 600 DUV scanners as well as well over 100 EUV scanners.

"85% of that order book really is for EUV and for immersion, so really caters to the more advanced and strategic part of semiconductor manufacturing," said ASML's chief financial officer Roger Dassen. "They really are building capacity also beyond 2023. And also there is still this element of tech sovereignty that we have been talking about. The fact that governments want to be more self-sufficient in their semiconductor manufacturing. So those secular trends are still very much intact, and I think that creates a situation that we are seeing where the lion's share of the customers are really still pushing us to get the tools sooner rather than later."

It will take years for the company to deliver these tools, as its target production capacity for 2023 is over 375 DUV machines and over 60 EUV machines.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"ASML expects fourth quarter net sales between €6.1 billion and €6.6 billion with a gross margin around 49%," said Peter Wennink, chief executive of ASML. "For the full year, we expect revenue of €21.1 billion with a gross margin approaching 50%."

ASML to Keep Shipping to China, For Now

Unlike WFE suppliers from the U.S., ASML did not lower its guidance for Q4 due to U.S. sanctions against the Chinese semiconductor sector that prohibit American chip production technologies from being shipped to China without a special export license from the U.S. Department of Commerce.

ASML is based in the Netherlands and does not use many parts designed or produced in the U.S. inside its DUV tools — therefore it can ship most, if not all, of its DUV tools to companies such as Semiconductor Manufacturing International Co. (SMIC), Hua Hong, and Yangtze Memory Technology Co. (YMTC), according to its chief financial officer Roger Dassen.

"We are still in the process of evaluating the [U.S. restrictions against China's chip industry]," said Dassen. "Our initial appreciation is that the direct implication for us is fairly limited. […] We will do whatever it takes to follow [the new U.S. export laws]. […] But the fact that we are a European company with limited U.S. technology in [our tools] of course creates this situation where a direct impact on us is fairly limited. We can continue to ship non-EUV lithography tools out of Europe into China."

ASML could not ship EUV scanners to its Chinese customers due to the Wassenaar Arrangement and now cannot ship them to China because they use Cymer's light sources designed and produced in the USA. Since ASML never expected to ship its Twinscan NXE scanners to its clients in China (which is why potential shipments EUV shipments to China were never counted in any guidance) and the impact of U.S. crackdown of Chinese semiconductor industry on ASML is projected to be limited, the company did not update its expectations for the fourth quarter and for the year 2022.

Meanwhile, ASML admits that there might be indirect impact on sales of its DUV tools to its Chinese clientele. Fabs need different kinds of machinery to operate, so if a customer does not get tools from Applied Materials or KLA, it may not need ASML's lithography scanners and may cancel its orders. This is somewhat unlikely as companies like SMIC and YMTC have billions in government subsidies and will probably continue to buy new litho tools while they can, and attempt to procure used American tools or parts made for U.S.-made equipment on the secondhand market.

And even if Chinese customers cease buying lithography tools from ASML, demand still outpaces supply and its backlog is so huge that sales to other clients will more than offset sales to companies in China.

All EUV Customers Committed to High-NA EUV

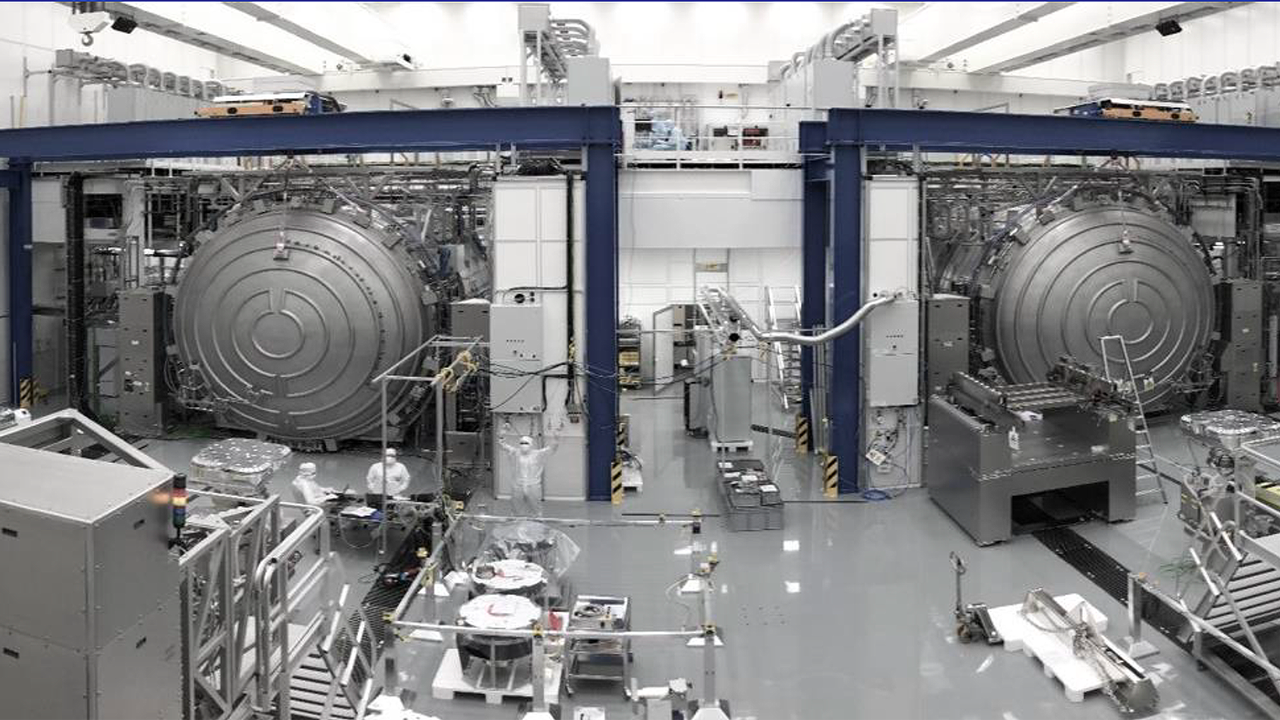

More good news for ASML this quarter are additional orders for its first commercial High-NA scanner, the Twinscan EXE:5200. At least one of the orders came from its current EUV customer that previously has not ordered this tool, which means that all companies that use (or plan to use) extreme ultraviolet lithography with 0.33 numerical aperture will eventually migrate to next-generation EUV lithography with 0.55 NA.

Previously the company said that three Logic and two Memory customers had ordered its High-NA scanners, and while ASML did not disclose names of its 0.55 NA EUV clients, we can deduce that it meant Intel, Samsung Foundry, and TSMC (Logic) as well as Samsung and SK Hynix (Memory). ASML does not disclose the name of its latest High-NA EUV customer for obvious reasons, but it is reasonable to assume that Micron ordered its first High-NA scanner in the third quarter.

Currently Micron is building two leading-edge memory fabs in the U.S. — in Utah and New York — that are set to start ramping up DRAM production in a 2025 – 2026 timeframe. Initially both fabs will use Twinscan EXE 0.33 EUV tools, but eventually Micron will need something even more advanced, which is why it is going to need 0.55 EUV scanners. Apparently the company has already begun preparing for the next generation.

Micron yet has to comment on its High-NA EUV commitment, but we have all reasons to believe that the company is looking forward ASML's next-generation High-NA EUV production tools.

Summary

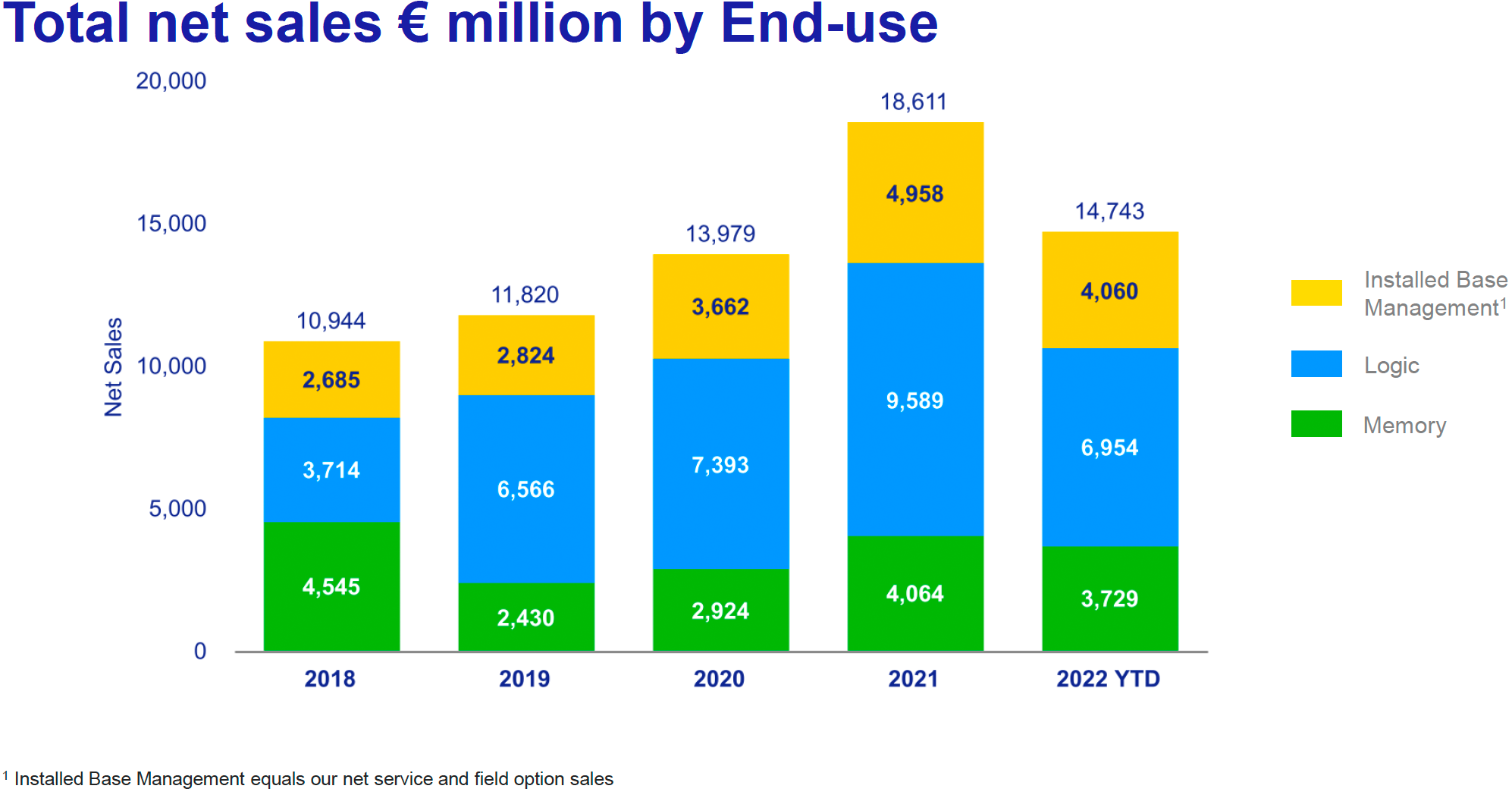

While demand for logic and memory chips aimed at PCs, smartphones, and consumer electronics got lower in the recent months and are unlikely to rebound in the next two or even three quarters, chipmakers continue to invest in their fabs — thus bringing their money to ASML. Demand for WFE is so high that ASML's backlog for advanced equipment increased to $38 billion in Q3, or by $5 billion in just one quarter.

While American companies now require a special export license from the U.S. DoC to sell their wafer fab equipment to customers in China, ASML believes that it can export its DUV scanners to the People's Republic without any restrictions. While it remains to be seen whether U.S. sanctions against China's semiconductor industry will hit ASML indirectly, demand for the company's tools around is so strong that even complete loss of Chinese clients might not be seen for at least a couple of years.

Leading makers of logic and memory chips that currently use EUV scanners that cost $160 – $170 per unit all plan to adopt even more advanced High-NA EUV machines in the future, ASML said.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.