Dutch government bans even simpler chipmaking tools from export to China — DUV lithography tools now get the axe

This will have a limited impact, as it mostly clarifies existing restrictions.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

ASML announced that the Dutch government has revoked its export license for two of its lithography systems, and it can no longer ship these tools to Chinese clients. The impact on ASML won't be significant as these machines are designed for advanced process technologies, while the vast majority of ASML's customers in China are focused on mature production nodes. However, it further restricts China's access to newer chip manufacturing technologies.

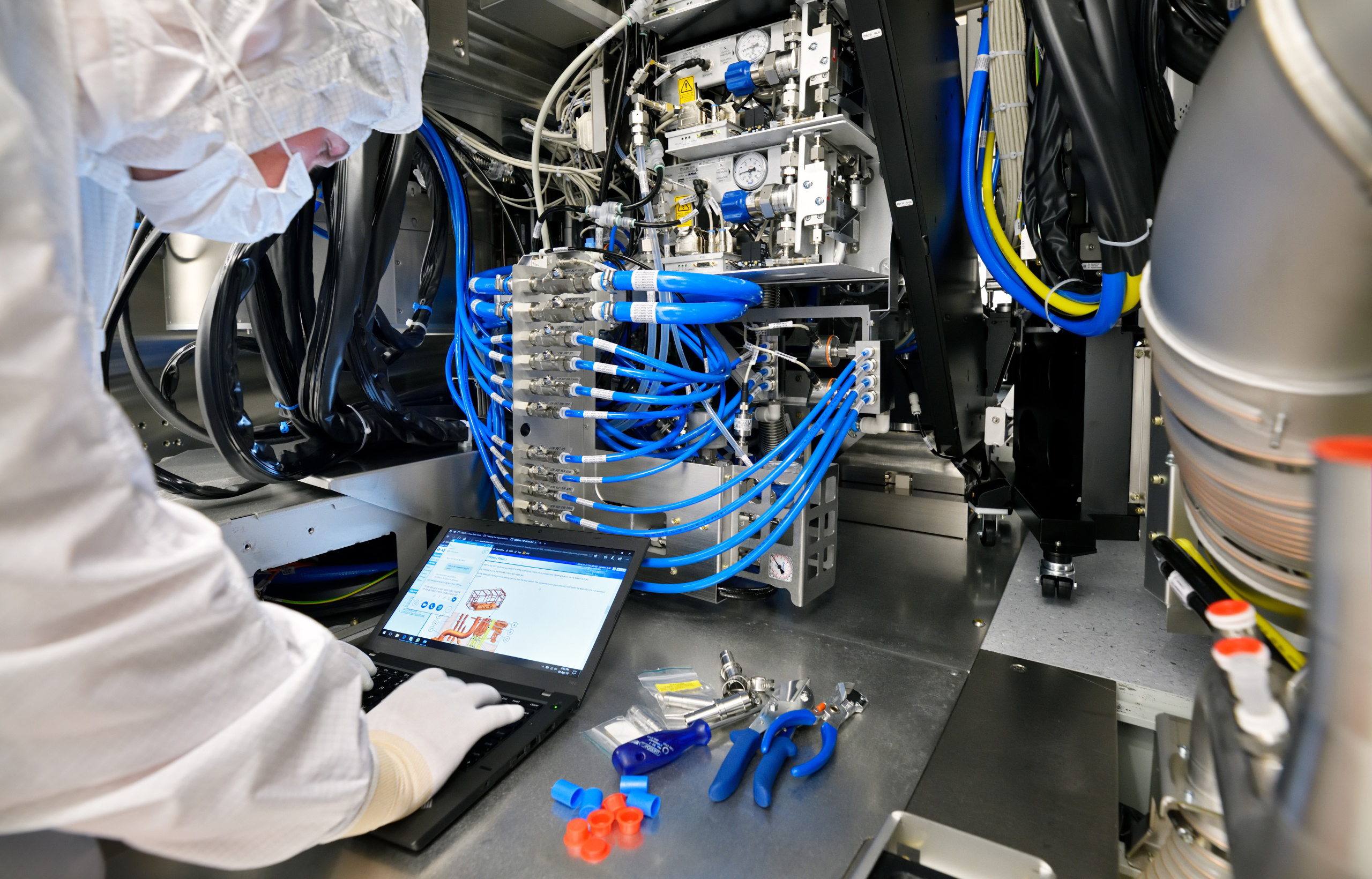

The tools in question are ASML's Twinscan NXT:2050i and NXT:2100i lithography systems, the company's most advanced deep ultraviolet (DUV) machines. Both machines are capable of ≤38nm resolution and can be used to make logic chips on 7nm and even 5nm-class process technologies, albeit with multi-patterning. Both machines can process up to 295 wafers per hour and can be used both for logic and memory production.

The NXT:2100i also features new hardware and software innovations that enable improved single-machine overlay by up to 10% (0.9 nm) and matched-machine overlay by 13% (1.3nm) compared to the NXT:2050i.

For now, the only Chinese chip manufacturer that has a 7nm-class process technology is SMIC. It uses previously imported DUV machines with multi-patterning. As a result of these new restrictions, it won't be capable of obtaining additional tools to boost its 7nm output. This could impact Huawei, one of a few Chinese chip designers that uses SMIC's 7nm production node.

Since both machines use technologies designed in the U.S., they both are subject to U.S. and Dutch export rules. The U.S. does not allow shipments of wafer fab equipment that can be used to make logic chips on 14nm/16nm and more advanced fabrication nodes, so ASML cannot really ship these tools to Chinese clients anyway.

"In recent discussions with the U.S. government, ASML has obtained further clarification of the scope and impact of the U.S. export control regulations," a statement by ASML reads. "The latest US export rules (published October 17, 2023) impose restrictions on certain mid-critical DUV immersion lithography systems for a limited number of advanced production facilities."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

TechLurker Probably boils down to the EUV license that ASML entirely relies on. The EUV tech underpinning ASML's dominance was entirely funded by the US under CRADA, and IIRC, only 3 groups got the licensing rights. Intel, SVG, and ASML. Canon and Nikon wanted in too, but they were denied the licensing since the US felt they were a threat to US dominance in chip production systems back in the 90s.Reply

Intel botched their program and gave up. Silicon Valley Group ended up being bought by ASML, giving them a partial US presence and incorporating SVG's IP into their own and basically cornering the EUV market as there were no other players left. However, the rights and whatnot is still held by the US, having been funded by taxpayer money years ago, and a lot of sweetheart deals were made to let ASML continue to be the only company with an active license instead of the US giving a new license to another player or two.

Hence, what the US says, ASML and the Dutch follow.

That said, many of the components making up the EUV machines also come from places like Japan, and Japan also has a near-monopoly on the exotic chemicals needed to produce chips, so ASML and the US fabs also play nice with Japan in that regard (Dupont also produces some of the exotic chemicals, but IIRC, they're not as pure or produced at the same scale and cost as Japan does).

Sure, there are some rivals still independently working out EUV tech; namely China and Japan itself, but they're also looking beyond it to other options that could let them break out beyond DUV tech.