Nvidia became world's largest fabless chip designer by revenue in 2023 thanks to AI boom

Nvidia leaps past Qualcomm, Broadcom, and AMD.

Driven by unprecedented demand for its H100 processor used for AI and HPC applications, Nvidia more than doubled its revenue in the calendar year2023 and became the world's largest fabless chip developer by revenue last year. The company did much better than the remaining nine companies in the top 10 and was among only four developers that posted revenue increases last year, reports TrendForce.

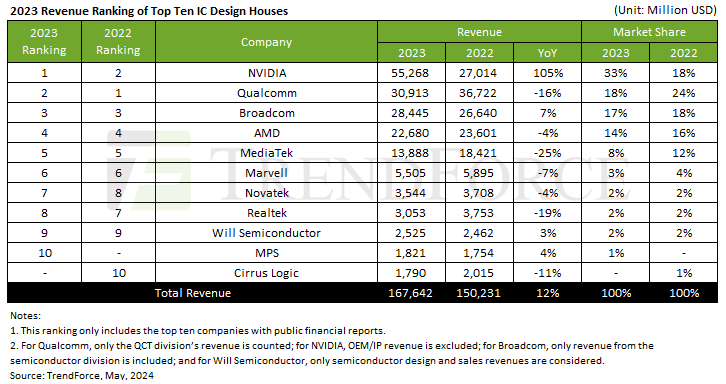

Revenue of the top 10 fabless chip design firms rose to approximately $167.6 billion, a 12% increase from the previous year, largely due to gargantuan contributions from Nvidia, which recorded a stellar 105% growth and earned $55.268 billion and reportedly captured over 80% of the AI accelerator market. TrendForce believes that Nvidia's ongoing dominance is set to strengthen in 2024 as the company is on track to release its Hopper-based H200 GPU and Blackwell-based B100, B200, and GB200 products.

Broadcom also saw positive growth: its 2023 revenue reached $28.445 billion, a 7% increase. This was partially fueled by the AI chip sector, which now accounts for nearly 15% of its semiconductor solutions, according to TrendForce.

Conversely, AMD faced a slight setback, with revenue dropping 4% to $22.68 billion, primarily due to reduced demand in the PC sector. However, growth in its data center and embedded businesses provided some offset, spurred by the company's acquisition of Xilinx.

On the other hand, Qualcomm and MediaTek — two major developers of application processors for smartphones — experienced declines due to a slump in the handset market. Qualcomm's revenue fell by 16% to $30.913 billion, impacted by poor performance in the handheld device and IoT sectors amidst low shipment volumes in China. Similarly, MediaTek saw a 25% reduction in its revenue to $13.888 billion, suffering losses across its smartphone, power management IC, and smart edge divisions.

Looking ahead, the IC design industry is poised for further expansion in 2024, driven by demand for AI processors. The proliferation of AI is anticipated to extend into personal computing devices, such as PCs and smartphones. This shift is expected to fuel continued revenue growth across the sector.

Notably, the rankings among the top ten companies saw some shifts. MPS made its way onto the list with a 4% increase in revenue, reaching $1.821 billion, thanks to its strong performance in automotive and enterprise data sectors. In contrast, Realtek experienced a 19% decline in revenue to $3.053 billion, leading to a drop in its ranking due to faltering PC sales and halted projects in China. However, prospects for recovery are on the horizon for Realtek with the rise of Wi-Fi7 and renewed telecom tenders expected to drive the company's sales.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

helper800 I think it's crazy how even lower on the totem pole middle managers at Nvidia are worth high single or even low double digit millionaires because of stock options.Reply