Nvidia becomes world's 4th most valuable company, surpasses Alphabet and Amazon

AI frenzy lifts market cap of Nvidia, Microsoft, TSMC, others.

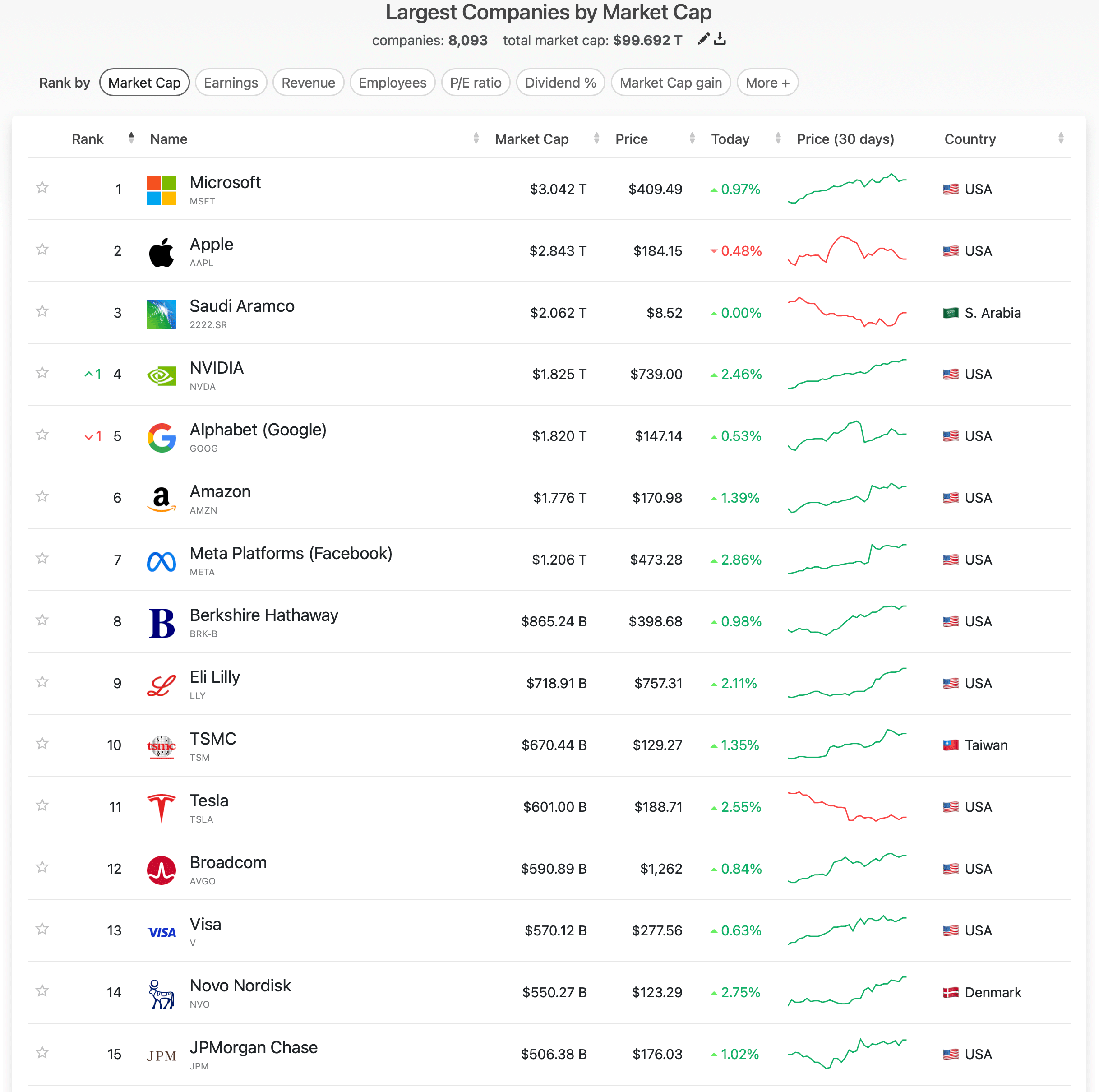

Artificial intelligence (AI) is expected to become a ubiquitous technology in the coming years, which means that demand for hardware needed for AI models training and inference will increase and companies like Nvidia, Microsoft, and TSMC are poised to capitalize on this. As a result, market capitalization of these companies are setting records. This week Nvidia's market cap eclipsed that of Alphabet and Amazon, whereas TSMC became the world's 10th most valuable company.

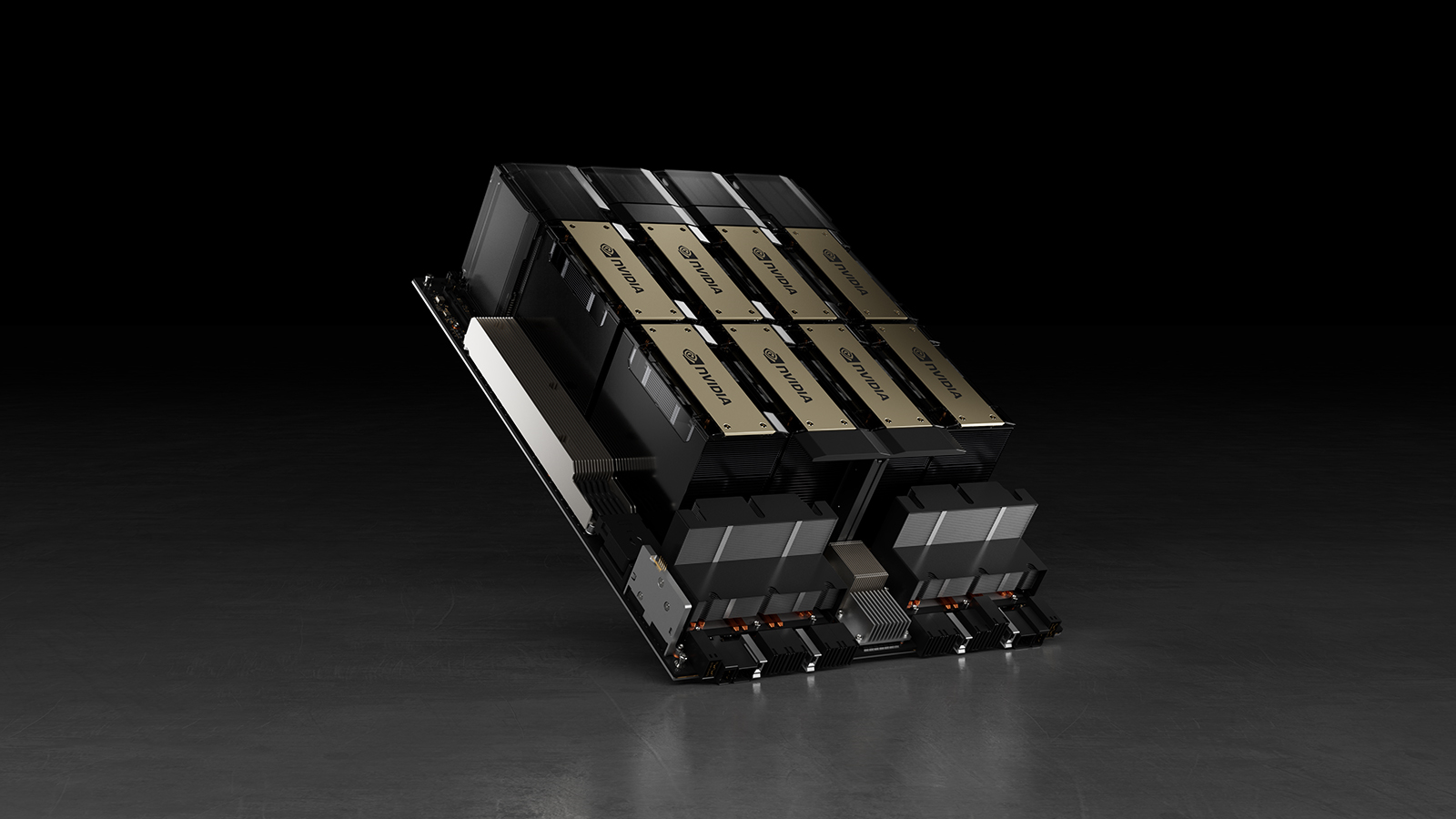

Nvidia's shares soared 2.5% on Wednesday, reaching a valuation of approximately $1.83 trillion, making it the fourth most valuable company globally, reports Bloomberg. This remarkable surge has been fueled by a 49% increase in its stock value (by $602 billion) this year, driven by the high demand for Nvidia's AI GPUs, such as A100 and H100. The appetite for these processors, which are essential for AI datacenters, is insatiable and Nvidia can barely meet it.

With Nvidia's earnings report scheduled for February 21, expectations are high. Nvidia could end 2023 with revenue of over $58 billion, according to estimates by analyst Dan Nysted, which means that the company will outperform both Intel and Samsung and will only be behind TSMC, which earned $69.3 billion in 2023.

Speaking of TSMC, the world's largest contract maker of chips, it became the world's 10th most valuable company this week as the company produces chips for Nvidia, which greatly benefits from AI frenzy, as well as Apple and AMD, which are growing fast.

This week TSMC experienced a significant surge in its market value, gaining tens of billions of dollars and reaching a record market capitalization of $670.44 billion. This growth propelled TSMC to become the world's 10th most valuable company, surpassing Visa, Tesla, and Broadcom, according to CompaniesMarketCap.com.

Demand for more advanced datacenter processors is expected to rise due to shift towards larger AI models. This trend will naturally benefit TSMC's advanced foundry business, as the company is expanding its production capacity to be well-positioned to meet increasing demand for processors like Nvidia's H100 and AMD's Instinct MI300-series.

At the most recent earnings call TSMC executives have expressed optimism about a return to solid growth in the current quarter and have indicated the possibility of ramping up capital spending in 2024, signaling an expected recovery in the demand not only for datacenter products, but also for PCs and smartphones.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

USAFRet Reply

https://companiesmarketcap.com/digitalgriffin said:I wonder where AMD and Intel sit on that list

AMD - #34

Intel - #61