China's chip imports fell by a record 15% due to U.S. sanctions and globally weaker demand

Imports for high-end chips especially seem down.

Chip imports to China have seen a historic drop year-over-year, with the value of imports in 2023 falling by 15.4% according to Bloomberg. Chip sales were down across the board in 2023 thanks to a weakening global economy, but China's chip imports indicate that its economy might be in trouble. The country's inability to import cutting-edge silicon is also certainly a factor in its decreasing chip imports.

In 2022, the value of chip imports to China stood at $413 billion, and in 2023 the country only imported chips worth a total of $349 billion, a 15.4% decrease in value. That a drop happened at all isn't surprising; even TSMC, usually considered to be one of the most advanced fabbing corporation in the world, saw its sales decline by 4.5%. However, a 15.4% decrease in shipments is much more significant, and indicates China has particular issues other than weaker demand across the world.

China's ongoing economic issues, such as its high deflation could play a part. Deflation is when currency increases in value, the polar opposite of inflation, when currency loses value. As inflation has been a significant problem for countries such as the U.S. and UK, deflation might sound much more appealing, but economically it can be problematic. A deflationary economy encourages consumers not to spend, since money is increasing in value, meaning buyers can purchase more if they wait. In other words, deflation decreases demand for products like semiconductors.

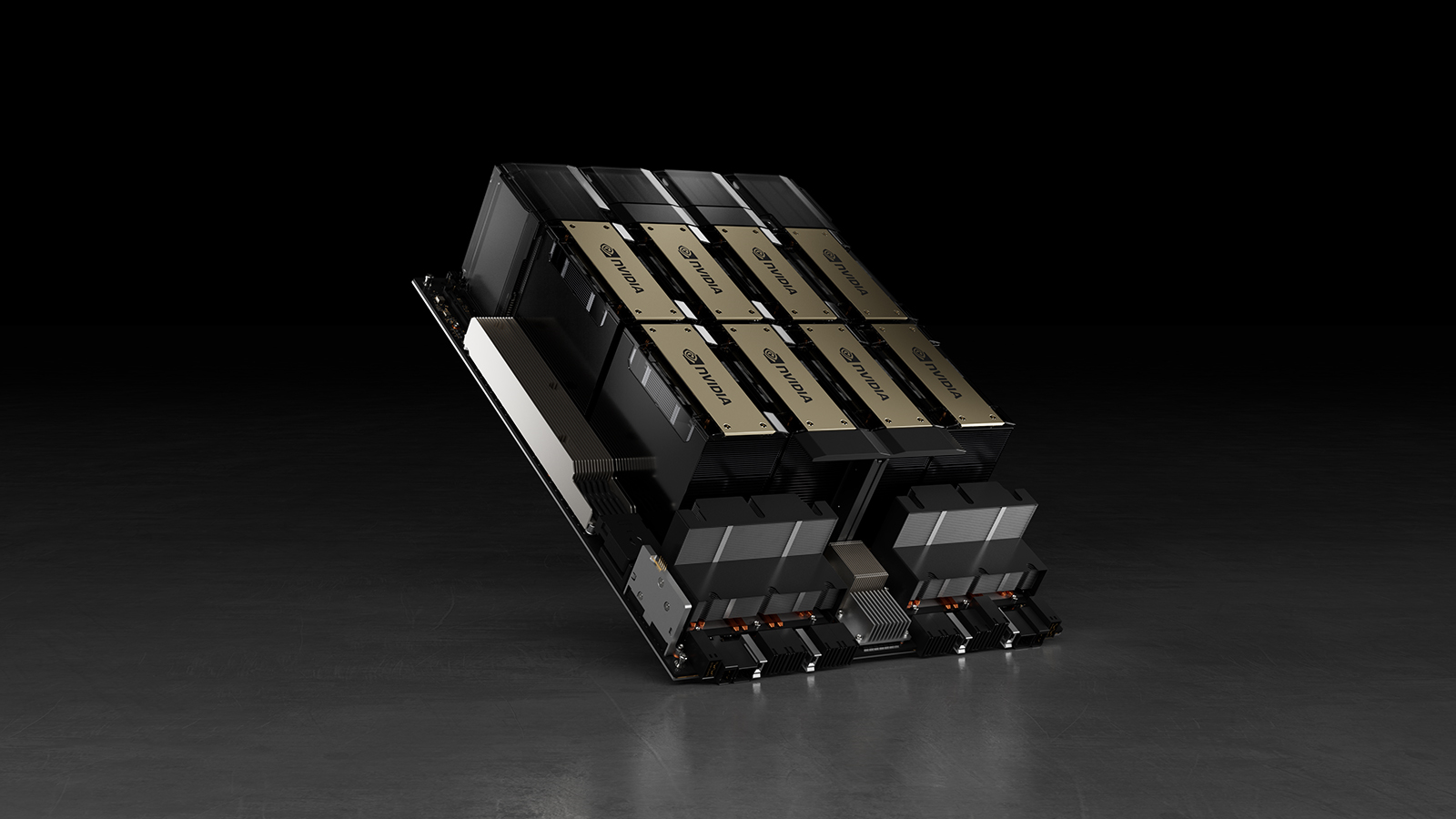

However, shipment volume only decreased by 10.8% compared to the 15.4% decline in value, meaning the chips that China didn't buy in 2023 were particularly valuable. This likely reflects U.S. sanctions on China, which prevents it from buying top-end graphics cards, especially from Nvidia. The H100, H200, GH200, and the RTX 4090 are illegal to ship to China, and they're some of Nvidia's best GPUs.

The moving target for U.S. sanctions could also make exporters and importers more tepid, as it's hard to tell if more sanctions could suddenly upend plans and business deals. The A800 and H800 were made specifically for China to replace the A100 and H100, but were quickly blocked by new sanctions anyways. The U.S. government has signaled it's cooling down on tightening export regulations further, but its mood could always shift back in the other direction.

Of course, China is also moving away from importing processors, and would rather make its own. China is apparently on track to double its chip manufacturing in five years, and its technology is also catching up to its western rivals. The country is seemingly working on a 5nm process technology, can make consumer-level CPUs and GPUs, and even is moving up to processors like datacenter CPUs and AI-powered GPUs. Even without economic issues or sanctions, domestic semiconductor production is bound to decrease imports.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Matthew Connatser is a freelancing writer for Tom's Hardware US. He writes articles about CPUs, GPUs, SSDs, and computers in general.

-

bit_user ReplyThe country is seemingly working on a 5nm process technology, can make consumer-level CPUs and GPUs, and even is moving up to processors like datacenter CPUs and AI-powered GPUs.

IIRC, their domestically-made AI processors are still on a 14 nm-class node, which puts them at a major disadvantage. These chips need to be large, in order to be effective, which should put quite some strain on their multi-patterning-based 5 nm node. As it is, it seems hard enough for them to make phone SoCs on that node. The availability of equipment to refine the node or move beyond it would seem to be quite a hurdle.

So, I wouldn't credit them with sanctions-beating, just yet. We'll have to see how things play out, over the next few years. -

Ravestein NL Reply

And as always (takes some time but still) Chinese chip developers will come with ingenious solutions to make their own CPU's and GPU's much faster on for example 14nm than Intel could ever have done. You are forgetting that people (Chinese) go searching for other solutions if they hit a brick wall. I'm confident that they will find solutions to their problems/needs.bit_user said:IIRC, their domestically-made AI processors are still on a 14 nm-class node, which puts them at a major disadvantage. These chips need to be large, in order to be effective, which should put quite some strain on their multi-patterning-based 5 nm node. As it is, it seems hard enough for them to make phone SoCs on that node. The availability of equipment to refine the node or move beyond it would seem to be quite a hurdle.

So, I wouldn't credit them with sanctions-beating, just yet. We'll have to see how things play out, over the next few years. -

Colin Ionita Reply

Interesting take, would be true if it wasn't just a Chinese engineer shooting them selves in the foot to do get around the problem, which inherently makes an inferior product. Intels 14nm density is still top of the pack, and by a lot, no Chinese CCP magic will change that.Ravestein NL said:And as always (takes some time but still) Chinese chip developers will come with ingenious solutions to make their own CPU's and GPU's much faster on for example 14nm than Intel could ever have done. You are forgetting that people (Chinese) go searching for other solutions if they hit a brick wall. I'm confident that they will find solutions to their problems/needs.