China's chip output expected to double in five years, Barclays says

Barclays says China's semiconductor industry is underestimated.

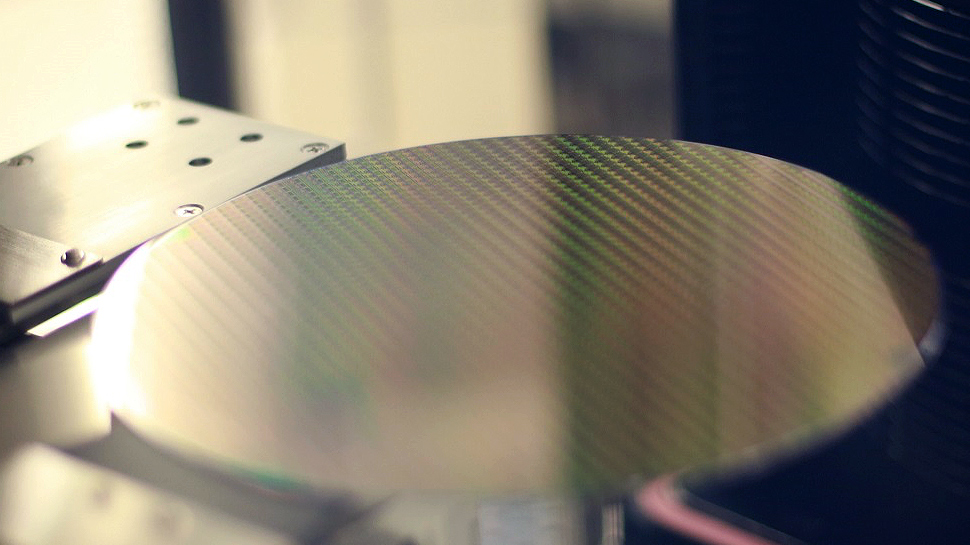

As China is building more new fabs than any other country on the planet, it is on track to significantly boost its chipmaking capabilities in the coming years. Barclays expects the country to more than double its capacity within the next five to seven years, Bloomberg reports. This growth surpasses current market predictions and may be another example how badly China wants to be self-reliant when it comes to chipmaking.

After examining the plans of 48 chipmakers for China, Barclays believes that the People's Republic could expand its chip production capacity by 60% over the next three years. While media reports about expansion plans of companies like SMIC, Hua Hong, and CXMT, the vast majority of new and upcoming capacities tend not to get noticed even by specialized press. As a result, Chinese semiconductor sector is largely underestimated.

"Local players are still underappreciated," analysts Joseph Zhou and Simon Coles wrote in the note published on Thursday and seen by Bloomberg. "There are materially more local semiconductor manufacturers and fabs in China than suggested by mainstream industry sources."

Most of the new production capacity will focus on older process technologies, such as 28nm and above. While these production nodes are not at the forefront of the innovation, they are used for a wide range of applications, from home appliances to automobiles, which is why they remain in high demand and will remain

This upcoming surge in production of chips using legacy processes raises concerns about potential market oversupply. The analysts from Barclays believe this could become a significant issue for existing chipmakers, but not until at least 2026 when the new fabs come online and prove that they can produce quality chips.

Additionally, the U.S. Commerce Department is keeping a close watch on China's semiconductor ambitions, particularly in the legacy technology sector. There is a possibility that the U.S. might implement tariffs or other trade measures in response to China's increasing prominence in the semiconductor industry.

It is noteworthy that this expansion comes at a time when China faces increased high-tech export restrictions from the U.S. and its allies. In an effort to combat these limitations and move towards self-sufficiency in technology, Chinese companies have accelerated their acquisition of crucial chipmaking equipment in 2023 and become the largest purchasers of wafer fab equipment. This rush for equipment is reflected in record orders received by such companies as ASML and Tokyo Electron.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.