SoftBank to acquire Arm CPUs for datacenter firm Ampere in $6.5 billion cash deal

Ampere's roadmap includes the launch of 3nm processors with 256-cores later this year.

SoftBank Group today said it would acquire Ampere Computing, a developer of Arm-based datacenter CPUs, for $6.5 billion in cash. Ampere will continue operating under its current name as a wholly owned subsidiary with 1,400 employees and will continue to offer its processors. SoftBank, which also controls Arm Holdings, is expected to use Ampere CPUs for its own datacenters, including proposed Stargate datacenters.

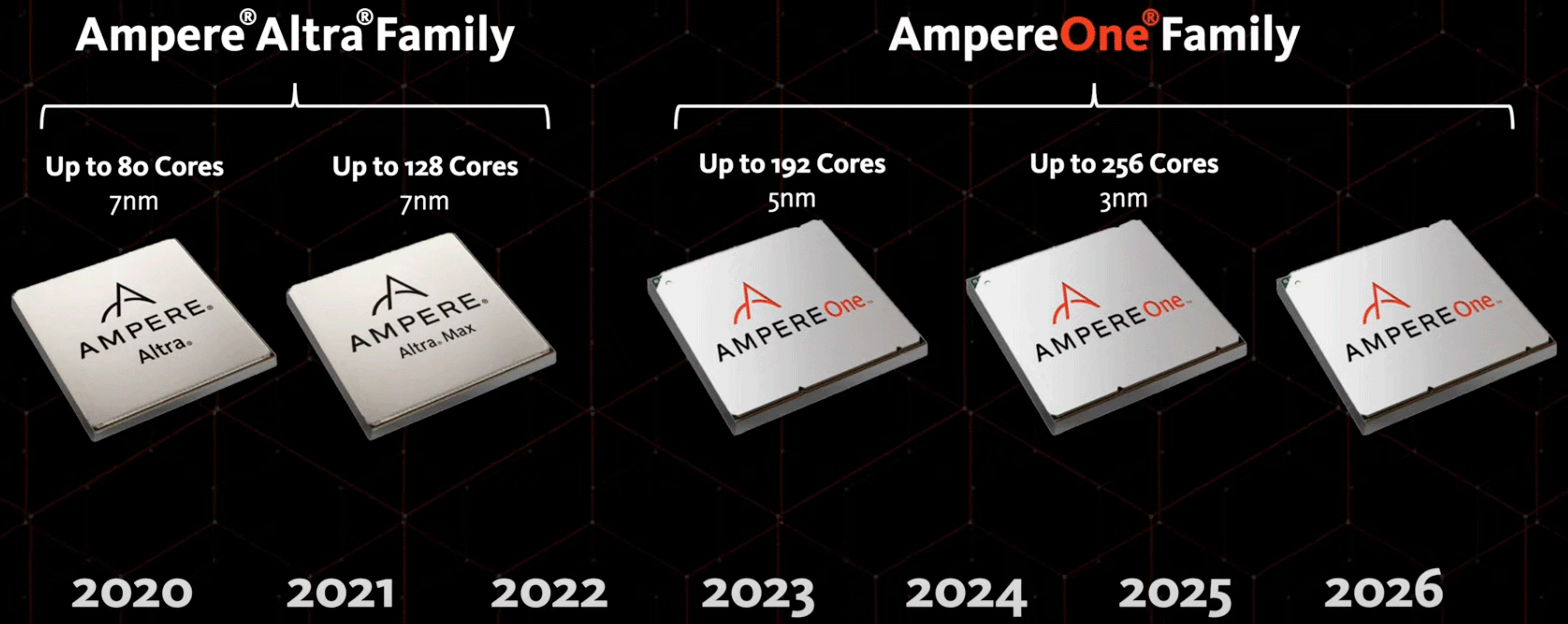

Ampere was established in 2018 in Silicon Valley with the backing from Carlyle Group and Oracle with an aim to develop CPUs tailored for the needs of cloud service providers (CSPs), which the company calls 'cloud-native' processors. Since then, the company released two product families — the Ampere Altra with up to 128 cores made on TSMC's N7 node and the AmpereOne with up to 192 cores made on TSMC's N5 manufacturing technology — that gained limited traction in the CSP.

The company's roadmap includes launch of AmpereOne CPUs with up to 256 cores produced on TSMC's N3 fabrication process in 2025 and then moves to something more advanced in 2026. With Arm's plans to offer its own datacenter-grade processors targeting hyperscalers and CSPs, Ampere's chances to gain a significant market share got substantially lower. Also, Ampere Computing has to compete with Intel's Xeon CPUs — such as Sierra Forest with up to 144 cores and its successor Clearwater Forest in 2026 — and this is something particularly hard given the ample ecosystem available for x86 CPUs.

However, as a statement from Ampere reads, the company "is expected to play a key role in future Softbank growth markets, including recently announced AI infrastructure investments like Stargate." SoftBank's AI strategy involves building massive cloud datacenters. Next-generation cloud datacenters for AI are expected to house tens or hundreds of thousands of nodes, which will represent a huge market. If Ampere supplies millions of CPUs to its owner, then its business will expand beyond where it is now. Also, if other Stargate partners — OpenAI and Oracle — adopt Ampere's CPUs as a default choice for their datacenters, this could be a breakthrough for the company. This may never happen, though.

"The future of Artificial Super Intelligence requires breakthrough computing power," said Masayoshi Son, Chairman and CEO of SoftBank Group Corp. "Ampere's expertise in semiconductors and high-performance computing will help accelerate this vision, and deepens our commitment to AI innovation in the United States."

As part of the agreement, SoftBank will purchase Ampere for $6.5 billion in cash. Ampere’s major investors — Carlyle and Oracle — are divesting their stakes in the company. The deal is contingent on standard closing requirements, including regulatory approvals, and is anticipated to be finalized in the latter half of 2025.

"With a shared vision for advancing AI, we are excited to join SoftBank Group and partner with its portfolio of leading technology companies," said Renée J. James, Founder and CEO of Ampere. "This is a fantastic outcome for our team, and we are excited to drive forward our AmpereOne roadmap for high performance Arm processors and AI."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

bit_user I'd guess the 256-core N3 CPU is cancelled, then. Only if they have big contracts lined up for it, would I expect to see it go ahead.Reply

The more interesting news is what this means for Arm. I guess we've already heard rumors of their intentions to enter the CPU market (i.e. selling not just IP, but physical CPUs), which this is aligned with. Ampere has the expertise with manufacturing and reference boards, plus relationships with systems companies like Gigabyte and Supermicro. I wouldn't guess that's worth $6.5B, but I guess time-to-market is worth something. -

Findecanor ARM being a chip vendor (again) would be bad for the ARM ecosystem.Reply

You can't both have partners and compete with them in the same space. That would be an unhealthy relationship that they would want to get out of.

It would be pushing them to adopting RISC-V, when what ARM should want is to keep them close. -

thestryker I'm really curious what this will end up meaning for both Ampere and Arm's design teams. Arm's licensing model makes things really murky since I can't imagine a lot of companies like the idea of Arm directly competing using the same designs they're licensing. At the same time there likely isn't a ton of overlap between socketed designs and the custom silicon hyperscalers have been using Neoverse cores for.Reply

It was seemingly inevitable that Ampere would be acquired, but this certainly wasn't the obvious company to be doing so.