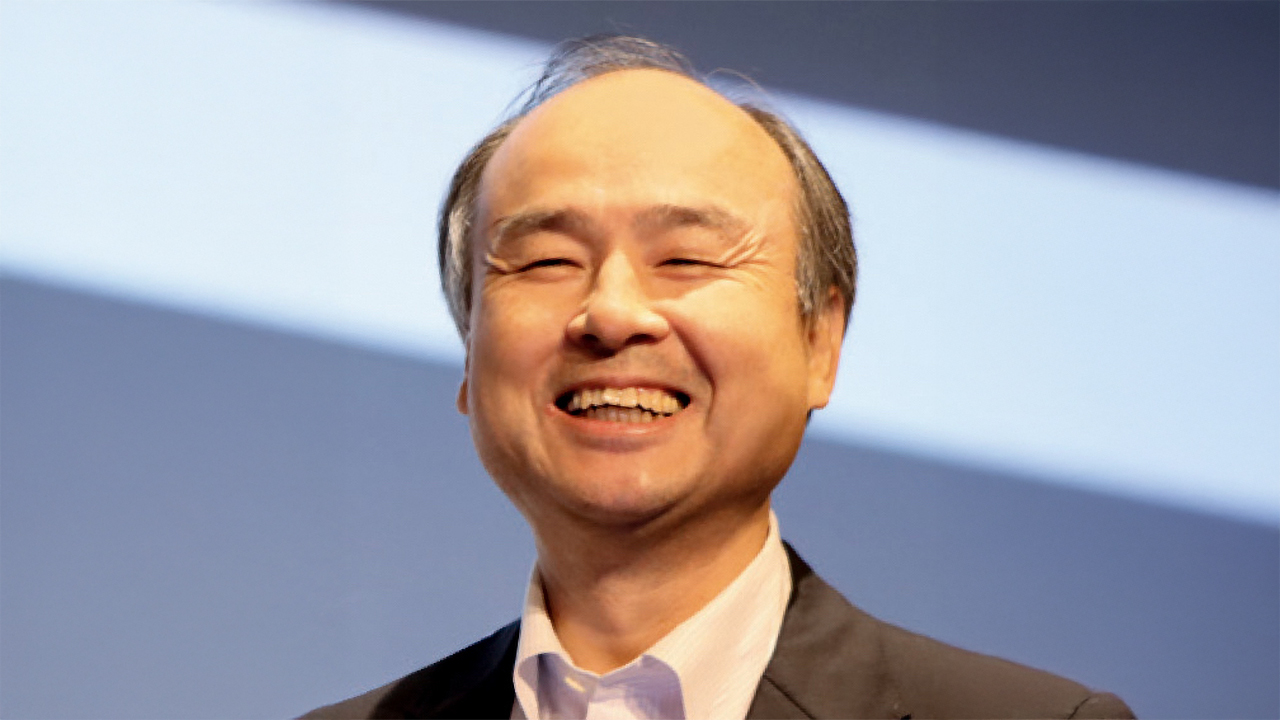

Trump and TSMC pitched $1 trillion AI complex — SoftBank founder Masayoshi Son wants to turn Arizona into the next Shenzhen

A lot of money for a lot of projects.

Masayoshi Son, founder of SoftBank Group, is working on plans to develop a giant AI and manufacturing industrial hub in Arizona, potentially costing up to $1 trillion if it reaches full scale, reports Bloomberg. The concept of what is internally called Project Crystal Land involves creating a complex for building artificial intelligence systems and robotics. Son has talked to TSMC, Samsung, and the Trump administration about the project.

Masayoshi Son's Project Crystal Land aims to replicate the scale and integration of China’s Shenzhen by establishing a high-tech hub focused on manufacturing AI-powered industrial robots and advancing artificial intelligence technologies. The site would host factories operated by SoftBank-backed startups specializing in automation and robotics, Vision Fund portfolio companies (such as Agile Robots SE), and potentially involve major tech partners like TSMC and Samsung. If fully realized, the project could cost up to $1 trillion and is intended to position the U.S. as a leading center for AI and high-tech manufacturing.

SoftBank is looking to include TSMC in the initiative, given its role in fabricating Nvidia's AI processors. However, a Bloomberg source familiar with TSMC's internal thinking indicated that the company's current plan to invest $165 billion in total in its U.S. projects has no relation to SoftBank's projects. Samsung Electronics has also been approached about participating, the report says.

Talks have been held with government officials to explore tax incentives for companies investing in the manufacturing hub. This includes communication with Commerce Secretary Howard Lutnick, according to Bloomberg. SoftBank is reportedly seeking support at both the federal and state levels, which could be crucial to the success of the project.

The development is still in the early stages, and feasibility will depend on private sector interest and political support, sources familiar with SoftBank's plans told Bloomberg.

To finance its Project Crystal Land, SoftBank is considering project-based financing structures typically used in large infrastructure developments like pipelines. This approach would enable fundraising on a per-project basis and reduce the amount of upfront capital required from SoftBank itself. A similar model is being explored for the Stargate AI data center initiative, which SoftBank is jointly pursuing with OpenAI, Oracle, and Abu Dhabi's MGX.

Melissa Otto of Visible Alpha suggested in a Bloomberg interview that rather than spending heavily, Son might more efficiently support his AI project by fostering partnerships between manufacturers, AI engineers, and specialists in fields like medicine and robotics, and by backing smaller startups. However, she notes that investing in data centers could also reduce AI development costs and drive wider adoption, which would be good for the long term for AI in general and Crystal Land specifically. Nonetheless, it is still too early to judge the outcome.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The rumor about the Crystal Land project has emerged as SoftBank is expanding its investments in AI on an already large scale. The company is preparing a $30 billion investment in OpenAI and a $6.5 billion acquisition of Ampere Computing, a cloud-native CPU company. While these initiatives are actively developing, the pace of fundraising for the Stargate infrastructure has been slower than initially expected.

SoftBank’s liquidity at the end of March stood at approximately ¥3.4 trillion ($23 billion). To increase available funds, the company recently sold about a quarter of its T-Mobile U.S. stake, raising $4.8 billion. It also holds ¥25.7 trillion ($176.46 billion) in net assets, the largest portion of which is in chip designer Arm Holdings. Such vast resources provide SoftBank with room to secure additional financing if necessary, Bloomberg notes

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

spongiemaster I don't understand why anyone would want to set up shop in Phoenix. Hit 117 yesterday. 15th day in row hitting 100, and we're only in June.Reply -

Sippincider Reply

Critical issues esp. at the proposed scale.hotaru251 said:potential issues:

water& power -

SonoraTechnical We weren't much cooler in Green Valley, AZ... 114degF (45.5degC) yesterday. measured at my home.Reply

There is also the issue of AI, Oracle and Softbank having trouble actually raising $500 Billion. I mean that amount of money is a significant portion of the GDP of countries like Spain, Mexico, South Korea, Brazil, Australia, and Canada (all below $1 Trillion).

Let that level of investment in AI by this consortium sink in for a minute. Located here in the USA and it's approx a 1/4 of either the Canadian or Mexican GDP.

Just imagine if that amount of money were applied elsewhere.

<edited becuase the original post had some misinformation regarding GDPs... always check... AI generated material is garbage... dig deeper for correct information.> -

SkyBill40 Reply

As an AZ resident and native of the state, I can certainly attest to both. We have no sustainable water supply and the Colorado River Compact has been revised so that all of the states need to make cuts for prolonged sustainability (and to help refill Lake Mead). Given those circumstances, I don't see how this works. As for the power element, yes, we do have the nation's largest nuclear power plant in terms of power generation, but even that has most of the juice it generates going to California.hotaru251 said:potential issues:

water& power.

This isn't going to work. Even TSMC's massive plant is a huge boat anchor on the aforementioned. -

bit_user Reply

Also, I'm assuming it uses a steam turbine, for electricity generation? In that case, it's just another big water consumer and scaling it up would likewise be problematic.SkyBill40 said:As an AZ resident and native of the state, I can certainly attest to both. We have no sustainable water supply and the Colorado River Compact has been revised so that all of the states need to make cuts for prolonged sustainability (and to help refill Lake Mead). Given those circumstances, I don't see how this works. As for the power element, yes, we do have the nation's largest nuclear power plant in terms of power generation, but even that has most of the juice it generates going to California. -

SomeoneElse23 They must know something we don't about power and water.Reply

Or they don't care about the effect it'll have on the AZ water supply for residents. -

usertests Reply

TSMC has reused their fab water in Taiwan due to water concerns there. Presumably they could do even more to reuse water if it's a real issue.ezst036 said:Where will they get water?

The article is talking about robotics manufacturing. It's unclear how much of that $1 trillion would be going to more fabs. Fabs aren't the only thing that use water, but other manufacturing processes could also use recycled water. -

bit_user Reply

Fabs are energy-intensive, which means more power-generation would likely be needed. Unless they plan a lot of wind & solar + storage, that will also be a big consumer of water.usertests said:TSMC has reused their fab water in Taiwan due to water concerns there. Presumably they could do even more to reuse water if it's a real issue.