Softbank reportedly considered buying Intel's foundry division outright before investing $2 billion into the company as equity

Softbank already owns ARM.

SoftBank today announced its intent to purchase a historic $2 billion worth of Intel shares—a roughly 2% stake—making it one of the largest shareholders of the American chipmaker. However, the Financial Times reports that just days before the deal was inked, Softbank actually considered buying Intel's foundry division outright.

This follows another unprecedented report that the White House is considering a 10% stake in Intel, utilizing grants from the CHIPS Act and converting them into equity.

Intel received that CHIPS Act money on the promise of never spinning off the fabs the funds directly impacted, as they serve an important geopolitical role in the race for bleeding-edge semiconductors. Intel is one of the last companies in the cutting-edge process race with TSMC, whose roots in Taiwan have provoked long-simmering concerns about its vulnerability and the stability of leading-edge semiconductor supply in the event that China should invade the island in pursuit of reunification.

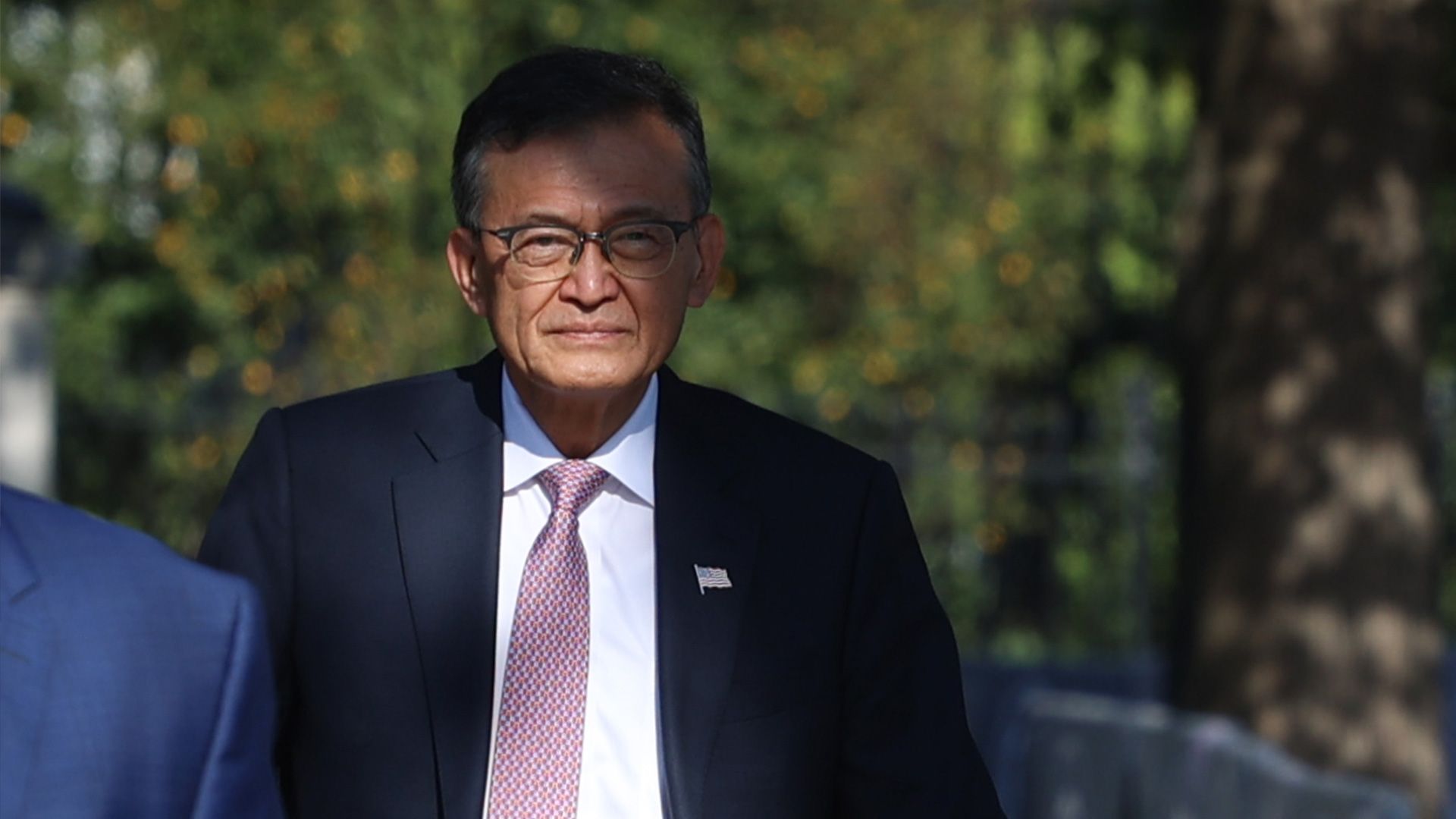

Intel has been struggling for years, and the current CEO, Lip-Bu Tan, was installed earlier this year to turn the company's fortunes around. Quickly, Tan shifted Intel's focus to save costs and stick to its core business. Despite efforts to bolster homegrown chipmaking, Tan has faced intense scrutiny, mostly due to his former ties with China, which even led to calls for his resignation by President Trump.

Of course, the relationship between Trump and Tan has done a 180 following a meeting in which the President was apparently won over by Tan's "amazing story."

SoftBank is a Japanese financial institution that owns a majority stake in semiconductor IP developer Arm and already has close ties with the Trump administration thanks to the Stargate project. For those out of the loop, that's a $500 billion promise to build AI infrastructure in the U.S. that would purportedly create 100,000 jobs, bolster American chipmaking, and make the country the clear leader in bleeding-edge AI applications.

SoftBank already owns 40% of that project and is now set to own 2% of Intel, marking a significant investment in the promise of a turnaround for the beleaguered company and its geopolitical importance in keeping bleeding-edge semiconductors local to America.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Lip-Bu Tan also served as a board member for SoftBank till 2022, and left amidst the company's own set of challenges following a few miscalculated investments.

Years later, Son is now investing in Intel. "Masa and I have worked closely together for decades, and I appreciate the confidence he has placed in Intel with this investment," said Tan. This endeavor aligns with SoftBank's broader strategies geared toward expanding its presence in the AI market and gaining a foothold in emerging technologies.

Previously, SoftBank invested heavily in Nvidia, owning about 4.9% of the company, but it sold those shares in 2019 when Nvidia's share price was in a downturn. After losing out on billions in gains in recent years when Nvidia began its meteoric rise, Softbank increased its investment in Nvidia to $3 billion at the beginning of 2025.

As part of its Project Izanagi initiative, Softbank reportedly explored fabricating an AI accelerator of its own with Intel in 2024, but due to a lack of confidence in Intel meeting its performance and volume projections, Softbank pivoted to TSMC for its foundry needs. SoftBank also acquired Graphcore for its AI accelerator IP as part of its larger strategy.

Right now, Intel's foundry business is struggling as its next-gen 18A and 14A process nodes are on the chopping block (the former for external customers) if it can't secure enough customer commitments. Intel has, however, reiterated that it is its own biggest customer and that the company is committed to chip manufacturing.

SoftBank's $2 billion stake in Intel demonstrates a great deal of trust in Tan's leadership, but Son's history of questionable investment choices means a resurgent Intel is far from a sure thing. Intel has also lost out to Nvidia in the AI race and continues to lose ground in both the consumer x86 and server markets to AMD. Whether Trump's and Son's interventions in the fate of the company are enough to save it remains to be seen.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Hassam Nasir is a die-hard hardware enthusiast with years of experience as a tech editor and writer, focusing on detailed CPU comparisons and general hardware news. When he’s not working, you’ll find him bending tubes for his ever-evolving custom water-loop gaming rig or benchmarking the latest CPUs and GPUs just for fun.

-

bit_user A Japanese firm (Nippon Steel) recently bought US Steel. I wonder if this deal would've been structured similarly.Reply

https://en.wikipedia.org/wiki/U.S._Steel#Finalized_deal,_golden_share

FWIW, I hope it wouldn't have been approved. Among other issues, Softbank's large stake in ARM poses conflicts of interest. I'd also be curious whether they have any stake in Rapidus. -

bit_user Reply

Really? Got a source on that? I'm very skeptical about that, unless it's a gross simplification of what was actually agreed.The article said:Intel received that CHIPS Act money on the promise of never spinning off the fabs the funds directly impacted

"bleeding edge" is not a synonym for "leading edge", that you can't simply drop into your articles to make them sound more punchy. Please stop that.The article said:marking a significant investment in the promise of a turnaround for the beleaguered company and its geopolitical importance in keeping bleeding-edge semiconductors local to America. -

Alex/AT Reply

There is no conflict of interest. More like a monopoly interest. x86-64 is no threat to ARM on embedded devices and specialized CPU IP blocks market, while ARM is no threat to unified x86-64 on the power computing market (desktop and servers).bit_user said:Softbank's large stake in ARM poses conflicts of interest. -

bit_user Reply

Amazon, Microsoft, and Google all now have their own ARM-based server CPUs. Not to mention Nvidia's Grace, which powers their high-end servers.Alex/AT said:ARM is no threat to unified x86-64 on the power computing market (desktop and servers).

The writing is on the wall.

Source: https://tspasemiconductor.substack.com/p/shifting-market-dynamics-the-rise

The main headwind facing ARM is probably China's reluctance to switch from one Western ISA to another. China would clearly rather move to Loongarch or RISC-V, where it can be much more self-reliant. -

TerryLaze Reply

Dude, are you even serious right now?!bit_user said:Amazon, Microsoft, and Google all now have their own ARM-based server CPUs. Not to mention Nvidia's Grace, which powers their high-end servers.

The writing is on the wall.

Source: https://tspasemiconductor.substack.com/p/shifting-market-dynamics-the-rise

The main headwind facing ARM is probably China's reluctance to switch from one Western ISA to another. China would clearly rather move to Loongarch or RISC-V, where it can be much more self-reliant.

You (they) show a real 1-2% drop from 2023 to 2024

assume a 5% from 2023 to 2025

and that in your/their mind then escalates into this graph....

The writing that is on the wall is 5% drop in the last 2 years, maybe since there is still almost half a year to go.

The other stuff is writing inside you mind, it might happen but it might also not be anywhere near to close. -

abufrejoval Sure, Softbank would have bought the fabs, but not for the price Intel shareholders might be dreaming of.Reply

And then they'd pull a Broadcom on it and let the rest become a patent troll: might still happen, they only need to wait... -

abufrejoval Reply

I don't see how there would be a conflict of interest for the foundry part: no x86 license included.bit_user said:Among other issues, Softbank's large stake in ARM poses conflicts of interest. I'd also be curious whether they have any stake in Rapidus. -

bit_user Reply

First of all, Softbank could give priority access or sweatheart deals to ARM licensees, advantaging them over chips incorporating IP from ARM's competitors.abufrejoval said:I don't see how there would be a conflict of interest for the foundry part: no x86 license included.

Second, ARM is getting into the hardware business, even potentially competing with its own licensees. Softbank could also give ARM similar advantaged access to IFS, perhaps even over and above ARM licensees.

Finally, there's the thing people were worried about with Intel retaining ownership of their foundry, which is leakage of competitive info to the design side of the house. If Softbank owned IFS, that conflict of interests would exist between IFS and ARM. -

93QSD5 Reply

Nonsense.bit_user said:Amazon, Microsoft, and Google all now have their own ARM-based server CPUs. Not to mention Nvidia's Grace, which powers their high-end servers.

The writing is on the wall.

Source: https://tspasemiconductor.substack.com/p/shifting-market-dynamics-the-rise

The main headwind facing ARM is probably China's reluctance to switch from one Western ISA to another. China would clearly rather move to Loongarch or RISC-V, where it can be much more self-reliant.

ARM is everything that's wrong with modern hardware and software engineering.

Let's create this reduced instruction set and get all the benefits.....and emulate x86_64 general programs onto it.

Does it work and depending on the application even similar performance? Yes.

You know what's even better? Sticking to writing ARM software for ARM chips making use of the underlying arm instruction set. -

Thunder64 ReplyTerryLaze said:Dude, are you even serious right now?!

You (they) show a real 1-2% drop from 2023 to 2024

assume a 5% from 2023 to 2025

and that in your/their mind then escalates into this graph....

The writing that is on the wall is 5% drop in the last 2 years, maybe since there is still almost half a year to go.

The other stuff is writing inside you mind, it might happen but it might also not be anywhere near to close.

Yea, this reminds me of those constantly shifting Itanium market share graphs from decades ago.