AMD Posts Highest Net Income In Seven Years, Fights Off Crypto Decline

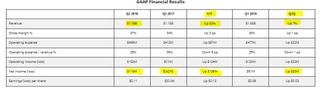

AMD has fended off the decline of the cryptocurrency market as the company announced its highest quarterly net income in seven years, which also marks its seventh straight quarter of double-digit revenue growth. The company's revenue weighed in at $1.76 billion, an increase of 53% year-over-year (YoY) and seven percent over the prior quarter. More importantly, AMD's net income rose by $35 million to $166 million in Q2, reversing the $42 million in losses the prior year.

AMD CEO Lisa Su stated at Computex 2018 that the company had sold a total of five million Ryzen processors since they were released, which is a seemingly minor amount compared to the ~150 million PCs sold per year. Nevertheless, AMD's income from Ryzen processors jumped 64% year-over-year, which isn't surprising given that Ryzen processors currently hold four of the top five spots on Amazon's CPU best sellers list. Ryzen processor sales only increased slightly over last quarters' 60% of AMD's CPU sales, but AMD forecasts that number to grow as more customers upgrade from older processors over the coming months.

AMD lumps its sales of CPUs and GPUs together into its Computing and Graphics segment, which jumped a whopping 64% year over year but reflected a loss of 3% compared to the prior quarter. Su attributed the lower revenue to the reduced average selling price of its flagship Ryzen 2000-series desktop CPUs, which debuted at much lower prices than the first-gen Ryzen models, and increased sales of less-expensive Raven Ridge APUs. That has contributed to a lower average selling price (ASP), which impacts revenue. Threadripper 2 will arrive to the market in the coming months, and the higher-priced models should help improve the company's declining ASPs.

Investors and analysts had punished AMD's stock over the preceding months with fears of a sales downturn due to the crash of cryptocurrency market, which is a big sales driver for AMD's GPUs. AMD did report lower GPU sales on the quarter, but they were offset by burgeoning sales of data center GPUs and the increased CPU sales. AMD CEO Lisa Su reported that quarterly income from GPU sales to crypto/blockchain had dropped from 10% of revenue the prior quarter to six percent, but AMD forecasts revenue of to $1.7 billion (+/- $50 million) in the next quarter amid even lower blockchain-derived revenue forecasts.

AMD is already shipping 7nm Radeon Instinct Vega GPUs to its partners and expects an official launch this year, which should boost graphics sales. AMD's 7nm GPUs are designed for artificial intelligence and machine learning workloads. Nvidia's biggest advantage in the data center stems from its ubiquitous CUDA software, so AMD is focusing on large hyperscale data centers that can adapt to new types of software faster than traditional enterprise customers. AMD hasn't set a time frame for 7nm GPUs for the desktop, but logic dictates they will come to market next year.

AMD's relatively low penetration in the laptop market has also been a concern for investors, but the company announced that doubled sales of its Ryzen Mobile processors were a significant contributor to the increased revenue. AMD also recently launched its Ryzen Pro commercial processors and HP, Lenovo and Dell all have laptops with the processors in their portfolio. That marks the first time in the company's history that all three OEMs are shipping laptops with AMD's commercial processors.

AMD's semi-custom business, which includes processors for Microsoft and Sony's game consoles and data center CPUs, is also moving along at a nice clip. Semi-custom revenue weighed in at $670 million, which is up 37% on the year and 26% on the quarter. The company's EPYC processors represent the biggest long-term cash generator, but ramp has been hampered by the long qualification cycles at AMD's major data center/hyperscale customers. AMD expects sales to ramp in the second half of this year. Lisa Su also revealed that the second-gen 7nm EPYC processors are being fabbed at TSMC, which should soothe any fears about Global Foundries' limited silicon output capacity. Su expects the 7nm EPYC Rome processors to ramp faster than the first-gen models.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

AMD's prospects are bright as it moves into next year with 7nm EPYC Rome processors and GPUs. Meanwhile, Intel has struggled to bring up the 10nm node, and a recently leaked roadmap indicates the first data center 10nm CPUs won't arrive until 2020. That gives AMD a big window to leverage its process superiority, a first, and gain market share. AMD also continues to work with its partners in its China JV to expand into that exploding market, and recent AMD job postings indicate the company will likely start a joint GPU production agreement in the country, as well.

Su stated that the company continues to invest more in R&D, with current investments up 25% on the year, so its advantage could widen further. Su also stated that "We have seen the first view of 5-nanometer, and we think 5-nanometer is very competitive as well," so it's clear the company is already looking beyond its next-gen products.

Paul Alcorn is the Managing Editor: News and Emerging Tech for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

baobaopv91 It's so good to see AMD raise. I'm looking forward for 5nm Zen processor to upgrade my R5 1600Reply -

JamesSneed Glad AMD is going to be around for the long game. Had some worries on the time between Ryzen and when they would have Zen 2 on 7nm. Looks like they are doing just fine. When they do get Zen 2 out it will be a game changer for them. It not only should make them much more competitive in the desktop market, it will be a huge boon on power per watt in the server market.Reply

So glad there is competition in the CPU market. I mean we have 8-cores from AMD in the desktop space and soon to release 8-cores from Intel in the desktop non-hedt space. All over the course of a year or so we went from 4 to 8 cores. -

gggplaya Reply

5nm will probably require a new socket/motherboard. But 7nm is coming next and is a worthy upgrade to first gen Ryzen. It'll have higher clock speeds.21176453 said:It's so good to see AMD raise. I'm looking forward for 5nm Zen processor to upgrade my R5 1600

-

kalmquist So Zen 2 chips are going to be manufactured at both TSMC and Global Foundries? As I understand it, the Wafer Supply Agreement means that AMD has to manufacture Zen 2 at Global Foundries or face a large financial penalty. Producing the same design at two different companies is expensive because process differences mean that moving a design from one company to another requires (at a minimum) a complete retesting of the chip. But it will be worth it to AMD if the demand for Zen 2 ends up exceeding Global Foundries' manufacturing capacity.Reply -

John Nemesh Meanwhile, at Intel:Reply

https://www.nag.co.za/wp-content/uploads/2018/01/this_is_fine_meme.jpg -

JamesSneed Reply21177069 said:So Zen 2 chips are going to be manufactured at both TSMC and Global Foundries? As I understand it, the Wafer Supply Agreement means that AMD has to manufacture Zen 2 at Global Foundries or face a large financial penalty. Producing the same design at two different companies is expensive because process differences mean that moving a design from one company to another requires (at a minimum) a complete retesting of the chip. But it will be worth it to AMD if the demand for Zen 2 ends up exceeding Global Foundries' manufacturing capacity.

Seems to be the case. Ryzen will be Gloflo and EPYC will be TSMC I assume Threadripper will also be TSMC. This was a good choice as the server chips don't need to hit super high clocks and TSMC is great at dealing with large chips plus the extra chip making capacity will be a boon for AMD. Ryzen though will need high boost clocks to compete with Intel and GloFlos 7nm was built with very high clocks in mind so it should serv Ryzen very well. Lisa Su is making every right choice these days. -

alextheblue Reply

The agreement requires them to buy a certain amount of wafers, IIRC. So if they're still producing some products on GloFo and hitting those numbers, they're in the clear.21177069 said:So Zen 2 chips are going to be manufactured at both TSMC and Global Foundries? As I understand it, the Wafer Supply Agreement means that AMD has to manufacture Zen 2 at Global Foundries or face a large financial penalty.

Most Popular