Apple Announces Plan for What It Will Do With $100 Billion

Company will start distributing dividends and buying back shares in the second half of this year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Apple late yesterday evening announced a 9 a.m. conference call to discuss what it plans to do with its massive cash balance. However, it seems the company just couldn't wait to reveal its plans, as a press release was published this morning detailing the company's intent to launch and dividends and share repurchasing program this summer.

Apple said that it will initiate a quarterly dividend of $2.65 per share in Q4 FY2012, which begins on July 1, 2012. When FY 2013 begins in September, Apple will begin a $10 billion repurchasing program that is to be executed over three years. Apple says the program's goal is to neutralize the impact of dilution from future employee equity grants and employee stock purchase programs.

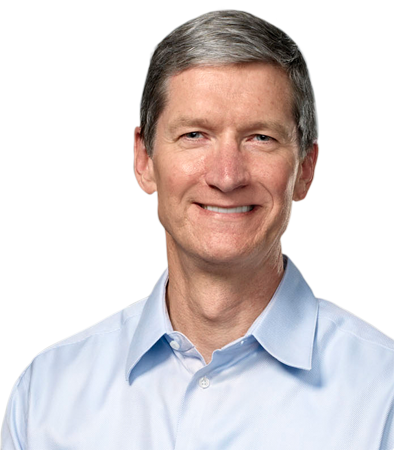

"We have used some of our cash to make great investments in our business through increased research and development, acquisitions, new retail store openings, strategic prepayments and capital expenditures in our supply chain, and building out our infrastructure. You’ll see more of all of these in the future," said Tim Cook, Apple’s CEO. “Even with these investments, we can maintain a war chest for strategic opportunities and have plenty of cash to run our business. So we are going to initiate a dividend and share repurchase program."

This is an announcement that Apple shareholders have been waiting a long time to hear. It might not be quite as exciting as a fistful of juicy acquisitions, but it's still an interesting move from the Apple camp. Apple CFO Peter Oppenheimer said the Cupertino-based company plans to spend $45 billion of domestic cash in the first three years of the programs. "We are extremely confident in our future and see tremendous opportunities ahead," he said.

Follow @JaneMcEntegart on Twitter.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Jane McEntegart is a writer, editor, and marketing communications professional with 17 years of experience in the technology industry. She has written about a wide range of technology topics, including smartphones, tablets, and game consoles. Her articles have been published in Tom's Guide, Tom's Hardware, MobileSyrup, and Edge Up.

-

s3anister kodekovNo buying Fox-Conn?No Philanthropy?Same old Apple..Reply

Or they could create manufacturing facilities in the U.S. Yet they still choose maximum profit margins instead of creating jobs for a country that needs it... -

house70 Marco925$2,65/share? geez, apple cheap much?LOL, looks like Tim Cook is keeping most of it for his bonus. Just look at that smile.Reply

kodekov...No Philanthropy?..Nope. It doesn't pay dividends, so......no. -

spookyman alxianthelastFoxconn employees continue to weep.Reply

Now now...

Apple is providing a 10 year old with a job with a job and pays him a salary of $2 a week.

-

keczapifrytki Yeah, how about you give some of that 100 billion to at the very least improve Fox-Conn working conditions, or give those people meaningful bonuses?Reply