AMD Reports 23% Revenue Growth and Strong 2019 Outlook, Stock Jumps

AMD appears to have largely sidestepped the pitfalls that its larger competitors, namely Intel and Nvidia, have suffered at the hands of the slowing China economy and the trade war.

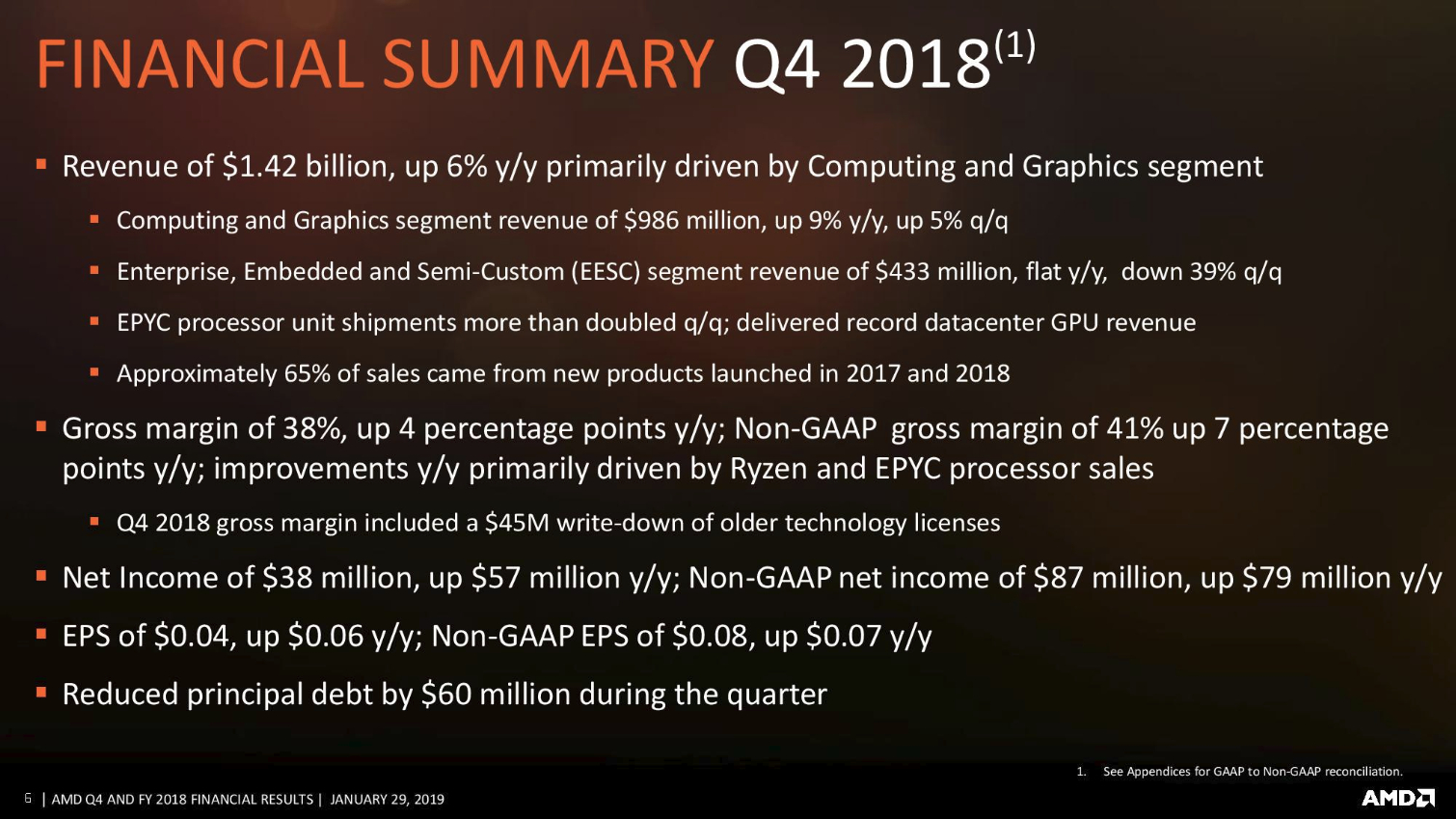

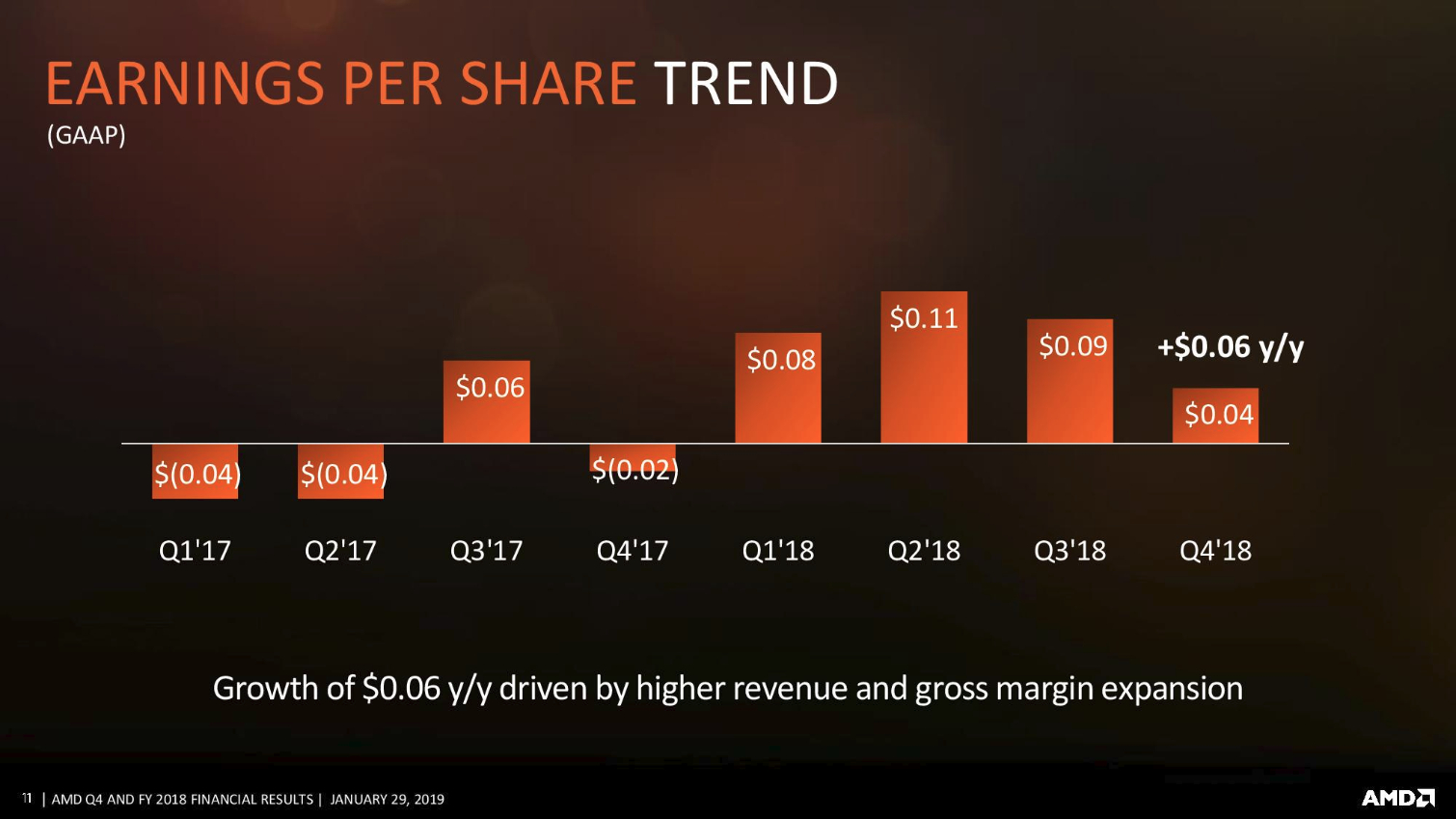

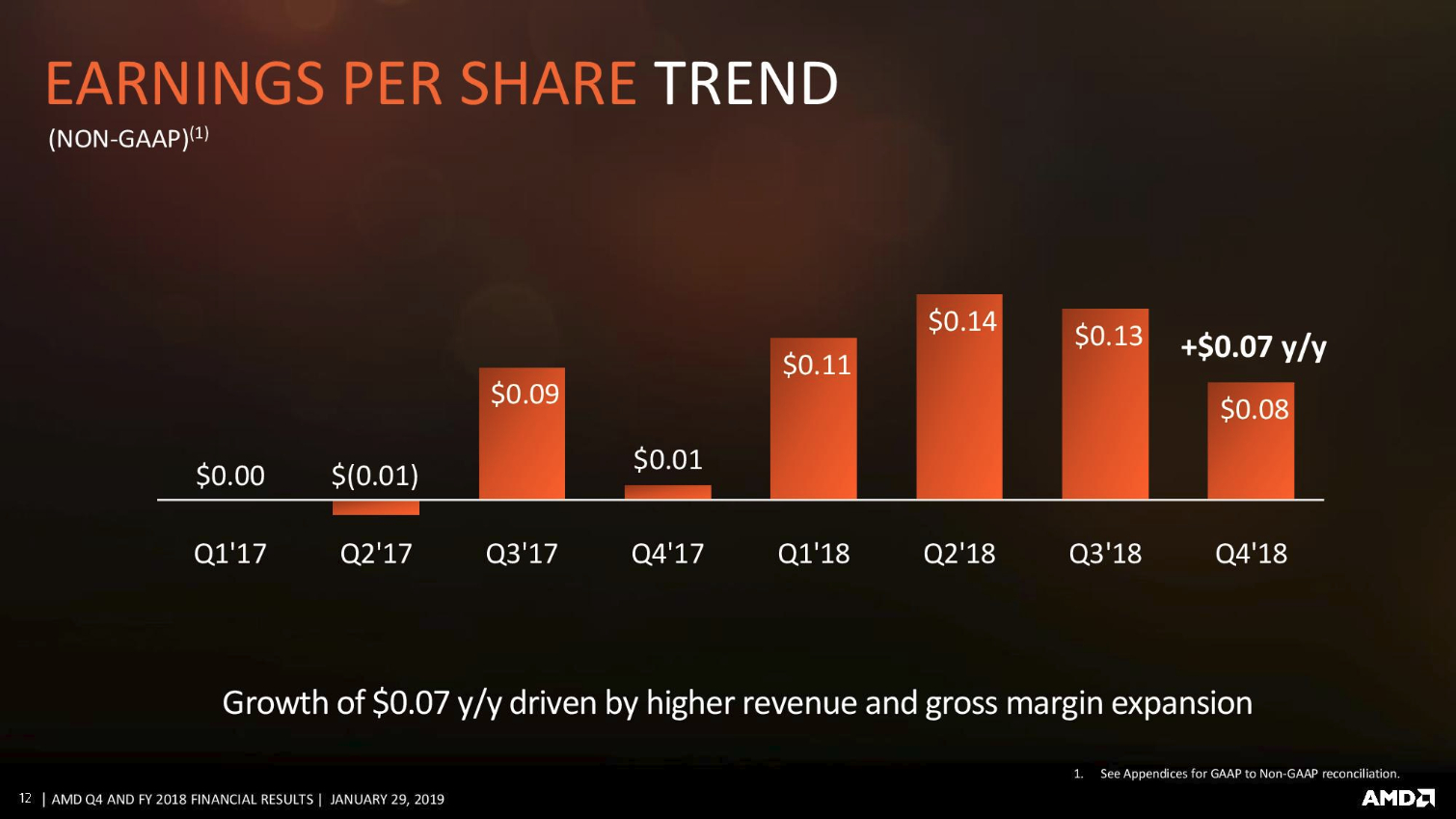

Despite falling short on revenue projections, AMD still managed to meet earnings projections of 8% per share, all while predicting a stronger-than-expected 2019 in its guidance. That news sent investors to the "buy" button in after-hours trading, where AMD's stock rose ~10%. The company also announced that it had restructured its Wafer Supply Agreement (WSA) with Global Foundries to more favorable terms.

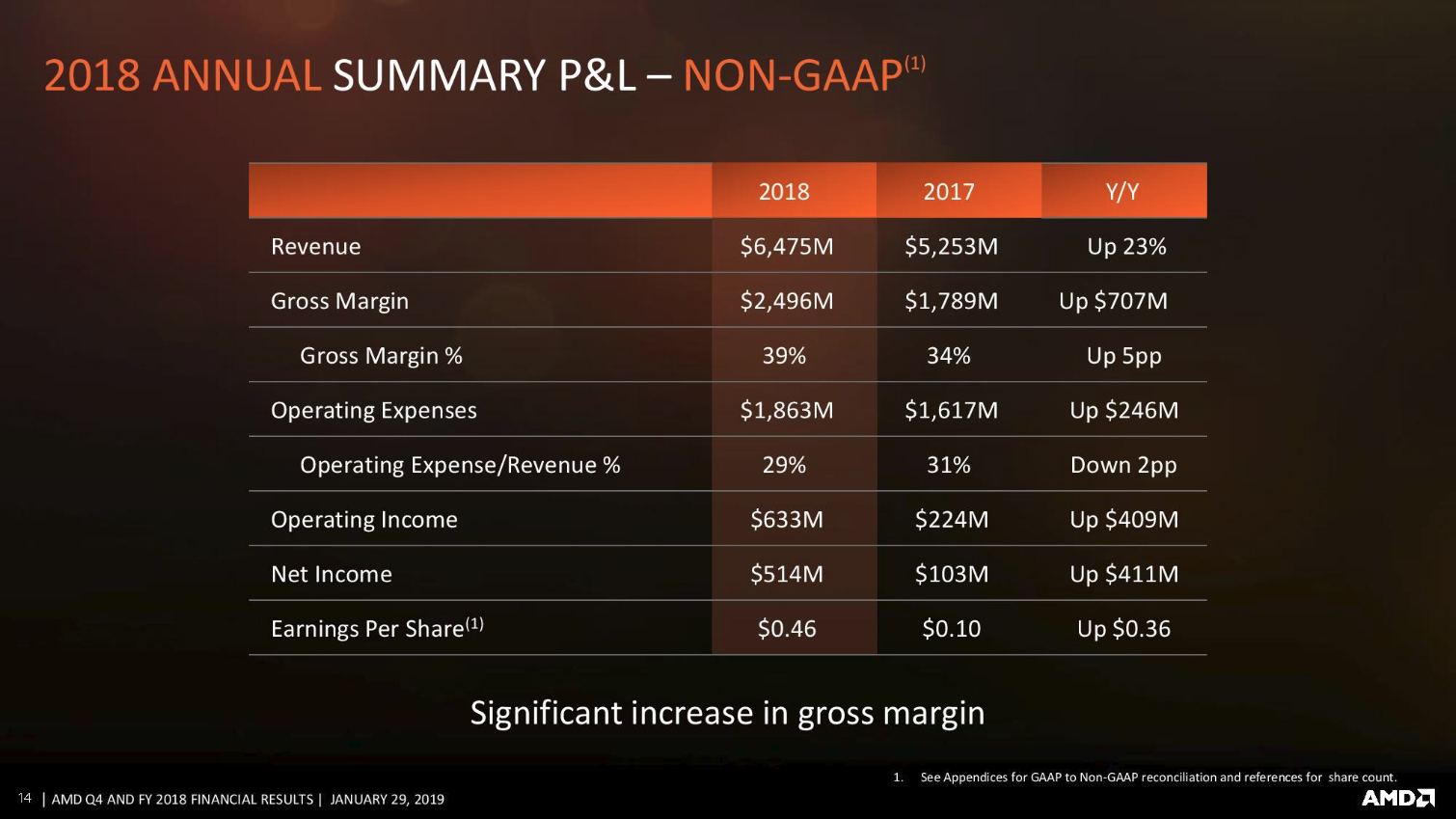

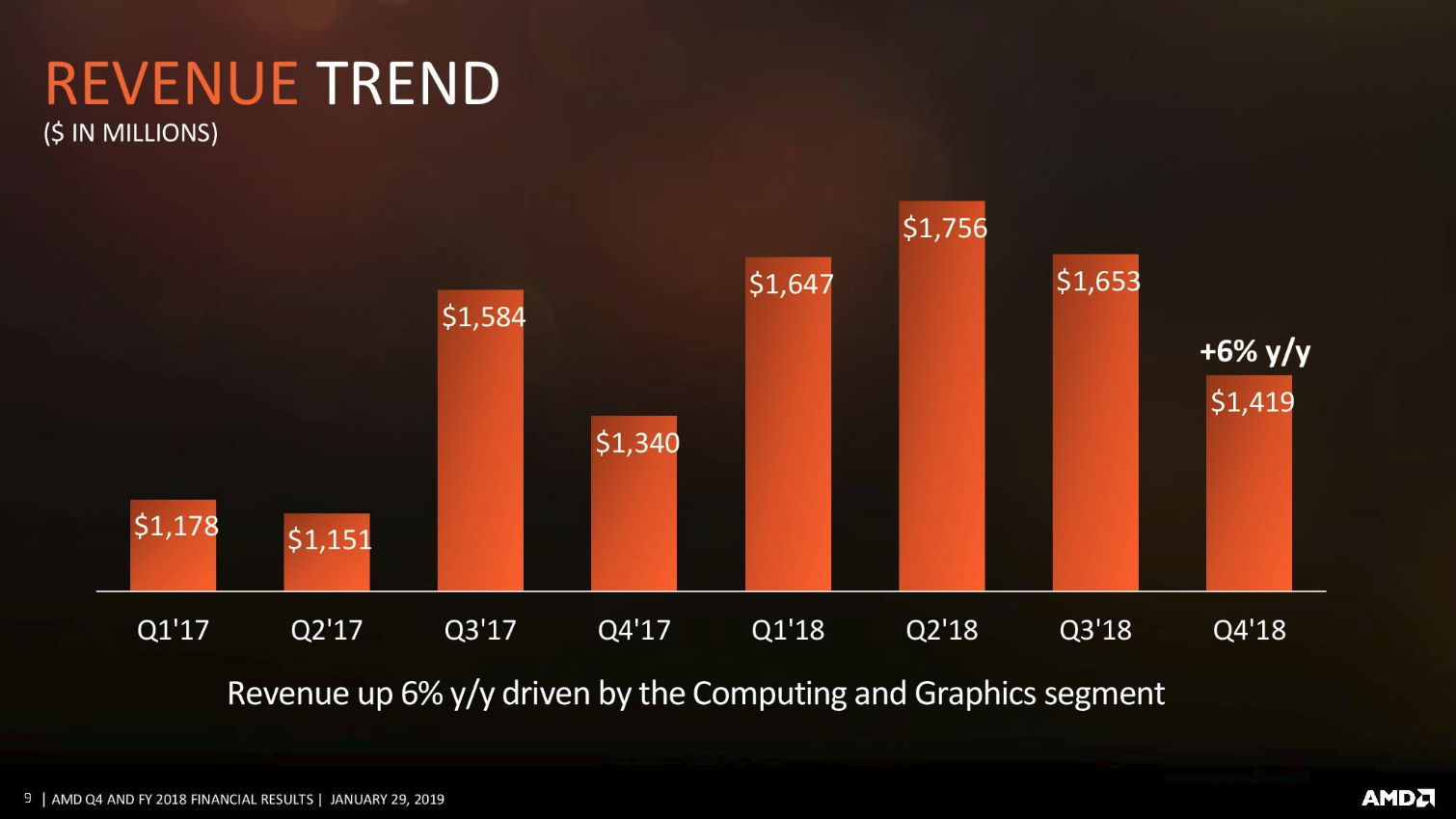

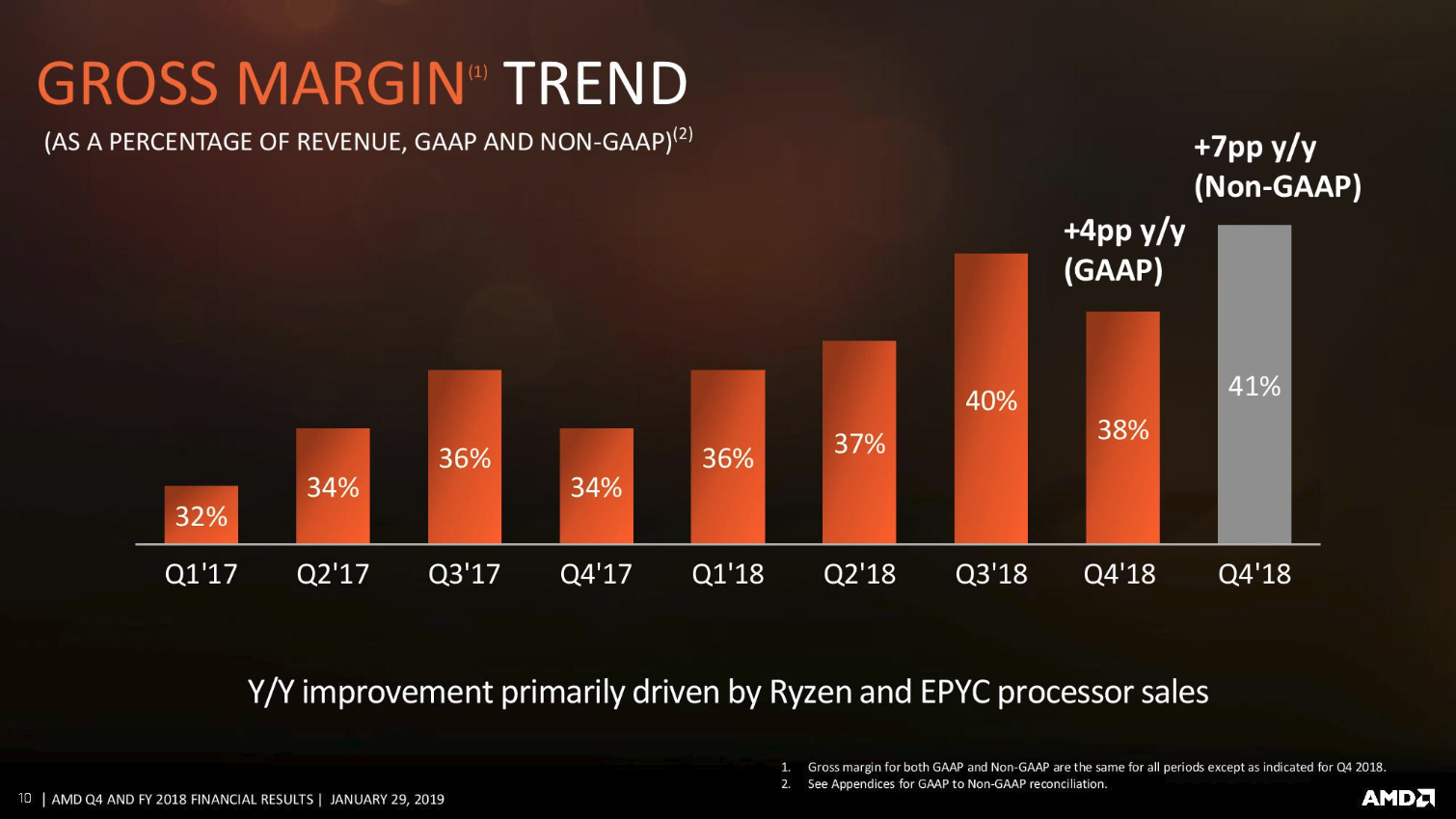

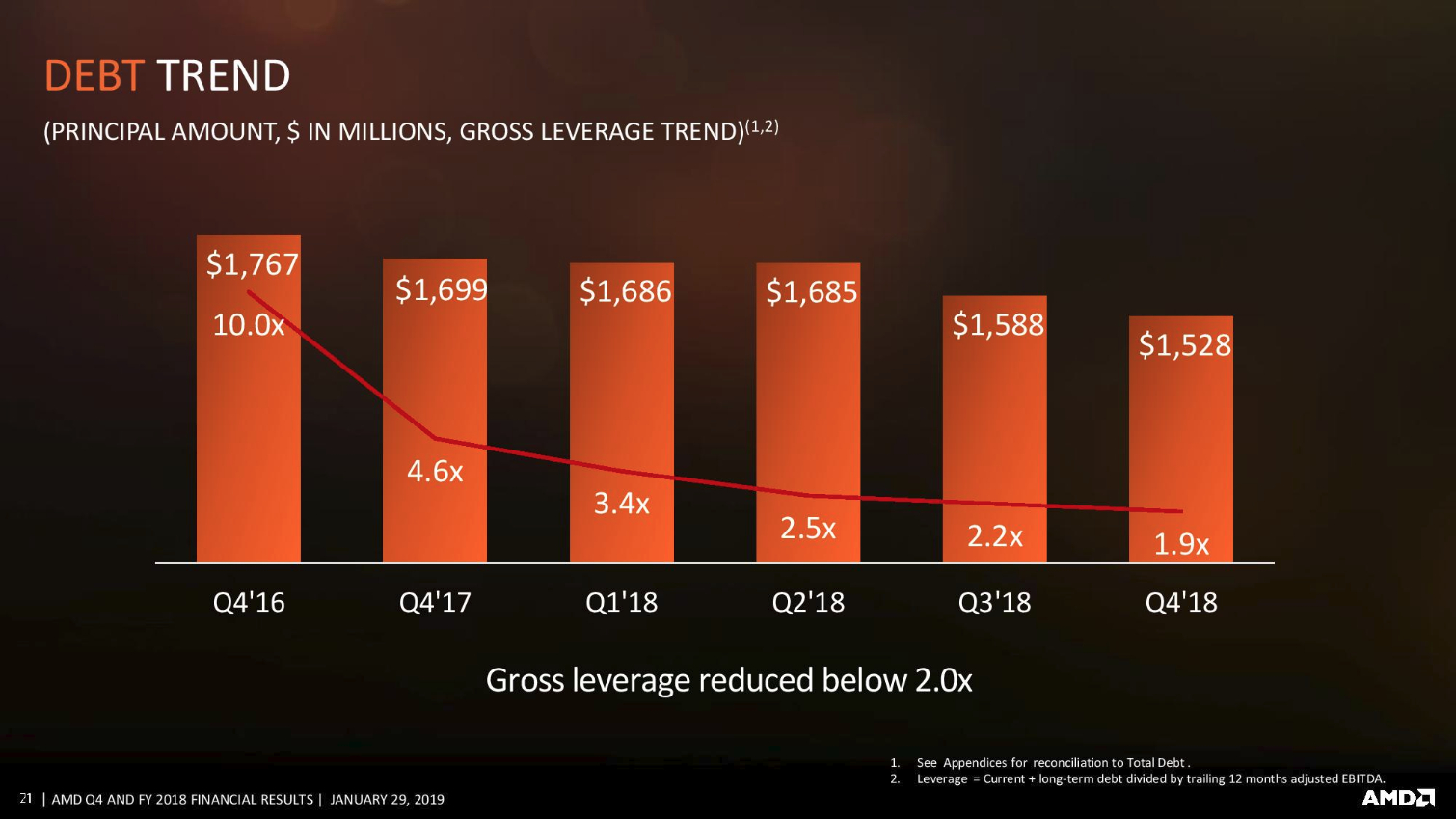

AMD's full-year 2018 revenue weighed in at $6.475 billion, which represents a 23% year-over-year (YoY) increase. AMD paired that stellar growth story with something much more amenable to investors: profit. AMD's 2018 results represent the company's highest profitability since 2011. That was accompanied by a significant reduction to the company's debt load.

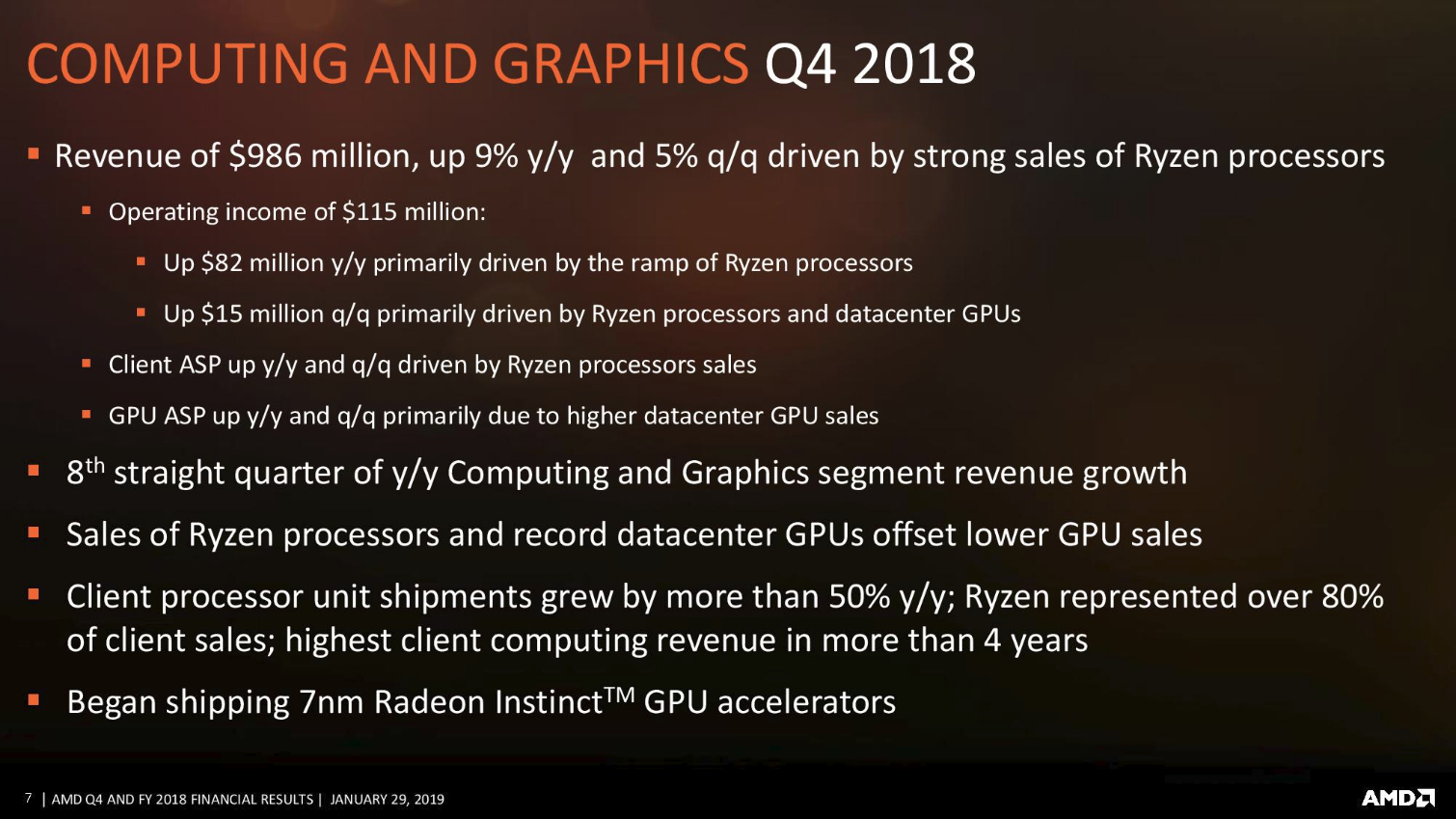

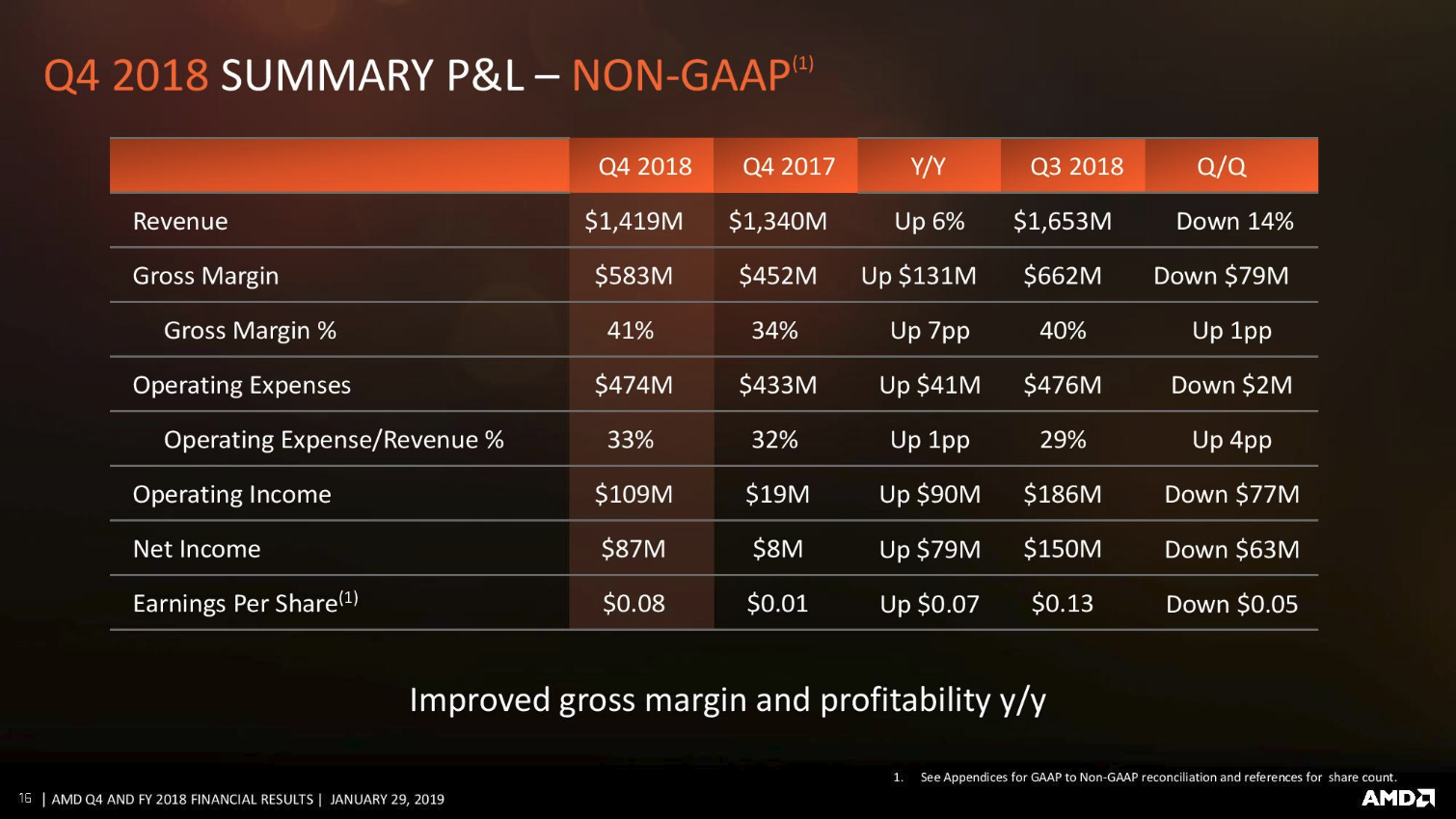

AMD's fourth quarter 2018 results, which increased 6% YoY to $1.42 billion, was a key contributor to its 2018 success. Much of those gains came on the back of explosive 50% YoY growth of its Ryzen product line, with unit shipments of its desktop processors now making up 80% of its client compute sales. AMD CEO Lisa Su said the company expects Ryzen sales to improve by 30% next year along with a 50% increase in notebook sales, with the latter addressing a key pain point in the largest segment of the PC market.

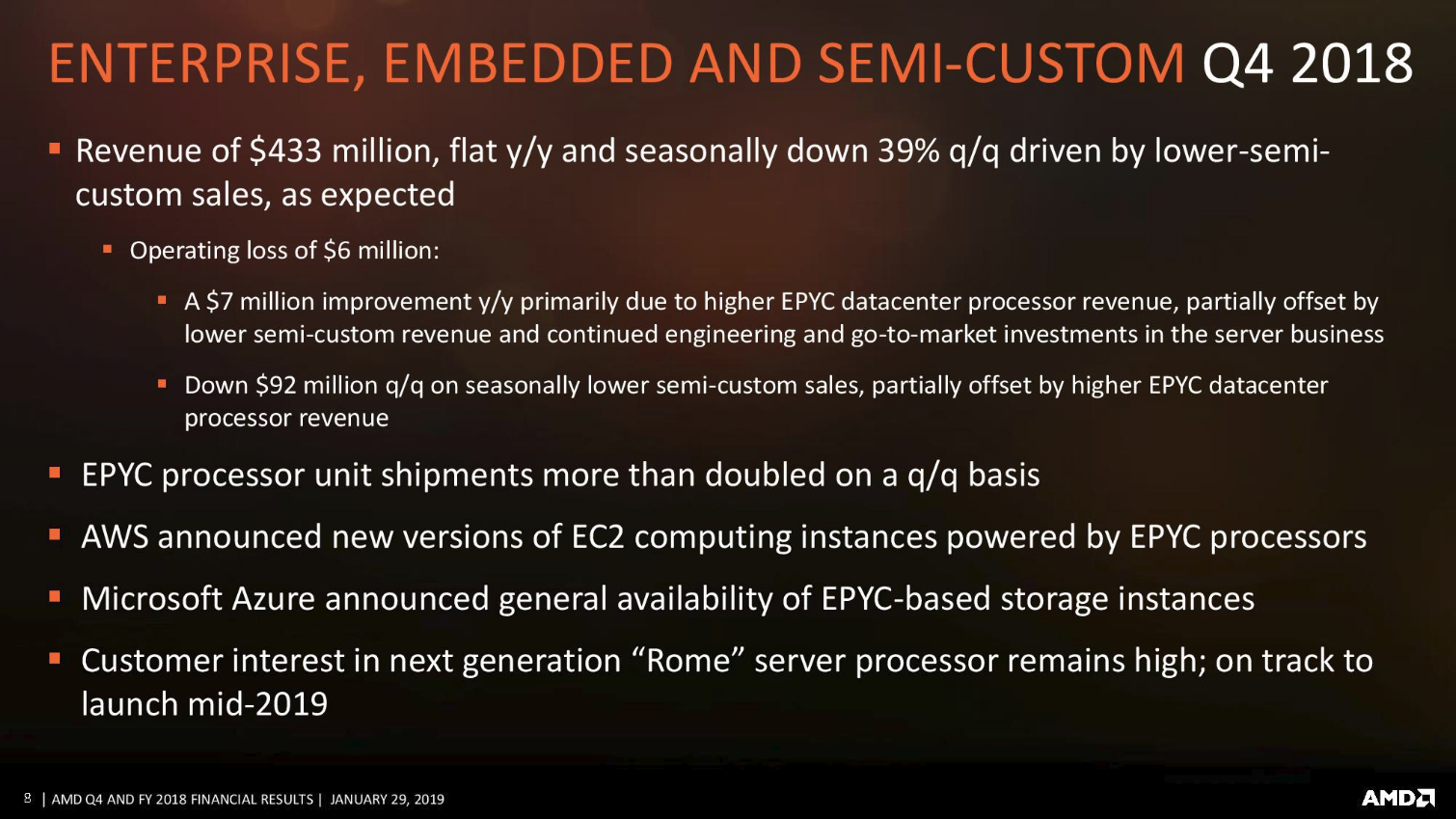

AMD also doubled its EPYC sales over the previous quarter, particularly to cloud compute bastions like Amazon, Azure and AWS, as it climbed to record revenue growth in its data center business. The improved EPYC sales, paired with the growth of Ryzen, contributed to a richer mix of products with high average selling prices.

AMD CEO Lisa Su remarked that the company had gained desktop PC market share in the fourth quarter of 2018 but didn't elaborate with a specific figure. Su also stated that the company had achieved its goal to claim "mid-single-digit" data center share in 2018.

The global GPU oversupply impacted AMD's quarterly earnings, and the company expects the shortages to persist through the second quarter of 2019. The oversupply comes as a side effect of the collapse of the blockchain (i.e., cryptocurrency mining) market, which AMD reported made a 'negligible' impact on its revenue for the fourth quarter of 2018. The company also isn't projecting any meaningful blockchain-derived revenue in the near future.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Nvidia is suffering at the hands of the oversupply, it recently slashed $500 million from its Q4 revenue guidance, but that company is more subject to the whims of the graphics market because GPUs are its primary revenue generator. AMD's diversified portfolio of both CPUs and GPUs has insulated it from such sharp drops, and it also noted that its 7nm Radeon Instinct GPUs are already enjoying brisk uptake.

Su also announced that the company had restructured its Wafer Supply Agreement (WSA) with Global Foundries. In exchange for lower pricing, the WSA compels AMD to buy a certain number of wafers from Global Foundries each year, or face penalties. Those penalties also apply if the company purchases wafers from another foundry.

Global Foundries' sudden exit from 7nm production earlier this year threw the relationship into question, as AMD had no choice but to source 7nm wafers from TSMC for its third-gen Ryzen and 7nm Radeon Instinct GPUs. The new seventh amendment to the agreement guarantees that AMD will continue to purchase a pre-determined number of wafers from Global Foundries until 2021, but the agreement now only applies to 12nm and larger nodes. Meanwhile, AMD is free to source 7nm wafers from TSMC without penalty.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

JamesSneed Very good news. Keep it going in 2019. We need a real competitor to fight it out going forward.Reply -

s1mon7 Those are stellar results. I don't think anyone expected them to be THAT great. I'm happy to see this, and looking forward to seeing how they turn their profits into development money for amazing upcoming products.Reply -

Kaz_2_ Amd is only nvidia and intel competitors against two giants with very good results. Thing will get even better in 2019 as their performance uplift is hugh.Reply -

Spock_rhp I suspect the financial details presented herein are wrong. PLEASE consult the company's actual earnings release for the correct figures.Reply -

redgarl "AMD's diversified portfolio of both CPUs and GPUs has insulated it from such sharp drops, and it also noted that its 7nm Radeon Instinct GPUs are already enjoying brisk uptake."Reply

And, of course, yesterday Nvidia backlash in revenue guidance affected AMD stock price because, once again, dumb investors are making the parallel that AMD GPU business = Nvidia GPU business.

Well, shorters got screwed today, which make it a good day. -

shrapnel_indie Reply21725246 said:And, of course, yesterday Nvidia backlash in revenue guidance affected AMD stock price because, once again, dumb investors are making the parallel that AMD GPU business = Nvidia GPU business.

Well, shorters got screwed today, which make it a good day.

Shorters always run the risk of losing money more so than other investor... especially when they operate under making a fast buck. Between shorters and other investors looking for and only caring about a quick buck...It surprising more businesses don't go under... but I guess that's because they, those that survive, know they can't cut too many.

Now, unless your credentials include being a financial analyst for investments, your statement of how shorters got screwed could be far from reality. -

jimmysmitty Reply21725246 said:"AMD's diversified portfolio of both CPUs and GPUs has insulated it from such sharp drops, and it also noted that its 7nm Radeon Instinct GPUs are already enjoying brisk uptake."

And, of course, yesterday Nvidia backlash in revenue guidance affected AMD stock price because, once again, dumb investors are making the parallel that AMD GPU business = Nvidia GPU business.

Well, shorters got screwed today, which make it a good day.

Market trends are typically similar between products. AMDs GPU business didn't benefit from the crypto crash just as nVidia did not. They still don't have a proper competitive line and wont until Navi launches at the earliest. Once they have that then their GPU business will probably help drive their stock up,. -

TJ Hooker Reply

It's not really dumb. Nvidia cited the bust in crypto mining (and associated glut of graphics cards) and weaker sales in China when they lowered their guidance, both of which it is entirely reasonable to expect would affect AMD too. And they did: AMD did in fact fall short of revenue projections for Q4, and estimated that Q1 revenue will also be lower than analyst projections. But luckily there was enough other good news that the earnings call ended up being a net positive for the stock.21725246 said:And, of course, yesterday Nvidia backlash in revenue guidance affected AMD stock price because, once again, dumb investors are making the parallel that AMD GPU business = Nvidia GPU business.

Well, shorters got screwed today, which make it a good day.