AMD Posts Record Revenue on High Demand and Improved Supply

AMD continues to grow despite supply constraints.

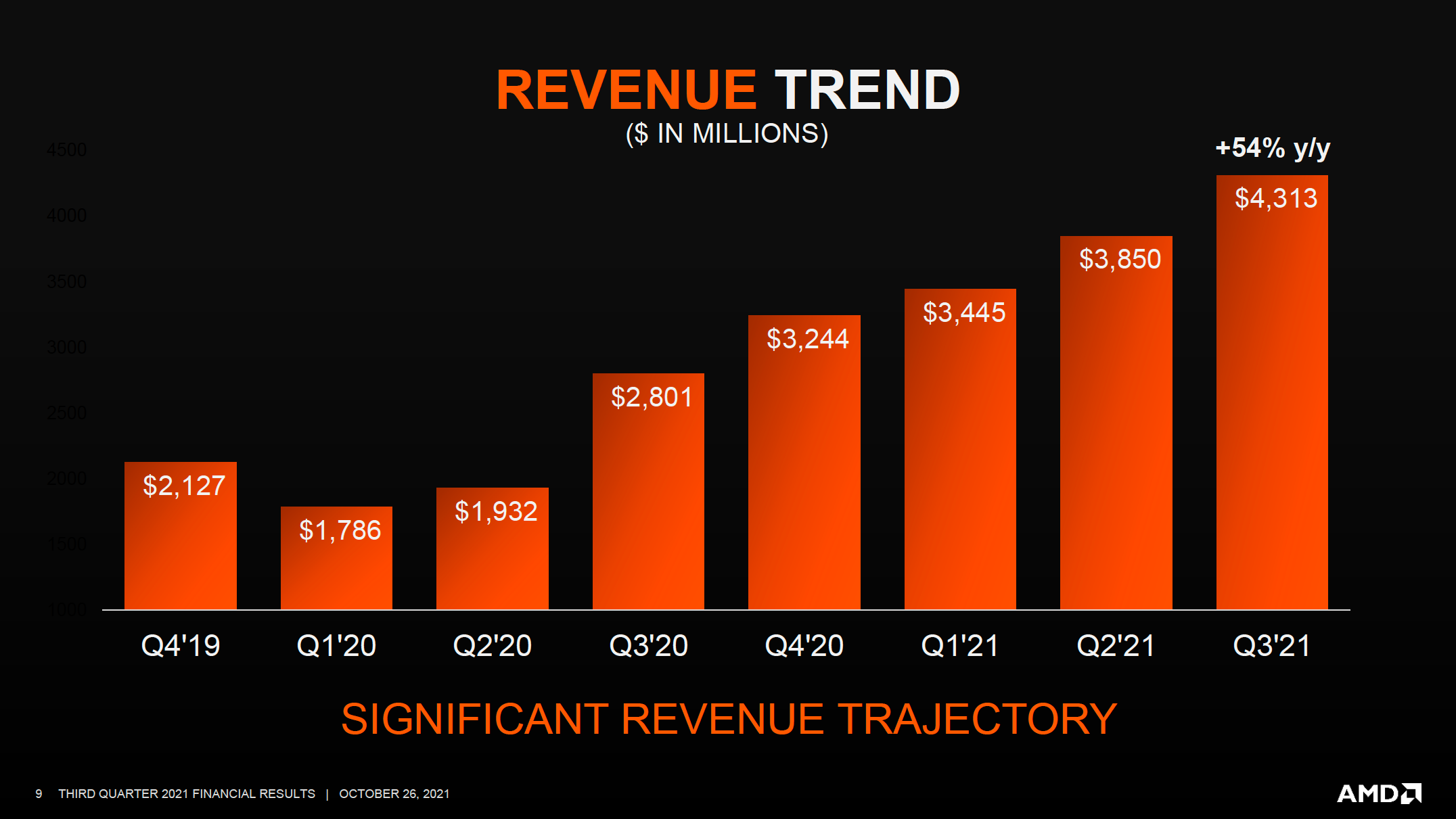

Owing to its very strong lineup of client and server CPUs as well as booming demand for PCs and servers, AMD has been posting a 50% year-over-year revenue growth for five consecutive quarters. In the third quarter of the company's fiscal 2021, AMD was in a particularly good shape as it managed to increase supply of its latest products that are in high demand. As a result, the company posted its new all-time record revenue.

Another Record Quarter

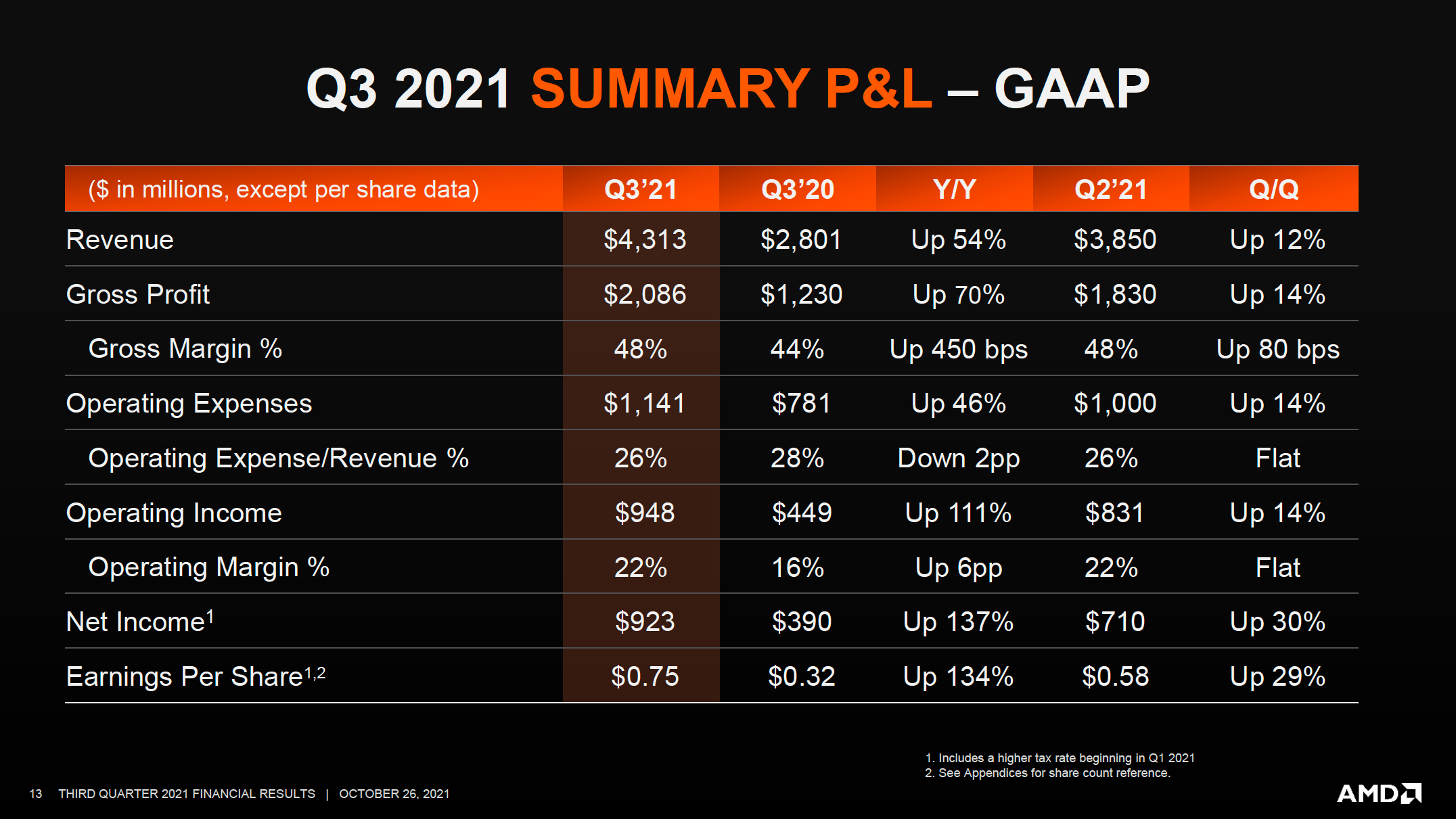

In the quarter that ended September 25, 2021, AMD earned $4.313 billion (up 54% year-over-year), which is more than AMD earned for the whole year 2016. The company's gross profit for the quarter totalled $2.086 billion, whereas its net income hit $923 million, up from $320 million in the same period a year ago. AMD's gross margin remained at 48%, whereas earnings per share reached $0.75.

"AMD had another record quarter as revenue grew 54% and operating income doubled year-over-year," said Dr. Lisa Su, AMD president and CEO. "3rd Gen Epyc processor shipments ramped significantly in the quarter as our data center sales more than doubled year-over-year. Our business significantly accelerated in 2021, growing faster than the market based on our leadership products and consistent execution."

AMD's cash, cash equivalents and short-term investments were $3.608 billion at the end of the quarter, up $1.837 billion YoY. With plenty of cash in its pockets, AMD can invest in securing additional production capacities to support its long-term growth. In particular, the company has been investing in packaging and testing facilities as they are among the key bottlenecks for the semiconductor industry these days.

Speaking of bottlenecks, it is noteworthy that AMD's inventories in as of the end of Q3 were worth $1.902 billion, which is a result of improved supply by AMD's partners and perhaps a mix of more expensive products.

"Our supply chain team has executed extremely well in a challenging environment delivering incremental supplies throughout the year, supporting our strong revenue," said chief executive of AMD. "We are also investing significantly to secure additional capacity to support our long-term growth."

Compute & Graphics Business

AMD has complained that it cannot meet demand for all of its products due to production constraints at subcontractors. As a result, the company has to focus on producing and supplying higher-end parts, such as premium APUs and CPUs for commercial, gaming, and workstation machines.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

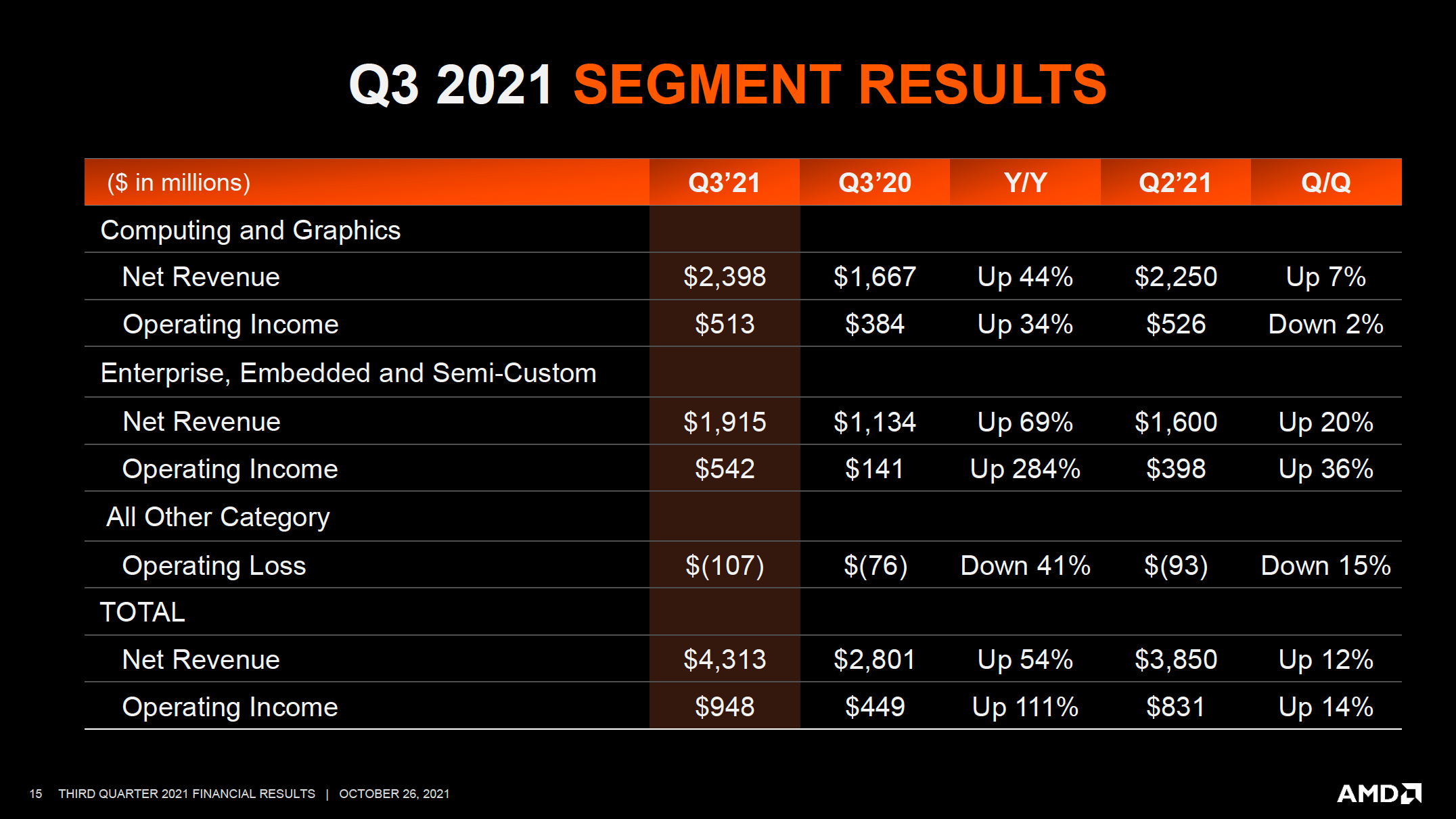

Such policy bore fruit in Q3 2021 as the company's C&G business unit earned $2.398 billion net revenue (up 44% YoY) as well as $513 million net income (up 34% YoY). AMD specifically noted that during the quarter it sold plenty of Ryzen Threadripper Pro CPUs for workstations thanks to their unique combination of core count, memory support, and the number of PCIe lanes.

"We are also seeing strong growth in the workstation," said Su. "According to IDC, Ryzen Threadripper Pro processors now power the best-selling workstations in their category in both North America and EMEA."

AMD also shipped its next-generation Instinct MI200-series compute GPUs set to be installed into the upcoming Frontier exascale supercomputer.

"Datacenter graphics revenue more than doubled year-over-year and quarter-over-quarter led by shipments of our new AMD CDNA2 GPUs for their Frontier," said Lisa Su.

Workstation CPUs and datacenter GPUs are expensive and are sold with a huge premium, so AMD significantly increased ASPs and reached record profitability for its C&G segment. Meanwhile, AMD admits that sales of its datacenter GPUs in Q4 will be down sequentially as there are no more large customers to adopt CDNA 2 GPUs just now

AMD's management also said that it increased unit shipments of its Radeon RX 6000-series GPUs in Q3 (something that we will have to verify with independent analysts), which also contributed to growing sales and higher ASPs (compared to both Q2 2021 and Q3 2020). In past few weeks AMD's top-of-the-range Radeon RX 6900 XT and enthusiast-grade Radeon RX 6800 XT became widely available from big retailers (albeit at high prices), so indeed it looks like AMD is increasing shipments of its GPUs.

"Our RDNA 2 GPU sales grew significantly in the quarter," said the head of AMD. "As we ramped production and expanded our-top-to-bottom portfolio with the launch of the midrange Radeon RX 6600 XT cards […]."

Enterprise, Embedded & Semi-Custom Business

AMD's Enterprise, Embedded, and Semi-Custom business unit earned $1.915 billion revenue in the third quarter, an increase of 69% YoY, and a 20% growth QoQ. Operating income of the BU reached $542 million, up a whopping 284% compared to the same period a year ago and a 36% increase sequentially.

During the quarter, shipments of AMD's 3rd generation Epyc processors exceeded sales of the company's 2nd generation Epyc CPUs, which clearly had a positive impact on the company's average selling prices (ASPs) and profitability. To date, AMD's partners have developed more than 100 server designs based on the 3rd Gen Epyc CPUs and as these designs ramp, shipments of the processors will continue to increase.

"3rd Gen Epyc processors continue ramping faster than the prior generation and contributed the majority of our servers CPU revenue in the quarter," said chief executive of AMD. "In cloud, multiple hyperscalers expanded their 3rd Gen Epyc processor deployments to power their internal workloads and both Microsoft Azure and Google announced multiple new AMD-powered instances. CloudFlare, Vimeo, and Netflix all recently announced new deployments powered by Epyc processors with Netflix highlighting how they doubled their streaming throughput per server, while also reducing their TCO."

Microsoft and Sony traditionally buy the highest number of SoCs for their consoles in Q3 in a bid to prepare for the holiday season. As a result, AMD's EESC unit was boosted surging demand for servers, growing adoption of its latest Epyc 7003-series CPUs, and seasonality that favors game consoles.

It is interesting to note that AMD expects its console business to increase further in the fourth quarter, a rather unprecedented turn of events, which will further contribute to EESC's growth in Q4.

Outlook

With demand for PCs, servers, and consoles remaining strong and supply situation improving, AMD is very optimistic about its prospects for the fourth quarter. The company expects its revenue to increase to $4.5 billion ±$100 million, an increase of about 39% compared to Q4 2020 and a 4% increase quarter-over-quarter. AMD attributes its growth in Q3 to surging demand for Epyc processors as well as console SoCs. The company also projects its non-GAAP gross margin to be 49.5% in Q4 2021.

AMD expects its revenue for the year to be roughly 65% higher compared to prior year and set another all-time record.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

-Fran- So matching nVidia and Intel's horrible pricing schemes does give profit, huh?Reply

I am so shocked... Not.

Oh welp; you feed snakes and you get biten and eaten. Or so the saying goes, lol.

Anyway, the upside is AMD can get just a bit closer to Intel. They're still about 7 times smaller, so this helps them go up the food ladder, I guess. I hope they just bring competition and not shadow the others horrible pricing tactics.

Regards. -

TerryLaze Reply

When talking about companies, revenue is the amount of money they get from sales, "earns" would be the earnings or net income which is what is left over after all the costs have been subtracted.Admin said:AMD earns $4.313 billion in Q3 2021 as sales of CPUs, GPUs, and SoCs are growing.

AMD Posts Record Revenue on High Demand and Improved Supply : Read more

https://www.investopedia.com/terms/e/earnings.asp -

ddcservices ReplyYuka said:So matching nVidia and Intel's horrible pricing schemes does give profit, huh?

I am so shocked... Not.

Oh welp; you feed snakes and you get biten and eaten. Or so the saying goes, lol.

Anyway, the upside is AMD can get just a bit closer to Intel. They're still about 7 times smaller, so this helps them go up the food ladder, I guess. I hope they just bring competition and not shadow the others horrible pricing tactics.

Regards.

You don't seem to understand how these things work, so let me educate you a bit.

First, on the CPU front(AMD vs. Intel), AMD offering 8 cores in 2017 vs. Intel 4 cores, pricing wasn't a problem, right? Up to $500 for the top end consumer CPU(yes, the 1800X wasn't really much better than the 1700, but it was a bit better, and AMD skipped the 2800X from the next generation because of it).

The move from the 3700, 3700X, and 3800X to the 5800x seemed like there was a big price increase, because AMD didn't make multiple tiers of chips. 6 core, 8 core, 12 core, and 16 core...only a single version for the Zen3 generation, so 3800X to 5800X was a $50 increase, which isn't a big jump in price. You just look at 3700 to the 5800x as the jump from generation to generation. Just because there is no, "low end with lower clock speeds" version bothers you doesn't mean that the price increase was as big as you want it to seem(because you are cheap and want a low cost option that isn't really slower than the expensive one).

So, that's the CPU business, $50 more generation to generation was what happened, and shipping and such does cost a lot more these days than in pre-Covid times.

Then, you have video cards, the AMD vs. NVIDIA. The Radeon 5700XT was a $400 card in 2019, a 40CU(compute unit) GPU. For the 6000 series, the 40CU card is the 6700XT. Big Navi is 60CU for the 6800, 72CU for the 6800XT, and 80CU for the 6900XT. So, the 6800 costing 50% more would bring it to $600 with 8GB of VRAM...AMD gave it 16GB of VRAM. Not really terrible, and if you look at the MSRP, prices were right on the money for the most part for what would be fair compared to the previous generation.

Now, what you probably missed is that MSRP for the REFERENCE design is what AMD suggests the prices should be. AMD only makes the GPU, not the cards themselves(except the versions you can buy at amd.com). So, who do you think actually makes the video cards? Yea, those video card makers, MSI, Asus, PowerColor, Sapphire, XFX, etc. Just because AMD suggests prices does not mean those card makers are going to listen. AMD can't really do anything if Sapphire makes even the reference design for $100 more than the MSRP, because AMD just supplies the GPUs. Now, can you buy direct from Asus, Sapphire, or the others, or do they sell to distributors, who in turn sell to others? Even if the video card maker sells to distributors for 40 percent below MSRP, if the distributor then turns around and sells the cards for MSRP to the retailers, those retailers WILL mark the price up so they make a profit. The real source of the problem is the video card makers and the distributors jacking up the prices. For all we know, AMD is selling the 6900XT GPU for $150 each to the video card makers who are selling the completed cards for $1000. That price increase isn't really increasing profits to AMD and NVIDIA. Generation to generation will see a price increase, but if you go from 40CU to 60CU, you should expect a 50 percent boost to prices, because the GPU is that much larger. Top end golden samples will always have an extra price premium though, so the 6900XT is going to be more expensive than double the 6700XT. -

-Fran- Reply

Cool story. Apologies I didn't read it though.ddcservices said:You don't seem to understand how these things work, so let me educate you a bit.

First, on the CPU front(AMD vs. Intel), AMD offering 8 cores in 2017 vs. Intel 4 cores, pricing wasn't a problem, right? Up to $500 for the top end consumer CPU(yes, the 1800X wasn't really much better than the 1700, but it was a bit better, and AMD skipped the 2800X from the next generation because of it).

The move from the 3700, 3700X, and 3800X to the 5800x seemed like there was a big price increase, because AMD didn't make multiple tiers of chips. 6 core, 8 core, 12 core, and 16 core...only a single version for the Zen3 generation, so 3800X to 5800X was a $50 increase, which isn't a big jump in price. You just look at 3700 to the 5800x as the jump from generation to generation. Just because there is no, "low end with lower clock speeds" version bothers you doesn't mean that the price increase was as big as you want it to seem(because you are cheap and want a low cost option that isn't really slower than the expensive one).

So, that's the CPU business, $50 more generation to generation was what happened, and shipping and such does cost a lot more these days than in pre-Covid times.

Then, you have video cards, the AMD vs. NVIDIA. The Radeon 5700XT was a $400 card in 2019, a 40CU(compute unit) GPU. For the 6000 series, the 40CU card is the 6700XT. Big Navi is 60CU for the 6800, 72CU for the 6800XT, and 80CU for the 6900XT. So, the 6800 costing 50% more would bring it to $600 with 8GB of VRAM...AMD gave it 16GB of VRAM. Not really terrible, and if you look at the MSRP, prices were right on the money for the most part for what would be fair compared to the previous generation.

Now, what you probably missed is that MSRP for the REFERENCE design is what AMD suggests the prices should be. AMD only makes the GPU, not the cards themselves(except the versions you can buy at amd.com). So, who do you think actually makes the video cards? Yea, those video card makers, MSI, Asus, PowerColor, Sapphire, XFX, etc. Just because AMD suggests prices does not mean those card makers are going to listen. AMD can't really do anything if Sapphire makes even the reference design for $100 more than the MSRP, because AMD just supplies the GPUs. Now, can you buy direct from Asus, Sapphire, or the others, or do they sell to distributors, who in turn sell to others? Even if the video card maker sells to distributors for 40 percent below MSRP, if the distributor then turns around and sells the cards for MSRP to the retailers, those retailers WILL mark the price up so they make a profit. The real source of the problem is the video card makers and the distributors jacking up the prices. For all we know, AMD is selling the 6900XT GPU for $150 each to the video card makers who are selling the completed cards for $1000. That price increase isn't really increasing profits to AMD and NVIDIA. Generation to generation will see a price increase, but if you go from 40CU to 60CU, you should expect a 50 percent boost to prices, because the GPU is that much larger. Top end golden samples will always have an extra price premium though, so the 6900XT is going to be more expensive than double the 6700XT.

Regards. -

ottonis Well deserved, AMD, well deserved!Reply

It's important to note that AMD's earnings right now will be a decisive factor how much R&D they will be able to put into their next generations of CPUs, APUs and GPUs.

Right know, we are at the verge of a paradigm shift, at the forefront of which Apple Silicon is paving the way for a fundamentally improved performance per watt ratio.

So, AMD knows that it will have to significantly rebuild its microarchitecture in the long run in order stay relevant.

Same applies for Intel, of course. -

sizzling ReplyYuka said:So matching nVidia and Intel's horrible pricing schemes does give profit, huh?

I am so shocked... Not.

Oh welp; you feed snakes and you get biten and eaten. Or so the saying goes, lol.

Anyway, the upside is AMD can get just a bit closer to Intel. They're still about 7 times smaller, so this helps them go up the food ladder, I guess. I hope they just bring competition and not shadow the others horrible pricing tactics.

Regards.

These companies have a legal obligation to protect shareholders investments and maximise shareholder returns. It is no wonder that when they have similar products that they end up with similar pricing models that are determined by what the market is will to accept. AMD’s results indicate their pricing model works for this market. -

-Fran- Reply

Hence: "you feed snakes and you get bitten and eaten".sizzling said:These companies have a legal obligation to protect shareholders investments and maximise shareholder returns. It is no wonder that when they have similar products that they end up with similar pricing models that are determined by what the market is will to accept. AMD’s results indicate their pricing model works for this market.

Part of the blame for current prices is people buying them at those price points. That much is clear.

Regards. -

dalek1234 For those of you complaining about AMD pricing, the solution is simple. Buy AMD stock. It will continue to climb for the next 3 years at least. The $ you will make on it will offset the higher price of AMD hardware, and you'll have plenty of cash left to spare.Reply