Apple To Replace China-Made NAND for Samsung: Report

Industry report alludes to Samsung replacing YMTC in China market

It is claimed that Apple has quietly decided to ditch its plans to use NAND flash storage supplied by China’s Yangtze Memory Technologies Corp (YMTC) in upcoming iPhones. A report shared by Taiwan’s DigiTimes claims that Apple are looking to Samsung rather than YMTC, as the Chinese NAND supplier is expected to be officially blacklisted by the US in December, in a new wave of tech sanctions.

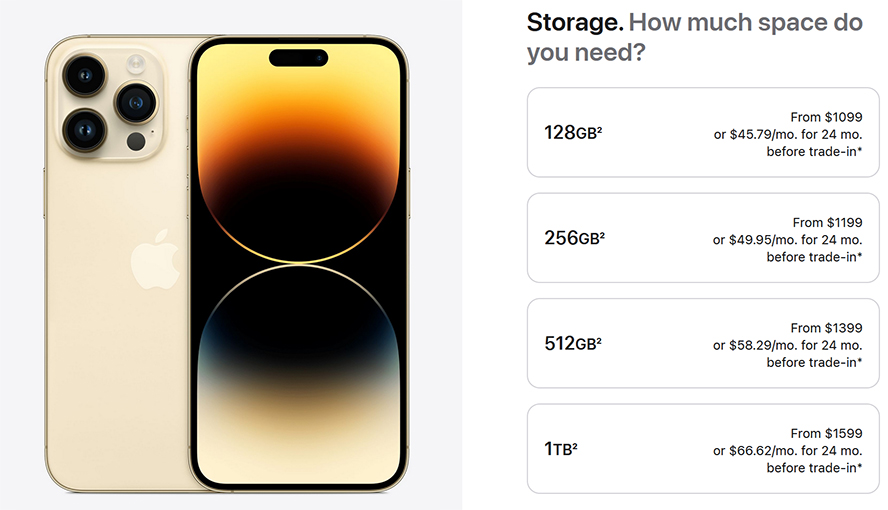

From the industry sourced report (so take the news with a pinch of salt) we understand that Apple intended to limit the use of YMTC flash storage chips to iPhones sold into the China market. This would mean approximately 10% of iPhones would use the YMTC NAND, while the rest of the world would have mainly bought iPhones packing Kioxia and SK hynix NAND. The extra supply from YMTC would help Apple keep its component prices down, and provide a buffer to any industry issues that arise from time to time (fires, earthquakes, flooding, pandemics etc).

YMTC’s loss is Samsung’s gain, according to the insiders talking to DigiTimes. The South Korean electronics giant is already a major supplier of DRAM for iPhones, but next year it will start to supply its 128 to 176 layer NAND to Apple, via its Xian (China) plant. Incidentally, Samsung Xian outputs 40% of Samsung total NAND shipments, and unlike Kioxia and SK hynix Samsung has made no announcements about lowering its flash storage capital expenditure. Perhaps it expected Apple to have a change of heart.

We reported on the budding relationship between Apple and YMTC back in September, but now it looks like the buds have been killed off by the first frosts of winter. As outsiders, we don’t know how much Apple could have saved with its move to Chinese NAND for Chinese iPhones, but the market is quite sluggish in Q4 2022, with Micron the latest big supplier trying to tickle prices upwards by constraining its output.

A couple of further interesting news morsels, regarding YMTC, are shared by DigiTimes. Firstly, it says YMTC was projected to grab 20% of the world’s NAND flash market if it wasn’t for impending sanctions. Secondly, the sanctions will bite into YMTC’s progress; it currently produces 128-layer NAND flash in China, but progress to the planned 232-layer NAND has been seriously hampered by chip machinery makers obeying sanctions.

With sanctions and related trade barriers being erected, suppliers to Chinese businesses and internal China chip businesses have been working on alternative ways to progress. For example; we recently reported on node tuning developments in China, and Nvidia is side stepping a chip performance sanctions with a reconfigured A100 GPU called the A800.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.