China's Bitcoin Mining Dominance Was Slipping Before the Crackdown Started

A minor slip before a major setback

The Cambridge Centre for Alternative Finance (CCAF) today revealed that China's dominance over global Bitcoin mining was slipping before most of the country's provinces had even started to shut down mining operations earlier this year.

CCAF said a major update to the Cambridge Bitcoin Electricity Consumption Index (CBECI) suggests "that China’s share of global hashrate (the total computational power of server farms participating in Bitcoin’s consensus process) has been in significant decline for some time prior to the recent crackdown on Bitcoin mining."

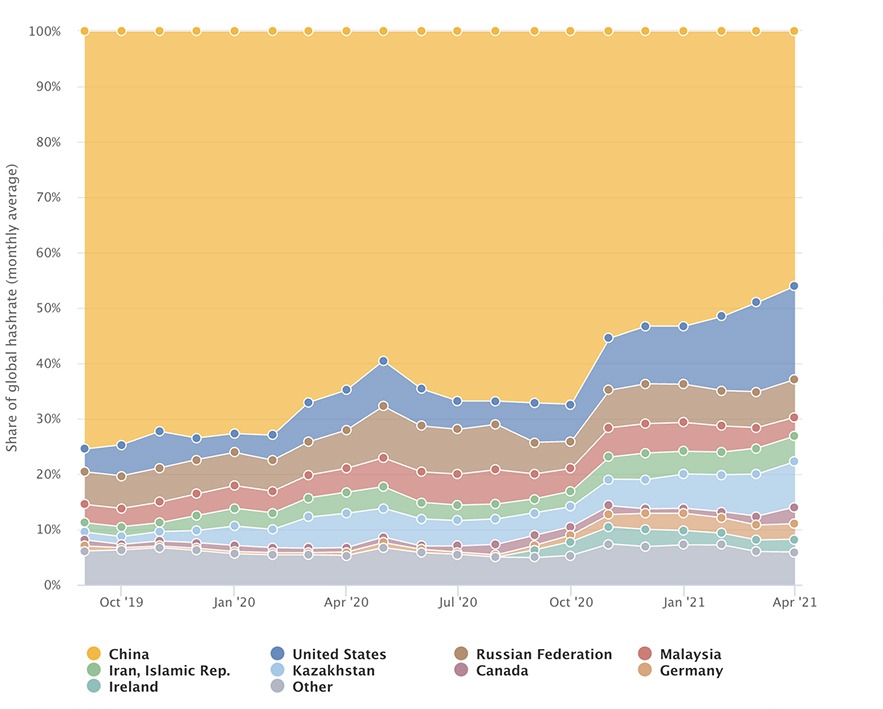

The updated CBECI "reveals that China’s share of total Bitcoin mining power declined from 75.5% in September 2019 to 46% in April 2021," CCAF said, though it's still the largest contributor to the cryptocurrency's hash rate. The U.S. claimed second place by increasing its contribution to the network from 4.1% to 16.8% in the same period.

China's reduced contribution to Bitcoin's hash rate could mitigate some of the concerns about losing the country's mining operations, but 46% is still a significant chunk of the power devoted to the cryptocurrency, and it wouldn't be surprising if it still took at least a year for the network to recover from its sudden disappearance.

CCAF said the updated CBECI also detailed the mobility of China's mining operations for the first time. Miners throughout the country were said to operate in the Xinjiang province during the dry season and then move to the Sichuan province during the wet season to take advantage of the cheap hydroelectric power generated there.

Unfortunately, those provincial migrations don't reveal much about where these mining operations will move now that Xinjiang, Sichuan, and other major provinces have sworn to shut them down. It was probably easier to bounce around provinces inside China than it will be for the mining operators to move to other countries.

"Gains in the US and Kazakhstan might be an indicator" of where those operations might move, CCAF said, "but the next upcoming data updates reflecting the impact of China’s mining ban will provide greater clarity as to where the hashrate has moved." Read: Even the new CBECI can't predict the future for China's miners.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Nathaniel Mott is a freelance news and features writer for Tom's Hardware US, covering breaking news, security, and the silliest aspects of the tech industry.

-

drivinfast247 Replydaworstplaya said:Let's hope this ponzi scheme NEVER bounces back.

Pon·zi scheme

/ˈpänzē ˌskēm/

Learn to pronounce

nouna form of fraud in which belief in the success of a nonexistent enterprise is fostered by the payment of quick returns to the first investors from money invested by later investors.