Report: DRAM Market Prices and Volume Fell in 1Q19

People often say that something is going to get worse before it gets better. According to a May 28 report from DRAMeXchange, the memory market's definitely in the "getting worse" part of that process, because DRAM prices and volume both declined in the first quarter of 2019.

Things have looked dire in the DRAM market for a while. Prices have declined the fastest they have since 2011, according to a DRAMeXchange report from March, as demand plummeted. Companies have already felt the effect of these problems: Samsung had to issue an earnings guidance earlier this year for the first time as its profits fell 60% in the first quarter of 2019. The company also ended up ceding the semiconductor throne to Intel.

Many analysts predicted that these issues would continue well into 2019. DRAMeXchange's most recent report agreed. Its parent company, TrendForce, predicted that "contract prices will keep plunging under as monthly deals are made in May and June and decline by nearly 25% for the whole 2Q." It expects server DRAMs--which are said to make up more than 30% of shipments--to face harsher pricing pressure in the months ahead.

Companies like Samsung and Micron have slowed production to ease their oversupply issues, but demand seemed to fall more than expected. DRAMeXchange said that memory companies aren't the only ones with too much supply to sustain current prices--their customers are also said to be sitting on too much memory as well. Those companies need to work through their existing inventory before they can help their suppliers with theirs.

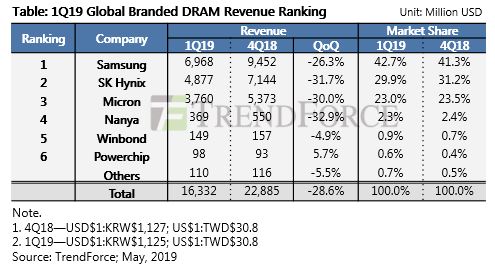

These problems have had serious effects on memory companies' revenues. DRAMeXchange said that quarter-over-quarter Samsung's revenue fell by 26.3% as SK Hynix's fell by 31.7% and Micron's by 30% in the first quarter of 2019.. Their margins have suffered, too, as prices continued to fall. It's a one-two punch: the companies are struggling to sell memory, and what they do sell doesn't fetch the same price it did just a few quarters ago.

This all reportedly made Samsung hesitant: "Technology observations show that Samsung's Line 17 and Pyeongtaek plant (2nd floor) will continue to make the transition into 1Ynm, yet considering current market trends, the company has yet to speed up its transition. In dealing with 1Xnm server issues, Samsung is planning to make capacity allocation adjustments to its production processes in order to reduce damage to a minimum."

Here's the latest global branded DRAM market revenue ranking from DRAMeXchange:

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Nathaniel Mott is a freelance news and features writer for Tom's Hardware US, covering breaking news, security, and the silliest aspects of the tech industry.