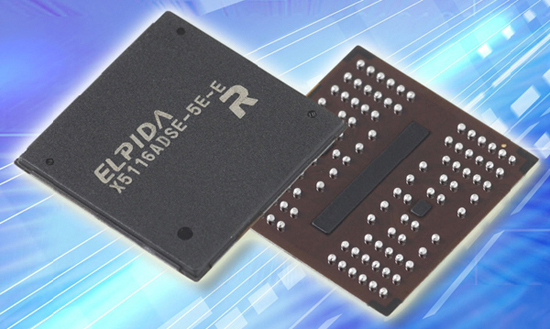

Micron Snaps Up Elpida for $750 Million

According to an announcement sent out early this morning, Micron will purchase the equity of Elpida for $750 million. However, there is substantial additional baggage.

Micron will have to cover about $1.75 billion of debt that will be paid to creditors in annual installments through 2019. Also, there is a $334 million payment due for a 24 percent stake in Rexchip Electronics from Powerchip Technology. According to Reuters, Elpida owns about 65 percent of Rexchip at this time.

Investors reacted positively to the deal and had sent the company's stock up nearly 5 percent during midday trading. Despite the volume of more than $2.75 billion, the acquisition of Elpida could turn into a bargain for Micron, which had been looking for opportunities to better compete with Samsung. Micron executives said that it would have cost the company at least $6 billion to create manufacturing and market presence it is acquiring through Elpida. The combined Micron/Elpida will own about 24 percent of the DRAM market, according to IHS iSuppli.

In a prepared statement, Micron CEO Mark Durcan said the deal will establish a "industry-leading pure-play memory company."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Douglas Perry was a freelance writer for Tom's Hardware covering semiconductors, storage technology, quantum computing, and processor power delivery. He has authored several books and is currently an editor for The Oregonian/OregonLive.

-

memadmax A Bad DayIsn't the DRAM market shrinking?Reply

The DRAM market goes up and down just like everything else.

Anyways...

Micron has a reputation of making cheapo ram, and being able to weather any storm, so this aquisition will prolly allow them to produce even more cheap ram, but nothing new since Elpida didn't really innovate much. So Elpida pretty much becomes a zombie ram maker =D -

ikefu The DRAM market is huge, its just the crazy competition that has driven the price per chip down (sales volume is high, prices are low). So Micron having a bigger market share will allow them to better handle price fluctuations and gain a bit of control.Reply -

Stardude82 Well, $750 million for the assets, plus $2 billion dollars in debt. I guess it's still a pretty good deal for a company that does about $2 billion in sales.Reply -

verbalizer stupid me, I thought they already acquired them late last year or early this year..?Reply

maybe I read about the possibility of such events..?

:/