Ethereum's Merge Completed Without a Hitch, GPUs Are Free

ETH Proof-of-Work is now Proof-of-Stake

In the early hours of today, September 15, 2022, the Ethereum community stood breathless. At 2:43 AM EST, there were over 41,000 people viewing an "Ethereum Mainnet Merge Viewing Party" via YouTube. The reason: a software upgrade to the Ethereum Virtual Machine (EVM), known as The Merge, the second most important event in Ethereum's history barring its creation. After the first validator node was successfully brought online (with more following suit), Ethereum's Proof-of-Work (PoW) ceased, replaced with Proof-of-Stake (PoS). Gamers and GPUs rejoice!

And we finalized!Happy merge all. This is a big moment for the Ethereum ecosystem. Everyone who helped make the merge happen should feel very proud today.September 15, 2022

The Ethereum Merge has been a long time coming ever since its proposal (in December 2020) as a possible upgrade to Ethereum. The Merge's main feature is to enable Ethereum to transition from the energy-intensive PoW method to the far less demanding PoS. In PoW, validators/miners employed the best graphics cards and perhaps a few ASICs to crunch the cryptocurrency's Dagger-Hashimoto algorithm, securing the blockchain in the process and ensuring transactions are processed correctly.

PoS does away with the computationally intensive security method. Instead, validators will have to show they have a stake in Ethereum's future by holding the equivalent of 32 ETH (~$50,615 at time of writing) in their node. Holding these 32 ETH units theoretically means that these validators have Ethereum's well-being on their minds, since working against it or "poisoning" transactions would likely eat into Ethereum's market perception and value, in turn reduce the value of their staked Ethereum tokens.

One concern that's been raised against the new PoS method is that centralized exchanges can participate in the staking process: users will be able to stake their ETH directly with services such as Coinbase. This has raised questions regarding the true decentralization of Ethereum. Institutions and law enforcement having greater power over centralized exchanges than they do on individual/organized miners has been one of the Merge's discussed aspects. Lido, a community-run validator collective, controls over 30% of the stake on Ethereum’s PoS chain. Coinbase, Kraken and Binance — three of the largest crypto exchanges — own another 30% of the network’s stake. That reads as a few key players being trusted with the keys to the kingdom.

That said, Ethereum's $60 billion ecosystem of cryptocurrency exchanges, lending companies, non-fungible token (NFT) marketplaces, and other apps are now supposedly more secure and scalable.

Perhaps more important for our readers and PC enthusiasts (granted, some of which likely did plenty of mining), The Merge and the PoS transition finally put an end to GPU mining on the Ethereum network, which has been online since July 2015. Speculation prior to The Merge was that this would lead to a flood of used graphics cards from AMD's RX 6000-series and Nvidia's RTX 30-series hitting secondary markets. The result is that graphics cards that are already selling at a discount, such as the $680 RX 6900 XT, could fall even further.

Until yesterday, the Ethereum network counted around 900 TH/s of primarily GPU-driven computing power. That's the equivalent of roughly 9.5 million RTX 3080 cards, but more likely a large mix of slower and older GPUs were also participating — meaning there was probably closer to 20 million GPUs involved with Ethereum mining, give or take. This doesn't necessarily mean that a mix of 20 million cards are going to suddenly hit the market, of course. If miners do choose to offload their graphics cards, though, Nvidia and AMD could see some difficulty in selling new graphics cards at retail.

At least some graphics cards have been put to work on alternate mining cryptocurrencies such as Ethereum Classic (whose hash rate has already doubled since The Merge, up to 158 Terahashes per second) and Ravencoin (also almost doubling from 8.9 TH/s up to 15,9 TH/s). But the more miners turn to these coins, the higher the mining difficulty imposed by the network, which will drive profits down. Cryptocurrencies using PoW generally follow a formula that adjusts the difficulty of the algorithm to control the flow of new coins into circulation. This means more people are competing for a limited resource, and if price doesn't surge in lockstep with hash rates, the profitability of mining will plummet.

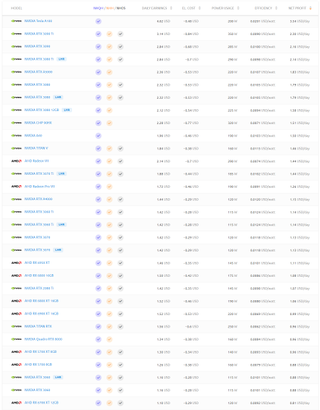

Above, you can see the data from NiceHash's Mining Hardware page, which is still based on the pre-Merge values. We ran some quick tests, using NiceHashMiner (and NiceHash's QuickMiner) to see where things stand right now. Prior to The Merge, a GPU like the RTX 3090 could gross around $2.80 per day and the RTX 3080 sat around $2.30 per day, almost entirely thanks to Ethereum mining. Now? Oh boy, how things have changed.

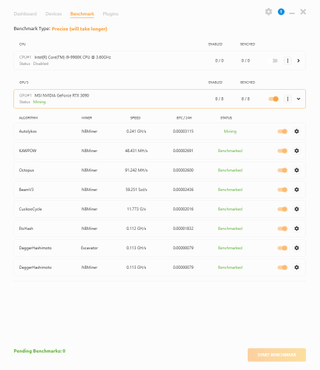

An RTX 3090 running NiceHash Miner decided Autolykos with the most profitable choice for mining. At 245 MH/s, it was bringing in BTC equivalent to around $0.65 per day, while the PC consumed 400W (about 330W from the GPU). Ethereum Classic meanwhile ran at 120 MH/s and consumed the same 330W, potentially bringing in $0.33 per day. At a baseline estimate of $0.10 per kWh, that's $0.80 in power used by the GPU per day, and $0.96 for the entire PC, meaning every coin right now is well into the unprofitable range with NiceHash.

Here's the full set of NiceHash Miner benchmarks for the RTX 3090, running the latest version 3.1.0.0 of the software. The GPU was tuned for memory intensive workloads like Ethereum, however, so these results should only be taken as a rough baseline of what could be achieved.

What about direct mining? WhatToMine's RTX 3090 data suggests you could gross up to $1.35 per day with mining Ergo (ERG) mining, which uses the Autolykos algorithm. GPU power might be tunable to as little as 260W, which means you could potentially net $0.70 per day. That's still far less than half of what the RTX 3090 was doing prior to The Merge, and it remains to be seen if any coin can emerge from the collective with sustainable mining profitability on GPUs in a post-Ethereum world.

The abandonment of GPU mining also means that Ethereum is improving its energy efficiency by leaps and bounds. Since graphics cards no longer need to run complex computations to power and secure the network, Ethereum's energy consumption footprint (and carbon footprint) has been reduced by 99.9%, simultaneously cutting worldwide power consumption by 0.2% (which is still much less than the worldwide energy consumption of electronics left on standby, by the way).

Interestingly, no price-action occurred for Ethereum post-Merge, positive or negative. That's partly because most exchanges put a freeze on Ethereum trading while waiting for the network transition to take place. It's also possible that speculation had already made its way into the pricing over the past few weeks, especially since the last successful testnet for the Merge, Goerli, occurred little more than a month ago.

While the main Ethereum network has done away with GPU mining, existing communities of miners may still attempt to keep their cash-cow running. Several proposals to copy the Ethereum blockchain while keeping mining capability (also known as a hard fork of the network, which we've seen happen with Ethereum Classic) have gained some ground within the mining community. Making a new coin based on an existing coin isn't difficult; the real problem will be convincing the cryptocurrency users of the utility of such a coin, to give it some perceived value.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

LolaGT We will see.Reply

It will be interesting to watch to see if there is an influx of more used GPUs on ebay or other places as new or used cards like 3080s are still ridiculously overvalued. -

lmcnabney ReplyLolaGT said:We will see.

It will be interesting to watch to see if there is an influx of more used GPUs on ebay or other places as new or used cards like 3080s are still ridiculously overvalued.

I believe there is a lot of pent-up demand for modern GPUs. I've been putting off a new build through the pandemic (sitting on a i5-4670k and 1080) and the PC market spent the 1H of 2022 in the doldrums. Getting realistic prices back on GPUs will help revive the market a bit. -

husker One does not have to understand cyber mining, cryptocurrency, blockchains, or any of that to understand this: When something takes a lot of effort to produce, it becomes worth something to somebody. When something suddenly takes a lot less effort to produce, it is going to become worth a lot less to somebody. You don't need a high end GPU to do that math.Reply -

A Stoner If the 3080 prices come down enough, i might buy a couple for the kid's computers. Otherwise, I am planning to get in on the new RTX 4000 series depending on the 4090 price.Reply -

helper800 Reply

I would bet the farm the 4090 is going to be 1800+ dollarsA Stoner said:If the 3080 prices come down enough, i might buy a couple for the kid's computers. Otherwise, I am planning to get in on the new RTX 4000 series depending on the 4090 price. -

JarredWaltonGPU Reply

That's possible, but I suspect most people will be more interested in the RTX 4080. I still think there's a reasonable chance Nvidia will put the 4090 at $1,499, the same as the RTX 3090 at launch — whether it will sell for that or not is a different matter.helper800 said:I would bet the farm the 4090 is going to be 1800+ dollars -

Eximo Replyhelper800 said:I would bet the farm the 4090 is going to be 1800+ dollars

Launch price for the 3090 was $1500, they could stick to that and do a $2000 launch for the 4090Ti if they do one.

If they do a simultaneous launch, they could also stick the 4080 Ti at $1200 and the 4080 at $1000. That would keep the $700 3080 in a reasonable spot compared to a $700 4070. -

irish_adam ReplyEximo said:Launch price for the 3090 was $1500, they could stick to that and do a $2000 launch for the 4090Ti if they do one.

If they do a simultaneous launch, they could also stick the 4080 Ti at $1200 and the 4080 at $1000. That would keep the $700 3080 in a reasonable spot compared to a $700 4070.

They charge what the market will bare, you can't charge $2000 for a card when your previous gen top card is selling for $500. When they released the last gen we were in a silicon shortage so they got away with stupid prices.

This time they have to compete with their own products that they have an over supply of let alone the second hand market. -

Eximo You underestimate what enthusiasts are willing to pay for the latest version of a product. They certainly can and have charged more for top end 'consumer' products.Reply

Titan RTX launched for $2500, and it sold. Titan V, $3000. You have to go all the way back to Pascal for 'reasonable' prices, and even then the Titan Xp was $1200. That tested well, so the launch price of the 2080Ti was $1200. Now they are looking at 80Ti as a step or two below flagship.

You have to realize that I am talking about MSRP, set by Nvidia, not the street price these things ended up at. Your higher end models are always going to be $100 or more expensive as well.

Most Popular