Goals of 'Made in China 2025' Are Unachievable: Tsinghua Professor

China can currently produce 41.4% of its chip needs.

The goals of China's 'Made in China 2025' program cannot be achieved, according to a report by DigiTimes that cites Wei Shaojun, a professor at Tsinghua University and Deputy Chairman of the China Semiconductor Industry Association. Not only will Chinese chipmakers not be able to satisfy 70% of the local IC demand in 2025, but their profitability, capitalization, and ability to invest in development are greatly behind those of their rivals.

In a recent address at the China Nansha International IC Industry Forum, Wei Shaojun pointed out that despite a rise in the value share of domestically produced chips from 13% in 2013 to 41.4% in 2022, the ambitious goal of reaching a 70% self-reliance rate for semiconductors, a key objective of the "Made in China 2025" initiative, seems nearly unattainable. That's due to the current global shifts that made both U.S. and Europe fund their semiconductor sectors from the governments' pocket.

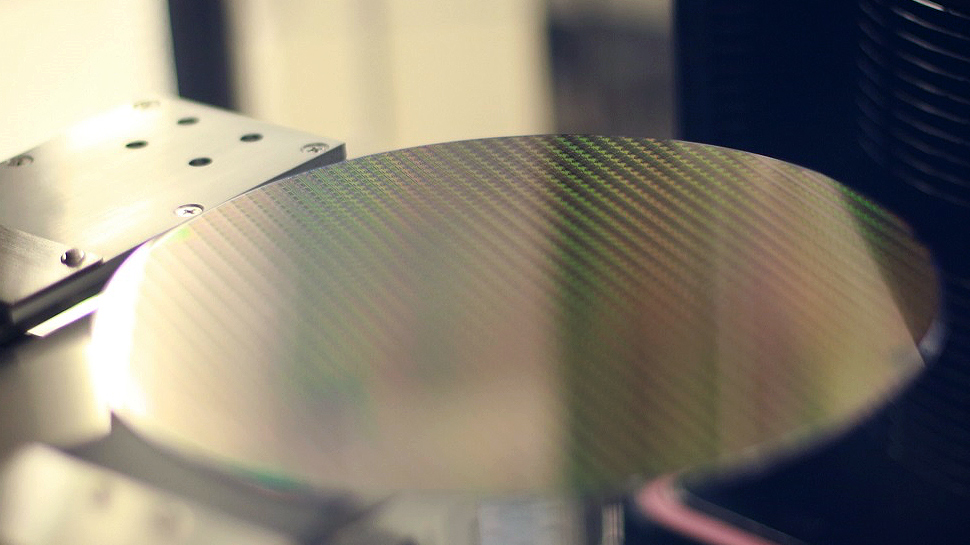

Wei highlighted an imbalance between supply and demand in China's IC design sector, pointing out that while the monthly demand of the country is about 1.5 million 300mm wafer starts per month (WSPM), domestically owned Chinese semiconductor producers can only provide a monthly output of 440,000 WSPMs.

The professor from Tsinghua University, an organization that has been particularly instrumental in the development of the local IC sector, underscored a critical misapprehension regarding the advancement of China's chip fabrication sector over the last ten years.

The accelerated growth of China's semiconductor production industry was largely due to foreign companies operating within the country. From 2016 onward, Chinese investor-owned semiconductor companies have experienced an average compounded annual growth rate (CAGR) of 14.7%. Yet, non-Chinese wafer fabrication enterprises from Taiwan, South Korea, and elsewhere, have seen a higher CAGR of 30%. This not only doubles the expansion pace of Chinese-owned businesses but also underlines the continued reliance on external assistance in China's semiconductor manufacturing industry.

The highly ranked executive of the China Semiconductor Industry Association also noted that the Chinese publicly traded semiconductor companies are currently underperforming, marked by the IC design sector's low gross profit margins.

Amid the AI boom that skyrocketed Nvidia's market value to over $1 trillion, Wei Shaojun pointed out that 135 Chinese semiconductor firms on China's STAR and ChiNext markets have a combined value of less than half of Nvidia's. Moreover, these firms' average gross profit margin of 39.1% in 2022, particularly 34.2% for the STAR-listed IC design companies, is significantly lower than the over 60% enjoyed by U.S. chip developers indicating that Chinese companies are still operating at lower profitability levels.

Judging by what we've seen from China's domestic CPU and GPU efforts, there's a lot of work remaining before it will close the gap.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

bit_user It's nice to see some hard data behind his claims, but did anyone realistically think otherwise?Reply

Even when we first heard about "Made in China 2025", it seemed unattainable. At the time, I figured they must be aware of that, but decided to set a lofty goal anyway, perhaps for inspirational reasons ...or maybe pride? -

pug_s Anton is wrong about "Made in China 2025" policy is and it is not all about semiconductors. Go to the wikipedia page it also mentions about IT, Robotics, Green Energy and Green Vechicles, Aerospace, high tech ships, railway equiopment, power equipment, new materials, medicines, and argiculture. Almost all of them they made much more headways than in semiconductors. Despite not reaching the 70% in 2025, 13% in 2013 to 41% in 2022 is considered significant, no?Reply -

The Historical Fidelity Reply

Yes and no, Chinese companies conducting business in market sectors affected by CCP 5 year plans have always benefitted from heavy government subsidies, now that western nations are beginning to subsidize their equivalent market segments, we are seeing a more level “input” playing field where western companies achieve more efficient “output” CAGR than Chinese companies. Some might say the de-centralized economic style of western nations plays a beneficial role in this vs the centralized economic style of China. However this is just speculation on my part. It would be interesting to do a deeper dive in this topic.pug_s said:Anton is wrong about "Made in China 2025" policy is and it is not all about semiconductors. Go to the wikipedia page it also mentions about IT, Robotics, Green Energy and Green Vechicles, Aerospace, high tech ships, railway equiopment, power equipment, new materials, medicines, and argiculture. Almost all of them they made much more headways than in semiconductors. Despite not reaching the 70% in 2025, 13% in 2013 to 41% in 2022 is considered significant, no? -

IamNotChatGpt Reply

No. Acceptable, if anything.pug_s said:Anton is wrong about "Made in China 2025" policy is and it is not all about semiconductors. Go to the wikipedia page it also mentions about IT, Robotics, Green Energy and Green Vechicles, Aerospace, high tech ships, railway equiopment, power equipment, new materials, medicines, and argiculture. Almost all of them they made much more headways than in semiconductors. Despite not reaching the 70% in 2025, 13% in 2013 to 41% in 2022 is considered significant, no? -

pug_s Reply

The whole point of government subsidies is to help spur growth in a particular sector. This is what many countries do and not just in China. A success story as the result of this Made in 2025 policy is its EV vechicles. In the first few years the government has been subsitizing the Chinese car makers and couldn't compete of the likes of Tesla. Now the Chinese government has eliminated those subsitidies and is extremely competitive despite not having it.The Historical Fidelity said:Yes and no, Chinese companies conducting business in market sectors affected by CCP 5 year plans have always benefitted from heavy government subsidies, now that western nations are beginning to subsidize their equivalent market segments, we are seeing a more level “input” playing field where western companies achieve more efficient “output” CAGR than Chinese companies. Some might say the de-centralized economic style of western nations plays a beneficial role in this vs the centralized economic style of China. However this is just speculation on my part. It would be interesting to do a deeper dive in this topic. -

The Historical Fidelity Reply

https://auto.hindustantimes.com/auto/electric-vehicles/chinas-abandoned-car-graveyard-holds-chinese-ev-makers-secret-details-here-41687318239590.htmlpug_s said:The whole point of government subsidies is to help spur growth in a particular sector. This is what many countries do and not just in China. A success story as the result of this Made in 2025 policy is its EV vechicles. In the first few years the government has been subsitizing the Chinese car makers and couldn't compete of the likes of Tesla. Now the Chinese government has eliminated those subsitidies and is extremely competitive despite not having it.

The Chinese EV industry is rittled with market and investor manipulation so not a strong rebuttal. This tactic has been seen in many sectors, the most notorious is the bike-sharing market where dozens of startups manufactured hundreds of thousands of bikes to gain government subsidies then the owners running away with the money. The density of bikes on the streets became so bad that now almost every city in China has a bike-sharing graveyard.

https://www.cbc.ca/documentaries/documentary-channel/inside-one-of-china-s-hidden-bike-sharing-bicycle-graveyards-1.6325287

Not to mention the hundreds of cases where their EV’s seemingly ignite into fireballs. -

pug_s Reply

Lol, you quoted an article from Serpentza and Hindustantimes which are biggest producers of anti-China fake news propaganda. As for bikes, the government ended subsidies a long time ago and not even listed in Made in China 2025 campagain.The Historical Fidelity said:https://auto.hindustantimes.com/auto/electric-vehicles/chinas-abandoned-car-graveyard-holds-chinese-ev-makers-secret-details-here-41687318239590.html

The Chinese EV industry is rittled with market and investor manipulation so not a strong rebuttal. This tactic has been seen in many sectors, the most notorious is the bike-sharing market where dozens of startups manufactured hundreds of thousands of bikes to gain government subsidies then the owners running away with the money. The density of bikes on the streets became so bad that now almost every city in China has a bike-sharing graveyard.

https://www.cbc.ca/documentaries/documentary-channel/inside-one-of-china-s-hidden-bike-sharing-bicycle-graveyards-1.6325287

Not to mention the hundreds of cases where their EV’s seemingly ignite into fireballs. -

The Historical Fidelity Reply

Pictures and videos of the mass Chinese EV graveyards don’t lie. I didn’t quote the article or serpentza, the pictures were the point. And the bikes comparison was used to point out the trend with Chinese companies to overproduce in order to manipulate the government subsidies market and private investments.pug_s said:Lol, you quoted an article from Serpentza and Hindustantimes which are biggest producers of anti-China fake news propaganda. As for bikes, the government ended subsidies a long time ago and not even listed in Made in China 2025 campagain.