Intel Dominates Chip Revenue Forecast, TSMC, AMD, Nvidia Gaining

The wafer race is on

The coronavirus has thrown the world economy into a tailspin, but according to industry soothsayer IC Insights, that hasn't slowed down the semiconductor industry. Instead, chipmakers are enjoying booming sales — the firm projects that sales will swell 13% for the entire industry in 2020, twice the original forecast. That's quite the bounceback from 2019, which found industry revenue shrinking by 15%.

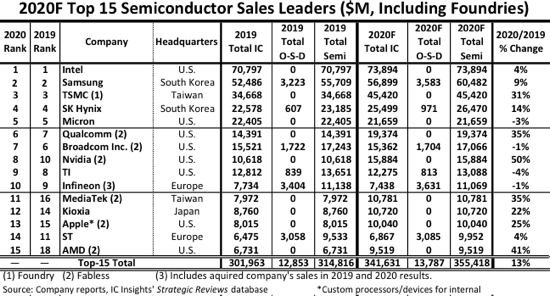

The list is built off of the firm's projections for the final 2020 revenue results, and given that we're in the final stretch of 2020, it should be close to the final numbers. The report also reminds us that AMD, Apple, and Nvidia all lack Intel's sheer production volume — Intel generated twice the revenue of those three companies, combined.

Intel continues to post impressive revenue even as it faces an uncertain future due to its continuing manufacturing challenges. As expected, Intel should cling to its leading position in the market with $73.89 billion in IC sales this year. That's an increase of four percent over 2019. Samsung comes in a close second, but there's still quite the gap — it's revenue trails Intel's by 22%.

TSMC lands in third place, but this pure-play foundry has fast become the world's foundry, and its 31% growth rate eclipses Intel's. It isn't surprising that this growth comes as the fruits of the company's success with the 7nm node, and the continuing ramp of 7nm production and the debut of its highly-anticipated 5nm process next year should hasten its rate of growth. Intel is projected to generate ~63% more revenue than TSMC this year, but it's rational to think that delta will shrink significantly next year.

The list includes companies that don't make their own chips, too. The hard-charging AMD appears on the top 15 semiconductor sales leaders list for the first time, landing in fifteenth place with a 41% increase in revenue, propelling it from its previous position in eighteenth place.

Putting AMD's projected $9.5 billion in IC sales next to Intel's $73.9 billion is a stark reminder that AMD's startling comeback truly has happened against all odds: Even after AMD's three years of explosive growth, Intel's revenue is still 7.8 times larger. That also explains the market's optimism for AMD; there's plenty of room to steal share from Intel, and that appears to be moving along swimmingly. Things should accelerate for AMD this year, too, as its performant Ryzen 5000 processors now lead Intel's, and its Radeon RX 6000 series GPUs have proven to be a formidable foe to Nvidia's Ampere. Now all AMD needs is more supply from TSMC to accelerate its rate of growth (which may be difficult to get).

Interestingly, Apple, the lone producer on the list that doesn't sell chips to the open market, lands in 13th place, beating AMD by ~5.5% and notching a 25% year-over-year growth rate. Now that Apple is in the desktop PC chip design game with the Apple M1 chips, we could see even larger growth next year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

In terms of yearly revenue growth, Nvidia, another fabless chip company, has the best showing with a projected 50% yearly increase in revenue, reaching the tenth spot on the 2020 projections list. That's a lot of GeForce and data center graphics cards, but it's important to note that while Nvidia's growth is explosive, we aren't sure if that includes its Mellanox acquisition. Also, Nvidia's latest generation of graphics cards isn't even fully on the market yet - shortages are impacting the entire industry, and Nvidia is no exception. Given the popularity of the Ampere series, we could see the company post even larger gains next year if supply stabilizes.

The stellar growth in the semiconductor industry is largely spurred by the pandemic, and the unanticipated demand has punished all of these companies with a series of rolling shortages. For now, the challenge is for those companies to carefully manage any production expansions to prevent sudden and massive oversupply conditions as the pandemic eventually recedes. An oversupply isn't good for business or profits, so we can expect a slow-but-sure expansion of chip production, which could restrict potential short-term growth rates.

That also means that, despite the money the semiconductor firms are shoveling into their coffers at an astounding rate, it might not be easier to score a leading CPU or graphics card any time soon.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

Co BIY The strategic implications are a bit confused by combining the fabless companies with those who have fabs but I guess that reflects the market. The double counting of revenue between the designers and their fabs actually means intel is more dominant than this chart would suggest.Reply

Really looks like a big three that can actually produce the chips. This has implications about how fast Intel competitors can grow if they compete with each other for production opportunities and how much of their profits TSMC can lay claim to.

Intel's move to the "low" or mainstream market makes more sense to me now.

Where did Global Foundries go? -

JayNor "...it might not be easier to score a leading CPU or graphics card any time soon."Reply

general comments indicate that GPUs are harder to get than CPUs.

Intel's entry into the discrete GPU market is happening faster than I expected. They are already shipping DG1 and SG1, sampling Xe-HP and Xe-HPG has been in the lab since mid-summer.

The GPU shortage sets up a situation where Intel's GPUs could achieve higher market share than anticipated... especially since Xe-HPG could be creating even more demands on TSM capacity available to competing GPUs.