Intel's Gelsinger Likens Xeon vs AMD EPYC to 'Knife Fight in a Phone Booth'

Intel isn't afraid to get bloody in its fierce battle with AMD in the server CPU market.

Intel CEO Pat Gelsinger is known for using colorful language to describe the not-so-friendly rivalry between his company and AMD in the CPU business. Gelsinger recently added to his repertoire in an interview with Bloomberg, reiterating that Intel has "reasserted leadership [with Alder Lake]" and that "we're looking out the windshield and AMD is in the rear-view mirror."

But Gelsinger went on to admit that the server market has been highly contested in recent years and that AMD has been a formidable foe as it gobbles up market share. Somewhat comically, Gelsinger likened the tussle between Intel [Xeon] and AMD [EPYC] to a "knife fight in a phone booth." While the imagery of that statement is quite amusing in its own right -- considering how brutal fighting with knives in such close quarters would be -- the choice of a phone booth is definitely "old school."

While Gelsinger admits that its Client Computer Group (i.e., Core processors) is its most significant business (by revenue), the Data-centric Business (which includes Xeon processors) is still highly profitable and essential to the company. And as we saw yesterday following AMD's Q4 2021 earnings report, Intel's primary competitor is firing on all cylinders with a 50% year-over-year growth in revenue to $4.826 billion ($16.434 billion for the whole year). Some of the growth inevitably comes at the expense of Intel.

AMD's server surge also helped boost its gross margin, which climbed to 51% for 2021. For comparison, Intel is not that far ahead at around 52% gross margin. And to see just how far AMD has come following the arrival of Zen, Intel stood at a 63% gross margin just a half-decade ago compared to 31% for AMD.

More importantly, AMD CEO Dr. Lisa Su explained, "[Datacenter platform] revenue more than doubled year-over-year and increased by a double-digit percentage sequentially driven by demand across both cloud and enterprise customers. In the cloud, revenue more than doubled [YoY] as the largest providers expanded internal deployments and more than 130 new AMD powered instances launched from Amazon Web Services, Alibaba, Google, IBM, Microsoft Azure, and others."

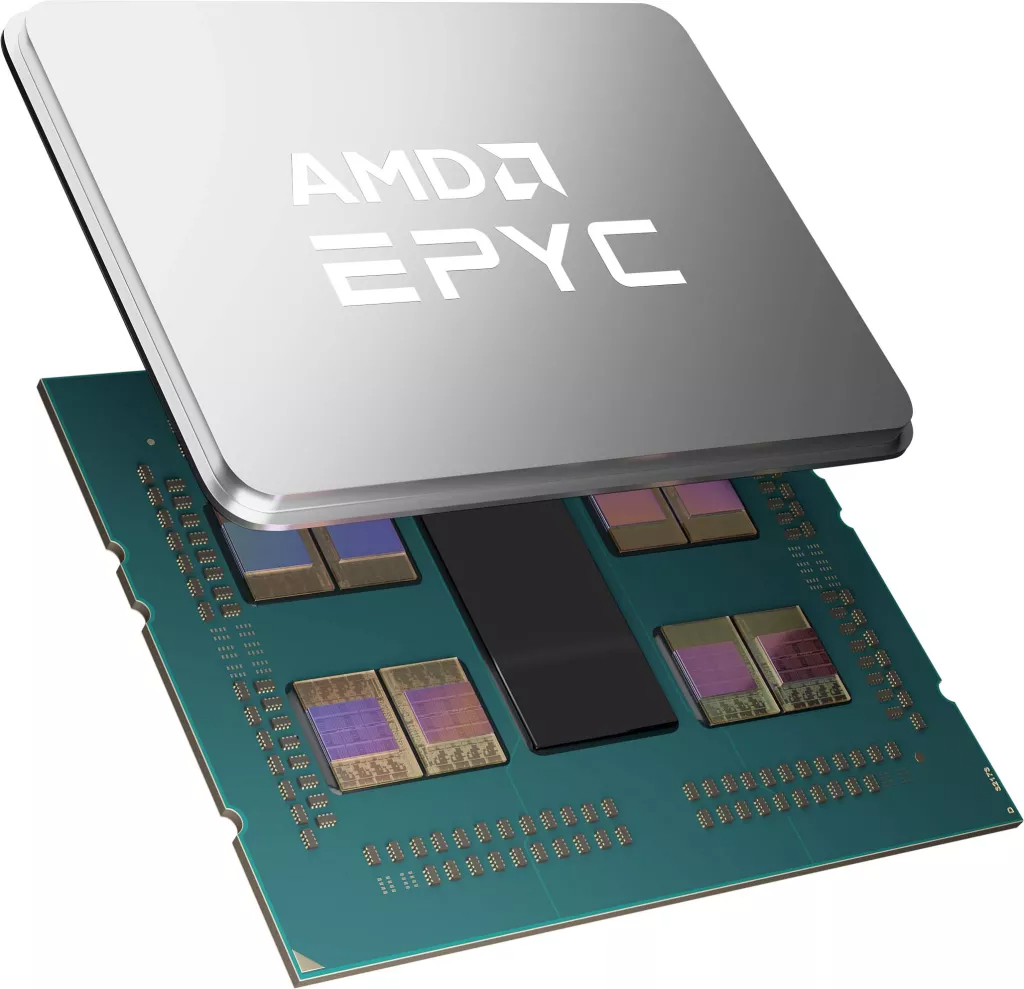

AMD is not letting off the gas either, as its third-generation EPYC Milan-X processors featuring 3D V-Cache technology are currently sampling. AMD promises that HPC instances with 3D V-cache can deliver up to an 80% uplift in performance depending on the application. The company also has an impressive roadmap for its Zen 4 products this year, including its Genoa and Bergamo server processors that will compete with intel's Sapphire Rapids Xeons.

According to the most recently available market share data from Mercury Research (Q3 2021), Intel still commands 75% of PC CPU sales compared to 24.6% for AMD. In the lucrative server CPU segment, Intel stood at an 89.8% share in Q3 2021 compared to 10.2% for AMD. However, the critical point here is that AMD's market share was only 6.6% in Q3 2020.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Brandon Hill is a senior editor at Tom's Hardware. He has written about PC and Mac tech since the late 1990s with bylines at AnandTech, DailyTech, and Hot Hardware. When he is not consuming copious amounts of tech news, he can be found enjoying the NC mountains or the beach with his wife and two sons.

-

dalek1234 This guy is delusional. I'd say it's more like knife-less Intel is stuck in a phone booth, while AMD is launching nukes at the booth from far away.Reply

Out of the entire CPU stacks the two companies produce, it's the server CPUs where Intel is the furthest behind AMD in terms of performance/efficiency/cost/Cores...you name it. -

hotaru251 only "bloody" intel can currently do is sell at a loss and hope ppl will buy them that way. (and many wont as space is limited and prefer fewer better than worse but many)Reply -

spongiemaster Reply

Not really. Right now, AMD sells everything they can produce, which appears to be about 10% of the server market. Then Intel sells at whatever price they feel like to the other 90% of the market because there is no one else to buy from. They're still at over 50% margins. They aren't selling anything at a loss.hotaru251 said:only "bloody" intel can currently do is sell at a loss and hope ppl will buy them that way. (and many wont as space is limited and prefer fewer better than worse but many)