Intel Uncertain About Near PC Future, Windows 8 Impact

Over the past decades, Intel has always been an early indicator of economic trouble in IT and it has always been the spearheading horse to pull an entire industry out of a downturn. This time may be different.

If there is a single sentence that can summarize the company's Q3 earnings call, it would be, "We just don't know."

Intel's quarterly result was slightly above the previous guidance and came in at revenue of $13.5 billion, and net income of $3.0 billion. That is not exactly shabby, but does not reflect some tough spots. PC client revenue was down 8 percent from last year; server CPU revenue were up 6 percent from last year, but down 5 percent sequentially; and other architecture group revenue was down 14 percent year over year. Conclusively, Intel said that Q3 revenue reflected "a continuing tough economic environment."

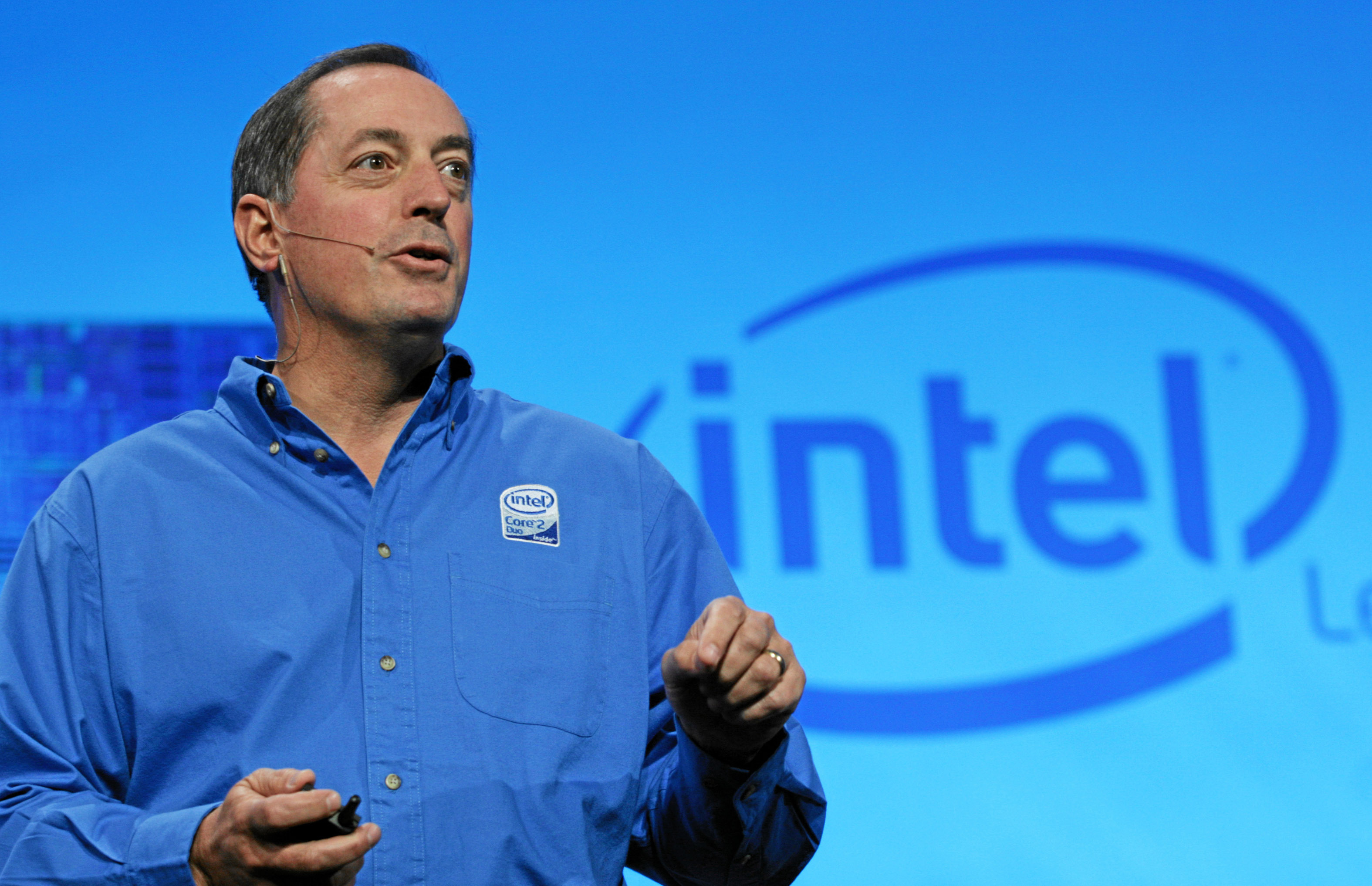

Of course, Intel has prepared itself with a strong product offering for the year-end finish line and it has fueled the ecosystem with pretty much everything it could to spark innovation. For example, it sent out its engineers to help vendors to design their products and fine-tune them to meet performance expectations. Compared to previous product launches, this has been an unprecedented effort in its scale. During the earnings conference call, CEO Otellini stressed that there will be more than 140 Core-based Ultrabooks to be launched with Windows 8, 40 of which will feature touch screens. The $699 price point will be met and there will be even "bridge SKUs" that will beat that price, he promised. The executive also noted that there will be a handful of Ivy Bridge-based enterprise tablets in Q4, as well as about 20 Clover Trail-based consumer-targeted designs running Windows 8.

This is everything but a weak showing for an operating system launch as disruptive as Windows 8. So. it is even more puzzling how much doubt Intel expressed about the near future of the PC market. There seem to be so many variables in play at this time, and so much uncertainty about the consumer market that even Intel appears to have become uncertain about what to expect. Otellini said that "Q3 PC sales grew approximately half of the seasonal norm and reflected flat enterprise sales." Some improvements were seen at the end of the quarter due to Windows 8 system production, the CEO stated. However, for Q4 Otellini noted that Intel expects that the "overall PC business will grow at about half" of what is typical for the seasonal change. Keep in mind that this is not your average Christmas season. This is the season when Microsoft launches its most disruptive operating system since Windows 95 -- and a season that builds on an already slow quarter that reflected half of the normal seasonal growth.

Intel is apparently creating very low expectations but, in the end, it's better news to beat a low guidance than miss an overly confident forecast. But "half" the growth is pretty dramatic from every point of view, especially when we consider the impact a new Windows launch should have. Otellini remained rather distant from the expectation of Windows 8 sales, but said that Intel's "customers are taking a cautious inventory approach in the face of market uncertainty and the timing of the Windows 8 launch."

Chief financial officer Stacy Smith added that Intel's unit inventory levels are too high at this time, since the already-reduced expectation from September has not materialized yet, causing the company to scale back its utilization to bring back inventory to a much more healthy level. He also hinted that Intel is not relying on seasonality as a sales guidance anymore, which is remarkable in itself. "What we are seeing in the back-half of this year," Smith said, "I am less convinced that normal seasonality is a great guide. What we are seeing is that the customer is managing things very cautiously. Depending on how our sales go, I think we can have multiple different outcomes for [the upcoming] Q1."

On a product level, Otellini noted that it is not entirely clear to Intel what variables are impacting the current flatness in the PC market at which level, leaving an analyst to question whether the PC market could return to normal growth rates with a rather sketchy answer. He mentioned that he does not believe that the tablet is the final computing device the market is trending to at this time, but believes that currently created devices that combine notebooks with the features of a tablet are more likely to prevail and become the "high-volume runners". However, he also noted that he has no idea what this device will be and that he "honestly will not know for 12 months".

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Some other topics of the earnings call included the switch to 14 nm processor production and how efficiently Intel will be able to do that. But all the upsides were not able to clear any doubts that Intel has a way out of the current slump. The last time this happened in a similar severity, following the dotcom bust, Intel aggressively pitched the investment and innovation path and the claim that only innovation can save the industry from an even deeper fall. Sure, Intel has innovation in its pockets as well, and it counts on a strong innovative showing from its customers, but the tone is much more subdued and, subjectively, less optimistic.

It is this uncertainty that may create even more concern and may raise some doubt about the real potential of Windows 8.

Wolfgang Gruener is an experienced professional in digital strategy and content, specializing in web strategy, content architecture, user experience, and applying AI in content operations within the insurtech industry. His previous roles include Director, Digital Strategy and Content Experience at American Eagle, Managing Editor at TG Daily, and contributing to publications like Tom's Guide and Tom's Hardware.

-

Benthon hastenVista wasn't a complete change in concept though...Reply

From XP? I'd say it was almost as drastic as 8 is from 7. -

ivanto WTF? "for an operating system launch as disruptive as Windows 8"Reply

What is disruptive about Windows 8? It's Windows 7 with a strap-on of MCE/Metro GUI App. What does Win8 disrupt ?

Android and iOS are disruptive by definition - cost less or free, are not as good as existing OSes (like Win7/Linux/OSX) but give users something they value more (easier to use touch UI and Apps in the pocket).

But, I wish MS good luck, would hate to see them going down because consumer will loose with lesser competition.

-IvanTO -

jojesa Windows 8 is very good OS on touch screen devices. I would not install it on my desktop or laptop though even if I get new systems.Reply

-

chewy1963 I think Win 8 is going to put a butt hurt on both Intel and MS. Especially on the desktop segment. This would be a perfect time for someone to come up with a great OS for desktops and laptops. I really like Ubuntu (with Gnome UI), but it needs a better software ecosystem then it has now. I dual boot Win 7 and Ubuntu 12.4 lts and Ubuntu seems much more efficient (CPU/RAM wise) for things like watching movies and web browsing. But I end up using 7 (great OS IMO) for most things because the quality of many applications is just so much better than Ubuntu 'equivalents' (if available at all).Reply -

house70 Big corporations ignore the fact that there is a global recession going on? They expect to keep making the same kind of profits as they did before that?Reply

Get a grip.

BTW, just because your bottom line is a bit smaller than last year doesn't mean the whole PC industry is doomed. You just have to tighten your belts a bit, like everyone else, roll with the punches, suck it up and ride it out. People will still need computers, even if they buy them less often than before. Same goes for other corporations, like you.

"PC-doom" Gruener is back. -

bison88 Windows 8's biggest failure is that nobody needs it. There was a logical step to take going from XP to Vista, although Microsoft blundered it with lack of Software and Hardware developer support, Windows 7 was simply a correction to Windows Vista. Very little under the surface was changed, just fixed for the mainstream out the box. Most big changes came with Vista under the hood.Reply

Windows 8 really doesn't have a place nor a reason for being based off just what I've seen and read from the white sheet. Whether you love it or hate it matters not. There was no need to spend 3 years building Windows 8 for the PC at all since the focus always has been on the mobile platform for the OS.

I remember a year prior to Windows 7 all my IT professors and students were just constantly talking about Windows 7 and how much it righted Vista's wrongs. Now all I hear from my IT professors and fellow colleagues every time (and only when randomly brought up), is how much Windows 8 is the silliest thing ever. The groans around the room are priceless. -

tului If they'll ever get virtual machine GPUs where they can use IOMMU or some other sort of pass through and get 90+% native performance I can relegate Microsoft's crap to a VM. As it stands I have to dual boot for games. Microsoft's Windows 8 has done nothing to help the PC ecosystem/economy.Reply

Intel's constant innovation and attempts to make inroads into the SoC sector can do nothing but good for consumers, at least in the short term. Sure they might make a bit less, but as a previous poster said, the global economy is on the ropes. Are investors really so greedy that they can't stomach reduced growth for a couple of quarters? Normal people deal with no growth in their paychecks for years at a time. -

southernshark I am looking forward to Windows 8.Reply

I do not believe that serious enthusiasts are upset about Windows 8.

Rather it is the dumbs.... the people who can't figure out how to turn Metro off... the seriously stupid LOL KATS crowd who slurk along the mainstream pathways of the cybernet. -

mightymaxio Windows 8 is awesome, I love the new OS been running it since the start of my dreamspark premium membership. For those who don't like change such as Metro use classic shell which has been around for ages. It changes it to Windows 7 UI with all the improvements 8 has on speed.Reply