Nvidia, AMD Stocks Up Sharply as AI Drives Chip Demand

Nvidia shares are up nearly 30% and AMD nearly 10% in afterhours trading.

Nvidia published its latest set of quarterly financials after markets closed on Wednesday evening. Reading the first paragraph of the press release is hardly inspiring, with mention of typical ups and downs in revenue trends. However, Nvidia shares have seen incredible interest overnight, and at the time of writing, they are up nearly 30% in value pre-market. In fact, it appears that Nvidia is on the path to being the first semiconductor chip maker with a $1 trillion market cap.

The reason for the Nvidia boom is little or nothing to do with gaming graphics cards, so popular with which PC enthusiasts and gamers. Instead, the rocket fuel here is Nvidia's pivotal perceived role in accelerating the AI revolution.

"The computer industry is going through two simultaneous transitions — accelerated computing and generative AI," said Jensen Huang, founder and CEO of Nvidia. Huang went on to predict a trillion dollars worth of data center infrastructure being readied for generative AI purposes. Coincidentally, with today's valuation boost, Nvidia is headed to being the first trillion-dollar chip company.

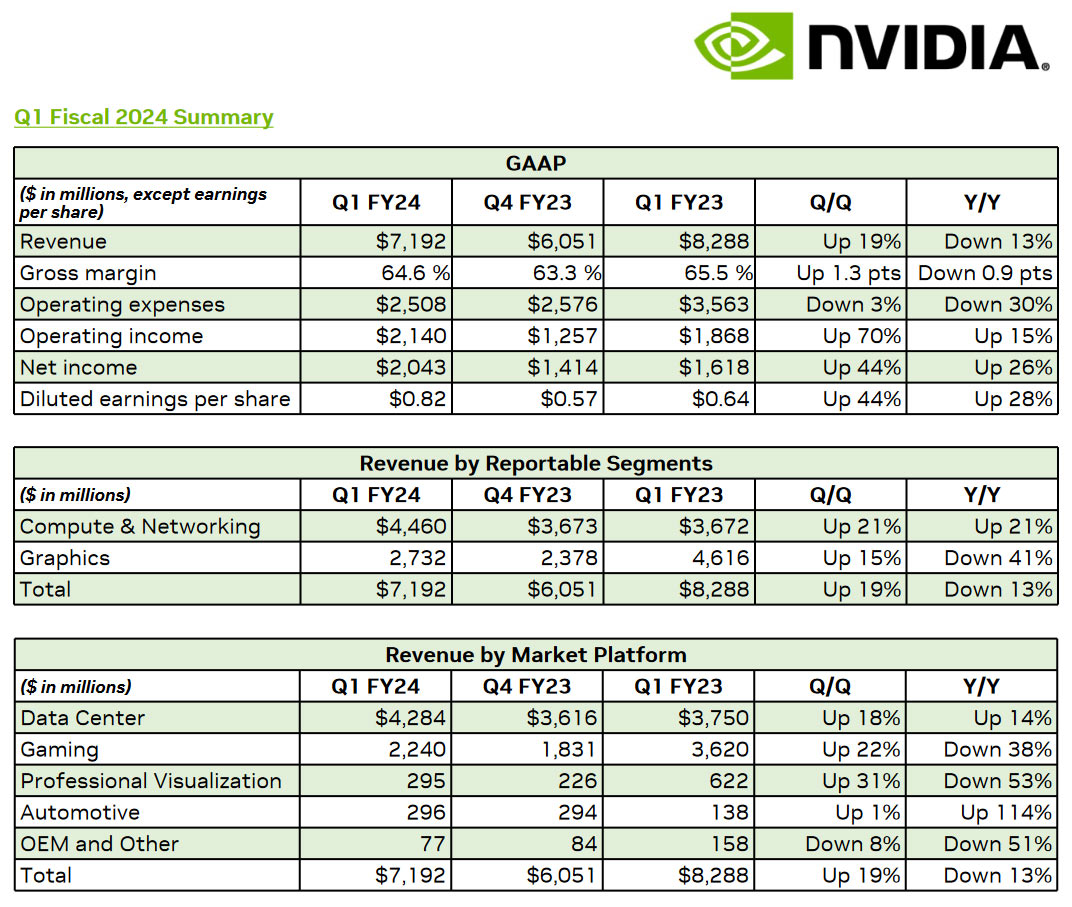

In the above chart, you can see that Nvidia, the PC graphics company that used to talk a lot about data centers, is now firmly a data center accelerator company. This transition has really gripped the company over the last year, after a long time in gestation. The latest figures show that Data Center revenue was almost double that raised by the Gaming division. Also, looking at the changes/trends, you can see the positive momentum is in segments like Data Center, Visualization, and Automotive.

In summary, for Nvidia, it is its forecasts which have gripped investors in the last few hours. Its stronger-than-expected forecast of sales growth of about $11 billion, plus or minus 2%, in the current quarter, is over 50% better than Wall Street had estimated.

Impacts Felt by The Wider Market

The other part of our story today is the impact Nvidia's results are having on the wider chip design and manufacturing landscape. Our headline highlights great news for AMD investors. While the red team might have made no financial announcements yesterday (or today), shares in AMD are up nearly 10% pre-market. That's a nice bonus to wake up to, and it seems to be entirely on the coattails of fierce rival Nvidia.

The good news for AI accelerator designers at both Nvidia and AMD is also good news for the wider semiconductor business, and both ASML and TSMC shareholders have been basking in sympathetic sunshine today. Dutch firm ASML, a key player in the chip manufacturing equipment business, is up over 5% at the time of writing. Additionally, the world's largest contract chipmaker TSMC is up 3.5%. The valuations of shares in these companies are usually quite sticky - they have a lot of inertia - so these movements are pretty strong.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

edzieba ReplyThe reason for the Nvidia boom is little or nothing to do with gaming graphics cards, so popular with which PC enthusiasts and gamers. Instead, the rocket fuel here is Nvidia's pivotal perceived role in accelerating the AI revolution.

That, and the projected $11bn quarterly revenues for Q2 2023. Or pulling in during one quarter what they pulled for the entirety of 2020. Even more optimistic than the recent wafer purchase would suggest.

edzieba said:For an extra 10,000 wafers, that's on the order of 640,000 H100 dies (minus defects that cannot be binned out). Assuming an average of $20k volume pricing per card, and a very conservative 50% yield, that's on the order of $6.4bn in revenue above what was previously expected. Split across 4 quarters, that'd be something like a 50% uptick in datacentre revenue. -

InvalidError Question is: how long is Nvidia's AI gold rush going to last until ASICs dedicated to specific algorithms steal its lunch just like ASICs did with most crypto-mining?Reply -

SlitheryDee62 It feels like nvidia has been laying track for this for much longer than AMD. They've really done a remarkable job predicting where the industry was going. It seems right now that they are reaping the rewards.Reply -

magbarn Doesn't this pretty much mean Nvidia has no reason this gen to lower GPU prices as they're getting fat revenue from AI chip sales? Might be an opportunity for AMD, but they like to grab defeat from the jaws of victory.Reply -

2+2 At this point in Nvidia's life,Reply

PC graphics cars are

Charity.

So we should be grateful for

any bone they give us.