PC Sales Remain Above Pre-Pandemic Levels Despite Recent Declines

Lenovo remains in pole position, Apple surges, and HP declines.

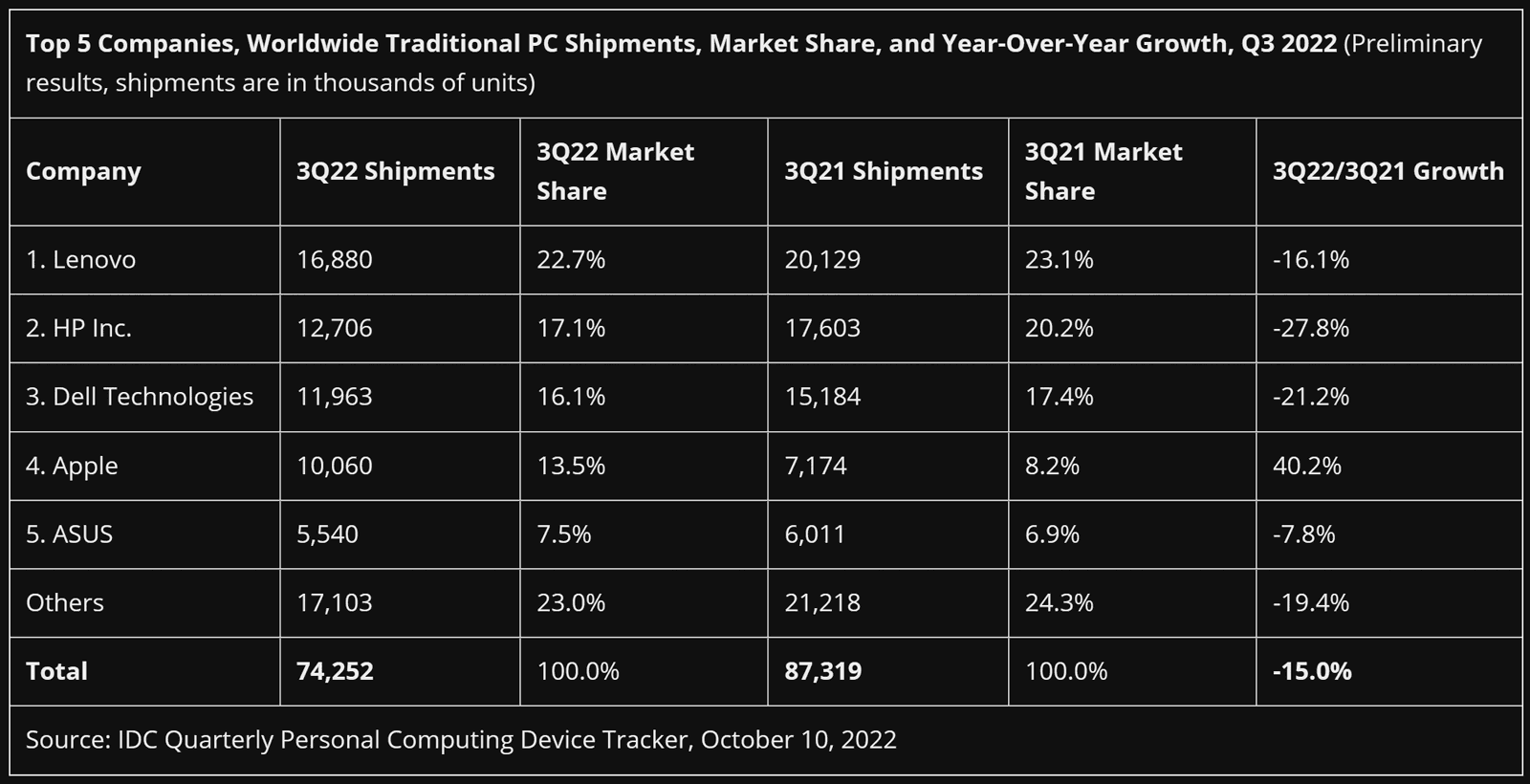

Market research outfit IDC has published its latest data, giving us a measure of the performance of the PC market as we enter the last months of 2022. The significant findings for Q3 2022 are that pre-built PC shipment volumes have remained above pre-pandemic levels. Nevertheless, there is terrible news for the industry overall, as it suffered a 15% contraction year-on-year. As with all these shifts in sales numbers, some PC makers fare better than others. We note that only Apple sold more PCs in Q3 2022 than in Q3 2021, boosting its market share percentage into double figures. On the flip side, it looks like HP was the poorest performer.

In Q3 2022, IDC measured global PC shipments of 74.3 million units. A year ago, in the same quarter, shipments tallied 87.3 million units; thus, there has been a 15% YoY decline overall. It sounds like bad news, but PCs sold in far fewer numbers pre-pandemic, notes IDC. If we go back to Q3 2017 and Q3 2018, for example, PC shipments were flatlining at just above 67 million units. Thus it looks like what inspired consumers to invest in PCs still has some strength post-pandemic.

The raw shipment numbers don’t tell us everything, of course. There has been a notable increase in average selling prices (ASPs) of PC desktops and laptops since the pandemic started. PC makers took advantage of the increased demand and shortages to push a high of $922 per machine in Q1 this year. Recently ASPs have retreated with the onset of the war in Ukraine and recessionary/inflationary pressures reducing household disposable income.

Lenovo is still the PC industry champ, with a 22.7% market share in Q3 2022. It has slipped a little in market share, but more seriously in shipment quantities – with 16% fewer PCs shipped compared to a year ago. Second-placed HP is the worst off, though, losing both market share and sliding almost 30% in shipment volumes. As mentioned in the intro, Apple showed impressive strength in these latest figures. Its market share grew from 8.2% to 13.5% YoY, and its shipments were up by 40%. People are pretty interested / excited by Apple’s recent Apple Silicon transition, which is probably driving both platform upgrades and switchers.

IDC doesn’t single out brands like MSI, Gigabyte, Razer, and smaller firms in its press release stats but offers more profound market research to paying clients. Such brands make up the ‘Others’ category, which has seen a relatively stable transition from 2021 to 2022 in market share terms, but as part of the bigger picture, the group’s shipments are down 19.4%.

Here's a table of the past four years of IDC's worldwide PC shipment details, if you want a slightly longer view of things.

| Header Cell - Column 0 | Q3'22 | Q2'22 | Q1'22 | Q4'21 | Q3'21 | Q2'21 | Q1'21 | Q4'20 | Q3'20 | Q2'20 | Q1'20 | Q4'19 | Q3'19 | Q2'19 | Q1'19 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Lenovo | 16.9 | 17.5 | 18.3 | 21.7 | 19.8 | 20.0 | 20.4 | 22.4 | 19.2 | 17.4 | 12.8 | 17.8 | 17.3 | 16.3 | 13.4 |

| HP Inc. | 12.7 | 13.5 | 15.8 | 18.6 | 17.6 | 18.6 | 19.2 | 19.3 | 18.7 | 18.1 | 11.7 | 17.2 | 16.8 | 15.4 | 13.6 |

| Dell Technologies | 12.0 | 13.2 | 13.7 | 17.2 | 15.2 | 14.0 | 12.9 | 15.8 | 12.0 | 12.0 | 10.5 | 12.5 | 12.1 | 11.6 | 10.4 |

| Apple | 10.1 | 4.8 | 7.2 | 7.6 | 7.6 | 6.2 | 6.7 | 7.0 | 7.0 | 5.6 | 3.1 | 4.7 | 5.0 | 4.1 | 4.1 |

| ASUS | 5.5 | 4.7 | 5.5 | 6.1 | 6.0 | — | — | 5.4 | 5.8 | — | — | — | — | — | — |

| Acer Group | — | 5.0 | 5.4 | 6.0 | 6.0 | 6.1 | 5.8 | 6.5 | 5.9 | 4.8 | 3.4 | 4.4 | 4.6 | 4.3 | 3.6 |

| Others | 17.1 | 12.6 | 14.5 | 15.4 | 14.4 | 18.8 | 18.9 | 15.3 | 14.9 | 14.3 | 11.8 | 15.2 | 15.1 | 13.3 | 13.5 |

| Total | 74.3 | 71.3 | 80.5 | 92.7 | 86.7 | 83.6 | 84.0 | 91.7 | 83.4 | 72.3 | 53.2 | 71.8 | 70.9 | 64.9 | 58.5 |

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

InvalidError What must be softening the return to pre-pandemic sales decline must be the people and companies who were somewhat overdue for upgrades but couldn't afford doing so with mid-pandemic pricing deciding to do so now.Reply -

waltc3 It's interesting because certainly there are more people than ever who are building their own box with hand-picked components in 2022. This number is easily in the tens of millions, but never makes these estimates...;)Reply -

spongiemaster Reply

More people are doing a lot of things more than ever since there are a lot more people than ever. Even if the number is that high, which I doubt, it is dwarfed by the OEM market. An estimated 340-350 million PC's were sold in 2021.waltc3 said:It's interesting because certainly there are more people than ever who are building their own box with hand-picked components in 2022. This number is easily in the tens of millions, but never makes these estimates...;) -

JarredWaltonGPU Reply

According to IDC's figures, the number is 347 million. So far, 2022 is on track for around 301 million, but Q4 sales are almost always substantially higher which means the final tally will probably be in the 320-325 million range. Still 8~10% less than 2021, but also 6~8% higher than 2020 and 20~22% higher than 2019.spongiemaster said:More people are doing a lot of things more than ever since there are a lot more people than ever. Even if the number is that high, which I doubt, it is dwarfed by the OEM market. An estimated 340-350 million PC's were sold in 2021. -

waltc3 Replyspongiemaster said:More people are doing a lot of things more than ever since there are a lot more people than ever. Even if the number is that high, which I doubt, it is dwarfed by the OEM market. An estimated 340-350 million PC's were sold in 2021.

Number was at least ten million PCs custom built by consumers, ~10 years ago. I threw that out here as the bare minimum estimate. More people than ever know how to build their own boxes--and/or upgrade them piecemeal these days--and the market for peripherals sold separately is gigantic--take a look at Amazon and Newegg. "PC Part Picker" didn't exist a few years ago, and you can buy programs available on Steam and elsewhere to show you how to build a system--which are nice resources for n00bs these days. When I was a n00b, it was 100% flying by the seat of your pants.

I'm not really sure what your point is. For instance, I haven't bought an OEM system since 1995--last system I ordered was a Micron for ~$4700. "Rolling my own" is far better...;) The only point to be made is that systems built with cherry-picked components aren't ever estimated, but judging by the incredibly huge market for peripherals sold separately (motherboards, PSUs, CPUs,GPUs etc.) it must be huge. I'm not sure why you'd want to dispute that...? I can't really see a problem with pointing out the obvious--that millions of systems are never counted in this bunch. Could be 20-30 million these days--who knows? Estimates are between 1.5 billion and 2 billion people use computer tech globally every day now...

It's not just that there are "a lot more people," it's also that a lot more of them know how to assemble a PC from components than was true 20 years ago, etc.--it's about as difficult as Lego blocks, etc. -

spongiemaster Reply

The DIY builders are a tiny percentage of the overall PC market. That's why nobody states numbers.waltc3 said:I'm not really sure what your point is.

PC sales have been in decline for years until Covid. So assuming there's been a multifold increase in the DIY market while the over market has been in decline is peculiar. Not impossible, but certainly not likely. -

waltc3 Replyspongiemaster said:The DIY builders are a tiny percentage of the overall PC market. That's why nobody states numbers.

PC sales have been in decline for years until Covid. So assuming there's been a multifold increase in the DIY market while the over market has been in decline is peculiar. Not impossible, but certainly not likely.

Nah, I think it's more that they have no metric on which to estimate. So, I guess we will have agree to disagree...;)