AMD Threadrips Intel's Sales at Puget Systems

From zero to hero, fast.

Puget Systems recently shared sales data showing that its sales of AMD-powered systems have now passed the 50% mark, unseating Intel from its previously-dominating 100% share of the company's sales. This win comes even though Puget Systems previously stopped selling AMD systems back in 2015 because Team Red was no longer competitive on the performance front. Still, after resuming building AMD systems again in 2017, Puget has seen explosive growth in the number of AMD systems it ships.

Puget Systems is a boutique system vendor specializing in higher-performance systems that range from smaller system builds to the highest-end workstations. Hence, the data strongly implies that AMD's gains in the higher-end desktop PC and workstation markets are accelerating.

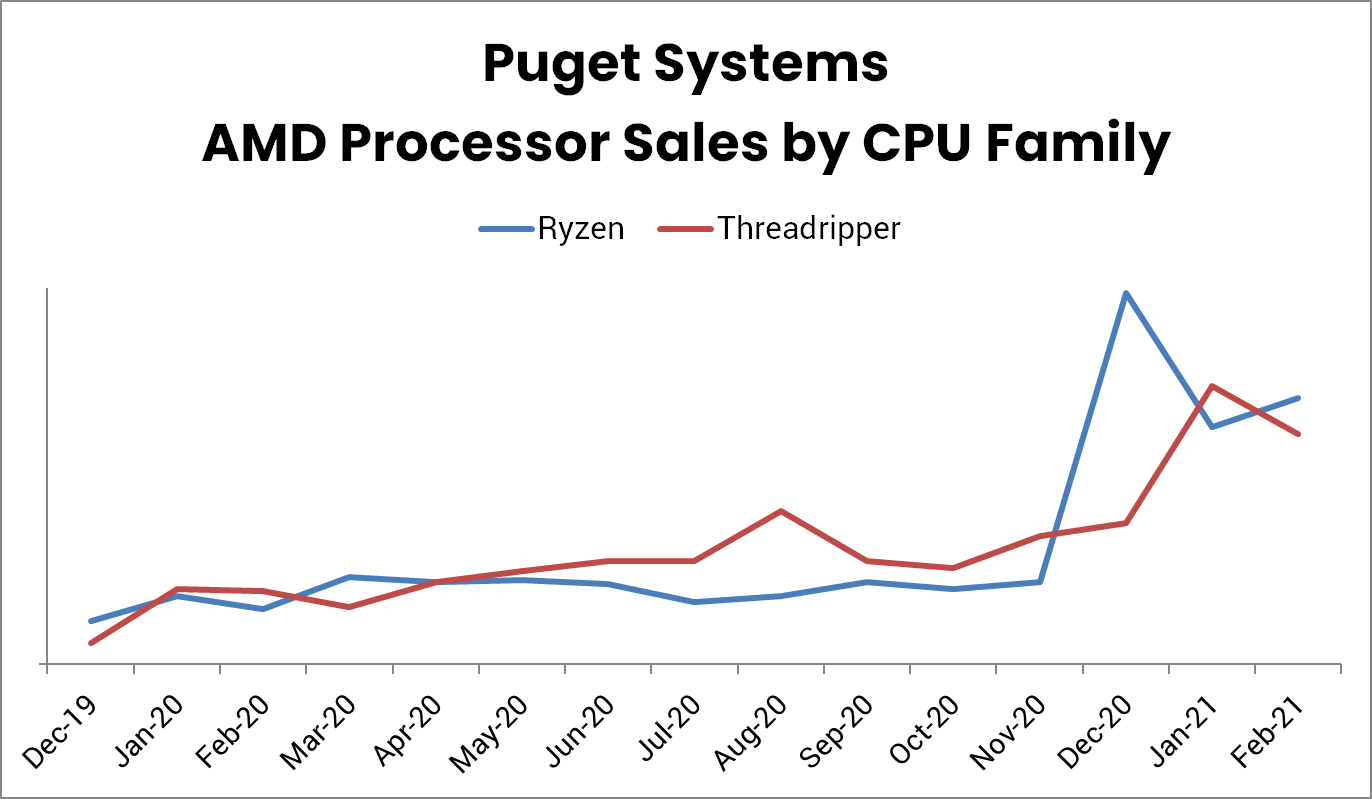

Puget's sales of AMD-powered systems took quite some time to accelerate, with the lion's share of its sales growth occurring after November 2019 when AMD began shipping its Ryzen 3000 series processors. That makes a lot of sense, as the Ryzen 3000 processors marked the debut of 12- and 16-core processors for mainstream desktop platforms. Those platforms lend themselves to lower price points than competing Intel HEDT processors but come with enough horsepower to match Intel's expensive HEDT chips in many workloads.

The debut of AMD's Threadripper 3000 series in early 2020 obviously helped accelerate AMD's gains in the workstation market, and Puget's sales of AMD-powered systems started a long uptick at the beginning of 2020. Naturally, those processors are a good fit for the highest-performance PCs, falling right into Puget's target audience. Intel's Cascade Lake processors, like the Core i9-10980XE, aren't in the same class as the Threadripper processors, and Intel hasn't refreshed its HEDT lineup in more than a year.

Fast-forwarding to the November 2020 debut of AMD's beastly Ryzen 5000 processors, like the Ryzen 9 5950X and 5900X, and AMD began its final push to unseat Intel as Puget's top-selling CPU brand. That makes plenty of sense, as the Ryzen 5000 processors have completely unseated Intel's competing processors in pretty much every metric that matters, and you can see the explosive gains in Ryzen sales right at the 5000-series launch. This isn't surprising, the Ryzen 5000 chips have taken over the top spots on our CPU Benchmarks hierarchy by substantial margins, giving AMD a commanding performance lead. As you can see, currently there's a pretty even split between Puget's Ryzen 5000 and Threadripper sales, but that could change in the coming months now that Threadripper Pro has finally come to market.

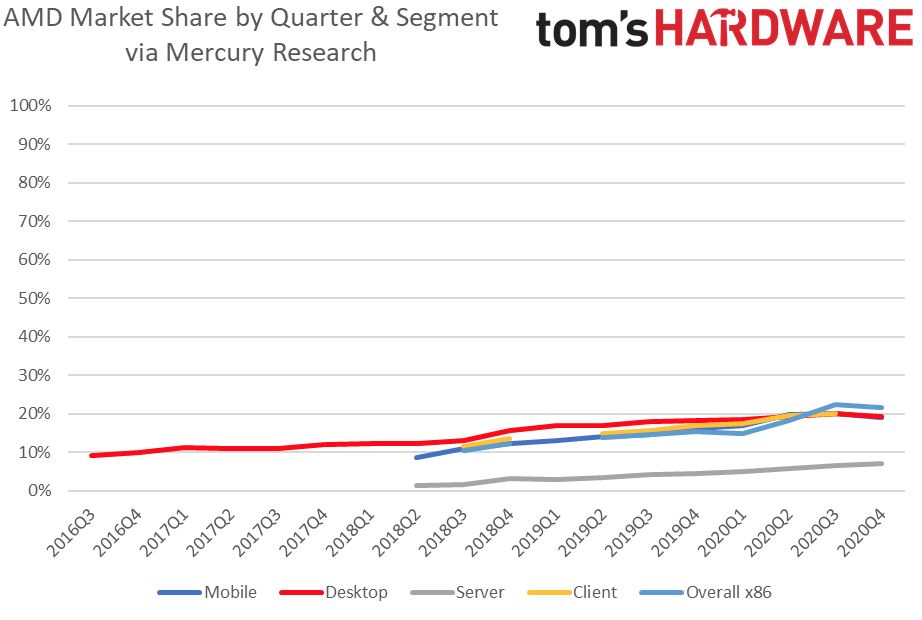

AMD's return to prominence in the desktop PC market is well known, but despite its remarkable turnaround, the company still only holds 19.3% of the overall desktop PC market share. As you can see in the chart above, which plots data from industry analyst firm Mercury Research, AMD still has plenty of room to grow.

Intel still holds a huge advantage in the mainstream OEM markets with the types of systems we see sold at big box stores, but given the trends we see at Puget Systems, we can expect AMD to begin taking over that segment, too. At least once it can work out its supply issues. Ultimately, supply is AMD's biggest current constraint, but recent trends suggest that the company is working out the kinks as more Ryzen 5000 series processors are becoming readily available at retail. Of course, that leads one to wonder just how much more lopsided the situation at Puget would be if Ryzen chips were fully available.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

escksu I have to say this is not representative of the entire market, just in case someone thought AMD has overtaken Intel in sales/market share.Reply

The bulk of Intel sales isn't from retail processor sales, its from OEM, esp. from the big 3 (Dell, HP and Lenovo). -

Sleepy_Hollowed Not surprising, considering that anyone looking for power savings and high processing power, AMD is the bigger bang for the buck at recommended prices.Reply

The only people that I know eyeing Intel CPUs for high powered systems are those looking for compatibility in virtualization, because Intel is ahead on that respect due to their long monopoly.

It's the same case with the non-thread ripper Ryzen processors as well, just the ability to run ECC RAM for workloads that require accuracy is a amazing for the price AMD allows you to have it at. -

Jim90 Replyescksu said:I have to say this is not representative of the entire market, just in case someone thought AMD has overtaken Intel in sales/market share.

The bulk of Intel sales isn't from retail processor sales, its from OEM, esp. from the big 3 (Dell, HP and Lenovo).

Indeed, the stench of sweeteners is still strong with Intel. -

didgetmaster I just wish I could buy a 5950x processor without having to pay a 50% premium on ebay. It has now been 5 months since AMD released its 5000 series processors and they still have a major supply problem. Everyone is out of stock. My 10 year old system is getting long in the tooth and rather than having to build a new system every 3 years, I splurge for the top of the line system at the time and it takes more time before it feels 'old'.Reply -

tennis2 Not entirely surprising considering AMDs Zen 3 stuff is finally beating Intel on performance.Reply

However, this data ignores:

***number of AMD vs Intel systems that Puget is offering for each timeframe. After all, they only resumed AMD sales in 2017, but we're not being told what the ramp-up looked like.

relative pricing of "equivalent" AMD vs Intel systems

"sweet spot" pricing of AMD vs Intel systems.

If there are more AMD than Intel system options in the "sweet spots", that's going to skew data.Puget (IMO) is more of a premium retailer and generally geared heavily toward the productivity sector. Hence AMDs general core advantage plays favorably in Puget's customer base. -

Rookie_MIB I must say, who would have thought that just 5 years ago AMD was barely a blip on the radar when it came to high performance processor sales - to this...Reply -

tennis2 Reply

Yeah, they made a gamble with Bulldozer and it definitely didn't pay off. However, with product development cycles, you can't just overhaul an entire architecture in a year or two. Look at how much trouble Intel is having just "revamping" their pre-planned architectures in lieu of their process node woes.Rookie_MIB said:I must say, who would have thought that just 5 years ago AMD was barely a blip on the radar when it came to high performance processor sales - to this... -

spongiemaster Reply

Or it's just a simple math problem. Why would Intel need to incentivize sales now when both they and AMD are maxed out on capacity? AMD is selling everything they can produce. Even if everyone prefers AMD over Intel, Intel would still have 80% of the market because AMD can't supply beyond about 20%.Jim90 said:Indeed, the stench of sweeteners is still strong with Intel.

AMD should be dominating sales at a reseller like Puget Systems. AMD's Threadripper is so far superior to Intel's offering, that Intel gave up on the HEDT market and isn't even trying to compete right now. -

NightHawkRMX Puget systems are often focused on workstations, and similar rigs where AMD has been winning for the last 2 generations, so it would make sense that they sell more AMD than Intel.Reply

However, Intel will still outsell AMD in your typical (imo junk) prebuilt computers from Dell, HP, Lenovo, etc. Intel's production capacity is higher for one. Secondly, typical buyers of these systems aren't constantly watching tech reviews and will just purchase what is familiar, which is Intel.

I have reason to believe intel is doing something similar to what they did to gain prebuilt sales back in the 2000s too. This time they are most likely disguising the oem bribes better as to not get sued for this behavior. again... -

watzupken Actually no matter what Intel does, the damage is already done. We can see from a few sources that they are indeed losing market share all around, and even if they try to use "under table" methods to retain sale, it will just eat into their profit margins. With big organizations starting to move towards their own ARM based processors and some to AMD to diversify their dependency on Intel chips, its a matter of time we see some impact to their bottomline if this continues.Reply