Toshiba to Ship First Microwave-Assisted 18TB MAMR Hard Drives by Late March

Toshiba's 18TB HDD gets qualified by hyperscalers.

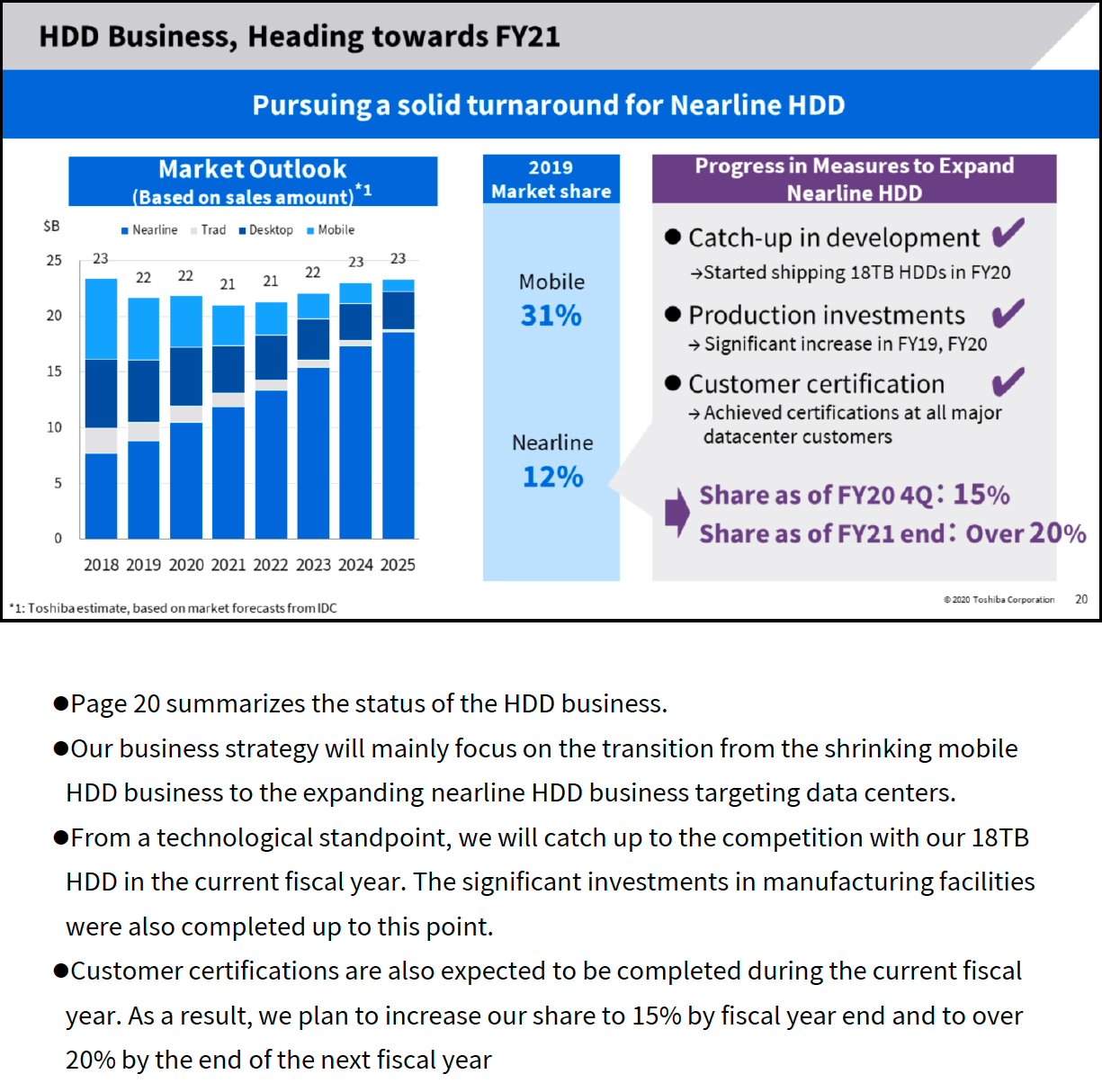

Unlike its rivals, Toshiba has been trying to keep a low profile on its energy-assisted magnetic recording (EAMR) technology roadmap. The company has announced on a couple of occasions that it was working on a microwave-assisted magnetic recording (MAMR) technology-based hard drives, but has never updated the public on its progress. But recently, the company finally disclosed plans to 'catch up to the competition' with its 18TB HDDs by late March, 2021.

Toshiba's 18TB HDDs Are Nearly Here

Showa Denko K.K. (SDK), the largest independent maker of HDD platters, announced in February 2019, that it had completed the development of its MAMR platters for next-generation hard drives and named Toshiba the first customer to get samples of the disks. SDK revealed that Toshiba planned to use its 2TB media for 3.5-inch drives to build its nine-platter 18TB HDDs. Based on SDK's announcement, Toshiba has been working on its 18TB hard drives featuring MAMR technology for at least 20 months now, but the company itself remained tight-lipped.

In one of its recent presentations concerning its Toshiba Next strategic plan, the company finally broke the silence about the progress of its 18TB HDDs. As it turns out, the company has already started to sample the drives with select customers (which are naturally usual suspects from the hyperscale datacenter crowd) and expects them to certify the HDDs for their datacenters by the end of Toshiba's fiscal 2020, which ends on March 31, 2021. Therefore, the HDDs will be formally introduced by the end of Q1 next year, or as soon as Toshiba starts commercial shipments of the drives (i.e., when the product gets qualified by at least one customer).

Microwaves Lead to Delays

There are only three makers of hard drives left on the planet, and the competition between them is pretty fierce. In fact, the manufacturers are fighting on different levels.

Obviously, Seagate, Toshiba, and Western Digital are doing the best they can to offer the highest-capacity hard drives for nearline applications, the fastest growing markets for HDDs these days. In addition, they attempt to increase both sequential and random performance of their drives. What is not so obvious for most people are technologies that enable the manufacturers to increase performance and capacities of HDDs. Each producer chooses its own path based on demands from its customers and its vision for the short- and long-term future.

When it comes to enery-assisted magnetic recording (EAMR), Seagate, Toshiba, and Western Digital have different approaches. Seagate has decided to stick to heat-assisted magnetic recording (HAMR) technology, which is relatively hard and costly to implement now as it requires new heads, new glass media, and a new magnetic recording layer. Western Digital originally intended to use MAMR starting from 2020 because it was easier to implement than HAMR as it only required new heads, but then decided to go with an intermediate step called energy-assisted perpendicular magnetic recording (ePMR) before going MAMR. Toshiba has determinedly chosen to use MAMR, but it turns out that it has taken the company quite some time to make the technology good enough for commercialization.

Toshiba is the only HDD maker that has not yet started commercial shipments of its 18TB hard drives. By contrast, Western Digital announced its ePMR 18TB HDDs back in late 2019 and started shipments in July, whereas Seagate began to ship its PMR/TDMR drives in September. It should be noted that the vast majority of Seagate's and Western Digital's clients yet have to certify their 18TB HDDs, so high-volume shipments of these products are set to start in 2021, but it is still evident that Toshiba is somewhat behind its industry peers.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

A New Hope

Just like its competitors, Toshiba pins a lot of hopes on its nearline hard drives. Demand for 2.5-inch laptop HDDs is dropping rapidly as solid-state drives are getting cheaper and gaining capacity. The market of desktop HDDs is also shrinking. By contrast, appetites of hyperscalers like Amazon Web Services, Dropbox, Facebook, Microsoft's Azure, and dozens of others are rising, so the market of nearline hard drives will continue to grow for some time.

In 2019, Toshiba commanded 31% of the mobile HDD market as well as 12% of the nearline hard drive market, according to the company's internal estimates based on data from IDC. Therefore, to sustain or improve its positions in the coming years, the company will have to increase production of nearline HDDs amid inevitable reduction of 2.5-inch HDD shipments.

Historically, Toshiba focused on 2.5-inch hard drives for notebooks and obtained capacity to build 3.5-inch drives only when Western Digital was ordered to sell its 3.5-inch factory to close its acquisition of Hitachi Global Storage Technologies (HGST). At present, Toshiba offers 3.5-inch HDDs for a wide variety of applications, including desktops, NAS, surveillance, and hyperscale datacenters. Meanwhile, in a bid to sustain its nearline growth, the company had to upgrade its production facilities and make significant investments, which have been completed by now, the company revealed recently.

In general, Toshiba believes that it is gaining market share. Back in Q1 2020, it controlled around 15% of the HDD market, but by the end of Q1 2021 it believes it will command over 20% of the market.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.